中国利用量子计算机首次攻破加密算法?全球市场热议潜在加密威胁

中国研究团队据称利用D-Wave量子计算机攻破了传统加密算法,包括保护银行账户和加密钱包的机制。这一消息在全球引发广泛关注,尽管研究细节尚未完全披露,其对加密货币和其他加密技术的影响仍在评估中。

Weiliang

Weiliang

Source: insights4.vc, compiled by Shaw Golden Finance

The week of July 17-24, 2025 saw landmark action in the United States on digital currency policy. Congress advanced three major measures: the GENIUS Act established a unified federal framework for stablecoin issuance and reserves; the CLARITY Act clarified the jurisdiction of the U.S. Securities and Exchange Commission (SEC) and the U.S. Commodity Futures Trading Commission (CFTC) over crypto assets; and a provision in the FY2026 National Defense Act states that the Federal Reserve may not issue a central bank digital currency (CBDC) without explicit congressional approval. This article analyzes the terms and timelines of each bill, assesses its immediate impact on major stablecoin and currency markets with a market value of more than $250 billion, and examines the systemic risks highlighted by regulators—from the “singleness” of currencies and run dynamics to illicit financial activities and monetary sovereignty. We quantify stablecoin adoption trends for retail and institutional use cases (USDT vs. USDC dominance, emerging market FX usage, B2B and payment volumes), and explore strategic responses by banks, payment companies, merchants, and policymakers (including the BIS’s Project Agorá). We conclude with best-case, worst-case, and stress scenario forecasts for the coming year, assessing how these developments may shape global digital currency usage with influence from the United States and Europe.

Key provisions of recent U.S. digital asset legislationThe Guiding and Establishing National Innovation for Stablecoins in the United States Act (the “GENIUS Act”) was signed into law on July 18, 2025. The Act establishes the first nationwide regulatory regime for payment stablecoins (digital tokens designed to maintain a stable value relative to fiat currencies). Key requirements include: 100% reserve backing in safe, liquid assets (US dollars, Fed deposits, short-term US Treasury bills, repurchase agreements, and money market funds), and monthly disclosure of reserve composition by public accountants. Issuers must maintain a reserve ratio of at least 1:1, and rehypothecation (reuse of collateral) is strictly limited to ensure stability. The definition of a permissible issuer is very strict: only regulated entities can issue stablecoins in the United States, such as licensed bank subsidiaries approved by banking regulators, federal stablecoin issuers chartered by the Office of the Comptroller of the Currency (OCC), or state qualified issuers that meet equivalent regulatory standards. This effectively excludes unregulated or offshore issuers: after the bill is phased in, any stablecoin issued by a non-"permitted" US issuer or approved foreign issuer will not be treated as cash or cash equivalents for accounting purposes, nor may it be used as collateral in regulated markets. Notably, issuers are not allowed to pay interest to stablecoin holders, thus preventing the emergence of bank-like yield products. In the event of an issuer’s bankruptcy, stablecoin holders’ redemption requests take precedence over other creditors, adding a layer of consumer protection. The bill also requires issuers to comply with financial crime laws: stablecoin operators must register, implement a Bank Secrecy Act anti-money laundering program, and have the technical ability to freeze or “destroy” tokens pursuant to a lawful order. Federal and state regulators are responsible for overseeing compliance: the Office of the Comptroller of the Currency will oversee the new federal stablecoin bank, while state regulators can oversee smaller issuers (those with less than $10 billion in tokens) if their rules are deemed “substantially similar” to federal standards. Larger state issuers (or those without equivalent rules in their states) are subject to joint federal oversight to ensure that there are no regulatory gaps.

The GENIUS Act has an effective date of January 18, 2027, or 120 days after federal regulators issue implementing rules, whichever is earlier. Until then, the issuance of stablecoins remains the status quo. From the effective date, new issuances must comply with the regulations (only approved issuers can issue), although existing non-compliant stablecoins will remain tradable until July 18, 2028 as a transitional period. By July 18, 2028, all stablecoins issued in the United States must come from regulated issuers, phasing out unregulated stablecoins from the U.S. market. This multi-year transition period reflects lawmakers’ trade-off between innovation and risk: giving the current major stablecoins time to apply for a license or cease operations in the United States. The passage of the GENIUS Act with bipartisan support in the Senate demonstrates that stablecoins are now seen as a mainstream part of the financial system and require federal standards. The bill aims to bolster confidence in stablecoins as trusted digital cash equivalents, thereby encouraging broader adoption (and, in the case of USD stablecoins, cementing the dollar’s dominance).

In addition to the stablecoin law, the House of Representatives has also advanced the Digital Asset Market Clarity Act (CLARITY Act) to clarify regulatory jurisdiction over cryptocurrencies. The bill, which was passed by the House of Representatives on July 17, 2025, resolves the long-standing ambiguity about when crypto tokens are securities (regulated by the U.S. Securities and Exchange Commission) and when they are commodities (regulated by the U.S. Commodity Futures Trading Commission). The bill provides that most "digital commodities" - generally crypto tokens that are inherently related to decentralized blockchains - are regulated by the U.S. Commodity Futures Trading Commission even in the spot market. The bill also provides that tokens that were originally part of an investment contract (for example, a token sale used to raise funds) can become non-securities after sufficient decentralization or the network "matures." In practice, this provides a migration path for projects: projects can file a notification with the SEC indicating that their blockchain has reached a "mature" state (no controlling entity), at which point their tokens will be regulated as commodities rather than securities. The SEC still has jurisdiction over initial investment contracts and any tokens that are still controlled by the issuer, and is responsible for anti-fraud enforcement, but the regulation of trading in truly decentralized tokens and commodity-like crypto assets must be ceded to the Commodity Futures Trading Commission (CFTC). The bill also creates new regulatory categories under the CFTC - digital commodity exchanges, brokers and dealers, similar to traditional securities intermediaries. These entities will register with the CFTC and comply with customer protection, reporting and custody rules tailored for the crypto market, bringing crypto trading platforms that are currently in a gray area into a clearer regulatory scope. In addition, the CLARITY Act strengthens the disclosure and protection rules for digital asset companies (e.g., requiring segregation of customer funds, requiring bankruptcy proceedings to protect customers, and conflict of interest disclosures) to prevent the abuse of customer assets like FTX.

The intersection of the Act and stablecoins is the confirmation that payment stablecoins are neither securities nor commodities as long as they comply with the regulatory requirements set out in the GENIUS Act. This clarity exempts compliant stablecoins from being deemed investment securities by the SEC and commodities by the CFTC, thereby establishing stablecoins as a new and distinct category of regulated payment instruments.

The CLARITY Act passed with strong bipartisan support in the House (294 in favor, 134 against) but is still awaiting action in the Senate as of late July 2025. The bill’s fate in the Senate is unclear; opponents argue that it could unduly weaken SEC investor protections. However, the bill’s passage in the House reflects the industry’s strong desire for regulatory certainty. Observers point out that agreement on a statutory framework could help the U.S. catch up with overseas comprehensive regulatory regimes such as Europe's Markets in Crypto-Assets Regulation (MiCA) and keep crypto innovation at home. The bill proposes to make the CFTC the primary regulator of cryptocurrency transactions, which would mark a major adjustment in U.S. cryptocurrency regulation and limit the SEC's recent assertion of broad regulatory authority over digital assets. If the bill is passed, the SEC and CFTC will have to jointly develop rules and coordinate, which is a challenging but potentially stabilizing development for market participants.

The third development is the inclusion of anti-central bank digital currency (CBDC) provisions in the National Defense Authorization Act (NDAA) for Fiscal Year 2026. House Republicans, led by Majority Leader Tom Emmer, pushed the "Anti-CBDC Surveillance State Act" (H.R. 1919), which aims to prohibit the issuance of U.S. central bank digital currencies without congressional consent. This reflects the political resistance to retail "digital dollars." The provision, which was eventually attached to the must-pass defense bill amid heated debate in the House of Representatives, prohibits the Fed from issuing central bank digital currencies directly or indirectly to individuals and requires any central bank digital currency project to obtain explicit authorization from Congress, effectively preventing the Fed from unilaterally launching a "digital dollar." The provision also stipulates that the Fed may not use central bank digital currencies to implement monetary policy or control the money supply in new ways. Supporters see this as protecting privacy and freedom: critics argue that, unlike decentralized cryptocurrencies, centralized central bank digital currencies would enable the government to monitor and control private transactions.

The political context is worth noting: President Trump has issued an executive order prohibiting the federal government from working on central bank digital currencies, and the bill aims to write this ban into law. Many Republicans believe that the United States' central bank digital currency would pose a threat to the role of the private sector and the anonymity of cash.

House leaders tried to link the anti-CBDC bill to the NDAA to force its deliberation. However, it is uncertain whether the measure can pass the Senate and House meetings. The Federal Reserve, for its part, has been cautious about advancing the digital dollar, repeatedly stating that it will not act rashly without clear congressional support. However, the House's move sends a clear signal that the Fed will face severe legislative obstacles if it attempts to launch a central bank digital currency for the general public. This position has prompted the United States' digital dollar efforts to turn to other alternatives (such as private sector stablecoins or bank-issued digital deposits), as detailed in Section 5. It is worth noting that the anti-CBDC clause does not directly affect ongoing wholesale CBDC or payment system improvements (the Federal Reserve is continuing to explore these improvements, such as the FedNow instant payment service). Its main role is to convey policy signals - making US law tend to favor private innovation (and perhaps tokenized bank deposits) rather than centrally managed retail currencies. In the short term, this reassures stablecoin issuers and cryptocurrency advocates that government competitors are temporarily on hold, thereby maintaining the role of the stablecoin market in digital dollarization.

The combined effect of these three initiatives is to incorporate stablecoins into the regulated financial system while drawing a clear line with certain state-controlled digital currency models. The remainder of this article will assess how these changes play out in the market, and the risks and opportunities that arise from them.

The direct impact of the GENIUS Act on major stablecoin issuers is huge. Tether (USDT), the largest stablecoin with about 60% of the market share, faces a choice: either comply with the new law or exit the US market. Tether's issuer is located overseas and has always had low operational transparency. Under the new law, by 2027, Tether will need to register an entity in the United States (or work with a US-regulated issuer) and keep its reserves entirely in approved assets and be audited monthly. Otherwise, its USDT tokens will no longer be legally available to US users after the transition period ends. Tether has already withdrawn from some heavily regulated jurisdictions (it withdrew from the European Union rather than comply with the new licensing requirements under the European Crypto-Asset Market Regulation). It may similarly limit its U.S. operations if it deems compliance costs too high or exposes too much information. However, given that Tether is backed by dollars and has a large share of U.S. Treasuries in its reserves, even overseas issuers are indirectly affected by U.S. policy. Tether may increase transparency and strengthen its reserves to maintain confidence - it has a strong incentive to show 100% reserve backing to avoid redemptions, especially if the act explicitly states that non-compliant stablecoins cannot count as cash equivalents in regulated venues.

In contrast, Circle (USDC) is a U.S. company that has been lobbying for clear regulation. Circle's USDC already invests most of its reserves in short-term Treasuries and cash and attests monthly. The GENIUS Act recognizes Circle's approach and provides a path for it to become a federally approved issuer (possibly through a charter from the Office of the Comptroller of the Currency). As Circle seeks the much-sought-after federal license, its market position may be strengthened as an FCC (fully compliant token) that institutions may prefer. The fact that the bill prohibits interest payments means that stablecoin holders will not be directly compensated; this preserves the current model, where seigniorage revenue flows to the issuer. Today, Tether and Circle earn a significant amount of interest from reserve asset investments. In fact, Tether’s profits from reserve investments are now comparable to those of large financial institutions. With regulation, this revenue model is legitimized, but it also attracts competition from traditional finance.

The Stablecoin Act opens the door for banks and fintech companies to join the fray. Large banks have been hesitant to issue their own stablecoins amid regulatory uncertainty. Now, banks (or their affiliates) can issue “payment stablecoins” with permission from federal regulators. We may see large custodial banks, payment companies, or technology companies (if allowed) launch stablecoins, subject to safety safeguards. Large tech companies are subject to one obvious restriction: publicly traded non-financial companies may not issue stablecoins unless a high-level regulatory committee unanimously determines that they do not pose systemic risk and comply with strict data privacy rules. This provision is clearly aimed at projects like Facebook's past Libra/Diem plans. This means that it will be difficult for companies like Amazon or Meta to issue stablecoins directly, but rather to work with licensed issuers or banks.

In the short term, changes in market structure may include competition for GENIUS Act licenses, small business integration, and non-compliant currencies exiting US platforms. For example, as the deadline approaches, offshore US dollar stablecoins or algorithmic tokens (which do not meet the act's definition of full reserves) may be delisted from US exchanges. Instead, tokens backed by US debt are expected to gain favor. Circle and Paxos (the issuer of USDP) have positioned themselves as transparent, regulated brands, which may help them grab market share lost by Tether. Early data shows that the market is rebalancing: after falling in 2022, USDC's market share has rebounded to about 25% by mid-2025, snatching a few percentage points from USDT. In the coming months, we may see Tether reduce the risk assets in its reserve portfolio and shorten its investment duration to comply with the Act's restrictions (only liquid, short-term instruments are allowed). All issuers are likely to hold a larger proportion of US Treasuries, both for compliance and to signal their stability to investors.

The core premise of the GENIUS Act is that bringing stablecoins under regulation will increase demand for US Treasuries, thereby consolidating the dollar's reserve currency status. In fact, the mandatory requirement to be backed by Treasury bonds and bank deposits makes stablecoins a significant source of demand for safe assets. There are now more than $260 billion in US dollar stablecoins in circulation, including tens of billions of dollars in short-term Treasury bonds. Analysis by the Bank for International Settlements shows that the flow of stablecoin reserve funds can affect money market rates. One study found that an inflow of about $3.5 billion into stablecoins could reduce the three-month Treasury yield by about 2 to 2.5 basis points in 10 days. These effects are temporary but noteworthy, highlighting the growing influence of stablecoins in short-term funding markets.

Conversely, large stablecoin outflows or redemptions can significantly increase yields, suggesting that a sudden run on a stablecoin could quickly tighten money markets. This has practical implications: a large number of USDT redemptions prompted by regulatory changes could cause Tether to liquidate its Treasury holdings, causing yields to spike. The restrictions in the GENIUS Act are intended to reduce the risk of a run by ensuring that stablecoins are as good as cash. In the short term, money market investors are closely watching the flow of stablecoins. The passage of the bill has raised expectations of increased stablecoin issuance, which means more Treasury purchases and, therefore, a narrowing of Treasury yield spreads.

The prohibition on paying interest to stablecoin holders ensures that issuers capture all of their seigniorage profits from investing their reserves. With short-term U.S. Treasury rates around 5%, this profit is significant. For example, USDT’s approximately $130 billion in circulation is invested in short-term Treasuries, generating approximately $6-7 billion in annual returns, comparable to the profits of large financial institutions. In the short term, this dynamic incentivizes issuers to expand supply. We observe Tether’s issuance reaching an all-time high, and Circle also repositioning to expand USDC after contracting in late 2024.

However, as regulated players such as banks join, the seigniorage spread may narrow if issuers adopt competitive strategies such as fee rebates to indirectly share in the benefits. Banks may argue that stablecoin issuers should face similar capital or deposit insurance requirements. This debate may influence regulatory rulemaking on stablecoin capital and liquidity requirements. Initially, after the bill was passed, market confidence in stablecoins increased significantly, and some stablecoins had tight pegs and small premiums. Short-term winners include Circle and US money market funds, which indirectly benefited from inflows. Losers or challenges include algorithmic stablecoins and currencies that rely on riskier assets, which may force Tether to further cut non-compliant assets. If demand grows further, the demand for stablecoins may have an impact on the issuance of Treasury bonds. Overall, the clarity of legislation is integrating the liquidity of crypto-dollars with traditional markets, affecting the behavior of issuers, the flow of funds for U.S. Treasury bonds, and the layout of financial institutions entering the stablecoin field.

The rapid rise of stablecoins has triggered warnings from economists and central bankers about potential systemic risks. The Financial Times pointed out that despite the increasing use of stablecoins, they are "no substitute for money" because they replicate some of the functions of money but lack comprehensive guarantees. This section will examine the key risk arguments put forward by the Financial Times and the Bank for International Settlements, including currency unity (unified currency value), bank run dynamics, illegal finance, and monetary sovereignty, in conjunction with the new US measures.

A fundamental concern is that multiple private stablecoins could undermine the “foreign” fungibility of money. In a well-functioning monetary system, a dollar is worth the same whether it is a bank deposit or cash, and is always redeemable at par. However, stablecoins introduce fragmentation: Issuer A’s tokens may not always trade 1:1 with issuer B’s tokens or actual dollars, especially under stress. Hyun Song Shin of the Bank for International Settlements likens today’s stablecoins to 19th-century wildcat notes, which often traded at different discounts depending on the creditworthiness of the issuer. He notes that stablecoins “often trade at different rates depending on the issuer, undermining the principle of central bank money foreclosure.” This lack of unity, or lack of unity, means that stablecoin holders bear the credit risk of the issuer. In fact, some small deviations have already occurred: USDT once traded below $1 during the market panic, and USDC also briefly decoupled to about $0.90 in March 2023. GENIUS attempts to address the problem of singularity by imposing redemption obligations and reserve transparency to ensure that each regulated stablecoin is reliably worth $1. The bill also prohibits misleading claims that any stablecoin claims to be an official legal tender. However, singularity can only be truly achieved if stablecoins can be directly redeemed at the central bank, which is not currently provided. The Bank for International Settlements advocates a better solution: the tokenization of central bank currencies or bank deposits on a unified ledger, which guarantees singularity by design. Until then, stablecoins remain only an approximation of currency, which will bring the risk of currency fragmentation.

Stablecoin runs are perhaps the most serious systemic threat. If holders doubt the asset reserves of a stablecoin, large-scale redemptions may force the issuer to quickly sell off the reserve assets. Such a sell-off could have repercussions for broader financial markets, especially when the reserve assets include a large amount of a specific asset. For asset-backed stablecoins like USDT and USDC, a run would translate into a large number of sell orders for government bonds or bank deposits, exacerbating market pressures. The Bank for International Settlements explicitly warned that if a stablecoin collapses, its asset reserves may experience a "dumping". So far, stablecoins have generally shown strong resilience; even during the USDC decoupling in March 2023, the redemption process was relatively orderly. The bankruptcy provisions in the GENIUS Act give stablecoin holders priority claims, aiming to reduce the motivation for a run. The bill also requires issuers to develop suspension and liquidation plans and stipulates that highly liquid reserves must be held to meet redemption needs. However, a major issuer scandal or cyberattack could still trigger a wave of redemptions. In addition, if stablecoins are used as collateral for DeFi or settlement, instability may spread. U.S. regulations aim to reduce this risk through greater transparency, stronger oversight, and clear redemption rights.

Stablecoins raise concerns about money laundering, sanctions circumvention, and illegal transfers of funds due to their near-instant global liquidity. The Financial Times and the Bank for International Settlements have pointed to the “opaqueness” of stablecoin arrangements and expressed doubts about the integrity of reserves. The GENIUS Act requires issuers to implement a comprehensive BSA/AML compliance program and strictly comply with U.S. sanctions laws, including having the technical ability to freeze tokens involved in illegal activity. Major issuers like Tether and Circle already maintain blacklists, although Tether has been criticized and fined for insufficient controls in the past. U.S. regulation through agencies such as the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC) will increase transparency and compliance monitoring. However, if mainstream stablecoins become too transparent, illicit actors may turn to less regulated stablecoins or privacy-enhancing tokens. Overall, recent regulatory actions have strengthened financial integrity by making illicit finance harder to hide and easier to track.

The widespread use of foreign stablecoins could undermine national monetary sovereignty, especially in emerging markets. The Bank for International Settlements has warned that unregulated stablecoins pose risks to monetary sovereignty and could fuel capital flight. U.S. dollar stablecoins have been widely circulated in countries facing inflation or capital controls, effectively acting as unofficial dollarization. This weakens the monetary control of local banks and central banks. The GENIUS Act addresses this issue by imposing strict conditions on foreign currency stablecoin issuers to enter the U.S. market, in effect requiring major offshore issuers to accept U.S. regulation or be banned. However, U.S.-regulated stablecoins could still proliferate globally, strengthen the dominance of the U.S. dollar, and cause tensions abroad. Institutions such as the International Monetary Fund have suggested that emerging economies strengthen foreign exchange controls or consider issuing their own digital currencies. Overall, the new U.S. framework has promoted the global expansion of U.S. dollar stablecoins, which is beneficial to the influence of the U.S. dollar, but has also sparked debates on stability issues abroad.

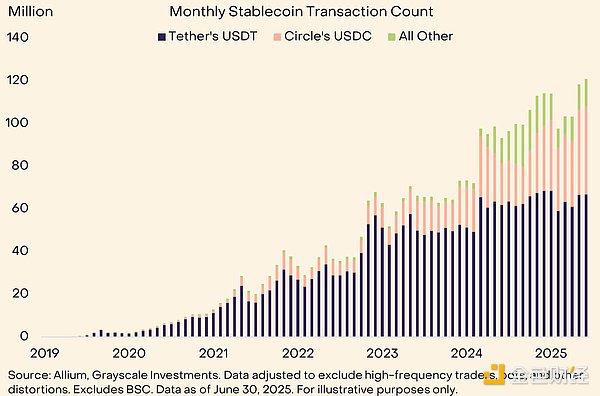

In 2025, the global adoption of stablecoins continued to accelerate, with both market size and actual applications reaching new highs. This section will quantify key trends: overall market capitalization, network distribution (Tron and Ethereum), usage in emerging markets (including P2P foreign exchange), corporate (B2B) transaction volume, payment card integration, and cross-border payment indicators. The total value of stablecoins in circulation now exceeds $250 billion, with the vast majority denominated in U.S. dollars (USD-backed stablecoins account for about 99% of the stablecoin market by value). This is more than double the figure from two years ago and significantly higher than the roughly $160 billion at the beginning of 2024. According to Messari’s “State of Stablecoins in 2025” report released on July 22, 2025, the total market value has exceeded the $250 billion mark, driven by clearer regulatory requirements and rising demand for U.S. dollar liquidity. USDT remains the largest stablecoin (~60%-62% of total market cap). Circle’s USDC is second (~20%-25%), and while it lost ground in 2023, it has since stabilized. A notable new entrant is PayPal’s PYUSD (launched in 2023), which still has a small share of the market. Other entities such as TrueUSD (TUSD) and BUSD have had more volatile trajectories—for example, BUSD was scaled back in 2023 due to regulatory actions. Legislative progress is expected to consolidate the top two (USDT and USDC) while encouraging the emergence of new regulated stablecoins. Messari notes that USDC’s share has begun to rise again as Circle adapts to new regulations and some users prefer its regulated status. In the first half of 2025, the value settled in stablecoins on public chains exceeded $2.6 trillion, reflecting its high circulation velocity in use cases such as trading and arbitrage.

A notable pattern in stablecoin usage is the difference in preference for different networks. In many areas, USDT has become synonymous with the Tron blockchain, while USDC is primarily used on Ethereum and Layer2 networks. A May 2025 survey found that USDT accounted for 90% of stablecoin payment transactions, of which about 60% were processed by Tron. Tron offers faster and cheaper transactions than Ethereum mainnet, which explains its popularity in high-volume, cost-sensitive applications. Tron now routinely processes five times as many USDT transactions per day as Ethereum. Retail users in emerging markets tend to use Tron-based USDT because of its near-zero fees. Ethereum remains important for exchange settlements and decentralized finance. BSC and Polygon also carry stablecoin transaction flows. Regulators have noticed these differences: Tron is more opaque and primarily outside of U.S. jurisdiction. Regulatory actions may indirectly prompt migration to more compliant chains, but Tron is expected to remain dominant in USDT transaction volume in the short term. Circle is expanding USDC to networks such as Arbitrum and Solana, both of which are expected to continue to grow and serve different user groups. Stablecoins in Emerging Markets – Peer-to-Peer (P2P) FX Trading and Remittances Stablecoins have had a profound impact on emerging markets, providing access to USD outside the traditional banking system. Individuals in Africa, Eastern Europe, the Middle East, and Latin America use USDT or USDC through peer-to-peer trading platforms or over-the-counter brokers to hold USD value or send remittances abroad. Binance’s peer-to-peer marketplace trades USDT in local currency with narrower FX spreads than banks or remittance services. In Nigeria, for example, the stablecoin market actually sets the actual FX rate. People working abroad send stablecoins home quickly and at a low cost, competing with traditional remittance channels, especially in Latin America. Local startups in places like Argentina offer fiat spending options for stablecoin balances to combat inflation. A significant portion of B2B payments involving emerging markets are now conducted through stablecoins, reducing FX slippage and bank fees. Stablecoin adoption has increased significantly in emerging markets, where it is used for payroll, trade settlements, and savings. Chainalysis reports that in some emerging markets, stablecoins account for more than 30% of total cryptocurrency transaction volume.

Stablecoin adoption continues to increase in business-to-business (B2B) transactions and consumer payments. As of early 2025, annualized stablecoin payment volume is approximately $72.3 billion, covering categories such as B2B, B2C, person-to-person (P2P), card payments, and lending. Businesses use stablecoins to settle invoices, pay suppliers or contractors, especially in cross-border transactions. Circle provides an API for businesses to integrate USDC into their financial operations. Payment cards associated with stablecoin wallets have emerged, allowing cryptocurrencies to be converted into fiat currency for spending at the point of sale via Visa or MasterCard debit cards. Coinbase and Crypto.com offer cards that use USDC or USDT balances. Stablecoin transaction volumes are already competitive with networks such as Visa and PayPal on some metrics, with millions of stablecoin transactions occurring every day. Visa and Mastercard themselves are also piloting stablecoin settlements, viewing stablecoins as a complement to traditional money flows.

Cross-border payment indicators highlight the popularity of stablecoins, with cross-border flows of stablecoins growing rapidly, especially in high-cost corridors such as the United States, Mexico and Europe and Africa. The World Bank and central banks are now tracking stablecoin remittances, recognizing their growing role. The premium on stablecoins in local markets suggests that there is strong demand for them for capital flight or savings purposes. Stablecoins have penetrated the foreign exchange trading and settlement sector, reducing the cost of currency exchange and remittances, and posing a challenge to traditional financial services.

Prompt all parties involved in traditional finance and policy to adjust their strategies. This section explores the responses of banks, payment service providers (PSPs), large merchants, and policy institutions, including initiatives such as the Bank for International Settlements’ (BIS) Agorá project that offer alternatives.

Initially, banks were cautious about stablecoins, viewing them both as a threat (to deposits) and an opportunity (to provide new services). With the GENIUS Act legalizing stablecoins, many banks are moving from a wait-and-see approach to engagement. There are several potential strategies for large U.S. banks: (a) issuing their own stablecoin or deposit token; (b) partnering with an existing issuer (e.g., acting as a custodian or settlement bank); and (c) integrating stablecoins into payment services without issuing them themselves. So far, some smaller institutions have dabbled, such as Silvergate Bank (now defunct) which helped launch a token, Signature Bank using Signature Systems, and JPMorgan Chase which has launched JPM Coin (a private permissioned stablecoin for corporate clients) since 2019. But these attempts have been isolated and not widely used on public blockchains. The new law paves the way for specialized “narrow banks” focused on digital dollars by providing stablecoin issuers with a charter from the Office of the Comptroller of the Currency (OCC). Banks like Custodia (a digital asset bank registered in Wyoming) have faced lawsuits after the Fed refused to open an account for them, in part due to a lack of federal law - now, under the framework of the bill, they may have a clearer basis to reapply.

Traditional banks are also incentivized by the returns from stablecoins. If billions of dollars in interest income flow into Tether's profits, banks think this can also become their business (because they traditionally profit from deposits). We may see alliance efforts: In fact, in 2024, a group of banks and credit unions in the United States explored a stablecoin called USDF, but it stalled for regulatory reasons. Under the GENIUS model, such an alliance could become a government-approved issuer (backed by members insured by the Federal Deposit Insurance Corporation). Banks may find that stablecoins help increase interbank settlement speed and provide faster capital flows for corporate customers. Many banks in Europe and Asia are already testing tokenized deposits — essentially blockchain-based representations of bank deposits. These are similar to stablecoins, but still on the bank’s balance sheet. Standard Chartered and HSBC, for example, have piloted such tokens for internal transfers. In the U.S., some experts are advocating for a “regulated liability network” model, where banks jointly issue interoperable tokens (think of it as each bank issuing its own stablecoin, 1:1 fungible). This divergence in regulation (the Fed does not issue central bank digital currencies, but allows private, regulated cryptocurrencies) has led banks to lead innovation. JPMorgan’s CEO famously said that if a stablecoin gets big enough, banks will get involved — and that seems to be happening. Expect one or more of the largest U.S. banks to announce stablecoins (likely for institutional users first) or stablecoin services for fintechs over the next year.

European influence: European banks, facing the Market Infrastructure Directive (MiCA) that allows them to issue “electronic money tokens,” are also exploring this area, and transatlantic alignment could push U.S. banks to keep up. On the other hand, banks have also expressed risk concerns: they worry that stablecoins could lead to deposit outflows in a crisis (if people are worried about bank defaults, they might withdraw money from banks and put it into stablecoins, which is the opposite of the usual concerns about stablecoin runs). As a result, they may push regulators to level the playing field, for example by requiring stablecoin issuers to have similar capital buffers. We may see banks requiring stablecoin issuers to gain access to the Fed’s master account to safely store reserves (this is not required by law, but it is a real issue). If approved, this would bring stablecoins closer to the model of central bank digital currencies (CBDCs), but managed by private banks. In short, the strategic response of banks is to embrace and shape: they want to participate in the stablecoin game directly or through infrastructure support, while ensuring that the rules do not weaken their competitive position. This is a delicate balance - some smaller banks may support stablecoin innovation to win new business, while large banks may ensure that any such currencies are under strict control of the banking industry.

Payment companies (such as Visa, Mastercard, PayPal, Stripe) and large merchants are also adapting to this change. PayPal boldly launched its own USD stablecoin (PYUSD) in 2023, becoming the first major technology company to launch such a product.

While acceptance has been low so far, PayPal's move shows that payment service providers (PSPs) see stablecoins as both a threat and a logical extension of their business. With legal clarity, PayPal can now apply for a federal license or work with an issuer (its stablecoin is actually issued by Paxos under New York State regulations and may transition to a federal framework in the future). Visa and Mastercard have been very active in connecting cryptocurrencies and traditional payments. Both companies have worked with stablecoin companies to enable conversions at the point of sale Visa's head of cryptocurrency McHenry reiterated the company's commitment to using stablecoins to settle transactions when it is advantageous, essentially viewing stablecoins as a new settlement currency. These card networks are also developing messaging and identity standards to attach to blockchain transactions - for example, Mastercard has launched "crypto credentials" that tag blockchain transfers with verified information, which could make stablecoin transactions more commercially acceptable by reducing anonymity. Stripe and other payment processors have already integrated stablecoin payment capabilities: freelancers can now get paid in USDC through Stripe Connect, which is invaluable in countries where Stripe cannot easily send money. For large tech retailers (Amazon, Apple), they have not directly accepted cryptocurrencies so far, but Amazon is rumored to be exploring this aspect. If there is customer demand, the legislative environment may encourage them to accept stablecoins, as they can now be sure of consumer protection and legal status. We can perhaps imagine that large retailers will soon accept USDC or USDT for online purchases, perhaps converted to fiat currency through third-party payment gateways. Starbucks and some chains have already experimented with accepting cryptocurrencies (mainly through conversion apps); stablecoins are easier to accept because of their lack of volatility. Additionally, merchant acquirers — companies that process credit card payments for merchants — may include stablecoin payments as a payment method in their terminals. This could reduce fees for merchants if done outside of traditional credit card channels (cryptocurrency transaction fees can be much lower than credit card fees, especially for cross-border sales). For example, a merchant that sells digital goods globally might prefer to accept stablecoin payments to avoid the 3% credit card fee and the hassle of currency conversion. Currently, adoption is low, but companies like Overstock (a US retailer) have been accepting stablecoins for years, and some travel booking sites also accept USDC. As regulation improves, more mainstream companies may try to get involved in this space, perhaps starting with business-to-business (B2B) use cases (e.g., paying suppliers with stablecoins to get early payment discounts).

Strategic logic: Merchants and payment service providers (PSPs) will eventually follow customers and cost advantages. If stablecoins can provide near-instant settlement and lower fees (no chargebacks, etc.), they can improve merchants' cash flow. On the other hand, merchant acceptance of stablecoins brings with it foreign exchange considerations — European merchants accepting USDC face dollar risk unless they immediately convert it to euros. However, stablecoin infrastructure providers now offer automated exchange and custody services to manage this risk. We have seen similar developments in Latin America: merchants in countries such as Venezuela have begun to informally accept USDT for everyday items because they trust it more than their own bolivars; formal businesses in hyperinflationary economies may also begin to price in stablecoins. Payment giants do not want to be replaced by crypto networks, so their strategy is to “embrace and expand”: incorporate stablecoins into their ecosystems, ensure that they remain a trusted brand to facilitate transactions, and perhaps even use stablecoins to enter new markets (for example, 24/7 cross-border settlements that are currently difficult to achieve with banking networks).

On the public sector side, central banks and international institutions are developing responses to private stablecoins. With the US not considering launching a retail CBDC for the time being, the focus has shifted to improving existing systems and exploring hybrid systems. The Bank for International Settlements (BIS) has been leading projects through its Innovation Hub to demonstrate how the benefits of stablecoins (fast, programmable payments) can be achieved with sovereign currencies. The Agorá project, launched in 2024, involves seven major central banks (France/Eurozone, UK, Japan, South Korea, Mexico, Switzerland, and the Federal Reserve Bank of New York) and more than 40 private financial institutions. The goal of the Agorá project is to create a "unified ledger" that can host different forms of tokenized money on an interoperable platform - tokenized central bank wholesale deposits, tokenized commercial bank deposits, and potentially tokenized bonds or other assets. In essence, it is a blueprint for a public-private coexistence system: banks will issue tokenized deposits (similar to stablecoins, but fully regulated by banks), central banks will provide wholesale central bank digital currencies (CBDCs) for interbank settlement, and the system will enable seamless cross-border payments in multiple currencies through a unified ledger and smart contracts. The project aims to confront the fragmentation and trust issues of stablecoins head-on - Agorá attempts to preserve the two-tier banking model (and thus the single nature of money) while achieving near-real-time cross-border settlement and programmability. As of mid-2025, Agorá is still in the design phase, but the involvement of large players (including the US through the Federal Reserve Bank of New York) indicates strong interest in this approach. If successful, this would allow a network where, for example, a payment could consist of a series of transactions where a tokenized stablecoin-like deposit representing US dollars and a deposit representing euros could be atomically swapped with a central bank backing final settlement. The advantage is that it avoids a retail CBDC and leverages the strengths of the existing system (banks’ customer relationships and credit provision) while having cryptocurrency-like efficiencies. Other policy responses include strengthening domestic fast payment systems (the FedNow system launched in 2023 in the US provides instant bank transfers 24/7 – seen by some as a response to the need for digital cash alternatives). The EU is moving forward with a digital euro, but primarily for domestic use; however, the EU’s MiCA has already heavily regulated stablecoins (e.g., restricting the use of non-euro stablecoins for payments within the euro area to preserve euro sovereignty). One can view the US approach (promoting private stablecoins) versus the EU approach (considering a public digital euro, with tight controls on private stablecoins) as two different responses to the same phenomenon. The IMF and World Bank are working with countries to modernize exchange controls and consider issuing their own national stablecoins or CBDCs to compete with dollar tokens. Nigeria, for example, launched eNaira, but adoption is low, while a group of African technologists are working on an African stablecoin. China’s digital yuan is gradually being rolled out, perhaps aiming to provide an alternative to the dollar stablecoin in Belt and Road trade. The Bank for International Settlements (BIS) position in its 2025 annual report is that the tokenization of official currencies combined with the regulation of cryptocurrencies is the best path forward. BIS General Manager Agustín Carstens urged central banks to “go boldly with tokenization” to gain efficiency gains while maintaining control. The Agorá project embodies this philosophy. We may see Agorá launch prototypes or pilot transactions in the next 12 months—perhaps cross-border settlements between participating central banks using tokenized deposits and wholesale CBDCs. There are also projects like Icebreaker (a smaller BIS pilot project that aims to connect retail CBDCs for cross-border transactions) and mBridge (connecting multiple Asian CBDCs for trade settlement). These all suggest that policymakers are taking a cautious approach: even if retail central bank digital currencies are hampered, work on wholesale and cross-border central bank digital currencies is moving at full speed to ensure that central banks have ready alternatives if stablecoins or foreign digital currencies become too influential.

Regulators such as the Financial Stability Board (FSB) and the International Monetary Fund (IMF) have also proposed frameworks. In July 2023, the FSB issued recommendations on global stablecoin regulation, many of which have been adopted by the US GENIUS Act (e.g., redemption rights, prudential standards). The IMF is developing the concept of an interoperable central bank digital currency platform, aimed at preventing a situation where national systems are incompatible or private currencies dominate.

In summary, the strategic responses all revolve around a theme: the public and private sectors leverage each other. Banks and payment companies are incorporating stablecoins into their business models, preventing business marginalization by providing a trust and compliance layer. Policymakers are on the one hand increasing regulation of stablecoins, and on the other hand accelerating projects such as Agora to provide the next generation of payment infrastructure, which may one day reduce the importance of current stablecoins. In the meantime, we may even see a hybrid model, such as central banks allowing or supporting full-reserve stablecoins issued by banks (some call them “synthetic CBDCs”).

It is worth noting that the House majority, in line with the “anti-CBDC” position, has not prevented the Fed and its allies from innovating in the wholesale space. The likely equilibrium, at least for the next few years, is that regulated private stablecoins are used for retail and central bank tokenized currencies are used for wholesale, and the two are expected to be interoperable.

Large merchants and enterprises will benefit from lower costs—many are neutral on this and will adopt the most efficient technology, whether it is Circle's USDC, JPMorgan's deposit tokens, or the Fed's products. The July 2025 legislative choices move the United States firmly toward a model of retail innovation driven by the private sector, while regulating—a position that is consistent with the country's financial tradition, but will also prompt regulators to remain vigilant to ensure that the public interest (stability, inclusion, sovereignty) is protected while private digital currencies flourish.

The possible development path lies between the baseline and best-case scenarios. The July 2025 legislative progress allows the United States to take advantage of private innovation while addressing the clear risks that exist in the stablecoin and cryptocurrency markets. If executed properly, these legislations will make stablecoins a reliable part of retail and wholesale finance—speeding up transactions, expanding the use of the dollar worldwide, and keeping the United States at the forefront of fintech innovation.

However, regulators still need to remain vigilant: stablecoins blur the line between public and private currencies, so careful supervision is needed to ensure that the unity and stability of currency are maintained and that the development of fintech does not exceed the regulatory framework of traditional finance. In the coming year, the world will pay attention to the progress of the US experiment. Successful trials may accelerate the arrival of a new era of digital finance led by a strong US dollar ecosystem; failures or mistakes may trigger a crisis and strengthen the voices that warn that stablecoins are "dangerous" tools that require stricter supervision. For global financial markets and monetary systems, the risks are enormous.

中国研究团队据称利用D-Wave量子计算机攻破了传统加密算法,包括保护银行账户和加密钱包的机制。这一消息在全球引发广泛关注,尽管研究细节尚未完全披露,其对加密货币和其他加密技术的影响仍在评估中。

Weiliang

WeiliangAnthropic has launched two new AI models, Claude 3.5 Sonnet and Claude 3.5 Haiku, featuring improved coding abilities and performance. The Sonnet model can now interact with computer interfaces directly, allowing it to automate tasks, while the Haiku model aims to deliver high efficiency and low latency for user-facing applications.

Weatherly

WeatherlyMeta cautiously reintroduces facial recognition, testing it on 50,000 celebrities to combat "celeb-bait" scams and reduce deepfake ads. But is this enough to stop compromised accounts, or is more action required?

Catherine

CatherineTesla recently transferred its entire Bitcoin stash of 11,509 BTC to new wallets, sparking speculation about a possible sell-off. However, blockchain analysts believe these movements are just wallet rotations, indicating that Tesla still owns the Bitcoin and may be preparing for future strategic moves.

Anais

AnaisA man from China, Jiangsu, accumulated significant debt after losing money in cryptocurrency and gambling. To cover his losses, he committed fraud by borrowing against luxury cars he didn't own, which led to his arrest and a three-year prison sentence for contract fraud.

Weatherly

Weatherly本周一,菱传媒爆料,前台北市长柯文哲因涉嫌京华城案被羁押,相关调查发现其加密货币冷钱包已被查扣。然而,由于缺少钱包的私钥和助记词,检调遇到技术瓶颈,调查进展受阻,或将延长羁押期限。专家指出,即便无助记词,USDT等加密资产仍有可能通过申请冻结处理。

Alex

AlexTelegram game Tomarket has set new requirements for its 31 October TOMA token airdrop on TON. Players must reach Bronze status and include a tomato emoji in their username to qualify. The key question: will TOMA fade after the hype, or achieve lasting success?

Catherine

Catherine本周一,四位联准会官员针对未来的降息策略发表了各自的看法。三位官员倾向于“谨慎、渐进降息”,而拥有今年投票权的旧金山联准银行总裁戴利(Mary Daly)认为当前利率过于严格,暗示降息步伐可能需要加快。

Alex

AlexTigran Gambaryan, a Binance executive, was released after Nigeria dropped money laundering charges due to his worsening health. His detention lasted over seven months, and diplomatic pressure played a key role in securing his release.

Joy

JoyMiles Brundage, OpenAI’s Senior Advisor for AGI Readiness, has resigned to focus on AI policy. His departure, alongside other high-profile exits, prompts questions about the potential long-term impact on the for-profit AI company. How will these shifts influence OpenAI's future trajectory?

Kikyo

Kikyo