Author: House of Chimera Source: X, @HouseofChimera Translation: Shan Ouba, Golden Finance

Linea positions itself as "the Ethereum Layer 2 network (L2) built to enhance Ethereum." Its mission is deceptively simple, yet incredibly powerful. With Ethereum's price rebounding significantly over the past two months and nearing new highs, Linea has quickly become one of the most anticipated projects in the crypto space, especially with its upcoming Token Generation Event (TGE). At its core, Linea is more than just another Layer 2 network—it’s a zkEVM project designed to take Ethereum further while fitting seamlessly into the Ethereum ecosystem. Founded by ConsenSys, the company behind key Ethereum infrastructure like MetaMask and Infura, Linea has deep institutional backing and years of experience behind core tools used by over 30 million users worldwide. ConsenSys, led by Ethereum co-founder Joseph Lubin, has raised $725 million from institutions including Microsoft, SoftBank, and Coinbase Ventures, providing solid support for Linea's long-term development.

Linea's Technology and Ethereum's Challenges

Ethereum's core challenge has always been scalability. Competing chains like Solana excel at speed and throughput, forcing Ethereum to rely on Rollup for expansion. Rollup works by bundling large numbers of Layer-2 transactions and submitting them to Ethereum for settlement. Rollup uses two methods: optimistic fraud proofs (requiring up to seven days for final confirmation) and validity proofs (also known as ZK proofs), which are faster and more secure.

Linea uses the Type 2 zkEVM, meaning it is fully equivalent to the EVM, but not entirely equivalent to Ethereum.

In practical applications, this allows developers to deploy Ethereum dApps directly to Linea without rewriting their code, while enjoying faster proof generation and lower costs. Linea aims to gradually transition to the

Type 1 zkEVM by 2026, achieving full compatibility with Ethereum. Reducing Costs and Improving User Experience

Linea has demonstrated its ability to improve user experience, most notably by significantly reducing gas fees. In its Alpha V2 upgrade, Linea introduced a mechanism for aggregating multiple batches into a single proof, reducing fixed costs and reducing average gas fees by 66%. This makes Linea one of the lowest-cost L2 blockchains, giving it an advantage in attracting and retaining users.

Core features that drive adoption

Linea's design revolves around three pillars:

Ethereum alignment - using ETH to pay gas fees to maintain consistency with Ethereum's native design;

Native yield - introducing token economic incentives at the network level;

Multi-Rollup network architecture - building an ecosystem by linking different Rollups.

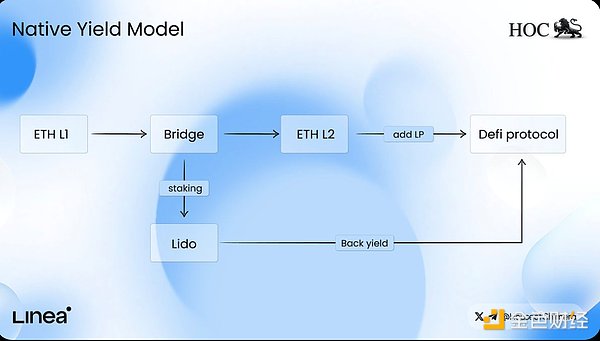

At the same time, Linea adopts a double burn mechanism: ETH fees used in transactions will burn both ETH and LINEA tokens. This mechanism tightly ties Linea's success to the health of Ethereum. Native Yield Mechanism and Ecosystem Flywheel Another key differentiator for Linea is its native yield mechanism. Through integration with Lido, ETH bridged to Linea can be automatically staked, with the generated yield flowing back into the ecosystem to support liquidity and incentivize growth. This design creates a liquidity flywheel effect that is expected to support Linea's long-term development and avoid the boom-and-bust cycle seen in other projects driven by short-term incentives.

Linea not only positions itself as a second-layer network, but also provides a complete set of tools through the Linea Stack to help other projects build their own Rollups. This strategy is similar to Optimism's Superchain route, aiming to create a broader network effect, ensure interoperability and enhance the cohesion of the entire ecosystem.

Economics and Token Economics

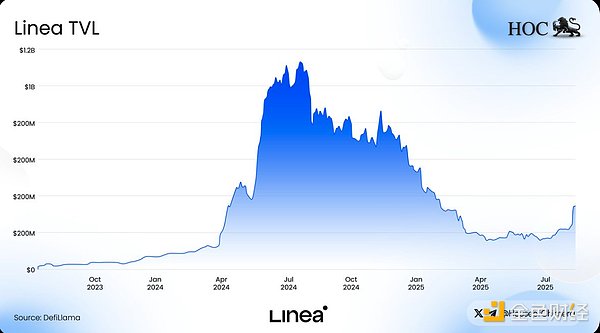

Linea's ecosystem is rapidly accumulating potential. It has established partnerships with over 400 partners across DeFi, NFTs, infrastructure, and AI, including major protocols such as Aave, PancakeSwap, SushiSwap, and Stargate. During the 2024 Surge event, its TVL reached $1.2 billion. Despite a decline after the end of the incentive program, capital is returning as the TGE approaches. The decentralized exchange Ethereum, launched only a few weeks ago, has surpassed $120 million in TVL, demonstrating a rebound in ecosystem capital. Unlike many projects, Linea has deliberately avoided allocating tokens to venture capital firms. Instead, Linea allocates 85% of its tokens to the ecosystem, with only 15% reserved for ConsenSys, subject to a five-year lockup period. Regarding governance, Linea intentionally excludes token governance. Instead, the Linea Consortium, comprised of trusted Ethereum organizations, manages token emission, grants, and incentives. This design mitigates regulatory risk while ensuring strong alignment between Linea and Ethereum's long-term vision.

Looking Ahead

According to the roadmap, Linea will launch a series of key upgrades in the third and fourth quarters of 2025, including a new destruction mechanism, an increase in the Gas limit, and the full implementation of the native revenue mechanism. By 2026, Linea plans to implement a Type 1 zkEVM and increase network throughput to 5,000 transactions per second (TPS), while also advancing the more ambitious real-time proofs on Ethereum.

Summary

Linea is a bold experiment: its lack of VC backing, native ETH returns, and Ethereum-first design make it more than just a scaling solution. While questions remain about its token model and long-term value capture, as the TGE approaches, one thing is certain: Linea's goal isn't just to scale Ethereum, but to strengthen Ethereum.

Alex

Alex

Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine Catherine

Catherine JinseFinance

JinseFinance Kikyo

Kikyo Davin

Davin