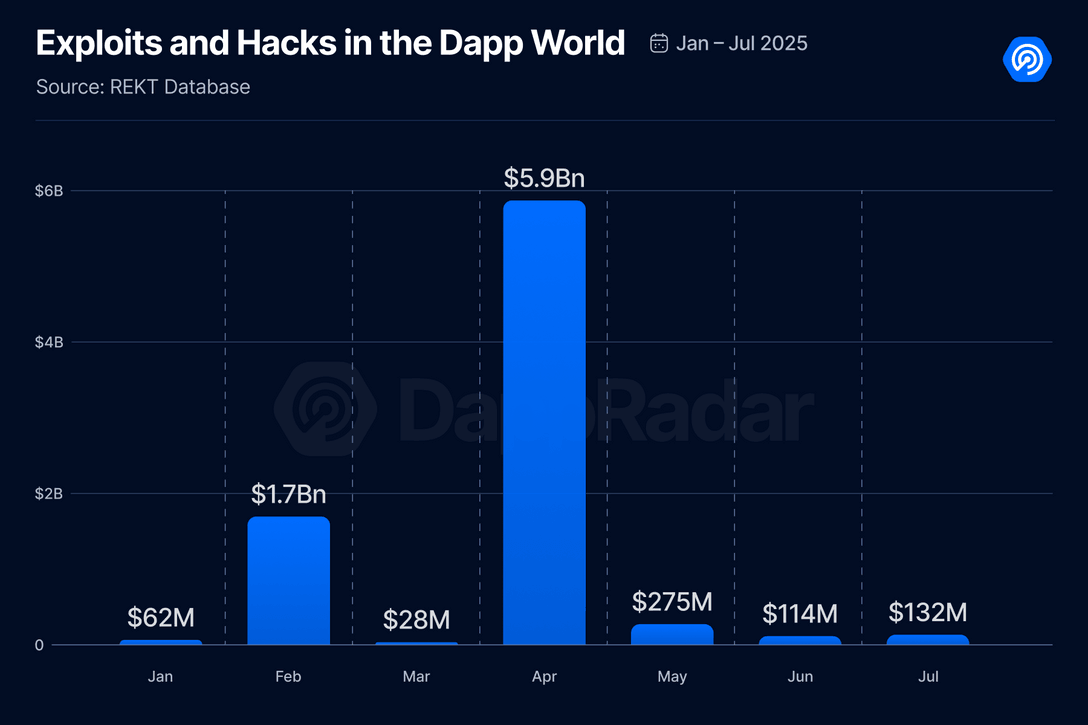

DApp activity declined, but Dmail, XPIN, and ChainGPT saw steady growth. July saw $132 million in losses due to vulnerabilities, a 16% increase from June. 1. Dapp Activity Cooled Down. As in previous years, July saw a typical summer slowdown, with the number of daily unique active wallets falling 8% to 22 million. The social sector saw the biggest drop, with daily active users (dUAW) falling 27% to 2.8 million. This isn't surprising, as social dapps tend to ride the wave of hype. Currently, platforms like Farcaster's InfoFi and the new Base dapp are garnering attention, but many of these communities still have strict barriers to entry. This makes it difficult for new users to participate, despite their enormous potential. However, in the long run, this category could become fundamental. The creator economy already dominates traditional media and is making a strong push into Web3. The AI sector also saw a significant 14% decline, with dual UAW falling to 4.1 million. Meanwhile, DeFi shrank by 6%, continuing its recent downward trend. However, the gaming sector showed resilience, growing by 2%, while NFTs remained stable. The gaming sector continued to lead the DApp ecosystem, holding 22.4% of the market share in July. This was followed closely by AI (18.7%) and NFTs (17.5%). A notable shift: DeFi, which was the dominant sector just two months ago, now lags behind NFTs. This clearly indicates a shift in user behavior and perhaps reflects a shift in users' priorities when interacting with Web3. 2. Most Used Dapps in Web3 Daily Unique Active Wallets (dUAW) Solana-based DEXs continue to dominate. The Memecoin wave is far from over, and these exchanges remain key venues for retail activity. Outside of DeFi, another notable dapp is World of Dypians, a gaming dapp that has maintained a stable user base and continues to drive steady growth in user activity. Also noteworthy: two AI dapps have reached the top of the rankings. Their emergence demonstrates that user interest in AI-powered Web3 experiences is not a passing fad but has become ingrained into everyday activities. While DeFi may no longer dominate in terms of overall wallet share, it still dominates the DApp rankings. Why? Because launching a DeFi dapp and truly acquiring users is challenging, but those that do successfully achieve this often enjoy high levels of activity and loyalty. In contrast, dapps in areas like gaming, social networking, or NFTs offer a much richer variety, and user attention is more dispersed. 3. Artificial Intelligence DApps: Rise, Fall, and Future While activity for most AI DApps declined in July, three projects stood out, showing steady growth: Dmail Network, XPIN Network, and ChainGPT. These and other projects are worth watching. Dmail Network: A blockchain-based encrypted email service. Exorde: Using AI to gather global news and insights. ChainGPT: A suite of AI-powered cryptographic tools, including ChainGPT Pad, a launchpad for early-stage projects. (ChainGPT Pad is also part of our DappLaunch program!) Furthermore, one of the biggest initiatives in this space came from Lightchain AI, which launched a mainnet purpose-built for on-chain machine learning. With its AI-specific virtual machine and "proof of intelligence" consensus mechanism, it offers a glimpse into the future of decentralized AI infrastructure. Theta Network also stepped up, integrating Amazon's Trainium and Inferentia chips to power use cases like "Quakebot," the AI agent for the San Jose Earthquakes of Major League Soccer (MLS). Protocols like Aethir and Render Network are making decentralized computing a reality. Aethir has reached 1 billion hours of compute and launched an AI-powered crypto credit card, while Render has migrated to Solana for faster and more affordable performance. The ASI Alliance, a coalition of SingularityNET, Fetch.ai, and Ocean Protocol, has officially merged under the $ASI token, aiming to create a fully decentralized AGI stack. In the gaming space, Elympics launched the $ELP token to enable AI-powered "Agentic Gaming" and connect it to NFT intellectual property like Pudgy Penguins and Doodles. AI tokens such as TAO, RNDR, and AGIX have attracted significant investor attention, with TAO receiving a $10 million investment from TAO Synergies, the largest public AI fund to date. Meanwhile, researchers unveiled A1, an AI agent capable of autonomously exploiting smart contract vulnerabilities, demonstrating the rapid evolution of AI as both a tool and a risk. On the regulatory front, the United States passed several bills providing clear guidance for participants in the AI and cryptocurrency sectors and appointed an AI and cryptocurrency czar, signaling the growing role of AI in the blockchain sector. 4. DeFi TVL hits a new high. DeFi saw a booming month in July, with TVL increasing by over 30%, reaching $259 billion at the close of the month. Even more remarkable, on July 28th, DeFi TVL hit a new all-time high of $270 billion, a clear indicator of growing market confidence, improved liquidity, and growing user demand for lending, trading, and tokenized assets. Tokenized equities were a particular highlight. The number of wallets interacting with this asset class surged from approximately 1,600 to over 90,000, while their total market capitalization increased by 220% during the same period. This isn't just growth; it's a sign that RWAs are beginning to reach critical mass. Ethereum continues to dominate the DeFi space, with a total value locked (TVL) of $166 billion, far exceeding Solana's $23 billion. In July, ETH prices surged nearly 60%, likely driven by favorable regulatory action. Meanwhile, the annualized yield on staking rewards surged to 29.4%, reflecting increased market confidence and user engagement. On Solana, Hyperliquid performed strongly, generating 35% of the blockchain's revenue in July, driven by rising demand for derivatives. Hyperliquid currently handles over 60% of 24-hour perpetual swap volume, with $15.3 billion in open interest, and facilitates $5.1 billion in USDC bridges. On the policy front, July marked a significant moment for US cryptocurrency regulation. Lawmakers passed: The GENIUS Act, which established a framework for stablecoins. The CLARITY Act, which clarified the classification of digital assets (SEC vs. CFTC). More importantly, SEC Chairman Atkins unveiled "Project Crypto," outlining a roadmap for the convergence of DeFi and traditional finance, including proposals for token issuance, custody, and a dedicated DeFi compliance framework. 5. NFT Activity Surpasses DeFi The NFT market is showing strong activity. In July, NFT activity surpassed DeFi, a shift not seen in some time. What's behind this momentum? Transaction volume nearly doubled, increasing 96% to $530 million. However, sales fell 4% to $5 million. This reflects one thing: NFT prices are rising. In June, the average price of an NFT was $52. In July, it soared to $105, a 103% increase. Blue-chip stocks are once again in the spotlight, with whales leading the charge. Blur, thanks to professional traders and its Blend lending protocol, dominates Ethereum NFT trading volume (accounting for up to 80% of daily volume). OpenSea maintains its leading position in user numbers (averaging approximately 27,000 daily users) thanks to long-tail asset listings and cross-chain activity. Zora has gained traction with its creator-first L2 network and $ZORA token, providing affordable and convenient NFT minting services. Additionally, Starbucks concluded its Odyssey NFT loyalty pilot program. Nike's SWOOSH continues its digital product launches, partnering with EA Sports to launch virtual sneakers in-game. Louis Vuitton, Rolex, and Coca-Cola (China) have launched NFT pilot projects related to authentication and collectibles. Netflix, NBA Top Shot, FIFA, and others are still involved, but with clearer licensing terms. A major shift? NFTs are evolving from hype to utility, from collectibles and cultural artifacts to identity, ticketing, gaming, and tokenized real-world assets. 6. Exploits Lead to $132 Million in Losses It's tempting to report a month without hacks or exploits, but that's not the case in the Web3 world (at least not yet). And as the market shows signs of recovery, it appears bad actors are stepping up their attacks. In July, losses from exploits exceeded $132 million, a 16% increase from June.

Major vulnerabilities of July 2025:

CoinDCX ($44 million) – An Indian exchange experienced a server compromise targeting its internal liquidity accounts. Fortunately, user funds were not affected, and the exchange remains operational.

GMX v1 ($42 million) – On July 9th, a vulnerability in GMX v1 on the Arbitrum platform allowed a malicious contract to manipulate internal accounts and withdraw funds exceeding the permitted amount. The GLP mining pool was affected; other GMX versions were not affected. A bounty has been set up to recover the funds.

BigONE ($28 million) – On July 16, the centralized exchange BigONE experienced unauthorized access to its hot wallet, resulting in losses across multiple chains. The platform stated that all user assets are safe and will cover all losses.

These incidents serve as a reminder that Web3 security remains a work in progress. Whether deeply involved in DeFi, NFTs, or AI DApps, please ensure you carefully check smart contract permissions, avoid clicking on suspicious links, and use hardware wallets whenever possible.

Olive

Olive

Olive

Olive fx168news

fx168news The Crypto Star

The Crypto Star Others

Others Beincrypto

Beincrypto Nulltx

Nulltx Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Nulltx

Nulltx Bitcoinist

Bitcoinist