Recently, U.S. stock on-chain transactions have become the latest hot spot. Mainstream trading platforms such as Kraken and Robinhood have launched on-chain stock trading services, allowing investors to buy and sell tokens representing real stocks. These services enable investors to trade popular U.S. stocks such as Apple, Tesla, Nvidia, etc. 24 hours a day, 7 days a week.

So,

Basic Overview

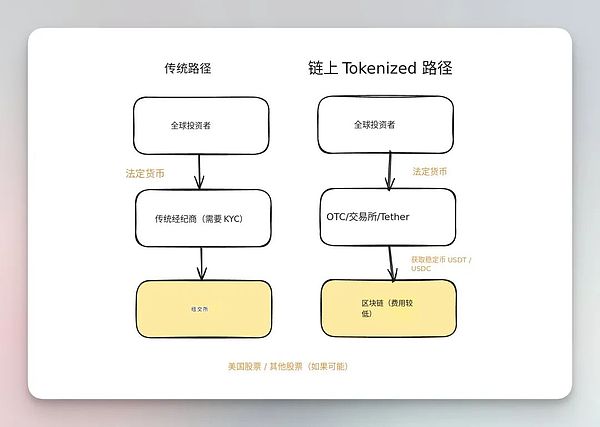

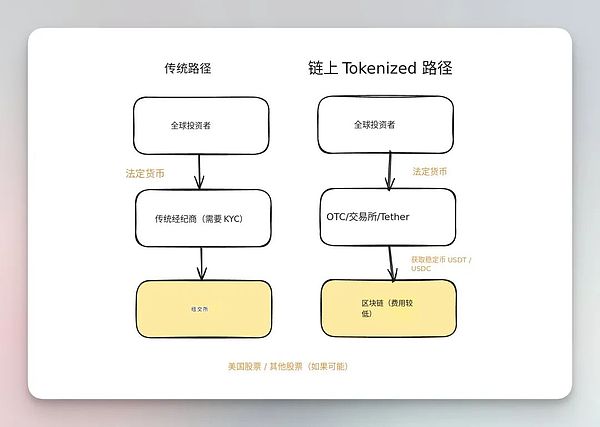

The above picture describes the basic operating principle of stocks on the chain. There are several key information in it:

1. When you buy tokenized Apple stock through Kraken's xStocks, you are not buying derivatives or futures contracts. Instead, Kraken's partner Backed Finance will purchase and hold actual Apple stocks in a regulated custodian. A corresponding token is then issued on the Solana blockchain, creating a digital representation of that actual stock. 2. Stocks ≠ Cryptocurrency. On-chain stocks introduce interesting arbitrage opportunities. During off-market hours, when the NYSE is closed but blockchain trading continues, the token price may deviate slightly from the last known stock price due to trading activity and market sentiment. Arbitrageurs can profit by buying and selling tokens and redeeming them through the issuer, thereby realigning the price. Be cautious when buying on-chain stocks during off-market hours. 3. This structure means token holders do not receive traditional shareholder rights, such as voting rights - these are retained by the custodian. You are buying economic exposure to the performance of the stock, not actual shareholder status. It’s a trade-off, enabling blockchain-based trading while maintaining regulatory compliance

24/7 trading?

The most obvious advantage of tokenized stocks is continuous trading. Unlike traditional exchanges which only operate about 6.5 hours a day and are limited to business days, blockchain-based tokens can trade continuously. Kraken’s xStocks offers 24/7 trading, while Robinhood currently offers 24/5 trading and plans to expand to around-the-clock trading after its Arbitrum-based Layer 2 launches.

This constant availability creates interesting market dynamics. When major news is released outside of traditional trading hours—such as earnings announcements, geopolitical events, or company-specific developments—your tokenized shares can react immediately. Token prices become real-time market sentiment indicators, potentially providing price discovery that traditional markets cannot match during closed hours

Traditional vs. Tokenized?

This picture shows the difference between traditional US stock trading and on-chain US stock trading such as Kraken and Robinhood. However, like traditional US stock trading, KYC is still required, but there is an essential difference in the custody model.

1. KYC (Know Your Customer)

In fact, any compliant platform that provides stock exposure needs KYC and abides by regulations - Completely anonymous stock trading is almost legally impossible unless the platform wants to violate the law. There have been attempts at decentralized non-KYC stock tokens in the past, but they have all run into legal trouble. A notable case is Terra’s Mirror Protocol, which from 2020 to 2022 allowed anyone with just a crypto wallet to mint and trade synthetic “mAssets” that mirrored US stocks (like Tesla, Google, etc.) without KYC. The US SEC later determined that Mirror’s stock tokens were unregistered securities and took legal action against Terraform Labs and its founder Do Kwon.

Different entry paths

This time it’s different, even large exchanges like Kraken and Bybit support trading stocks on their platforms. You can simply think of these "stock coins" as MeMe coins, except that a third party promises that each coin is backed by stocks. I think Trump might like this approach very much. It provides a more convenient way for retail investors to enter the US stock market through stablecoins. As long as the final settlement is in US dollars, I don't think the regulatory pressure will be too great.

2. Custody model related

Tokenized platforms prioritize accessibility and flexibility. Kraken and Robinhood offer zero-commission trading on their stock tokens, earning revenue through spreads and other services. They natively support fractional ownership, allow 24/7 trading, and may integrate with decentralized financial protocols.

But the trade-offs are also obvious. Traditional brokers offer regulatory protection, sophisticated client services and direct shareholder rights. Tokenized platforms offer greater accessibility and innovative features, but with less regulatory clarity and newer operating infrastructure.

There is a fundamental difference in the custody model. Traditional brokers hold shares in “street name” through a central depository and your holdings are recorded in their system. Tokenized platforms issue blockchain tokens that you can choose to self-custody, giving you direct control over your holdings, but also requiring you to be responsible for managing private keys and security. Why I think this is a bull market. 1. Capital magnetism. Consider the structural advantages of tokenized stocks over traditional equities. Retail investors in Nigeria can now buy Apple shares without having to navigate complex international brokerage relationships or currency conversion fees. This is not just convenience, but a fundamental expansion of market access that could drive unprecedented capital inflows into crypto infrastructure. The mechanisms here are more complex than simple user acquisition. When someone buys tokenized Tesla stock, they not only enter the crypto market - they create ongoing demand for stablecoins, generate transaction fees for Layer 2 networks, and validate the entire crypto technology stack as legitimate financial infrastructure. 2. Compounding Effect Ethereum and its Layer 2 (like Robinhood) will gain ongoing volume from stock trading, creating real economic value for ETH holders through fee destruction and network effects. Solana (Kraken and Bybit)'s high-throughput architecture may grab market share in high-frequency stock trading, driving demand for SOL transaction fees. Tokenized stocks can solve the "ghost town" problem of the crypto market in a bear market. Historically, when crypto prices crash, trading volumes evaporate and users flee to traditional assets. With on-chain stocks, capital may be more likely to stay in the crypto ecosystem, maintaining liquidity and platform engagement even when altcoins struggle.

3. Stealth Adoption

Tokenized stocks may achieve what years of crypto preaching have eluded: seamless mass adoption. Users in the EU who use Robinhood to trade Arbitrum stock tokens are not making a conscious decision to enter the crypto market - they are simply using better financial services. This stealth adoption model could attract millions of users who would never actively choose to buy crypto, but would be happy to use crypto infrastructure when it is abstracted.

Summary

In the long run, most stocks (and even other assets) may be traded on the blockchain, greatly benefiting from the low transaction costs and efficiency of the chain. Of course, this depends largely on the acceptance of on-chain asset trading and regulatory evolution in the future.

On the optimistic side, on-chain stock trading may become a killer application, allowing the crypto user base to grow exponentially and bring millions of real-world assets to the chain.

Brian

Brian