The industry environment has improved, and the market is looking forward to a rate cut, but it is difficult for FTX's creditors to calm down.

After three years of twists and turns, and countless arguments during the period, FTX's compensation process has finally started, and the compensation has come to the second stage. The market has not fluctuated greatly due to selling pressure. It seems that everything is on the right track. However, a word from the creditor representative has completely shattered the hopes of the Chinese people.

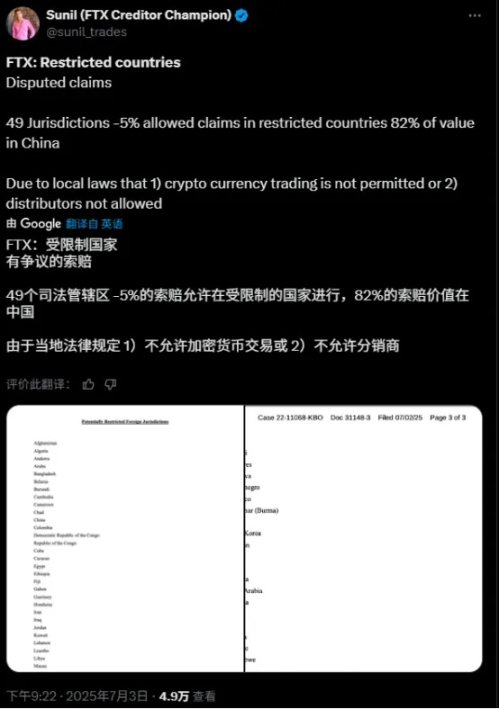

On July 4, Sunil, a representative of FTX creditors, posted on the X platform that creditors in 49 jurisdictions, including China, may lose their right to claim. The claim funds of creditors in these regions account for 5% of the total funds. On July 7, it spoke again, the total claim amount of restricted jurisdictions was US$470 million, and Chinese investors were the largest holders of FTX claims, holding US$380 million in claims, accounting for 82% of restricted claims.

As soon as this happened, the market was in an uproar. Chinese creditors who had waited for years and spent a lot of time and energy could only wait for the outcome of legal confiscation, which was obviously unacceptable to anyone.

Since FTX announced bankruptcy and liquidation in November 2022, creditors have experienced many news of restarting, acquisition, and restructuring. During this period, FTT also became a MEME coin under this trend. Finally, on January 3 this year, the FTX debtor reorganization plan officially came into effect. The first batch of debts will be paid within 60 days after it takes effect on January 3, including users with claims of US$50,000 or less will be paid first, and BitGo and Kraken will assist FTX in making compensation.

On February 9, Kraken announced that it had completed the first fund distribution of FTX estate, paying more than 46,000 creditors. More than three months later, the second round of compensation was launched. Sunil, a representative of FTX creditors, said that FTX's repayment will be paid on May 30, and users with an amount exceeding US$50,000 will receive 72.5% of the compensation; the remaining compensation (to 100%) and interest will be distributed in subsequent distributions, and it is expected that more than US$5 billion will be distributed to creditors.

It was thought that creditors only needed to wait for the compensation to arrive, but a piece of news on July 4 disrupted everyone's rhythm. Sunil tweeted that FTX will initiate a motion and will seek legal advice. If it can be distributed to restricted foreign jurisdictions, it will continue to be executed; if it is determined that the residents belong to restricted foreign jurisdictions, the claims will be disputed and users may lose their claims rights. There are 49 foreign jurisdictions established by the trust, including Russia, Ukraine, Pakistan, Saudi Arabia, etc., and China is also on the list. The document shows that the deadline for creditors to object to the motion is July 15. At the same time, creditors have 45 days to object to the distribution of claims.

This news is like a hammer, hitting the Chinese people on the forehead. Chinese creditors account for a large proportion of bonds, accounting for 82% of the total claims in restricted jurisdictions, and hold claims of US$380 million. Faced with huge compensation for selling the plane, it is obviously difficult for creditors to accept it. The most critical question is, why should their own claims be confiscated to the United States? Whose law is this in line with?

In theory, there are certain problems with FTX's split compensation. First, the compensation subject FTX is a US company and follows local laws. In Section 1123(a)(4) of the US Bankruptcy Code, there is a clear provision of "equal treatment of creditors of the same category". In the early stage of compensation, FTX's bankruptcy liquidation team did not mention nationality, but clearly informed that as long as the claim is submitted and the reorganization plan is voted in favor, the distribution can be obtained. Secondly, consistent with the traditional compensation process, throughout the compensation process, the claims are denominated in US dollars, which means that cryptocurrencies may not be involved during the period, and Chinese residents can obtain compensation through wire transfers and traditional payment modes. Even if it is paid in the form of stablecoins, according to current Chinese laws, most of our laws recognize the property attributes of virtual currencies and do not prohibit residents from holding virtual currencies. Even if it is paid in the form of stablecoins, according to current Chinese laws, our laws mostly recognize the property attributes of virtual currencies and do not prohibit residents from holding virtual currencies. Even if it is paid in the form of stablecoins, according to current policies in Hong Kong, China, a one-size-fits-all approach should not be adopted. In other previous bankruptcy compensation cases, Chinese creditors have not received extra attention. For example, in the Celsius case, the US court successfully paid US dollar compensation to Chinese creditors through international wire transfer. From the perspective of the Chinese people, it is hard not to suspect that this is a long-planned "legal robbery". In fact, as early as February, there were clues to the news. The creditor representative tweeted that FTX bankruptcy claims did not include jurisdictions such as Russia and China, but at that time, the creditors had not yet felt it. If we look at the operations of the FTX bankruptcy liquidation team, it seems that there are more traces to follow. In terms of composition, the liquidation team is extremely experienced and has a considerable background. John J. Ray III is the team CEO. He was previously responsible for Enron's bankruptcy liquidation and earned more than $700 million in high profits from it. In this liquidation, it also brought the original team and the old law firm Sullivan & Cromwell to share the remaining value of FTX.

Ordinary creditors may have to consider the price when selling assets, while professional liquidation teams obviously only care about the speed of realization. As early as the end of August 2023, the shareholder report disclosed FTX's crypto assets. The top 10 currencies accounted for 72% of FTX's total crypto asset holdings. At that time, the total value of holdings was about US$3.2 billion, of which SOL held the largest position, reaching 55 million, BTC held about 21,000, and ETH held 113,000. In addition to crypto assets, due to previous extensive investments, FTX also has a large equity portfolio, including Cursor, Mysten Labs, Anthropic and other very high-quality assets.

Such an excellent asset portfolio ignited the hopes of creditors and supported the wallets of the liquidation team. Almost all of these assets were sold at a low price by the liquidation team. Cursor, purchased for $200,000, was sold at the original price, while its valuation had reached $9 billion. $890 million of SUI token subscription rights were sold off for $96 million, but its highest value once reached $4.6 billion. 8% of Anthropic was sold for $1.3 billion, which was considered a good deal, but a year later, Anthropic, valued at $61.5 billion, slapped the market in the face again, not to mention the SOL token that the team auctioned at a low price in 2024, which has now risen to $151, making the debt acquirers at the time rich.

The premise of the liquidation team's disregard is the sky-high consulting fees it has received. Court records show that as of January 2 this year alone, FTX has paid nearly $948 million to more than a dozen companies hired to handle its bankruptcy case, of which the court-approved fees exceeded $952 million. FTX's chief law firm Sullivan & Cromwell LLP has received more than $248.6 million in compensation, financial advisors Alvarez & Marsal have received approximately $306 million in compensation, and consultants representing the interests of FTX customers and other creditors have received approximately $110.3 million in fees. Judging from the amount on the surface alone, this is already one of the most expensive bankruptcy cases in U.S. history, not to mention the hidden profits brought by nepotism in asset liquidation.

This also seems to explain what SBF said in his testimony, but almost no one believed it at the time, that the serious threat from the liquidation team forced FTX to quickly initiate bankruptcy proceedings. What is even more frightening is that in the new plan submitted by the FTX team to the bankruptcy court, there is a hidden clause that exempts consultants from liability, which means that no matter how it is handled later, the liquidation team will not bear any legal responsibility. Liquidation has completely become a tool for the team to make money, and other creditors are just the least important part of the tool.

From the current point of view, the situation of Chinese creditors is indeed not optimistic. First, cross-border collection is indeed complicated. The deadline for the opposition motion on July 15 is very tight. If the motion is passed and enters the stage of the liquidator entrusting a lawyer, it will be very unfavorable to the creditors; second, the motion adopts a voting system. Although Chinese creditors currently account for a high proportion of restricted judicial areas, they account for less than 5% of the total claims. More than 95% are other creditors. In order to speed up the distribution of claims, other creditors who have nothing to do with them will vote for approval more easily.

But even so, Chinese creditors will not sit back and do nothing. Means such as building groups and protests have emerged one after another, and self-help has become the key. On July 9, according to Cryptoslate, more than 500 Chinese creditors questioned the FTX payment freeze in the US court. The Chinese creditor with the pseudonym Will said in an interview with Law and Dynamic that he had hired an American lawyer and more than 500 Chinese creditors were organizing a response to FTX's decision. The Chinese creditor also called on other creditors to seek the help of professional lawyers as much as possible, or to send letters of opposition to the motion to the court in their personal names.

In addition to taking legal measures, there are also many debt transfer schemes on the market, that is, selling debts in packages to debt buyers who meet the compensation plan to quickly recover funds. The motion actually used a strange way to induce this method. According to Wil, there is a clause in the motion that "if a third-party institution buys your debt, your original country of holding will no longer be considered when determining the eligibility for compensation."

As for why some people want to buy debts in bulk, the core essence is still profit. In FTX's compensation, the claims are calculated at an annual interest rate of 9%, which has been nearly 3 years, and will continue to be calculated over time. In addition to the deterministic interest income, FTX is now in the process of recovering other assets, and there is the possibility of additional distribution in the future. Overall, therefore, FTX's claims are definitely high-quality claims, which are not only popular with individual acquirers, but also favored by the institutional market. Furthermore, financial institutions with mature systems can even package them into underlying assets and then arbitrage in the form of derivatives.

Market sales are a reasonable way to exit, but if they are forced to sell, it will obviously change the whole thing. Whether the efforts of Chinese creditors will be rewarded and whether they can get back their due claims is still unknown. As mentioned before, even if it complies with legal provisions, the liquidation team has begun to make a big fuss by using the topic of "jurisdiction" in an attempt to detain the assets of Chinese investors, which has also made the meaning of the word compliance more strongly questioned. Is the purpose of compliance to protect investors' assets or to add an unavoidable reason for confiscation?

This pending debt collection may tear apart the last fig leaf of compliance.

Alex

Alex

Alex

Alex Snake

Snake YouQuan

YouQuan Jasper

Jasper Jasper

Jasper Clement

Clement Kikyo

Kikyo Hui Xin

Hui Xin Aaron

Aaron Jasper

Jasper