Although ETF and stablecoin funds have recovered marginally this week, the momentum is insufficient, and the market still needs to wait and see whether funds will break through and whether there will be structural repair signals in the short term.

Crypto Market Summary

1. Macro situation: The market has recently experienced increased volatility under geopolitical disturbances and macro policy uncertainties, risk appetite has cooled, and funds have entered cautiously. Although ETF and stablecoin funds have recovered marginally, the momentum is insufficient, and the market still needs to wait and see whether funds will break through and whether there will be structural repair signals in the short term.

2. The Fed meeting was neutral, maintaining the expectation of a 2-point rate cut, but due to tariffs, inflation revisions and economic revisions, the rate cut path was conservative.

3. Due to oil prices, tariff implementation and low base inflation, it is difficult for the Federal Reserve to cut interest rates immediately. It is expected that after the impact of tariffs and oil price trends are confirmed in mid-August, September may be the time for the first rate cut, and core inflation may rise to 3.0% by the end of the year.

Macroeconomic Summary

The signing and approval of Trump's "Big and Beautiful" Act (OBBBA)

1. The debt ceiling is raised by $5 trillionThe bill raises the federal debt ceiling from $36.1 trillion to $41.1 trillion, adding $5 trillion in debt space for the US government. This move directly addresses short-term default risks and releases funds from the Treasury Account (TGA): TGA account releases liquidity: The current TGA balance is about US$372.2 billion (close to the low point of the year). After the bill is passed, the Treasury can replace existing debts and release cash through new bond issuance. It is expected that more than US$1 trillion of US Treasury bonds will be digested from July to September. Increased government spending: New debt financing will be used for national defense, infrastructure and tax cuts and subsidies, directly injecting US dollar liquidity into the market.

2. Tax cuts release funds from the private sectorThe tax cuts will reach $4 trillion over the next decade, the corporate tax rate will be permanently reduced to 21%, and the scope of equipment investment tax credits will be expanded:

Enterprise side: The return of manufacturing industry will receive tax incentives (such as the tax credit for chip factories increased to 35%), and the improvement of corporate cash flow may be converted into stock repurchases or investments.

Investors need to pay attention to the pace of liquidity release (the speed of U.S. debt issuance, the timing of the Fed's interest rate cuts) and the risk of policy spillovers (G7 trade negotiations, August China-U.S. tariff negotiations), and prioritize the layout of sectors with clear benefits (military industry, energy, defensive consumption) in the liquidity feast, while allocating gold to hedge long-term uncertainties.

1 Market Overview

1.1 Analysis of FMG RWA and AI Index

In the second half of June 2025, among the many indexes monitored by FMG, the RWA Index continued to rise, with a monthly return increase of about 6.11%. This is due to the fact that the alt season is delayed, Web 3 investment opportunities are relatively few and over-concentrated on BTC and stablecoins. OTC funds are turning their attention back to DeFi, asset management and strategy sectors. However, DeFi in a single Web 3 market is also highly risky, so products with real-world asset anchoring and DeFi attributes are currently being favored.

1.2 Crypto market data

As of June 31, 2025, the total market value of cryptocurrency was 3.33 trillion, which continued to rise compared to 3.12 trillion US dollars in the second half of May.

BTC Dominance Index: As of June 31, the current BTC dominance index is 64%, which continues to rise.

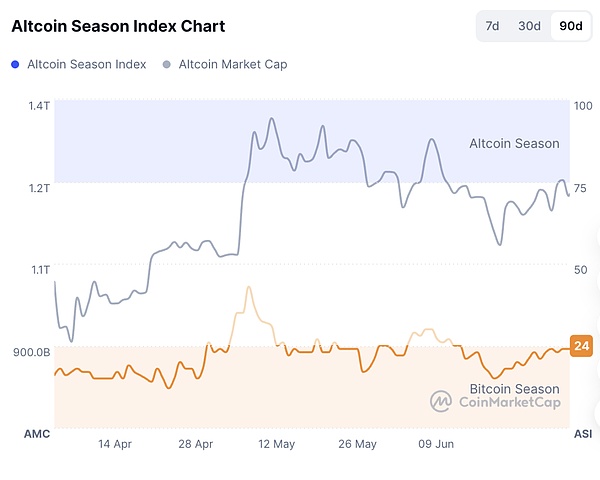

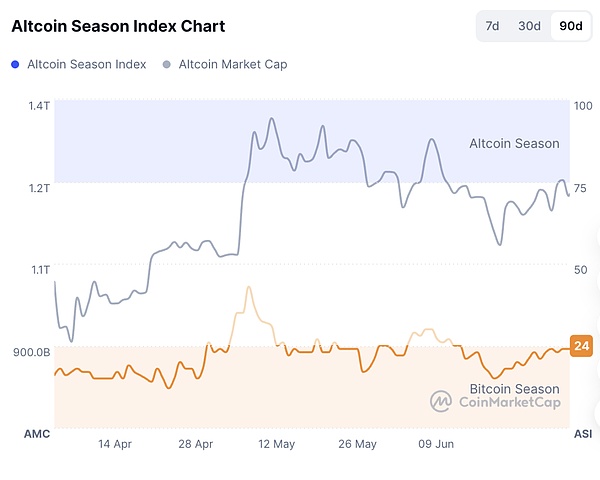

Altcoin Season Arrival Index: As of June 31, the current Altcoin Season Arrival Index is 24, which continues to rise compared to 25 in early May, which means that the current altcoin opportunities are gradually increasing.

1.3 Judgment of the market based on CPI and other data and market reactions

The Federal Reserveunanimously maintained the federal funds rate at 4.25%~4.50%, and maintained the balance sheet reduction scale at 5 billion U.S. Treasuries and 35 billion MBS per month.

Statement adjustment: The uncertainty of the economic outlook was changed from "further increased" to "weakened but still high", and the statement "the risk of rising unemployment and inflation increased" was deleted, reflecting that the impact of Trump's tariffs has been initially incorporated into the decision-making.

The economy is expanding steadily, the job market is stable, and inflation uncertainty remains the key to the dual mission (employment and inflation).

The forward guidance on interest rates continues to be cautious, emphasizing that the extent and timing of interest rate cuts will be carefully evaluated, suggesting that the pace of interest rate cuts will be slow.

2. Hot Market News

2.1 The first U.S. pledged cryptocurrency ETF will be launched on Wednesday, and Solana prices rose

According to Cointelegraph, the first U.S. pledged cryptocurrency ETF will be launched on Wednesday, allowing investors to hold Solana (SOL) and earn income through staking. REX Shares confirmed that the fund is coming soon.

The REX-Osprey Fund will provide investors with SOL spot and staking income, which may promote institutional adoption of cryptocurrencies. The SEC expressed positive feedback on its C-Corp structure.

Solana prices rose 6% to about $158 after the ETF news, up more than 12% in the past seven days. With a current market value of $83.5 billion, it is the sixth largest cryptocurrency.

Analysts believe that the approval of the Solana ETF may trigger a "summer of altcoins", and Solana has also performed strongly in the decentralized exchange market, with trading volume exceeding Ethereum.

2.2 Ark Invest sold $43.8 million worth of Coinbase shares on Monday

Cathie Wood's Ark Invest sold 124,892 shares of Coinbase, worth about $43.8 million, on Monday.

Coinbase (COIN) closed down 0.83% on Monday at $350.49, close to its all-time high of $375.07 set last Thursday. In the past month, Coinbase's stock price has risen 42.12%, and the year-to-date increase is 41.16%.

2.3 From MEME stocks to on-chain stocks: Robinhood joins hands with Arbitrum to enter the tokenized stock market, builds its own L2 blockchain and gambles on RWA

Officially launched the tokenization of U.S. stocks in the EU, and jointly developed the official L2 with Arbitrum

On the evening of June 30, at a press conference in Cannes, France, Robinhood announced that it will provide stock tokenization trading services to EU users. It now supports more than 200 U.S. stock assets to achieve 24-hour on-chain, 5 days a week circulation and trading, including tokens of OpenAI and SpaceX, and plans to expand to thousands of types by the end of this year.

Currently, Robinhood EU is giving away the first batch of private company stock tokens for free. If you are a Robinhood EU user and meet the qualifications, you can claim the tokens in the app until July 7.

It is reported that the product only charges a 0.1% foreign exchange conversion fee to reduce the high intermediary costs for European investors to access the US market. In the future, users will be able to self-custody tokenized stocks and ETFs through Robinhood's crypto wallet, or choose a simplified operating experience without managing private keys.

III. Regulatory environment

Sparkassen, Germany's largest banking group, will provide cryptocurrency trading services, including BTC and ETH

Sparkassen, Germany's largest banking group, plans to provide retail investors with cryptocurrency trading services, including Bitcoin and Ethereum. The service is expected to be launched in the summer of 2026. This decision comes three years after its board of directors rejected the relevant services due to volatility and risk issues.

It is reported that Dekabank, a wholly-owned subsidiary of Sparkassen, will be responsible for managing its cryptocurrency services. Previously, Sparkassen executives had been critical of cryptocurrencies, calling them "highly speculative."

Nasdaq-listed company LGHL announced that it has purchased a total of US$5 million worth of HYPE, SOL and SUI

According to PRNewswire, after completing the first purchase of HYPE tokens, Nasdaq-listed company Lion Group Holding Ltd. (LGHL) announced that it will continue to increase its holdings and has now purchased a total of approximately US$5 million worth of HYPE, SOL and SUI for its cryptocurrency Layer-1 asset reserves. In addition, the company disclosed that it is currently evaluating more participation in these ecosystems, including validator operations, governance participation and ecosystem partnerships.

Anais

Anais