In the Bitcoin world, there is a special "holy grail" level: Bitcoins from the Satoshi Era, which refers to Bitcoins that were mined or traded during the period from 2009 to 2011 when Satoshi was still active on the network. These coins are rarely active, and once they move, they are enough to attract the attention of the global market.

And on July 4, 2025, the largest "Satoshi Era Bitcoin Transfer" in the history of encryption quietly occurred.

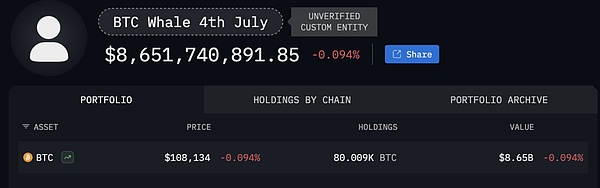

80,000 BTC from the Satoshi era suddenly moved, worth over $8 billion

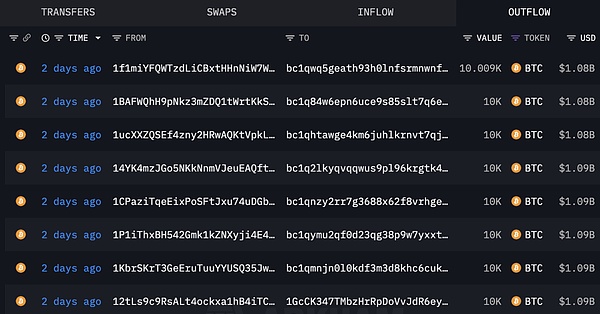

On that day, there wereeight Bitcoin wallets that had been dormant for more than 14 years. Each wallet transferred10,000 BTCto new addresses, with a total transfer of80,000 BTC, which is equivalent to over$8 billion at current prices.

Figure 1: This transfer record involves 80,000 BTC

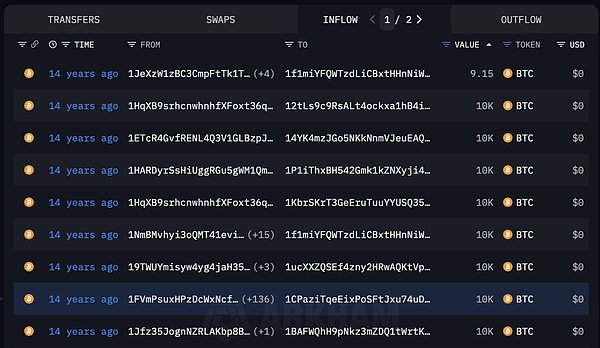

This batch of bitcoins was received on April 3, 2011. At that time, the price of bitcoin was only US$0.78. Today, each BTC has exceeded leaf="">100,000 US dollars, which means that the bitcoins on these addresses have appreciated by more than 13.9 million times. This transfer isthe largest BTC transfer in the "Nakamoto era" on record.

Figure 2: Records of receiving bitcoins 14 years ago, involving 80,000 BTC

Why is this transfer so concerning?

· Rare and scarce:Bitcoins from the "Satoshi era" are rarely moved, and these coins have always been the "whale indicator" that chain analysts and market observers focus on monitoring.

· Potential selling pressure and market expectations:When old addresses move BTC on a large scale, the market usually worries whether it means "early holders will cash out". Although these BTC have not yet flowed into exchanges, this move may still affect market confidence.

· Using modern format and not further transferred:This transferwas sent to a newly created wallet address and used a modern, lower-fee address format (SegWit), indicating that the holder understands the current on-chain operations. However, these new walletshave not been further transferred out or into exchanges so far, and the identity of the holders remains a mystery.

· Private key security and quantum computing speculation:Some people believe that this transfer may be related toprivate key leakage and quantum computing attack attempts. The P2PK (Pay-to-Public-Key) address used in the early days of Bitcoin will expose the public key after the first transaction. If a scalable quantum computer (using the Shor algorithm) appears in the future, it can theoretically be cracked.Andthose dormant wallets that have never been moved and have not exposed their public keys cannot be reverse cracked even in the quantum era.This wallet is the first transfer transaction, and the public key has never been made public in history, so the possibility of being cracked by quantum computing can be basically ruled out. This may explain why only some wallets were transferred this time, and no sweeping (emptying) occurred, suggesting that it may only be a partial key test or security migration.

Does it mean that Bitcoin is going to fall sharply?

From historical experience, large-scale transfers of "Nakamoto era" coins do not necessarily lead to sell-offs, but usually bring market volatility and panic in the short term.

Also need to note:

This transfer adopts the modern low-fee SegWit address format , indicating that the holder has the latest operation capabilities;

The new address has not yet flowed into the exchange, it may just be an internal split management or security migration;

If it enters the exchange in the future, it may form potential selling pressure, which is worthy of attention;

This incident also reminds the market to pay attention to quantum security issues.

Neil’s view: The most scarce thing about BTC is not time, but the belief of the holders

This large-scale transfer of BTC in the “Satoshi era” reminds us:

Bitcoin has a shorter history than any other financial asset, but it has condensed extreme value beliefs and supply constraints;

The market may fluctuate in the short term, but what really affects the price of Bitcoin in the long run is global liquidity, institutional allocation needs, and the structural scarcity of BTC under the decentralized financial architecture;

For coin holders, the most scarce thing is not time, but “the belief that will not be knocked down by emotions in the long run”.

Aaron

Aaron

Aaron

Aaron Kikyo

Kikyo Davin

Davin Jasper

Jasper Hui Xin

Hui Xin Catherine

Catherine Jasper

Jasper Catherine

Catherine Snake

Snake Clement

Clement