Connectionism, the Power-Law Expansion of On-Chain Assets

Ethereum is making a comeback with DeFi. Aave/Pendle/Ethena are turning revolving loans into leverage amplifiers. Compared to the on-chain ETH-based stacks of DeFi Summer, the leverage curve supported by stablecoins like USDe is much more gradual.

We may be entering a long, warm cycle. The examination of on-chain protocols will be divided into two parts. The first is to involve more asset types, as external liquidity will be more abundant amidst the expectation of Fed rate cuts. The second is to examine the extreme values of leverage ratios, corresponding to the process of safe deleveraging. That is, how individuals can safely exit and how the bull market will end.

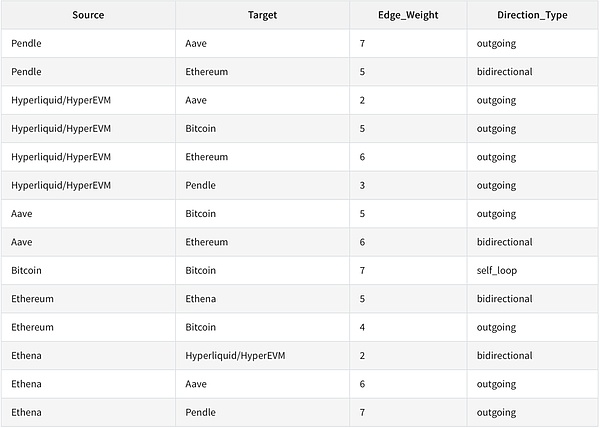

Six Crypto Protocols: Interaction between Ecosystem and Tokens

There are countless on-chain protocols and assets, but under the 80/20 rule, we only need to pay attention to parameters such as TVL/trading volume/token price. We can focus more on the smallest number of individuals that are indispensable to the on-chain ecosystem, and then examine their relationship in the ecological network, so as to take into account the individual importance, ecological connectivity and new protocols with the highest growth potential.

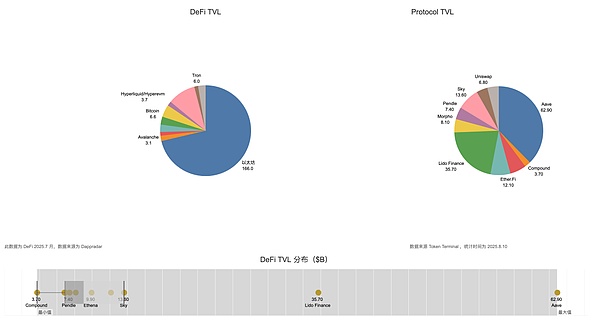

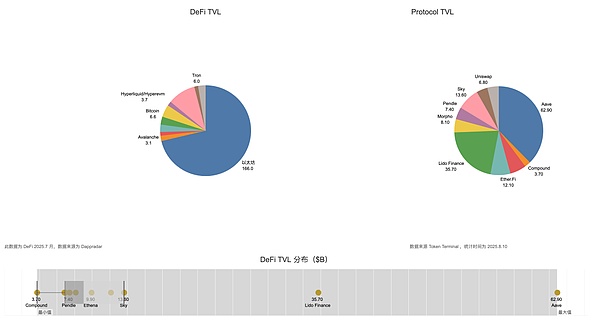

Image Caption: DeFi TVL Overview

Image source: @zuoyeweb3

In terms of DeFi TVL composition, Ethereum accounted for more than 60% of DeFi TVL in July, and Aave accounted for more than 60% of Ethereum ecosystem TVL. This is the 20% in the 80/20 rule. The remaining protocols must have a strong connection with the two to be included in the ranks of active and passive beneficiaries. With the flywheel of the three major revolving lending platforms kicking into gear, the correlation between Ethereum, Aave, Pendle, and Ethena goes without saying. Adding Bitcoin to the mix, WBTC, ETH, and USDT/USDC are the de facto foundational assets of DeFi. However, USDT/USDC, like Lido, possesses only asset attributes and essentially no ecosystem value. Plasma, Stablechain, and others are just beginning to compete. To make a slight distinction, a protocol can possess multiple values. For example, Bitcoin essentially only possesses asset value. This means everyone needs BTC, but no one knows how to leverage the Bitcoin ecosystem. I'm not saying BTCFi is a scam (I'm just kidding).

ETH/Ethereum, on the other hand, has dual value. People need both ETH and the Ethereum network, including the EVM and the extensive DeFi stack and development facilities built on it.

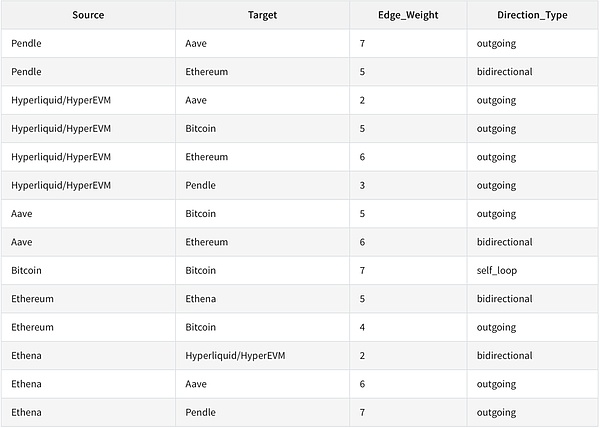

Further dividing based on asset and ecosystem value, examining the degree of "demand" of each head protocol, scoring one point for needed asset attributes and one point for needed ecosystem value, can be summarized in the following table:

Pendle/Aave/Ethena/Ethereum/HyperEVM/Bitcoin are the six protocols with the strongest links. The relationship between any two of them can be coupled with each other, requiring at most one additional protocol or asset link.

Let's explain a little:

1. Ethena <> HyperEVM: USDe has been deployed to the HyperEVM ecosystem

2. Pendle <> HyperEVM: $kHYPE and $hbHYPE rank first and third on the trend list

3. Aave <> HyperEVM: Hyperlend TVL accounts for 25% of HyperEVM ($500M vs. $2B). It is a friendly fork of Aave and promises to share 10% of profits with

4. BTC/ETH are the two most traded currencies on Hyperliquid, and can be deposited and withdrawn through Unit Protocol.

5. Pendle, Aave, and Ethena have become one, but USDe's asset attributes are recognized, and $ENA's ecological value is slightly inferior.

6. Pendle's new product Boros uses funding rates as the basis for transactions, and BTC and ETH contracts are the preferred choice.

7. Aave requires WBTC and various types of ETH, such as staked ETH. In particular, the ecological value of Ethereum as infrastructure is needed by Aave/Pendle/Ethena, which is ETH On-chain price support

8. The most unique feature here is that the Ethereum ecosystem unilaterally requires BTC, while the Bitcoin ecosystem does not require any external assets

9. Ethena and Bitcoin/BTC have no current relationship

10. HyperEVM/Hyperliquid is the "most proactive" external ecosystem, giving the impression of "I'm here to join this family"

According to statistics, these are the six most closely linked assets. The introduction of any other ecosystem or token requires more hypothetical steps. For example, Lido, the second largest by TVL, has a weak relationship with Hyperliquid and Bitcoin, and Pendle is "abandoning" LST assets in favor of YBS After that, Lido's interconnectedness within the Ethereum ecosystem will weaken. Based on BTC's highest of 7, we divide the six assets into three types of nodes according to their influence on other protocols. Please note that this is not a depiction of their asset value, but a ranking of their importance within the ecosystem: BTC/ETH is the strongest infrastructure. BTC excels in value attributes, and ETH's ecological position is unshakable. If you add Solana to the calculation of the degree of connection, you will find that it is not as well connected to Ethereum as Hyperliquid/HyperEVM. The core reason is that Hyperliquid's own transaction attributes, combined with HyperEVM, are more in line with the EVM ecosystem.

• Within Ethereum, Lido/Sky has insufficient interaction with the six existing protocols

• Outside Ethereum, Solana/Aptos has insufficient interaction with the six existing protocols

However, Solana needs to support its own DEX to be compatible with more external assets. This will naturally require one more hypothetical step, and it will also be more difficult for SVM to be compatible with the EVM ecosystem. In a word, everything about Solana must develop independently. However, in the network of relationships, the synergy effect of the Ethereum ecosystem is the strongest. $1 of Ethena was hedged by ETH and then entered Pendle and Aave. Value circulates in the network, and the gas fees generated become the value support of ETH.

Aside from Bitcoin, which naturally relies on BTC for its own self-circulation and circulation, ETH comes closest to a closed value loop. However, this is the result of proactive action, and the Hyperliquid/HyperEVM combination is still under development. Whether the linkage between transactions (Hyperliquid) + ecosystem (HyperEVM) and $HYPE can be achieved remains to be seen.

This assumes a gradually increasing entropy process. BTC only needs itself, ETH needs an ecosystem and token, and $HYPE needs transactions, tokens, and an ecosystem.

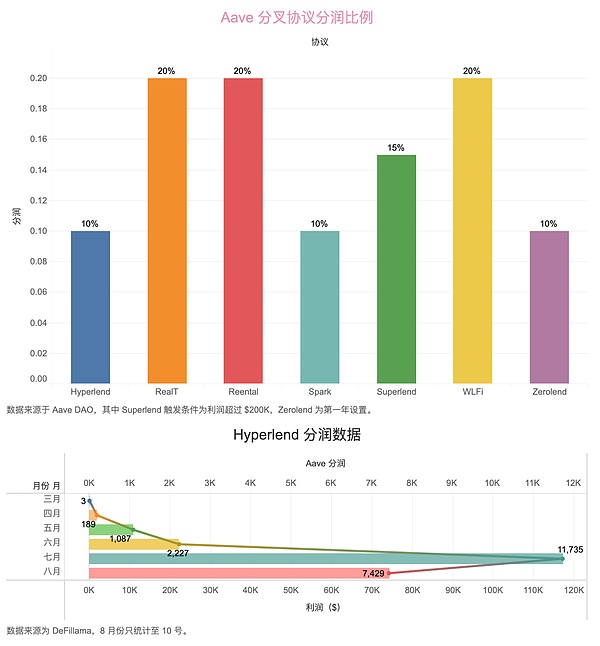

Is there an end to the expansion of DeFi? As mentioned earlier, Hyperlend needs to share profits with Aave, but Aave's influence is not limited to this. In fact, Aave is the main player in the revolving loan initiated by Pendle and Ethena, assuming the leverage of the entire circulation system. Aave is the closest to becoming an on-chain infrastructure for Ethereum. This is not because of its highest TVL, but due to a combination of security and capital volume. For any public chain or ecosystem, the safest way to launch a lending model is to fork Aave in a compliant manner.

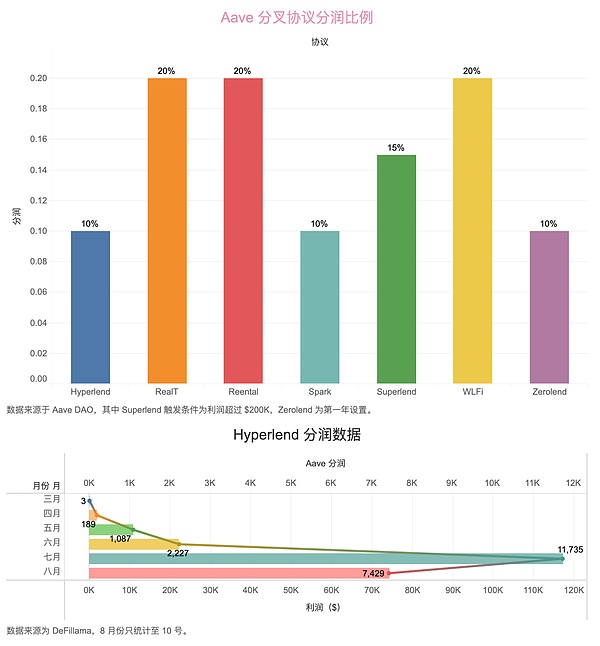

Image Description: Aave and Hyperlend profit-sharing settings

Image source: @zuoyeweb3

In Hyperlend's fork template, 10% profit is the basis. In addition, 3.5% of its own tokens are allocated to Aave DAO and 1% stAave holders. That is, Aave sells itself as a service to various ecosystems. This is where its ecological value and token value are linked. However, there are competitors. Maple has already expanded to HyperEVM, and new lending protocols like Fluid and Morpho are also actively competing with new assets like YBS. Even HyperEVM, as the strongest competitor to the Ethereum EVM ecosystem, may not remain peaceful. In terms of initiative, Bitcoin and HyperEVM are at opposite ends of the spectrum. HyperEVM is siphoning traditional transaction types onto the chain through HIP3, connecting HyperCore and HyperEVM liquidity through CoreWriter, and supporting its own front-end agents through Builder Code. Furthermore, it is leveraging Unit Protocol and Phantom to connect funds within the Solana ecosystem, siphoning all on-chain liquidity – another form of infrastructure expansion.

To sum up:

• Pendle is targeting all types of assets that can be divided. Starting from fixed income, it expands the derivatives market beyond perpetual contracts, that is, the interest rate swap market in a broad sense

• Ethena uses the DeFi revolving loan model and treasury strategy to create a third pole of stablecoins based on $ENA, $USDe and $USDtb. The basic use of USDT/USDC is still trading and payment. USDe hopes to become a risk-free asset in the DeFi field

• Aave is already the de facto lending infrastructure, and its status is closely tied to Ethereum

ConclusionThe six crypto protocols examine the degree of mutual connection. This does not mean that other protocols lack value, but that high collaboration will exponentially increase the freedom and utilization of funds, thereby enabling all to benefit from the same. Of course, if one loses, all lose. This requires examining the subsequent development of DeFi's anchor switch—from ETH to YBS. As a high-value asset, ETH is more aggressive in leverage. YBS, like USDe, is naturally more price-stable (not value-wise), making the DeFi foundation based on it more stable. Barring extreme depegging scenarios, this can theoretically make the leverage and deleveraging curves more gradual. Seats in the crypto pantheon are limited. New Chosen Ones can only strive forward, befriend existing gods, and build the strongest protocol network to earn a place for themselves.

Catherine

Catherine