1. The whole story of the OKX incident

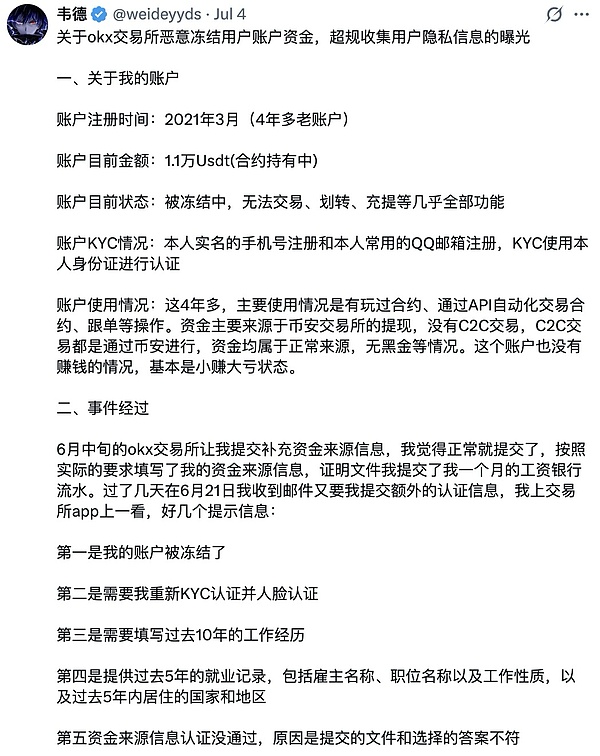

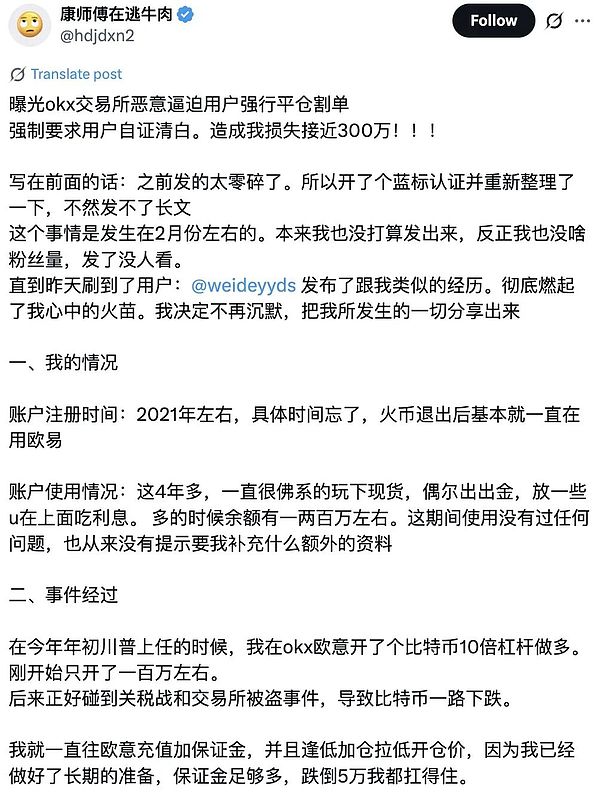

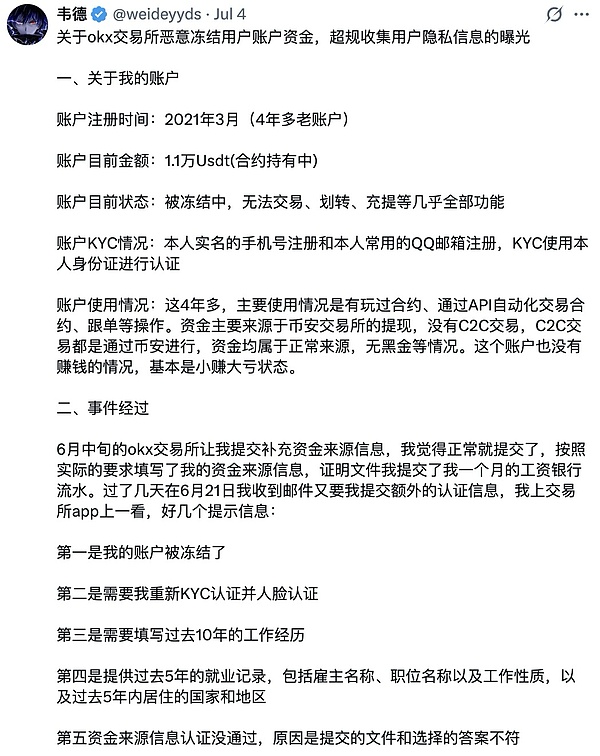

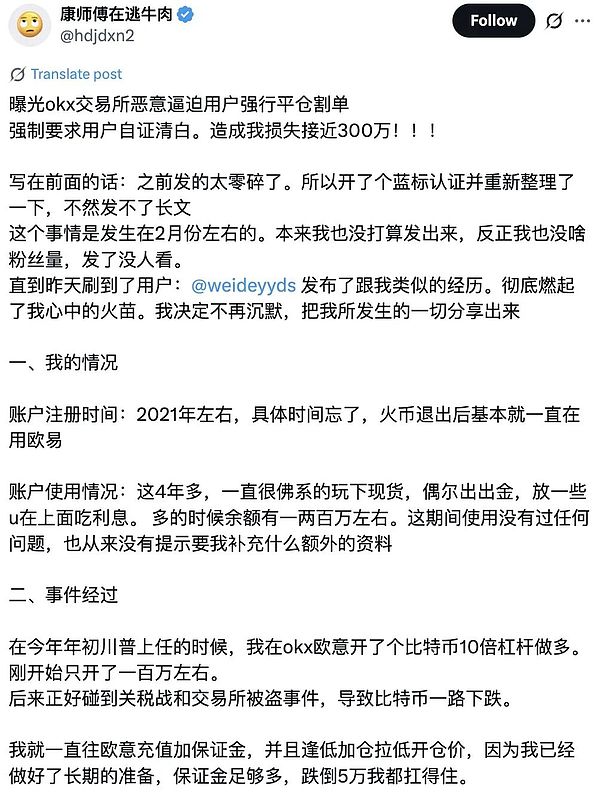

Recently, the OKX compliance incident has been a hot topic on social media. On July 4, OKX user Wade @weideyyds posted a long article on X, "About the exposure of OKX Exchange maliciously freezing user account funds and collecting user privacy information beyond regulations." The article stated that since mid-June, OKX asked him to submit additional information on the source of funds and submit salary flow. After the source of funds information authentication failed, OKX froze the user's account and required him to provide work experience in the past 10 years, employment records in the past 5 years, including employer name, job title and nature of work, as well as the countries and regions where he lived in the past 5 years. The user submitted relevant certificates again and again as required, but the relevant application was rejected. After consulting customer service, it was still fruitless. The user believed that the platform maliciously froze the account.

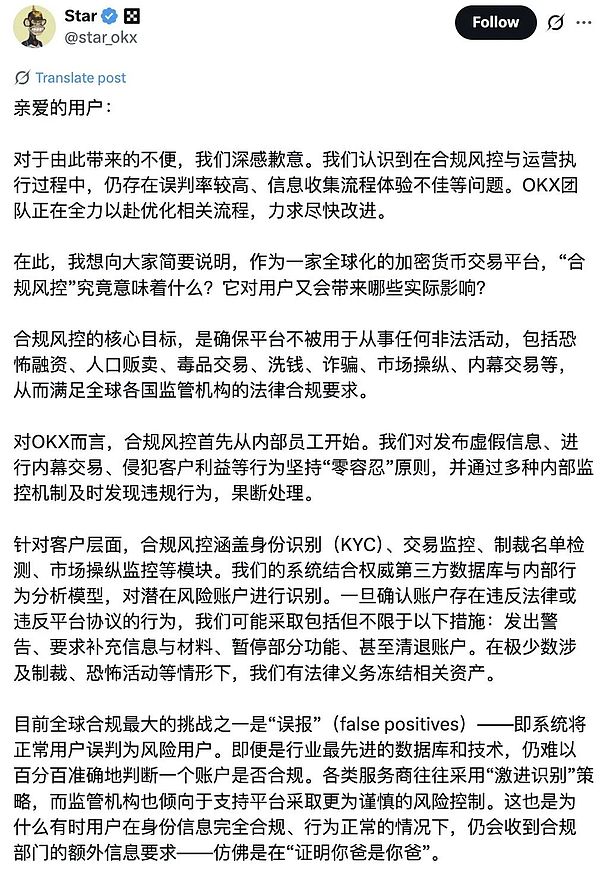

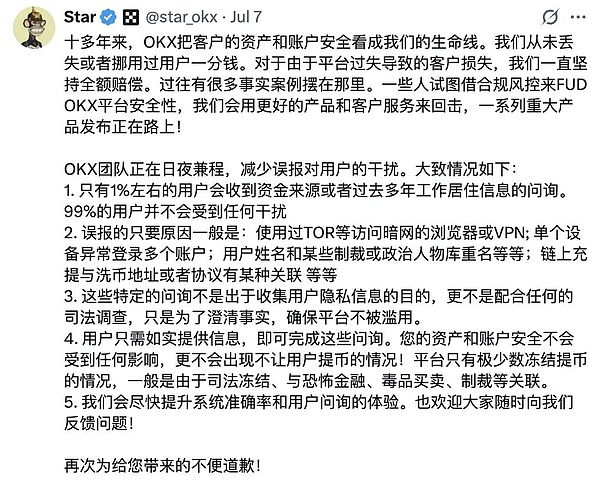

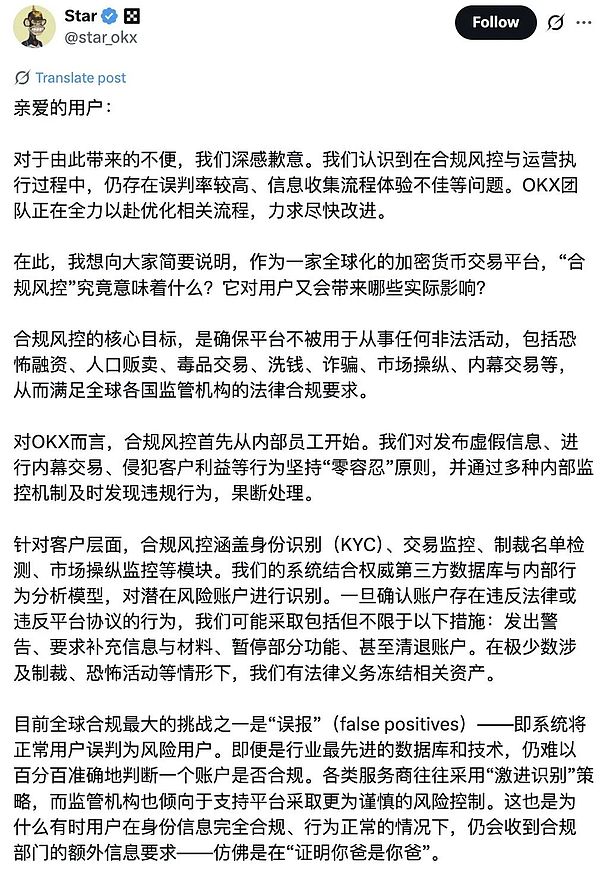

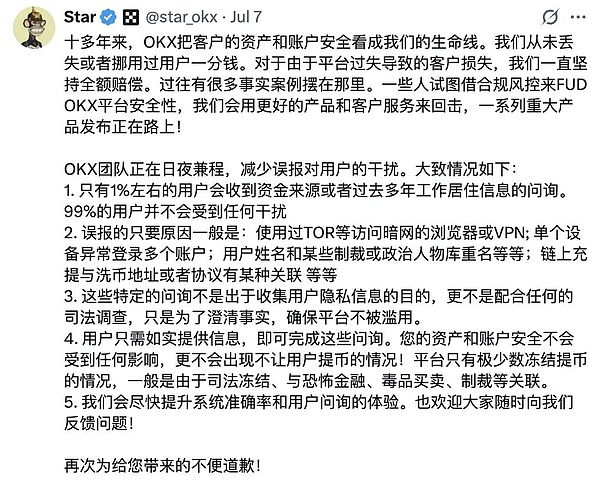

The article was widely circulated on X, resonating with many users. Many users said they had experienced similar things on OKX. The number of views of the original post exploded, exceeding 1 million in 24 hours. Due to the huge response, OKX immediately intervened, and the official account comments would be expedited to follow up and verify, and quickly solved the user's account problem, but it did not appease the emotions of other users. On July 5, after a night of fermentation, OKX CEO Star (Xu Mingxing) personally participated in public relations, quoted this tweet and explained, turning the topic from "OKX malicious account blocking" to "compliance risk control", using the concept of "false positives" (the system misjudged normal users as risky users) to explain why the platform collects additional information from many users, and introduced OKX's compliance team and related work.

As of now, the discussion on OKX's compliance storm is still ongoing.

2. CEX's road to compliance is long

OKX is not the first centralized exchange to be caught in a compliance dispute. For example, in September 2024, a Binance user claimed on a social media platform that Binance restricted his account because he used cryptocurrency assets as his only source of income, and asked the user to provide proof of annual income and tax payment, which also caused heated discussions.

Binance was founded in 2017 and rose rapidly in the early days when the crypto market was not yet strictly regulated. Between 2017 and 2020, Binance did not have a headquarters or a clearly defined registered jurisdiction. Its strategy was to achieve rapid growth through "decentralized offices" and "keeping distance from regulation." In a sense, Binance is actually a super-large trading network formed in a regulatory vacuum, with a user base and trading volume far exceeding that of traditional compliant financial institutions. However, starting in 2021, as global attention to the regulation of crypto assets intensified, Binance has gradually become the focus of regulators in various countries. In mid-2021, the Financial Conduct Authority (FCA) of the United Kingdom explicitly prohibited Binance Markets Limited from conducting any regulated activities in the United Kingdom. Subsequently, regulators in many countries, including the Financial Services Agency (FSA) of Japan, the Federal Financial Supervisory Authority (BaFin) of Germany, and the Italian Securities Supervisory Commission (CONSOB), also issued warnings or imposed restrictions. Such regulatory actions not only restrict Binance's fiat currency channels, but also seriously affect its payment and settlement capabilities in the traditional financial system. Faced with high regulatory pressure, Binance has gradually transformed into a compliance-oriented international institution since 2022, and has successively obtained virtual asset service providers (VASP) or equivalent licenses in France, Spain, Italy, the United Arab Emirates, Kazakhstan and other places, trying to establish a global legal business structure through the "regional spin-off + local compliance" model. At the end of 2023, as the U.S. Department of Justice filed a criminal lawsuit against Binance and reached a $4.3 billion fine settlement agreement, its founder Zhao Changpeng announced his resignation as CEO and was replaced by Richard Teng, the former director of the U.S. Treasury Department's Criminal Enforcement Network (FinCEN). This personnel change is generally regarded as a key step for Binance to show goodwill to regulation and accelerate compliance.

In contrast, OKX's internationalization and compliance transformation started significantly later. OKX was spun off from OKCoin in 2017. In the early days, it mainly cultivated the Chinese mainland and East Asian markets, and later moved its headquarters to Malta to try to access the local compliance framework. For a long time, OKX has not obtained a license in mainstream European and American countries, and its user base is still mainly in Asia and emerging markets. In recent years, OKX has launched an internationalization strategy, and has applied for and obtained some compliance qualifications in Dubai, Singapore, the Bahamas and other places, and became one of the applicants for the Hong Kong virtual asset trading platform license in 2023, but the overall compliance promotion speed and scope are slightly conservative compared with Binance. In terms of user management and risk control, OKX has begun to strengthen the KYC and AML processes in the past two years. Its official documents show that its KYC is divided into three levels: binding identity proof, address verification and face recognition as basic compliance elements. At the same time, OKX has connected with on-chain monitoring agencies such as Chainalysis in anti-money laundering policies, and has a transaction behavior risk control system.

However, OKX still has a gray area of "operating without registration" in some markets. Taking South Korea as an example, the South Korean Financial Intelligence Agency accused OKX of providing services to South Korean residents without permission in 2024, violating the Specific Financial Transaction Information Act. Similar situations are also reflected in Japan, the United States and other regions. In early 2025, OKX's Seychelles subsidiary reached a settlement with the U.S. Department of Justice, admitting that it provided remittance services to U.S. users without permission, and paid a fine of $84 million, giving up about $421 million in related income. Although no specific employee or customer responsibility was involved and no criminal charges were triggered, the incident also promoted the adjustment of OKX's compliance work. In response to regulatory concerns, OKX announced that it would significantly strengthen its KYC, customer risk rating (CRR) and anti-money laundering system (AML), claiming that it has formed an on-chain investigation and compliance team of more than 150 people. At this point, OKX's compliance journey has also entered a new stage.

3. Is compliance a dead end for CEX?

As crypto assets continue to develop, compliance is an inevitable trend. On July 7, Xu Mingxing once again stated that OKX is improving its technology to reduce the interference of false positives on users, pointing out that only about 1% of users will receive inquiries about the source of funds or work and residence information in the past years. 99% of users will not be disturbed in any way, and listed the main reasons for false positives. He also emphasized that specific inquiries are only to clarify the facts, ensure that the platform is not abused, and that the security of users' assets and accounts will not be affected in any way, let alone prevent users from withdrawing coins. Although Xu Mingxing sent 7 tweets in just three days, he still failed to calm the public anger.

Simply speaking of compliance, any CEX needs to cooperate with supervision. This is a common requirement of laws in various countries and is not wrong in itself. What really made OKX the target of public criticism was the crisis of trust in CEX caused by compliance. From the first exposure, OKX was suspected of maliciously freezing accounts. Then many people exposed OKX's forced liquidation, insufficient contract depth, malicious plug-in and other issues. These "common" scandals of the exchange exploded at once. In addition, some Kols began to "dig up old accounts" and re-examine old news of OKX, including the incident in 2020 that all users' assets were restricted from withdrawing coins for one month. OKX has more or less fallen into a crisis of trust. Many users even prepared to withdraw from OKX and switch to other CEX or even DEX due to concerns about the security of their assets, but found that OKX could not cancel their accounts. This "no way out" situation further ignited users' emotions.

As for why OKX is so urgent and aggressive in its compliance measures, some Kols speculate that the main reason may be that OKX is planning to go public on the US stock market. Previously, OKX has repeatedly sent out signals that it will publicly capitalize, and has also made arrangements for this for many years, from buying Shell Cloud Chain in Hong Kong stocks many years ago to reducing the empowerment of $OKB, and pushing for business compliance at the critical moment of the wallet war. Is OKX really becoming conservative in order to go public? Of course, as a world-renowned exchange, OKX has very bright fundamentals and can obtain a very high valuation. If it uses the SEC review to clarify past disputes and successfully go public to obtain a ticket to the mainstream financial circle, it can be said that it will be a hundred benefits without any harm. But the corresponding direct cost is to pay a high cost and make compliance rectifications based on a strict regulatory framework.

From another perspective, an important part of CEX compliance work is to build an information communication bridge between CEX and regulatory authorities, and coordinate the relationship between its own business model and regulatory requirements. Unilaterally transferring compliance responsibilities to users is not the right way to complete this work. Perhaps, if OKX hopes to truly establish a credible compliance system in the future, it should find a balance between user experience and regulatory cooperation, especially clarifying the boundaries of its compliance measures and giving users full information and protection in data storage and fund custody.

4. What ordinary investors can do

For ordinary investors, cooperating with KYC, asset source review and other systems has become a routine requirement of centralized exchanges. After completing basic identity authentication, ordinary investors should pay special attention to the preparation of evidence of asset source. For example, tax receipts, bank statements, transaction records, recharge records, work income certificates, etc. are all commonly used proof methods in compliance verification. Among them, "tax receipts" are an effective proof that has both official recognition and information completeness. If investors have declared and paid taxes due to profits from cryptocurrency speculation, their tax bills themselves can directly constitute a strong support for the legal source of income.

This also leads to an important but often overlooked issue: Do the gains from cryptocurrency speculation need to be taxed? The answer is yes. According to the standards generally adopted by tax authorities in various countries, profits from the sale and purchase of crypto assets are usually regarded as "capital gains" or "property income" and should be declared and taxed in accordance with the law. In the United States, the tax issue of cryptocurrency has attracted the attention of the IRS as early as 2014. In recent years, with the prosperity of the US crypto market, the tax regulations of the IRS have been continuously improved. "Bitcoin Jesus" Roger Ver, MicroStrategy CEO Michael Saylor and other cryptocurrency celebrities have been accused by the IRS for tax issues and faced huge fines or even imprisonment. Even in mainland China, which has a prohibitive attitude towards cryptocurrencies, the tax authorities are keeping a close eye on the income from cryptocurrency speculation. In particular, recently, a resident in Zhejiang was asked by the tax authorities to pay back taxes on his USDT income, which once again caused a certain degree of concern in the cryptocurrency circle. According to verification, the relevant income of this mainland resident was discovered by the tax department through CRS (automatic information exchange mechanism for financial accounts). At that time, there was a sum of money in his account, which was the profit of the resident's cryptocurrency speculation. Although the tax authorities' verification is not specifically aimed at the behavior of "cryptocurrency speculation", when the transaction income flows back to the bank account, it is naturally included in the financial supervision field. In addition, it should be noted that since trading institutions such as CEX are illegal in mainland China, the tax authorities in mainland China cannot obtain user transaction information on a large scale from them. Compared with currency exchange, it is more about tracking legal currency funds.

Cryptocurrency speculation and tax evasion is not an act in the "gray area", nor is it a small problem that can be ignored for a long time. Major countries around the world have long begun to pay attention to the tax issues brought about by crypto assets. Although the time, method and intensity of action taken by different countries vary, it is a reality that the income from the cryptocurrency circle needs to be taxed. For ordinary investors, the best solution to facing taxation or other supervision is not to evade, but to prepare and cooperate. Investors can consider actively keeping transaction records, legal currency in and out bills, capital flows and various vouchers in the profit accounting process, so that they can have a basis and clear defense in future tax inquiries. Otherwise, once they are required to pay taxes without being able to trace the source of assets, they may not only bear additional tax burdens, but also suffer more property losses due to difficulties in providing evidence.

Anais

Anais