Author: Irwyn Liong Source: artemisanalytics Translation: Shan Ouba, Golden Finance

Sui Overview

Sui has quickly emerged as a leading blockchain platform. Founded in 2022 by former Meta engineers, Sui aims to put people above the platform through secure, accessible and decentralized digital ownership. With low fees, high scalability and strong security, Sui has cultivated a strong developer community, driving adoption through hackathons, accelerator programs and growing transaction volume. Its groundbreaking scalability is due to Mysticeti, a next-generation consensus mechanism built on Narwhal and Tusk that optimizes transaction ordering, data availability and network resilience. As market sentiment remains bullish, industry leaders like VanEck expect Sui to grow and adopt further, solidifying Sui's position as a key L1 blockchain contender.

Sui's Object Model

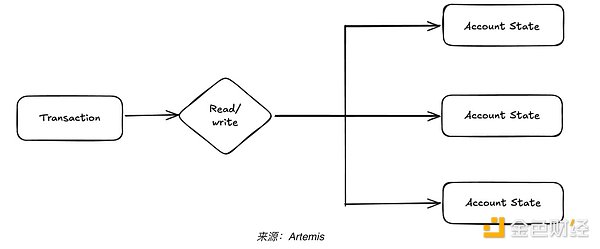

Before we dive into the Sui stablecoin ecosystem, let's take a look at how Sui organizes and records data more efficiently than traditional account-based blockchains such as Ethereum.

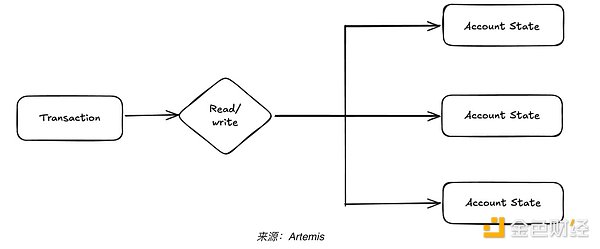

In the account-based model, each transaction records the debit and credit between two wallet addresses.

This means that every transfer will update the balance on the fixed wallet address, making it simple and straightforward to track token balances and transaction flows.

Indexing these blockchains is relatively simple because all balance changes are ledger-based and associated with static accounts.

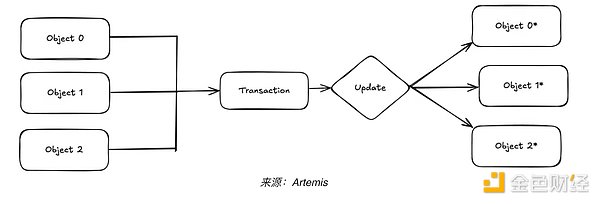

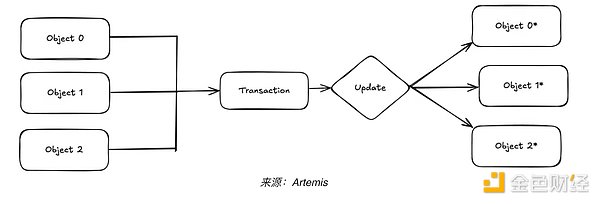

Sui takes a completely different approach and represents everything, including wallet addresses and tokens, as objects. This poses unique challenges in terms of data indexing and aggregation.

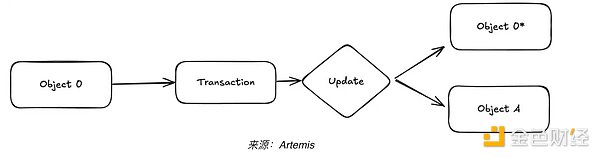

Each transaction updates all objects involved, rather than modifying the static balance on the address.

Unlike traditional ledger entries that show debits and credits, Sui modifies the state of objects, meaning balances are stored and tracked as evolving object versions.

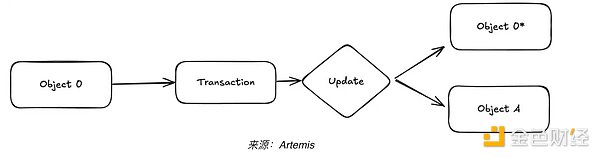

Unlike traditional account-based models, objects in Sui can not only change value, but also transfer ownership between accounts. This means that modifications to objects may include value updates and ownership transfers, creating new versions of objects that reflect these changes.

For example, a stablecoin transfer will not only update the "balance" field on the wallet address - it will create a new version of the token object, updating the metadata. That is, from object0 to object0*.

Since each wallet is also an object, the transaction actually modifies multiple objects at the same time, requiring a more complex indexing strategy.

In addition, if there is a partial transfer, the token object will update its balance, that is, from object0 to object0*, and generate a new object (objectA) to reflect the partial balance.

Understanding this distinction is critical to interpreting the on-chain data of stablecoins in the Sui ecosystem. At Artemis, we believe that in this increasingly fundamentals-driven world, we use first principles methods to reveal the real on-chain data for everyone.

Current Status of Sui Stablecoin Ecosystem

Note: All data collected as of February 18, 2025

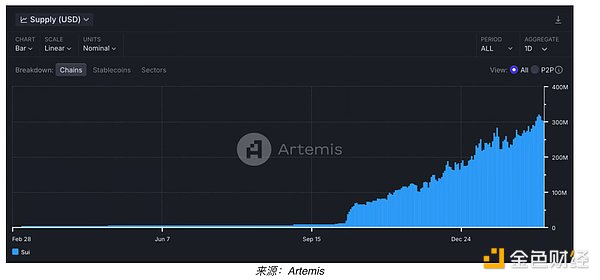

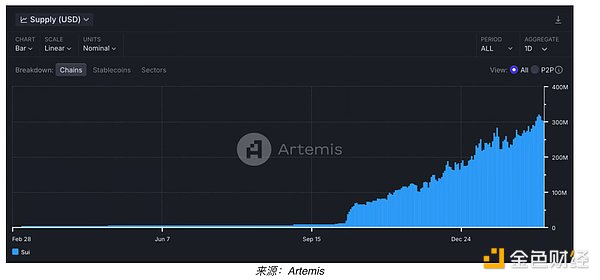

Sui’s significant growth over the past year highlights its potential as a significant player in the blockchain space. The network’s stablecoin market cap surged from $5.42 million in January 2024 to $555.15 million in February 2025, reflecting the ecosystem’s rapid adoption and growing prominence.

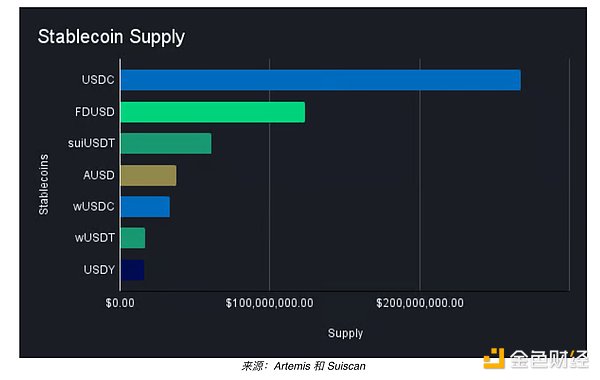

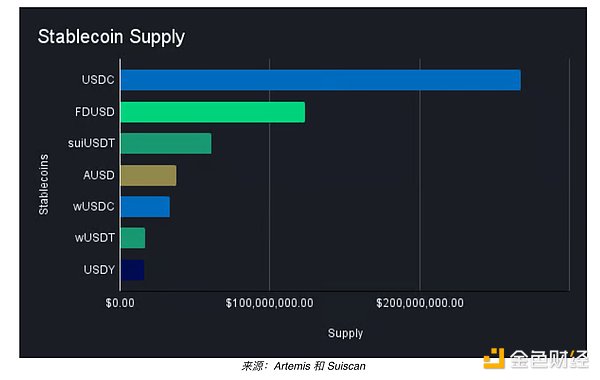

Sui has a diverse stablecoin portfolio, including 5 native and bridge tokens, that cater to a wide range of on-chain functional needs in DeFi applications. The ecosystem’s appeal is further enhanced by native stablecoins like USDC, which has gained notable attention due to its huge popularity as a stablecoin. Next, let’s look at the composition of Sui’s stablecoin supply:

According to the breakdown of Sui’s stablecoin supply, native stablecoins account for 80.1% of the network’s total stablecoin supply. In this research article, we will focus on native stablecoins.

1. Sui Stablecoin Market Chart

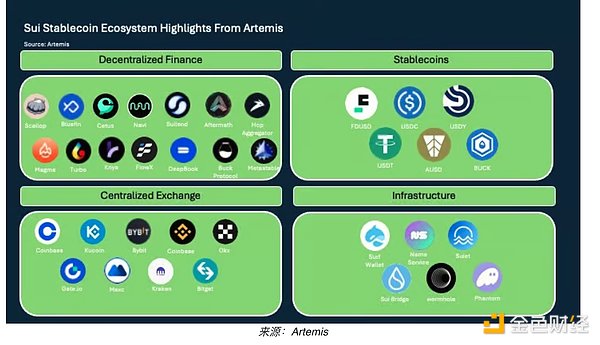

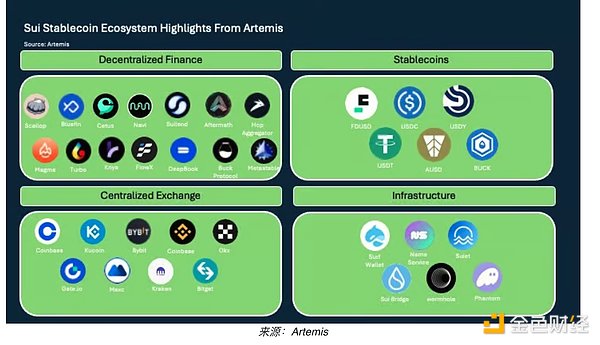

Sui’s stablecoin ecosystem has quickly gained momentum and become an important part of its thriving decentralized finance (DeFi) sector. To better understand its growth and composition, we compiled a market map of Sui’s stablecoin ecosystem:

Sui’s stablecoin market map reveals a thriving DeFi ecosystem, with stablecoins deeply integrated into decentralized exchanges (DEXs), lending platforms, and liquidity protocols. Key players like Cetus, Bluefin, and Suilend drive stablecoin trading, lending, and yield generation, becoming an important component of on-chain liquidity. Emerging protocols like Metastable, which offer stablecoin swaps with 0 slippage fees, may push the ecosystem to new heights.

2. Native Sui Stablecoin

*Note: We are not currently tracking FDUSD and BUCK, whose market caps are approximately $120 million and over $39 million, respectively, in the SUI stablecoin ecosystem.

Looking at the native stablecoin supply growth on Sui, it can be found that it is growing exponentially, indicating that its DeFi ecosystem is expanding and being adopted rapidly. Over the past year, the supply of native stablecoins has surged, reflecting strong demand for on-chain liquidity, lending, and trading. This growth is consistent with Sui’s rising TVL, increasing user activity, and deeper integration across DeFi protocols. As more stablecoin issuers recognize Sui’s scalability, low fees, and fast transactions, the ecosystem continues to attract capital inflows and new financial applications, solidifying its position as a hub for stablecoin-driven DeFi innovation to flourish.

3. TVL in the protocol

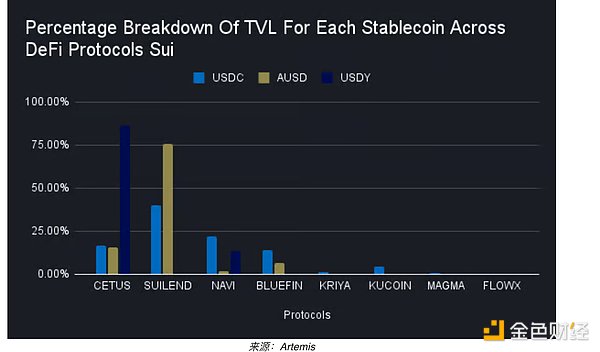

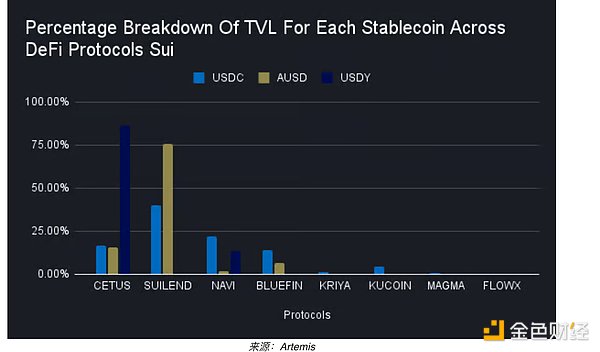

The bar chart shows the distribution of AUSD, USDC, and USDY in different DeFi protocols. A notable observation is that 75.80% of AUSD is deposited in SUILEND, which is significantly higher than USDC's 40.32% in SUILEND. We also found that 86.55% of USDY is stored in CETUS, which is the highest between the two protocols.

This raises two questions:

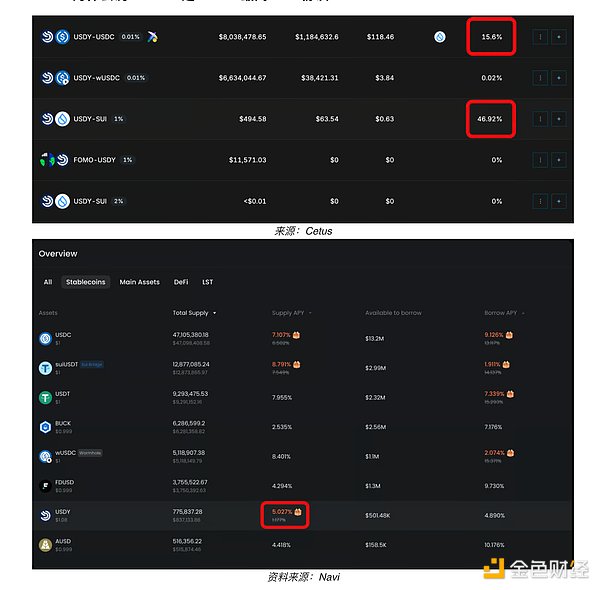

A closer look at SUILEND’s annualized rate of return (APR) provides a convincing explanation. Borrowing rates on SUILEND show that AUSD offers an annualized yield of 11.19%, making it one of the most attractive yield-generating stablecoins on the platform. In contrast, USDC's annualized yield is only 6.06%, making it relatively less attractive for yield-seeking depositors.

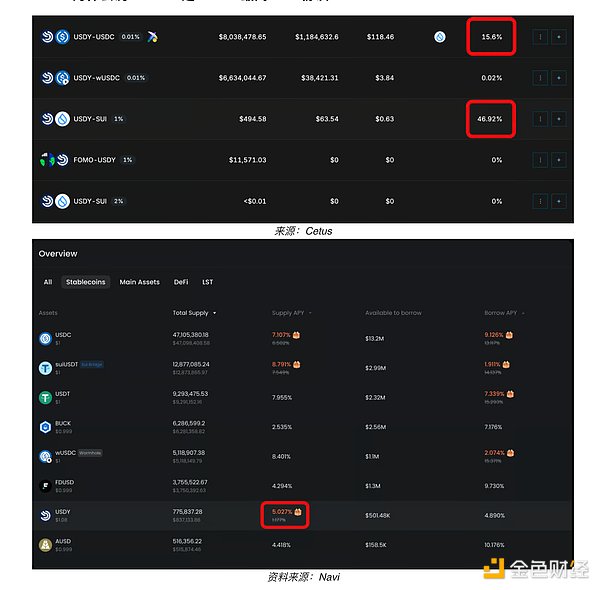

A key reason for CETUS's dominance is its annualized yield of 46.92%, which far exceeds Navi's 5% annualized yield. From the above data, it can be seen that this huge difference in yield may attract more liquidity providers to deposit USDY into CETUS, explaining its higher TVL share compared to other protocols.

4. Largest Shareholders (EOAs)

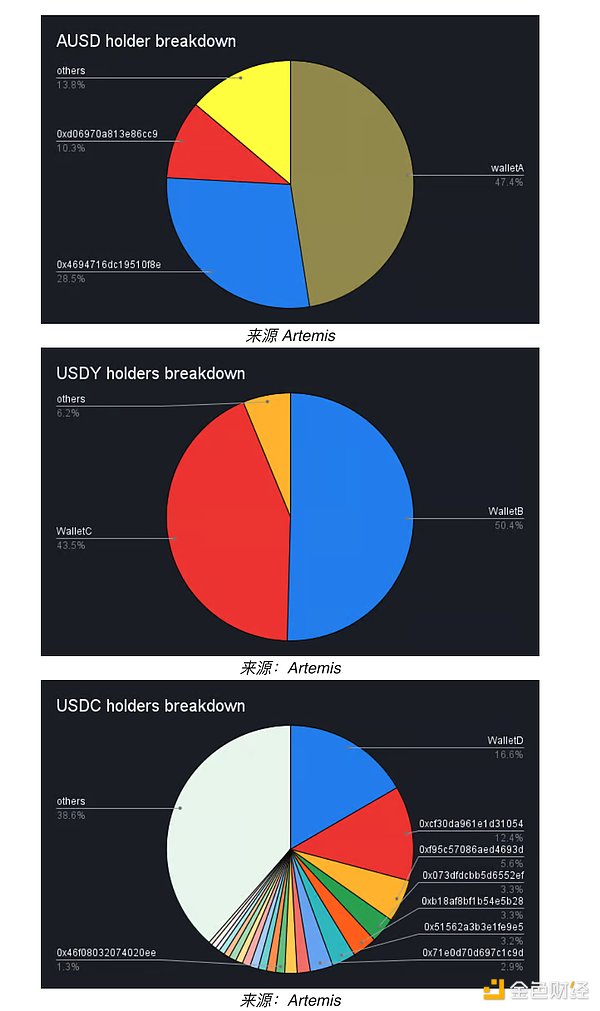

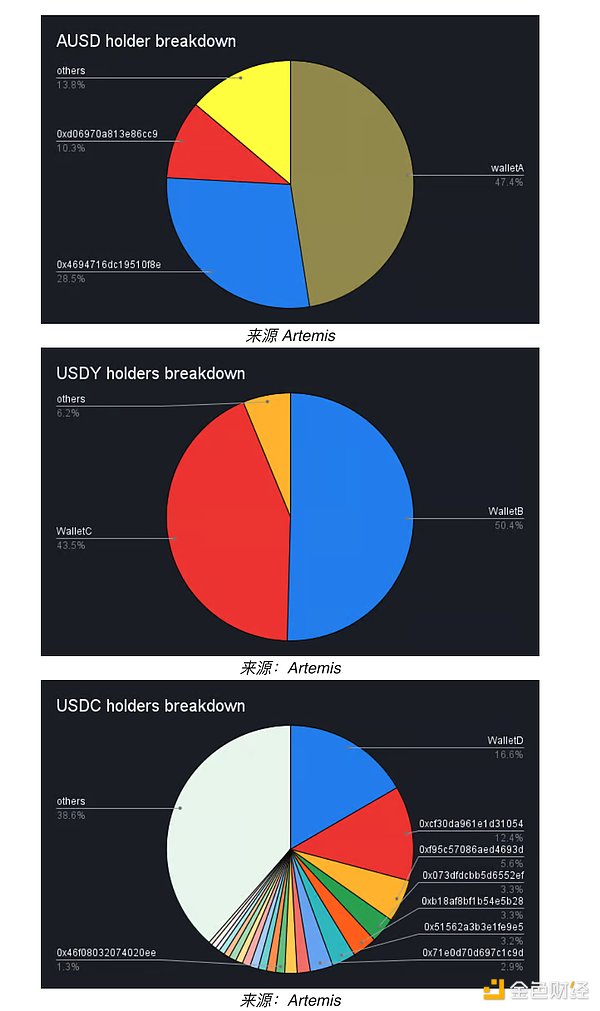

The distribution of stablecoin holders on Sui shows that a small number of wallets account for most of the liquidity, indicating that a few key players dominate liquidity in the ecosystem.

Stablecoin Distribution: Large Holders and Yield-Driven Liquidity Allocation

From the pie chart above, large holders strategically allocate funds to high-yield DeFi protocols. WalletA, the largest holder of AUSD (47.4%), mainly interacts with SUILEND, taking advantage of its high annualized lending yield. Similarly, USDY is also highly concentrated, with WalletB and WalletC controlling 94% of all USDY shares, and WalletB actively farming liquidity on CETUS. Meanwhile, the distribution of USDC is more diverse, although its largest holder WalletD (16.6%) frequently interacts with CETUS, adding and removing liquidity to optimize yield farming. These patterns highlight the role of yield incentives in shaping the distribution of stablecoins, with liquidity tending to flow to protocols that offer the most attractive returns.

What is the future of Sui stablecoins?

Beyond DeFi, Sui's application areas are also expanding, especially in gaming and payments. One notable project is SuiPlay0x1, which aims to attract traditional console and PC gamers by offering gaming rewards that seamlessly integrate with the Sui network. This approach is similar to platforms like Steam, which reports around 132 million monthly active users — a massive market that has yet to interact with blockchain services. The PC gaming market is expected to reach $60.84 billion in 2024, far exceeding the $31.8 billion crypto-exclusive gaming segment. By bridging this gap, Sui is expected to attract a large number of potential users who have yet to engage with blockchain services, introducing them to Web3 through a fun and familiar gaming experience. For stablecoin issuers, this is a rare opportunity to tap into such a large and diverse user base. After earning NFT-based or tokenized rewards, players need an easy way to exchange or "lock" their winnings - this is where stablecoins can come into play. When stablecoin issuers choose to issue natively on Sui, they will become the default medium of exchange for these in-game assets, ensuring stable real-world value for players while stimulating continued demand for the issuer's tokens. Ultimately, this will form a flywheel effect: bringing a vibrant new user base to stablecoins while providing players who are first exposed to blockchain capabilities with a fast and convenient way to cash out their rewards.

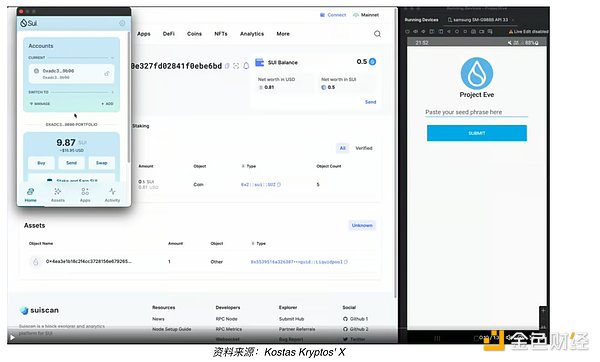

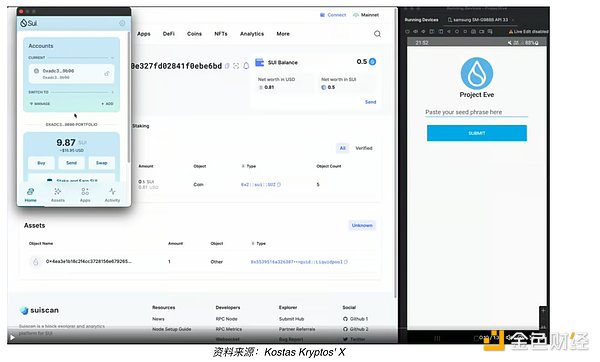

Beyond gaming, Sui’s focus on payments opens up another important avenue for stablecoin usage. In January 2025, Sui co-founder Kostas Krypto demonstrated a demonstration that enabled SMS-based transactions on the Sui network. This development has great potential for areas with limited connectivity, where cell phone signals are more prevalent than broadband connections. By combining SMS transactions with native stablecoins, it allows unbanked groups to transfer value securely, further driving the adoption of digital assets. By issuing natively on Sui, stablecoin issuers can get ahead in these emerging markets, unlock new revenue streams, and significantly expand their user base.

Final Thoughts

Sui’s rapid rise as a blockchain ecosystem has laid the foundation for the evolution of stablecoins and an increasingly dynamic ecosystem. With deep liquidity pools, strong DeFi adoption, and expanded real-world applications, Sui is proving itself to be a strong contender in the Web3 economy. The data highlights clear trends - yield incentives drive capital flows, liquidity is concentrated in the hands of a few major players, and DeFi remains the main use case for stablecoins on Sui. However, as the network continues to expand in the gaming and payment sectors, new opportunities for stablecoin integration continue to emerge, bringing a wider and more diverse user base. Whether through high-yield lending, liquidity farming, or seamless on-chain transactions, stablecoins will become a core pillar of Sui's financial infrastructure, shaping the future of decentralized commerce and more applications.

Brian

Brian