While you are still thinking about the next stop of cryptocurrency, a "key" connecting real assets and the digital world is quietly coming on the scene.

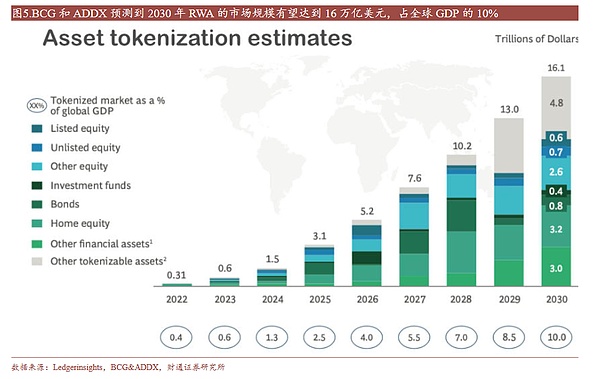

According to the views of comprehensive institutions, Real World Assets (RWA) are transforming traditional financial assets and physical assets (such as US bonds, real estate, and green energy) into on-chain digital tokens through blockchain technology, and a huge market that is expected to reach 16 trillion US dollars by 2030 is opening up.

For investors, This means the arrival of a new era of asset allocation. Analysts believe that RWA can not only fragment illiquid assets (such as private equity and infrastructure), but also greatly reduce the investment threshold, and provide investors on the chain with new targets that are linked to the real economy and have more stable returns.

What is RWA?

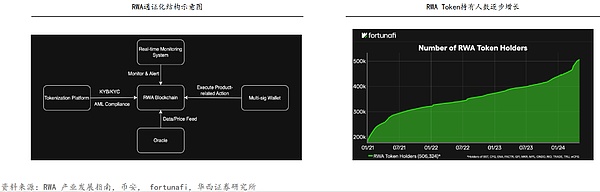

RWA, literally translated as "real world assets", refers to the "tokenization" of real assets (such as real estate, accounts receivable, carbon quotas, power station income rights, etc.) through blockchain technology, so that they have the ability to trade, split and circulate digital assets.

In short,RWA makes traditional assets that are "immovable, unsellable, and unaffordable" become like cryptocurrencies, which can be purchased in small amounts, traded quickly, and circulated across borders.

According to the views of Huaxi Securities and Caitong Securities, RWA has dual significance for market participants:

For asset parties:RWA provides an innovative financing channel with the advantages of fast financing, low cost, and high liquidity. It can divide large, low-liquidity assets (such as real estate and infrastructure) into small shares and raise funds for global investors.

For investors:RWA has greatly enriched the investment targets on the chain. Compared with highly volatile native encrypted assets, RWA is anchored to real assets and has a more stable source of income. At the same time, its "fragmented" feature allows ordinary investors to participate in the investment of high-value assets with a very low threshold (such as investing $50 in US real estate), truly realizing a new inclusive financial ecology from "elite investment" to "universal investment".

The trillion-dollar track is ready to go

Institutions generally believe that the global RWA market is on the eve of an explosion.

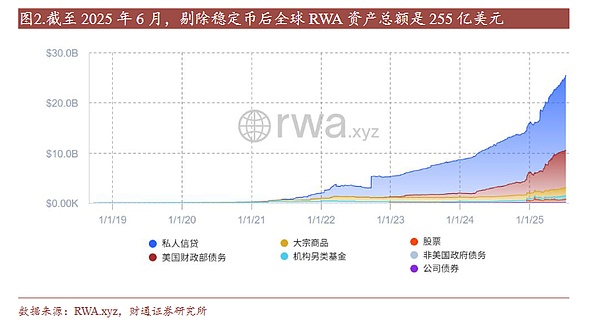

According to data from RWA.xyz cited by Caitong Securities, as of June 2025, the total global RWA assets excluding stablecoins have reachedUS$25.5 billion.

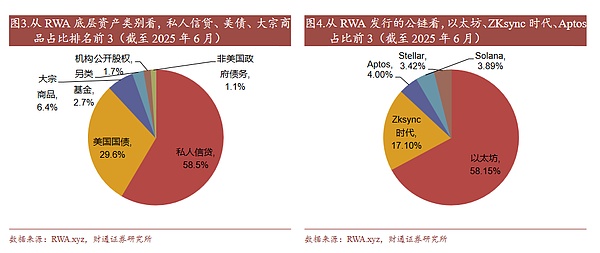

Currently, the market is dominated byprivate credit (58.5%), US Treasuries (29.6%) and commodities (6.4%).The US Dollar Institutional Digital Liquidity Fund (BUIDL) issued by BlackRock is the world's largest single RWA project, with a market value of over US$2.8 billion.

The RWA project is mainly issued on public chains such as Ethereum (market share 58.2%), ZKsync and Aptos.

The report cited a joint forecast by Boston Consulting Group (BCG) and ADDX that by 2030, the global asset tokenization market size will reach US$16.1 trillion, accounting for 10% of global GDP.

From the germination of the concept to the fact that everything can be put on the chain

RWA did not come out of thin air, but with the evolution of blockchain technology, the maturity of DeFi ecology, and the development of the industry. With the joint promotion of financial institutions testing the waters and the implementation of policies and regulations, it has come to where it is today. Today, its tentacles are rapidly expanding from financial assets to the vast physical world of real estate, energy, cultural tourism and even AI computing power. 1. Concept Exploration Period (2016–2018): Technical Prototypes and Thought Experiments In 2016, Ethereum co-founder Vitalik Buterin proposed a thought experiment on on-chain exchanges and asset tokenization.

Since 2017, platforms such as Polymath and Harbor have explored securities on-chain, kicking off the RWA prelude.

In 2018, Uniswap used the AMM model to solve the problem of on-chain liquidity, laying the foundation for on-chain asset transactions such as RWA.

2. Infrastructure construction period (2019–2021): Platform-based attempts to connect with DeFi

In 2019, Securitize, OpenFinance, etc. provided RWA token issuance and compliance services; the TAC Alliance promoted the unification of token standards.

Platforms such as Centrifuge began to tokenize real assets such as accounts receivable, and cooperated with DeFi platforms such as MakerDAO to open up on-chain lending scenarios.

Stablecoins gradually emerged and became the transaction basis and value anchor of the RWA ecosystem.

3. Financial institutions enter the market (2022–2023): Traditional capital integrates with the Web3 world

JP Morgan Chase, Goldman Sachs and others started RWA pilots to promote the listing of bonds and private equity assets on the chain.

BlackRock and Franklin Templeton issuedtokenized funds, and RWA entered the vision of the "regular army" from DeFi.

Securitize andOndo Finance Platforms such as

Securitize have emerged as the core intermediary infrastructure for RWA on-chain assets.

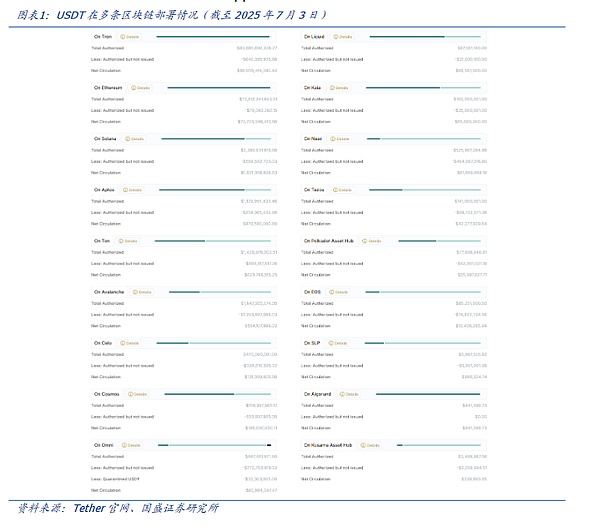

Stablecoins have become one of the largest application scenarios for RWA and are the "vanguard" of the digitization of real assets.

4. Application expansion period (2024–present): From financial assets to the real economy

Financial assets field: covering bonds, funds and stocks, precious metals and commodities. Ondo launched the tokenized U.S. debt fund OUSG, with TVL ranking among the top RWA platforms in the world; Jarsy fragmented the equity of unicorns such as SpaceX and put it on the chain, breaking the Pre-IPO investment threshold; Real Estate: RealT tokenized U.S. residential properties, with a minimum investment of US$50, truly realizing the "saleable" of real estate; The Dubai government launched an official RWA platform, planning to put US$16 billion of real estate assets on the chain by 2033.

Emerging DirectionsNon-standard fields such as AI computing power, carbon assets, agriculture, and cultural and tourism assets have explored the RWA path, and there is huge potential in the future.

It is worth noting thatstablecoin itself is the most successful RWA use case (tokenization of legal currency). At the same time, it also serves as the core transaction medium in the RWA ecosystem, providing pricing and settlement tools for the on-chain circulation of various assets.

China: Hong Kong's policies are implemented first, and green assets take the lead

In China, the development of RWA shows the characteristics of policy-driven and industrial application going hand in hand, especially under the leadership of Hong Kong, green assets and computing power have become outstanding highlights.

Hong Kong, China is the policy highland for the development of RWA in the world. Huaxi Securities pointed out that the Hong Kong Monetary Authority has provided RWA projects with compliance exploration space through the"Financial Technology Regulatory Sandbox"mechanism. In 2025, Hong Kong officially published the Stablecoin Ordinance and released the Digital Asset Development Policy Declaration 2.0, which clearly identified RWA and stablecoin as the core development direction, providing the market with a clear regulatory framework and development path. According to the research reports of Huaxi Securities, Dongwu Securities, Caitong Securities and other institutions, green energy assets are the pioneering field of RWA in mainland China, and Ant Digits is the core technology service provider.

Charging piles: In 2024, Longxin Group jointly with Ant Financial, with 9,000 charging piles as underlying assets, completed the first domestic RWA financing of RMB 100 million in Hong Kong, China.

Photovoltaic: GCL Energy Anchored in two provinces 82MW distributed photovoltaic power stations, completed the world's first photovoltaic green asset RWA, financing amount exceeded 200 million yuan.

Battery Swap Station: Patrol Eagle Group Completed the world's first battery swap asset RWA, financing tens of millions of Hong Kong dollars.

Computing power and emerging assets: Both Soochow Securities and Huaxi Securities emphasized the huge potential of computing power RWA. With the advancement of the "East Data West Computing" project and data center REITs, computing power assets have a standardized basis for on-chain for the first time. The computing power leasing market is expected to grow from US$14.6 billion in 2024 to US$63.6 billion in 2031.BEVMand other projects have joined forces with computing power giants such as Bitmain to launch a tens of millions of dollars ecological support plan to promote the development of the computing power RWA ecosystem.

Core challenges and pain points: regulation, technology, market risks.....

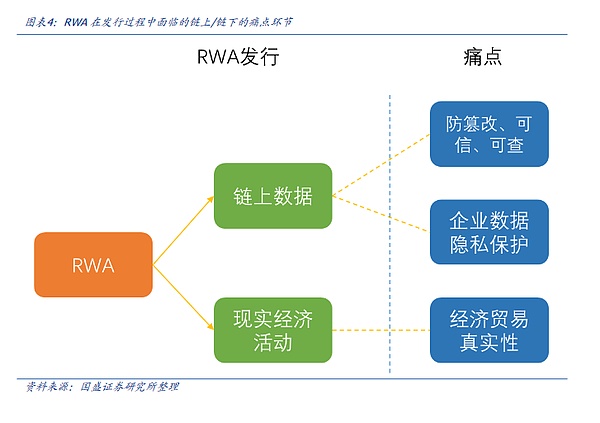

Despite the broad prospects, the reports of Guosheng Securities and Huaxi Securities also pointed out several major obstacles that RWA must overcome in the process of becoming mainstream:

Complexity of regulation and compliance: The tokenized securities attributes of RWA assets make them subject to strict securities law supervision. The US SEC members have clearly warned that tokenized securities are still securities, and their on-chain transactions (over-the-counter transactions) and offshore issues need to be resolved urgently. The conflict of cross-border regulatory rules also brings challenges to global circulation.

On-chain and off-chain consistency: How to ensure that on-chain tokens truly reflect the status of off-chain assets is the core pain point. This requires technologies such as the Internet of Things (IoT) and AI to ensure the authenticity and credibility of off-chain data and solve the "last mile" problem in trade, logistics and other links.

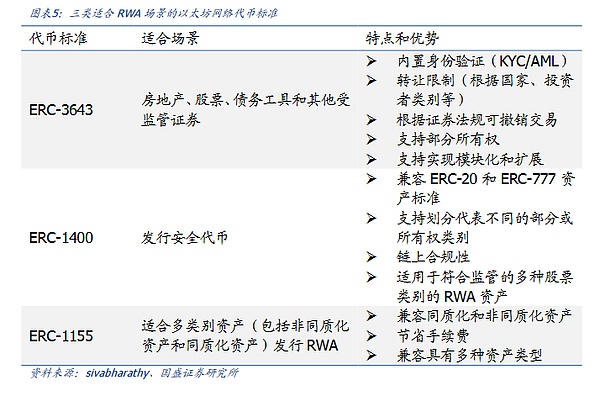

Improvement of technology and infrastructure:The RWA ecosystem requires new infrastructure, including a decentralized identity (DID) system to meet compliance requirements, and new token standards such as ERC-3643 that can embed regulatory rules.

Market risks: The current liquidity of the RWA secondary market is generally insufficient, and the pricing mechanism of non-standard assets (such as artworks) is not yet mature. In addition, the custody of off-chain assets relies on centralized institutions, which poses counterparty risks.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Anais

Anais Bernice

Bernice Olive

Olive Huang Bo

Huang Bo Catherine

Catherine Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx