On July 10, Bitcoin broke through its all-time high, and the scale of short positions in the crypto market soared to $600 million in 24 hours, accounting for 90% of the total liquidation volume on that day, setting a new record for short positions in a single day this year. What is particularly unusual is that when the explosion occurred, Bitcoin's increase was only 2.12%. The intensity of the explosion caused by a specific increase is rare in history, which shows that the current short-selling crowding in the market has reached a record level. Therefore, on July 11, Bitcoin rose by 6%, and the short squeeze broke out again. The amount of short positions in the market soared to a staggering $1 billion in 24 hours, setting a new record.

Compared with Bitcoin, Ethereum has encountered more fierce short-selling attacks in this round of market. Although the current price is only 55% of the historical high, its open interest has exceeded the historical peak. According to data from the Chicago Mercantile Exchange (CME), from May 6 to June 24, the short positions of leveraged funds on Ethereum futures surged from $466 million to $1.6 billion, and short bets surged by nearly 250%. It is worth noting that even though Ethereum has broken through the key resistance level of $2,500-2,600, the growth rate of short open interest is still far faster than the price increase, indicating that shorts have not given up their bearish stance due to short-term losses. This phenomenon is particularly evident on the Hyperliquid platform: among the top five whales in ETH holdings, four have been shorting for more than two months (trend shorts). Although most investors are cautious about the large-scale increase in short positions, historical trading data reveals a counterintuitive rule: the large-scale addition of shorts is often a booster rather than an obstacle to the trend. Specifically, in a strong trend, if the growth rate of holdings significantly exceeds the price increase (Delta holdings/Delta price>1), it usually indicates that the market still has sustained upward momentum; on the contrary, if the price rises sharply but is accompanied by a rapid decline in holdings, it is necessary to be alert to the risk of trend reversal - this essentially reflects the market's loss of short covering, a key source of liquidity.

On July 11, despite the explosion of more than $1.3 billion in the crypto market, the total open interest of the contract continued to increase (OI+8%), and the determination of the short-term hard trend was firm, indicating that this round of rebound still has room for further upward movement.

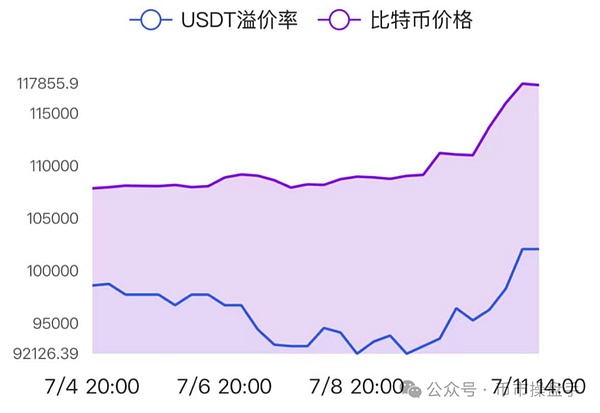

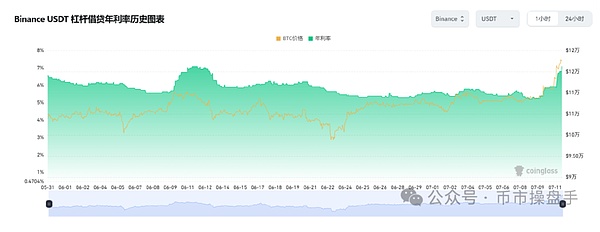

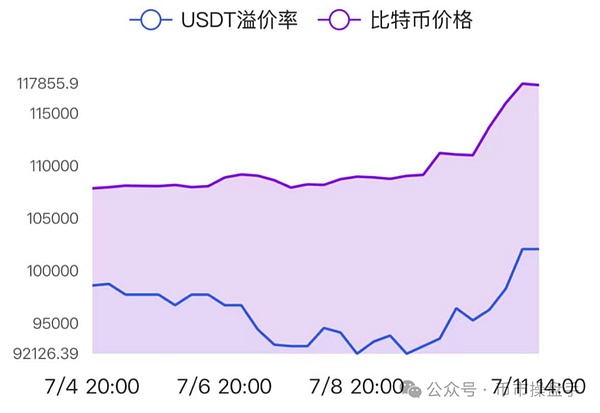

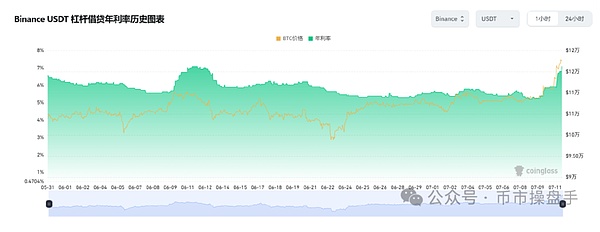

Under the stock pattern, every rise in the market is at the expense of consuming stock liquidity, and the greater the increase, the more serious the consumption of stock. Therefore, every big rise in the market in the past year has led to a decline in the premium rate of USDT. However, this time the continued rise in the crypto market was accompanied by a continued increase in the premium rate of USDT, which shows that this round of rise is likely to be driven by incremental funds. In addition, as the market continued to rise, Binance's USDT lending rate rose from 5.5% on July 9 to 7.3% on July 11, and OKX even soared to 41%, indicating that the market's demand for leverage is increasing rapidly. Based on past experience, the continued increase in leverage demand is usually a signal of rising risk appetite.

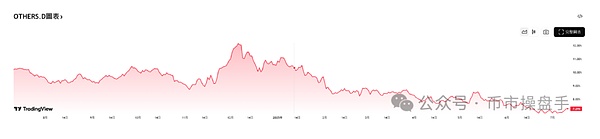

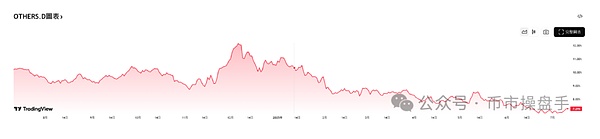

After the breakthrough of Bitcoin and Ethereum cameras, the market focus is turning to the potential for catch-up opportunities in altcoins (excluding the top 10 by market capitalization). Historical patterns show that the crypto market has seen a phased rebound in the market share of altcoins every year in the past three years. However, it is worth noting that since hitting a high of 12.15% in December last year, the market share of altcoins has continued to decline to the current 7.21%, with almost no effective rebound during this period. This extremely depressing trend may accumulate greater momentum for subsequent rebounds.

Although the improvement of the liquidity environment and the rise in the valuation level of the market provide a basis for the restorative market of the altcoin, two key conditions must still be met to achieve a "calf" level rebound:

1. The altcoin needs a leading sector to quickly activate the popularity of the market with a shocking increase and let the money-making effect continue to spread (the height of the leader determines the height of the market). For example, in February 2024, the first wave of the three leading AI sectors, RENDER, WLD, and ARKM, all rose by more than 10 times.

2. At present, the boundary between funds tracking Bitcoin and tracking altcoins is too obvious. The market needs a violent shock to complete the exchange of chips and the conversion of new and old kinetic energy. Only when the exchange rate of altcoins against Bitcoin shows a significant strengthening after a certain huge shock can it be confirmed that funds have begun to switch to altcoins.

In terms of operation, considering whether altcoins have these two major signals, it is recommended to temporarily treat the altcoin market as an oversold rebound. Of course, for traders with low positions, it is not too late to tentatively build positions now. Historically, every round of bull market has an obvious feature: unlimited scenery is at the peak. The income from holding on to the bottom for three months is often not as good as holding on to the top for one more day. Therefore, don't guess the top easily, or even short.

Joy

Joy