Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Takeaways:

Bitcoin’s realized market capitalization surpassed $1 trillion, reflecting deepening capital commitment and confidence among long-term holders, while the total crypto market capitalization approached $4 trillion.

Demand for Bitcoin (BTC) and Ethereum (ETH) has outstripped new coin issuance, driven primarily by continued spot ETF inflows and increasing corporate treasury holdings.

Market-leading gains are beginning to spread, with Ethereum showing relative strength. Altcoins like SOL and XRP are also attracting more capital due to rising spot trading volumes.

The GENIUS Act establishes the first federal regulatory framework for fiat-pegged stablecoins in the United States, bringing regulatory clarity and fostering greater participation and competition in the stablecoin market, valued at over $250 billion.

Introduction

The cryptoasset market is approaching the $4 trillion mark for the first time, a significant milestone in the industry's development. This surge is driven by a confluence of structural and cyclical forces: from continued inflows into spot Bitcoin and Ethereum ETFs, to accelerated increases in crypto asset treasury holdings, to key regulatory breakthroughs like the GENIUS Act. It's fair to say that the tailwinds driving the crypto market are strengthening.

This article will analyze the key market forces and on-chain capital flows driving this surge.

Bitcoin's realized market capitalization has surpassed $1 trillion, and market activity continues to expand

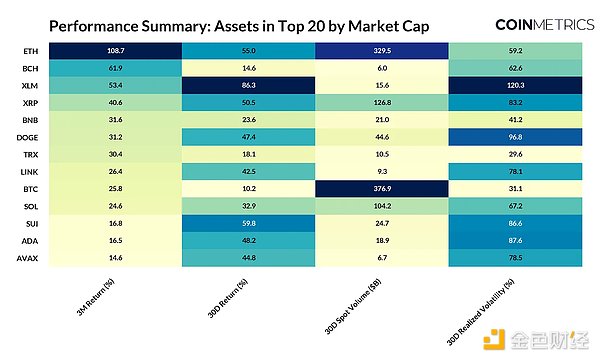

Bitcoin (BTC) hit a new high of $123,000, pushing its total market capitalization to $2.38 trillion. Its realized market capitalization (the total value of each Bitcoin at the price at which it was last transferred on-chain) also surpassed $1 trillion for the first time. This data demonstrates continued influx of capital, even at elevated levels, underscoring growing confidence in Bitcoin's long-term role as a global asset, particularly against the backdrop of growing ETF funding and institutional interest. Market activity also shows early signs of "lead contagion." Ethereum (ETH) has begun to demonstrate relative strength, with the ETH/BTC exchange rate up 73% since May and ETH surpassing $3,900. This momentum is supported by multiple factors, including record ETF inflows, accelerated adoption by corporate treasuries, and the positive impact on the Ethereum ecosystem (particularly stablecoins) following the passage of the GENIUS Act. This "spreading" trend is also reflected in spot trading data: not only does BTC trading volume remain strong, but trading volumes for ETH and major altcoins such as Solver and XRP have also increased significantly over the past few weeks. Meanwhile, Bitcoin's market dominance has fallen to 59%, while the total altcoin market capitalization is approaching $1.6 trillion. While there are initial signs of “leading the spread,” it remains to be seen whether this trend will continue.

The following table summarizes market statistics for the top 20 tokens by market capitalization, excluding stablecoins and other on-chain derivatives:

Demand Acceleration: Dual Drive from ETFs and Corporate Treasury

One of the important forces driving the growth in demand for Bitcoin (BTC) and Ethereum (ETH) is spot exchange-traded funds (ETFs). After a brief slowdown in March and April, inflows into Bitcoin ETFs reaccelerated in May, bringing total holdings of U.S. spot Bitcoin ETFs to over 1.27 million BTC (approximately 6.4% of the total supply). BlackRock's iShares Bitcoin Trust (IBIT) remains the largest holder, currently holding approximately 735,000 BTC (valued at approximately $87 billion). Ethereum (ETH) is experiencing a similar surge in demand. Over the past few weeks, spot Ethereum ETFs have seen consistent net inflows, at times exceeding Bitcoin inflows. ETH ETFs now hold a total of 5.8 million ETH, representing approximately 4.8% of the total ETH supply. Much of this growth has occurred in recent months, despite these ETFs launching over a year ago. Demand for ETH is also being supported by a growing number of Ethereum-focused corporate treasuries, which are accumulating ETH at a faster rate than new issuance. Unlike corporate treasuries that passively hold BTC, ETH treasuries earn native yield through staking and DeFi, a model now expanding to other major token ecosystems such as Solana (SOL), Tron (TRX), and Ethena (ENA).

On-chain holdings: divided by address balance

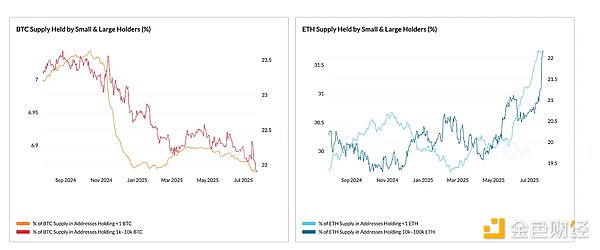

As shown in the above figure, the supply of BTC held by small holders (<1 BTC) and large holders (1,000–10,000 BTC) has gradually declined over the past year, indicating that the market has entered a distribution period as prices rise. In contrast, ETH is showing signs of renewed accumulation, particularly among large holders (10,000–100,000 ETH), whose share of the supply has risen to over 22%. Supply held by small ETH holders (<1 ETH) has also continued to rise, a trend that has continued since 2021. The GENIUS Act ushers in a new era of stablecoins. The GENIUS Act was signed into law on July 18, establishing the first federal regulatory framework for fiat-pegged stablecoins in the United States. The bill creates a level playing field for stablecoin issuers, requiring:

Fully backed by reserves

Reserve assets must be low-risk, short-term U.S. Treasury bonds or cash

Regular audits

Issuers must obtain a license

This is similar to the impact of the approval of the spot Bitcoin ETF, bringing regulatory clarity and legitimacy to the U.S. dollar-denominated stablecoin market.

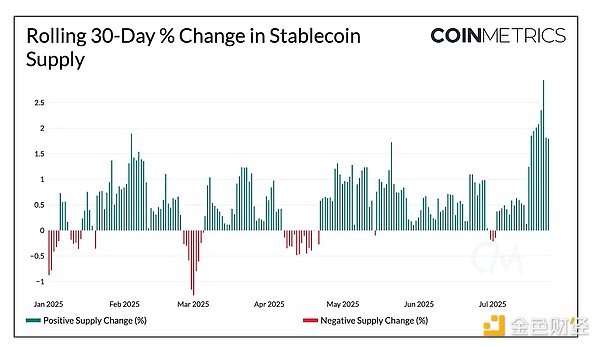

Recently, the growth of stablecoin supply has accelerated significantly, as evidenced by the 30-day rolling supply change. Currently, the total supply has exceeded $255 billion.

This regulatory framework is expected to enhance public trust in fiat stablecoins, lower the barriers to new entrants, and bring more competition to the payments market. This competition, from existing issuers like Tether and Circle to potential new entrants like regulated banks and fintech firms, is expected to drive down transaction costs, enhance the payment experience for consumers and businesses, and further strengthen global demand for the US dollar. Among existing stablecoin issuers, Circle and Paxos appear best positioned to meet the requirements of the GENIUS Act, as USDC and PayPal USD (PYUSD) already have full reserve backing and regularly provide audit reports. Circle is actively applying for a federal trust bank charter from the Office of the Comptroller of the Currency (OCC) to fully comply with the GENIUS Act and offer custody services to institutional clients. Other major issuers are also adjusting their structures to comply with the new law. For example, Anchorage Digital, a federally chartered crypto bank, has partnered with Ethena Labs to launch USDtb through its stablecoin issuance platform. Because Anchorage provides federal oversight and reserve management, Ethena's USDtb is one of the first stablecoins to fully comply with the GENIUS Act. This issuance model provides a one-stop compliance solution for projects seeking to continue operating in the US market. In contrast, Tether (USDT), which holds approximately 68% of the stablecoin market share, faces a more complex regulatory path. USDT has long operated outside the US regulatory system, with its reserve assets including non-GENIUS-compliant assets such as Bitcoin and precious metals. In response, Tether plans to launch a compliant stablecoin for institutional payments and interbank settlements that will adhere to all GENIUS Act requirements. The existing $162 billion USDT will continue to operate overseas, primarily serving emerging markets. Stablecoin issuers have three years to complete GENIUS Act compliance. After this period, only GENIUS-compliant stablecoins will be supported by exchanges and custodians, providing ample adjustment time for all parties. The recent surge in the total crypto market capitalization to $4 trillion reflects growing market confidence across the asset class. Demand from ETFs and corporate treasuries continues to outpace new supply, further improving the supply and demand structure for BTC and ETH. Valuation metrics such as Bitcoin's market capitalization to realized value (MVRV) ratio suggest the market is not currently overheated. While the market remains dominated by strong ETF inflows and long-term holders, market leadership is gradually becoming more widespread. Furthermore, the passage of the GENIUS Act marks a key turning point in US crypto regulation: it not only provides a clear regulatory framework for stablecoins but also paves the way for a more competitive landscape and deeper integration with traditional finance. While short-term volatility is possible, the combination of solid structural demand, a clear regulatory outlook, and a broadening range of participants suggests continued market strength.

Coinlive

Coinlive

Coinlive

Coinlive  Catherine

Catherine Coindesk

Coindesk Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph