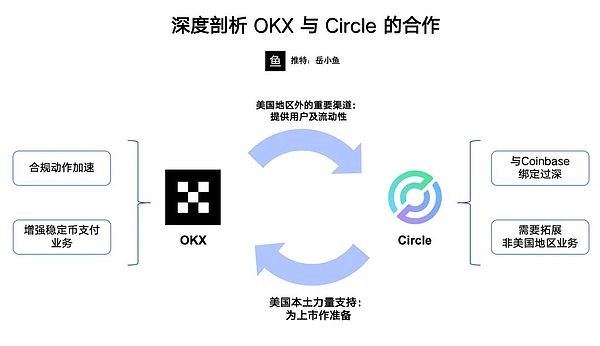

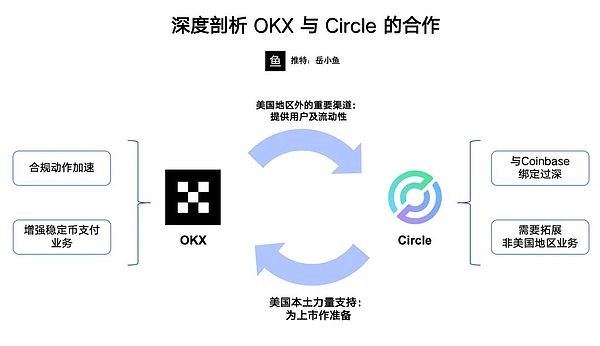

Many people actually did not understand the major event of OKX and Circle establishing cooperation, which revealed a lot of information behind it.

First of all, why did OKX and Circle reach a cooperation?

To understand why this cooperation took place, we must first understand the current situation of both parties.

1. Let's first look at the current situation of OKX:

For OKX, there have been recent rumors that it will be listed in the United States, and it can also be seen that its compliance actions have been accelerating.

DEX services have been suspended for compliance rectification, and now non-compliant users and funds such as online loans are being cleared.

All these actions also show that OKX's compliance road is going further and further, and the end point is to be listed on the US stock market.

At this time, OKX needs a heavyweight partner in the United States to provide stronger support for its listing.

On the other hand, there are also considerations for the stablecoin payment business. OKX previously specialized in OKX Pay, and it is very valuable to continue to expand to upstream stablecoin issuers.

OKX is able to cooperate with Circle in order to occupy an important ecological niche in stablecoin payments and gain greater profit margins in the entire payment process.

2. Let's take a look at Circle's current situation:

Circle has been listed in the United States, and it seems to be in the limelight for a while, but it has a very big potential risk: it is too deeply tied to Coinbase.

This starts with the development history of USDC:

USDC was first issued by Center, a joint venture between Circle and Coinbase, and the two companies share equity and control 50-50.

In the second half of 2023, Center will be closed and all control will be transferred to Circle, which will be solely responsible for the operation of USDC.

However, according to the agreement disclosed in Circle's prospectus, Coinbase still holds 50% of USDC's profits and receives additional dividends based on the proportion of USDC held on the platform.

Last year, Circle made a profit of approximately US$1.6 billion, of which approximately US$1 billion was paid to Coinbase.

The two companies actually have a very important agreement: If Circle is unable to pay dividends to Coinbase or encounters regulatory issues, Coinbase has the right to take over USDC and become the issuer.

Therefore, although USDC is now fully operated by Circle, Coinbase still plays an important role.

This explains why Circle and Coinbase are now so closely tied.

3. Back to the stablecoin business itself

The most critical thing about the stablecoin business is liquidity.

Many stablecoin issuers are exchanges because exchanges are natural channels.

Without liquidity, stablecoins are almost impossible to succeed.

In the beginning, Circle worked with Coinbase to solve the biggest pain point: liquidity, users and trading pairs were immediately obtained after issuance.

As the largest exchange in the United States, Coinbase brings huge traffic and brand credibility to USDC.

Now, Circle needs to solve the potential problem of being too deeply tied to Coinbase.

Now, Circle has found the second exchange outside the United States that can provide users and liquidity, which is OKX.

Some people may ask: Why not Binance?

The main reason is that Binance does not need USDC that much.

Before Circle went public, Binance did not know that Circle paid 1 billion in promotion fees. Binance only received 60 million, but gave Coinbase 900 million.

Then why does Binance help Circle promote USDC? So we can see that Binance is now on the side of the Trump family's USD1.

In comparison, OKX, the second largest exchange after Binance, needs Circle more.

4. To sum up

In short, the cooperation between OKX and Circle can be said to be a win-win situation:

OKX became Circle's first non-US compliant exchange partner, bringing very strong compliance power and US local support to its listing path, and also enhanced its stablecoin payment business.

For Circle, OKXis a good channel outside the United States. Cooperation with OKXcan alleviate the restrictions of Coinbase while expanding new users and liquidity.

Catherine

Catherine