By Anthony Pompliano, Founder of Professional Capital Management; Translated by Golden Finance

Rumors suggest that the White House will have President Trump sign an executive order later on August 7th, local time, allowing individuals to purchase Bitcoin and cryptocurrencies in their 401(k) retirement accounts. This would be a huge step forward for the cryptocurrency industry and long overdue.

It is estimated that the total amount of funds in all US retirement accounts is approximately $43 trillion, including approximately $9 trillion in 401(k) accounts. By comparison, the entire cryptocurrency industry has a market capitalization of less than $4 trillion, so this executive order will open up a massive pool of capital to flow into Bitcoin and crypto assets.

Now, many will complain about the White House's actions. They will claim that Bitcoin is risky. They will scream about how inappropriate it is to give individuals the right to allocate their retirement funds as they see fit.

But this is complete nonsense. First and foremost, every American should be allowed to do whatever they want with their money. Who should the government tell you what to do with your money? If you want to invest in a new company, go ahead. If you want to invest in Bitcoin, no politician or regulator should stand in your way. To the critics, your job isn't to stop people from doing what they want with their money. Your job is to strengthen financial education in America so that people can make smart, rational decisions. If you don't want people to gamble, explain the high rate of loss. If you don't want them to speculate in penny stocks, explain the benefits of long-term compounding by investing in high-quality assets. The days of treating American citizens like fools are over. Savvy, independent retail investors are on the rise. Many of them are outperforming institutional investors. Will some make mistakes and bad decisions? Of course. But that's also how we learn. We must restore personal responsibility. We don't need a matriarchal state micromanaging our people's personal investment portfolios. In fact, if the critics truly want to speak out for an important cause, they should start questioning why so many American retirement accounts are held in U.S. Treasury bonds. These assets are inherently destined to lose value over the long term, and retirement accounts are reportedly optimized to prevent that. So if we're willing to let people invest their retirement accounts in risky U.S. Treasuries, why can't they buy Bitcoin?

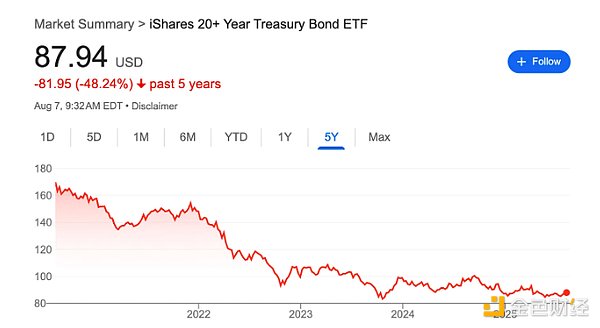

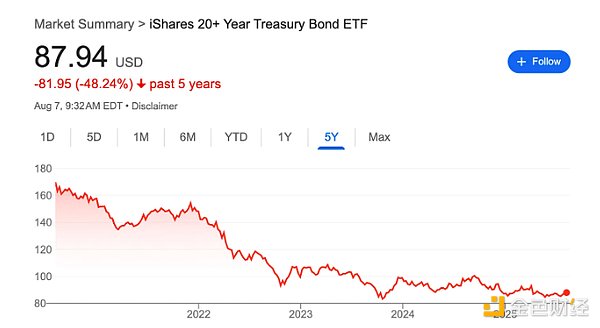

For example, the iShares 20+ Year Treasury Bond ETF is down nearly 50% over the past five years. Outdated financial advisors are destroying baby boomers' portfolios with outdated 60/40 portfolio allocations.

Galaxy's Mike Novogratz was on CNBC this morning, explaining the implications of opening up the retirement account market to Bitcoin and cryptocurrencies.

Last night, Trump came out and talked about crypto assets being eligible for 401k investments. I mean, that's a huge pool of capital . . . The window to buy crypto is constantly widening . . . And prices are determined at the margin, think about what happens when there are hundreds of millions of dollars in new money every day.

Bitcoin is digital gold. It's a hedge against endless money printing, and endless bad fiscal policy around the world.

As long as governments can't spend less than they take in, you'll continue to see Bitcoin appreciate.

So, ladies and gentlemen, let's go! The critics are furious, but they're on the wrong side of history. Bitcoin and cryptocurrencies are here to stay. And now, they're coming to a retirement account near you.

JinseFinance

JinseFinance