The meeting of the People's Bank of China's coordination mechanism for cracking down on virtual currency trading and speculation set the stage for the large-scale shutdown of mining farms in Xinjiang two weeks later. Overnight, Xinjiang, a land once considered an electricity paradise by miners, fell silent. Between December 14th and 15th, numerous mining farms in major mining clusters in Changji and Hami, Xinjiang, were suddenly cut off from power, forcing approximately 400,000 mining machines offline. The Bitcoin network hashrate plummeted by approximately 10% in 24 hours, with the largest single-day drop reaching 18%, marking the largest weekly decline since June 2022. This indicates an unusual tremor in the heart of the cryptocurrency market.

400,000 mining machines shut down

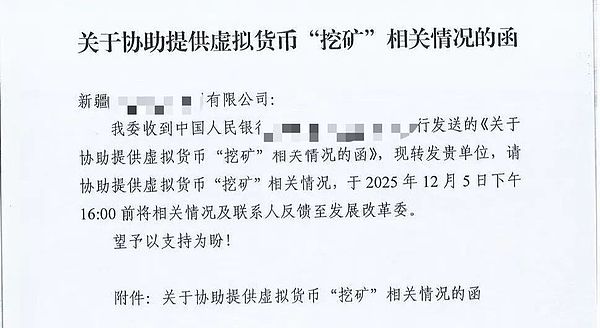

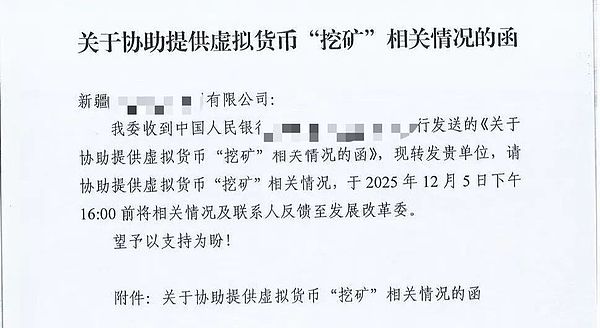

It is understood that many mining farms received an official letter forwarded by the National Development and Reform Commission (NDRC) at the beginning of the month, requiring them to "report their mining situation to the NDRC in accordance with the requirements of the People's Bank of China."

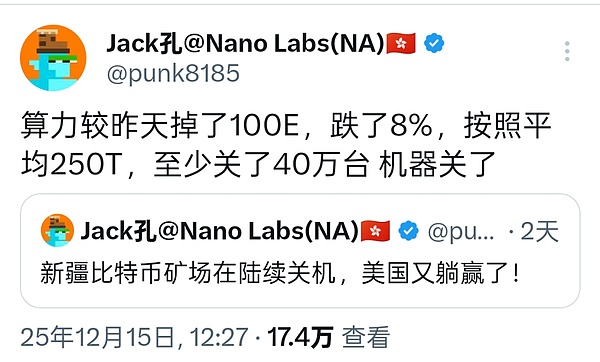

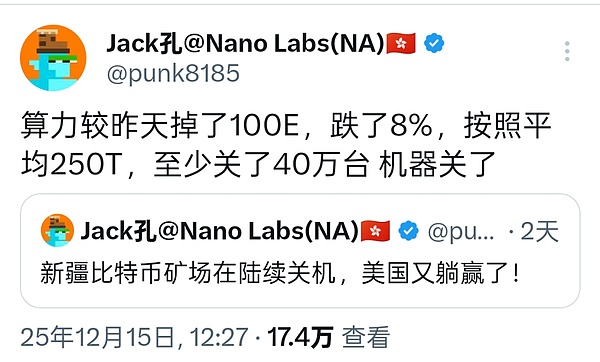

Multiple sources confirm that from December 14th to 15th, mining farms in major mining clusters in Xinjiang's Changji and Hami areas were required to suspend operations. It is reported that most of the mining machines were shut down suddenly due to power outages. According to Kong Jianping, founder of Nano Labs, combined with the recent significant drop in the network's hashrate (a 17.25% decrease last week), it is estimated that approximately 400,000 Bitcoin mining machines in Xinjiang, China, will be shut down recently.

Regulatory Storm Arrives

Unlike previous temporary power rationing due to power shortages, this shutdown is an organized regulatory action.

Rumors circulate that "it's not a power rationing, it's a complete power outage, not even allowing backup power to be turned on." This blanket approach demonstrates the determination of this action.

The regulatory stance has escalated from unilateral action by the central bank to a coordinated effort involving the central bank, the National Development and Reform Commission, and the Central Financial Stability and Development Office. On November 28th, the People's Bank of China convened a meeting of its coordination mechanism for combating speculation in virtual currency trading. Officials from 13 departments, including the Ministry of Public Security, the Cyberspace Administration of China, and the Central Financial Stability and Development Office, attended the meeting. The lineup of officials at this meeting conveys an important signal. Compared to the ten-department notice in 2021, this time two super-heavyweight departments, the Central Financial Affairs Office and the National Development and Reform Commission (NDRC), have been added. The Central Financial Affairs Office, as the highest-ranking financial management agency in China, signifies that the issue of virtual currencies has risen to the level of national financial security. The NDRC's entry directly targets the Achilles' heel of the mining industry. The NDRC controls the direction of industrial development, energy consumption, and economic security; its involvement means that the inherent danger of virtual currencies has been clearly defined as a systemic risk threatening national economic, energy, and industrial security. The communiqué also explicitly emphasized: "Stablecoins are a form of virtual currency, and currently cannot effectively meet the requirements for customer identification, anti-money laundering, etc., and are at risk of being used for illegal activities such as money laundering, fundraising fraud, and illegal cross-border fund transfers." This signal of normalized regulation stems from the region's special position in China's Bitcoin mining landscape. Despite a complete ban on mining in 2021, China's Bitcoin hashrate and costs have quietly rebounded to approximately 21% globally, ranking among the world's highest, with Xinjiang making a significant contribution. Xinjiang has become a "mining hub" thanks to its energy advantages: abundant coal, wind, and solar power resources, as well as a local power surplus due to high transmission costs, resulting in electricity prices as low as 0.1-0.15 yuan/kWh. These energy conditions have attracted many mining farms to operate here disguised as data centers or supercomputing centers. Compared to the cleanup in 2021, this operation is more institutionalized and normalized. The 2021 cleanup was mainly based on phased requirements put forward at the State Council level, while this time a cross-departmental coordination mechanism has been established, meaning that supervision will become the norm. Another key difference lies in the depth of supervision. After 2021, some mining farms continued to operate by disguising themselves as big data centers, while after this meeting, the scope of supervision has been comprehensively expanded, forming a full-chain supervision from financial transactions to energy use. As the meeting pointed out, "Recently, influenced by various factors, speculation and hype surrounding virtual currencies have resurfaced, and related illegal and criminal activities have occurred frequently, posing new challenges and new situations for risk prevention and control." For Chinese miners, this means the next wave of migration will be more dispersed, more covert, and more decentralized. Only when truly clean energy technologies and the energy internet achieve breakthroughs can Bitcoin mining perhaps achieve true decentralization.

Catherine

Catherine