According to the official press release of crypto financial services giant Galaxy Digital, the company successfully executed "one of the largest notional amounts in crypto history" on behalf of its clients. This transaction is exactly the largest "Satoshi-era" Bitcoin transfer in history that our channel has focused on before. The largest "Satoshi-era" Bitcoin transfer in history: Should the market be vigilant?

Galaxy released a message on the completion of the transaction

Transaction scale: over 80,000 bitcoins, market value of approximately US$9.3 billion

Galaxy said:

“We have completed a transaction of more than 80,000 bitcoinsThe sale, valued at over $9.3 billion at current market prices, was for a Satoshi-era investor. The transaction was part of a broader estate planning strategy for the investor.”

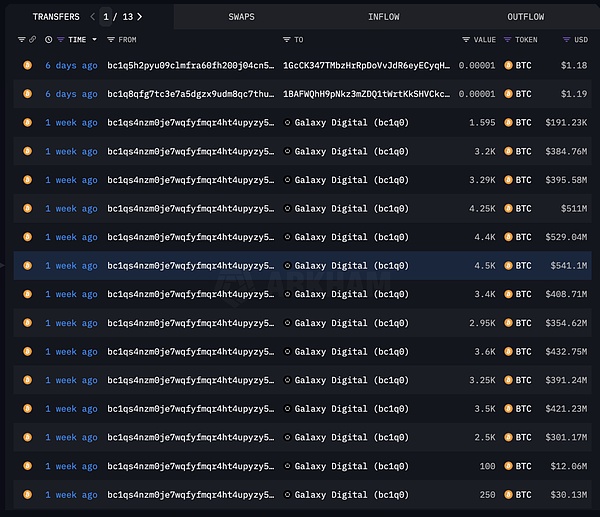

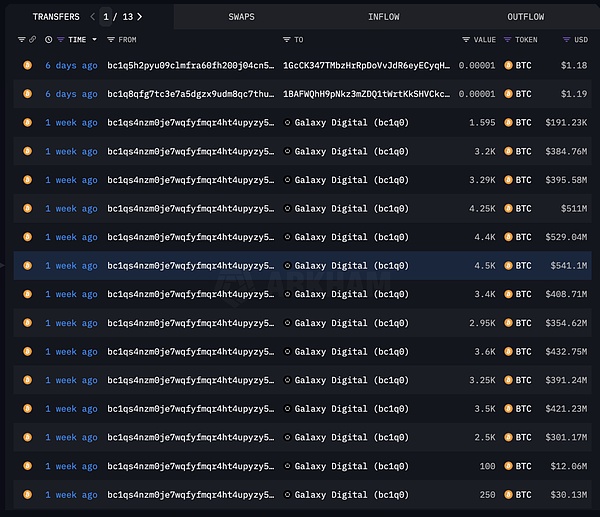

On-chain data shows that the whale’s 80,000 BTC was transferred to Dalaxy Digital a week ago

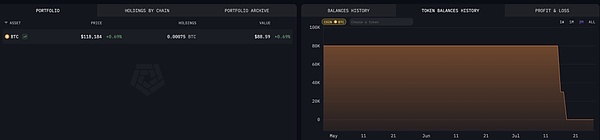

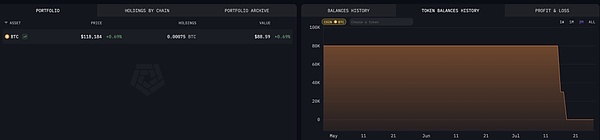

According to the on-chain data, the whale's BTC balance is only $88 (0.00075 BTC).

Mysterious identity: related to the MyBitcoin hacker?

Ki Young Ju, CEO of CryptoQuant, posted on the social platform X:

"This transfer of 80,000 BTC came from a wallet hosted by MyBitcoin before 2011 - these coins have been dormant for 14 years.

MyBitcoin is one of the earliest Bitcoin wallets and trading platforms, but in leaf="">In July 2011, the platform suddenly shut down, claiming that it was hacked. In the end, the platform only compensated customers for 49% of their losses, and the rest was considered "lost."

Ju added:

“These wallets have not had any transfer records since April 2011 and had been deactivated before MyBitcoin was hacked. They may belong to the hackers of that year, or be related to the mysterious founder known as Tom Williams.”

Behind the scenes and revelations

Precipitation and release of wealth: Many early whales’ funds were not used until more than a decade later, which may indicate intergenerational transfer or the release of security concerns.

The intersection of hackers and gray heritage: If the funds did come from the MyBitcoin hack in 2011, it means that the hackers have not used the assets for 14 years, and only completed the laundering or legalization today.

Involvement of large institutions: Galaxy Digital's participation shows that institutions played a bridging role in helping to process early large-scale Bitcoin transactions, and may also become "intermediaries" for old assets to return to the market.

Kikyo

Kikyo