The GENIUS Act was passed and signed by Trump, and the first stablecoin regulatory framework in U.S. history was officially born. The crypto market cheered, but if you think this is only good for USDC and USDT, then you underestimate its far-reaching significance. The real protagonist is Ethereum. It is quietly transforming into a "global settlement network for the dollar on the chain", and ETH is also being revalued as the clearing fuel for future finance. A structural bull market has begun.

1. The evolution of the US dollar stablecoin: from shadow currency to state machine

1.1 Starting point: a shadow system "born" by Bitfinex

Stablecoins are not new. After the 2008 financial crisis, the "liquidity sovereignty" of the US dollar in the world was infinitely magnified. The first stablecoin in the crypto industry, USDT, was launched in 2014 by Tether, a Bitfinex affiliate.

Its original intention was simple and direct:

"Let you own dollars in the crypto world".

It is not backed by the central bank and has no audit mechanism. It just says, "I have dollars in my account, so I dare to issue tokens pegged 1:1". USDT began to circulate, but it has not been accepted by regulators.

But the market loves it. It solves a key problem - between highly volatile assets such as Bitcoin and Ethereum, users need a "safe haven", an asset that can be priced stably and temporarily store value.

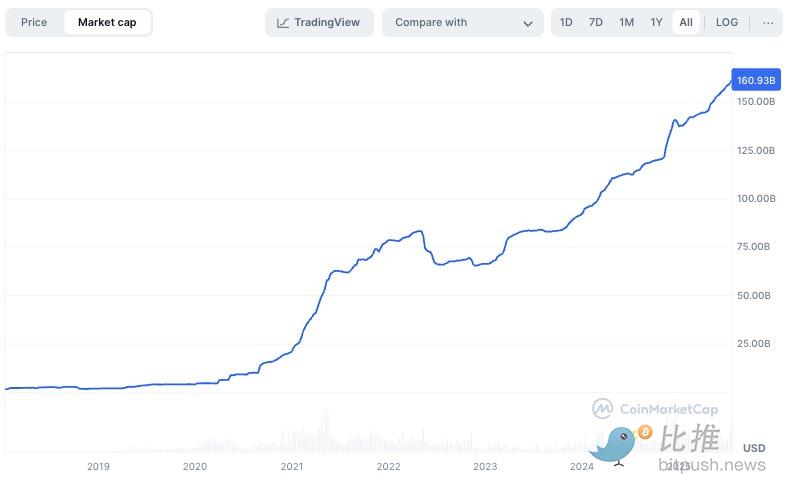

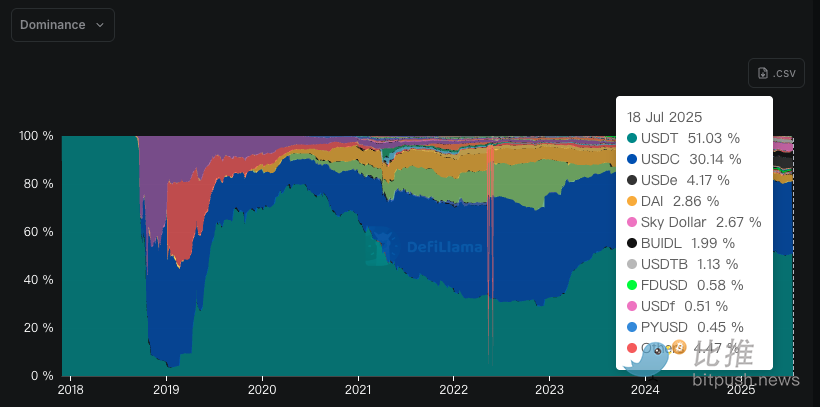

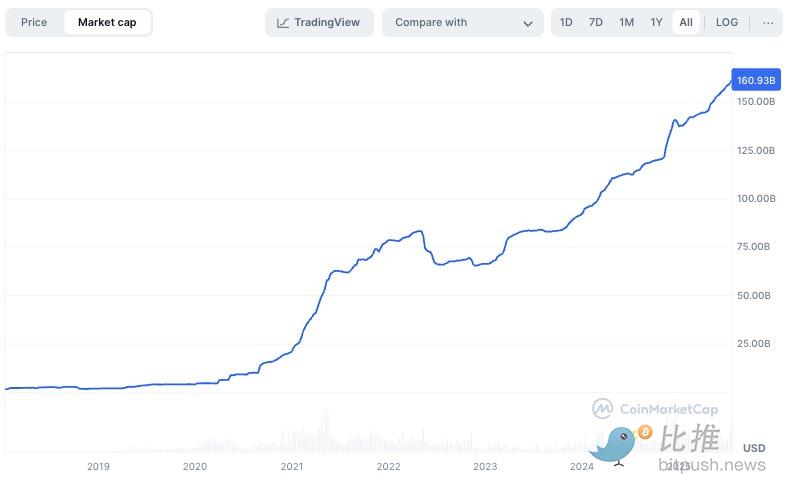

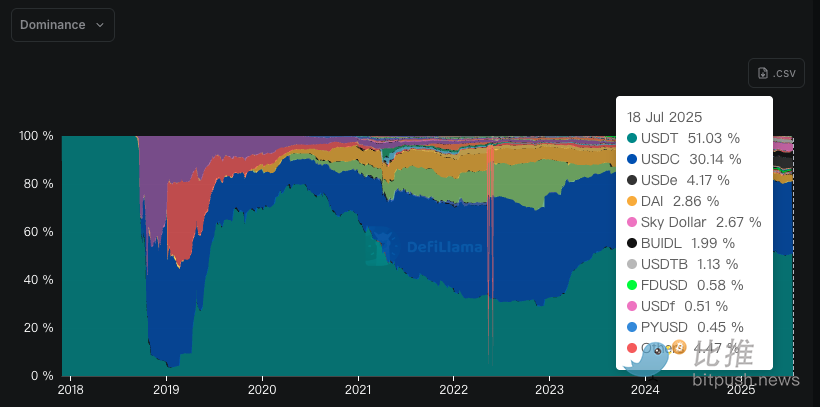

As a result, the use of stablecoins has grown rapidly. Its market value has soared from US$2 billion in 2018 to over US$160 billion in 2025, and the on-chain US dollar transaction volume even exceeded Visa's cross-border settlement volume in 2022.

1.2 Libra incident: The Fed’s awakening

In 2019, Facebook launched Libra (later renamed Diem), hoping to build a global stable currency system anchored by a basket of currencies.

"Global users use Libra to pay, bypassing SWIFT, banks, and even the US dollar."

This terrified the Federal Reserve: If a technology platform can control the global circulation of US dollars, what is the use of central banks?

The U.S. Congress urgently stopped Libra and began to think from then on - we need a stable currency system that we can control and regulate.

1.3 The bill was born: GENIUS, let stable currency enter the "system"

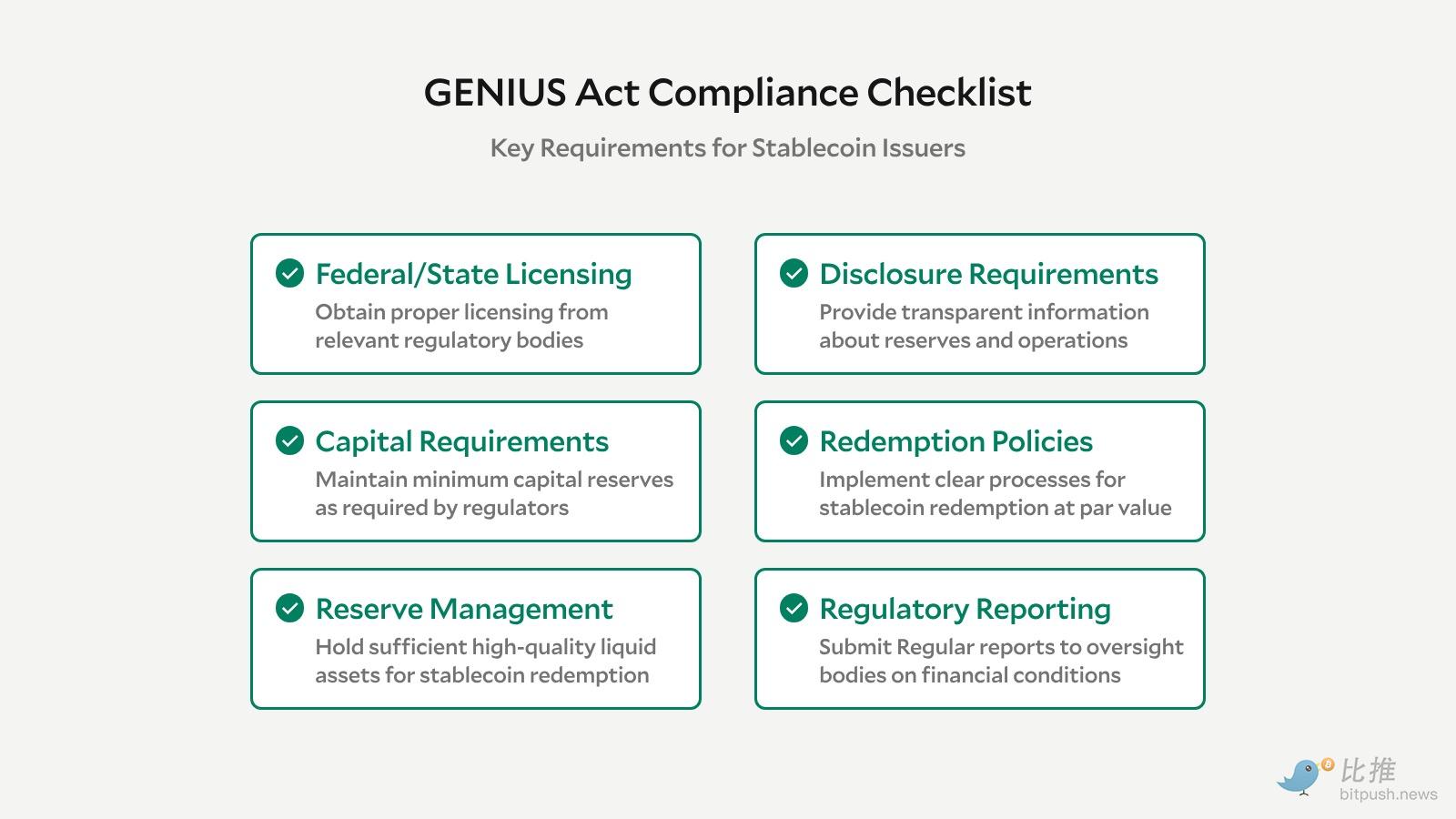

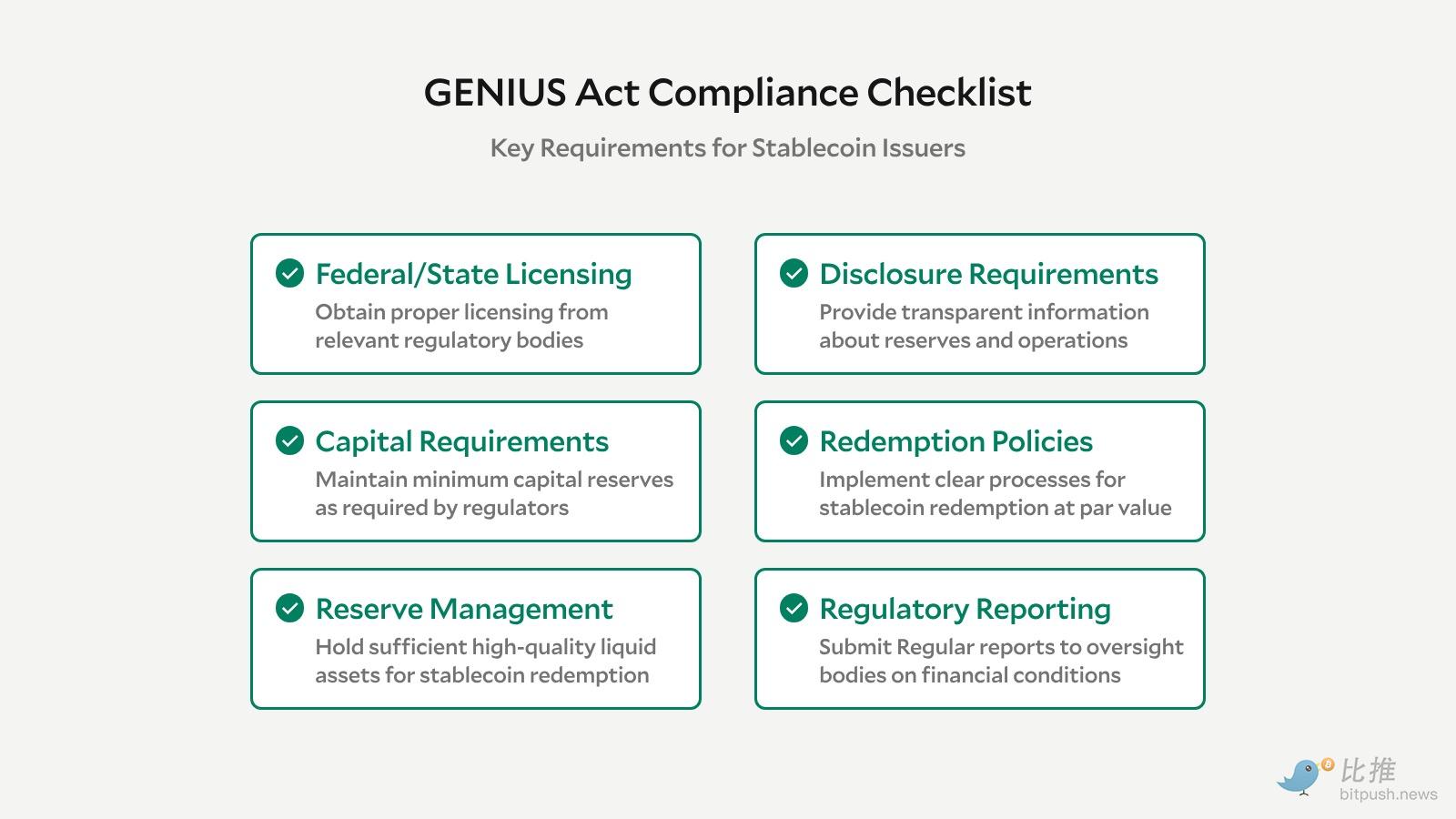

In 2025, the "GENIUS Act" was passed by Congress with a high vote. The core content is as follows:

Stablecoins must be 100% backed by U.S. debt or cash;

Issuers must obtain federal or state licenses;

Interest payments are prohibited, and shadow banking is prohibited;

After a three-year transition period, illegal issuance of stablecoins will be prohibited;

Overseas issuers must pay deposits, register and be regulated, otherwise they are not allowed to serve US users.

This is not a regulatory "ban", but a formal "national takeover".

It legalizes the US dollar stablecoin and incorporates it into the US financial infrastructure.

2. Ethereum: The "engine" and "foundation" of the US dollar on the chain

2.1 Which chain do stablecoins run on?

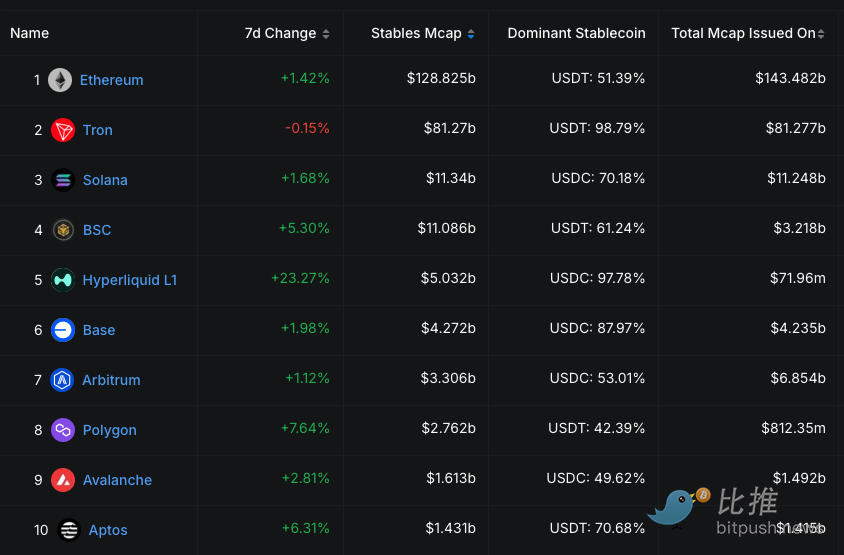

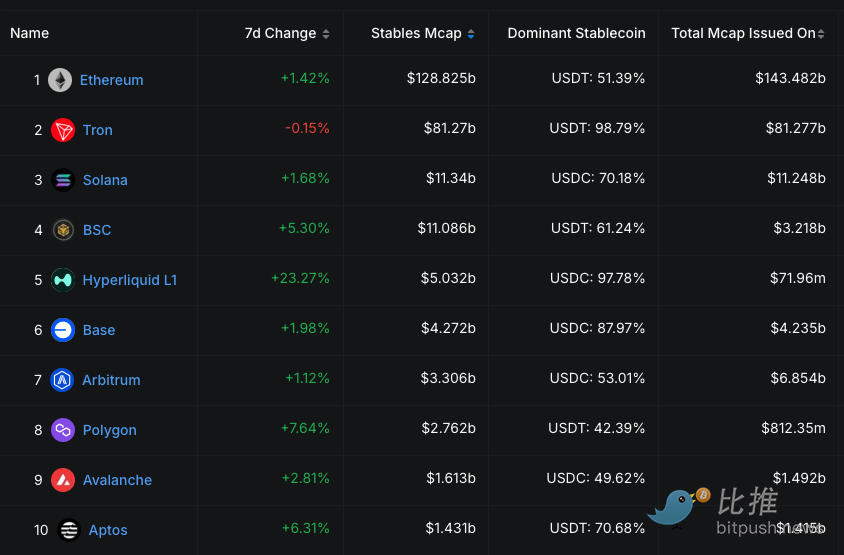

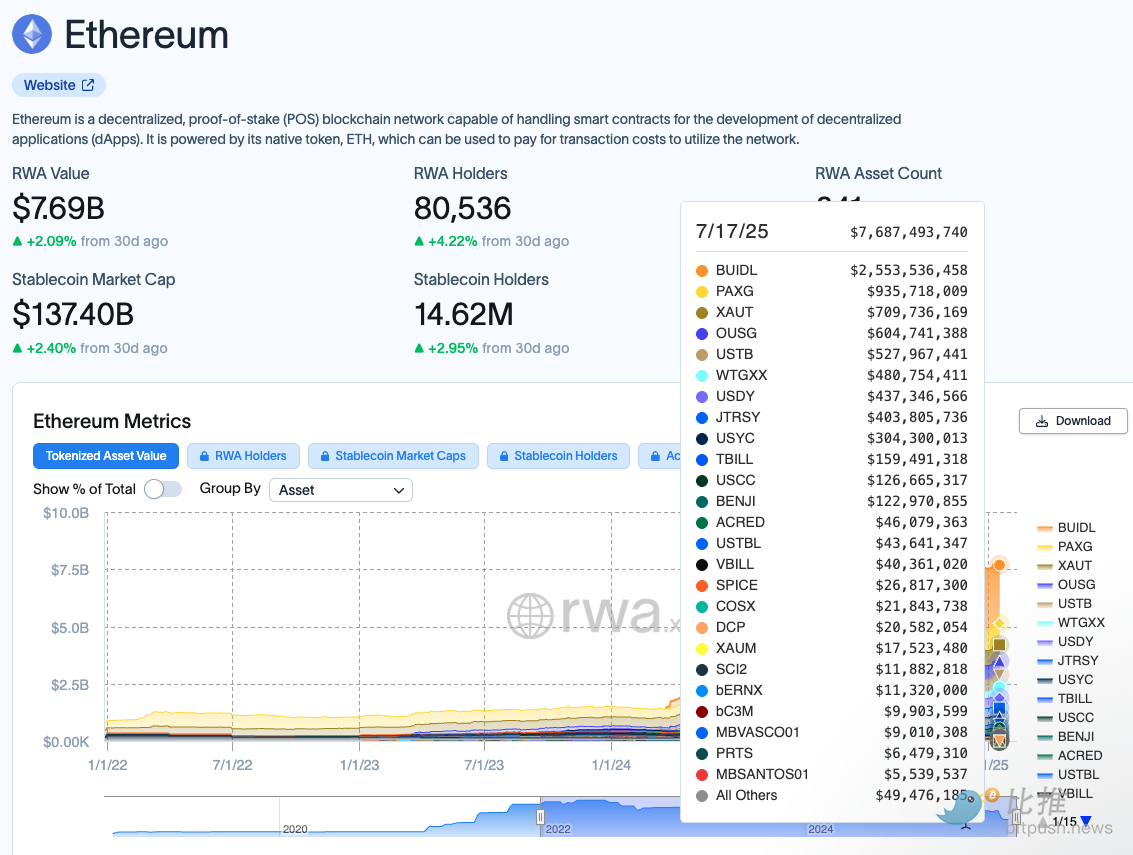

As of July 18, 2025:

It can be seen that:

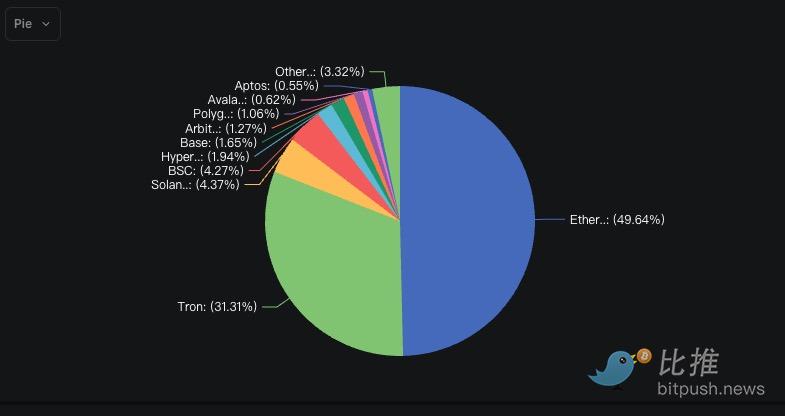

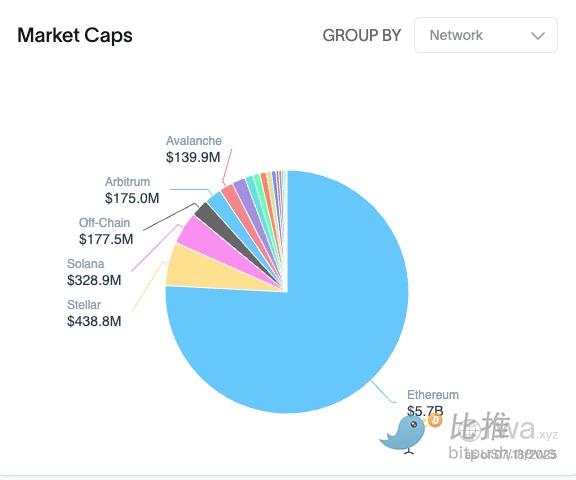

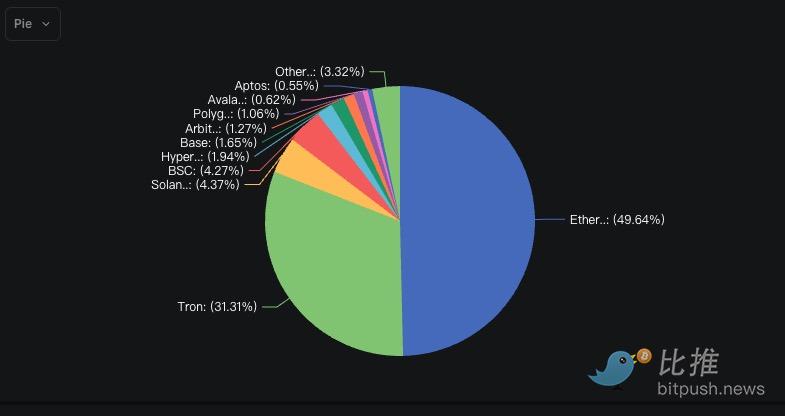

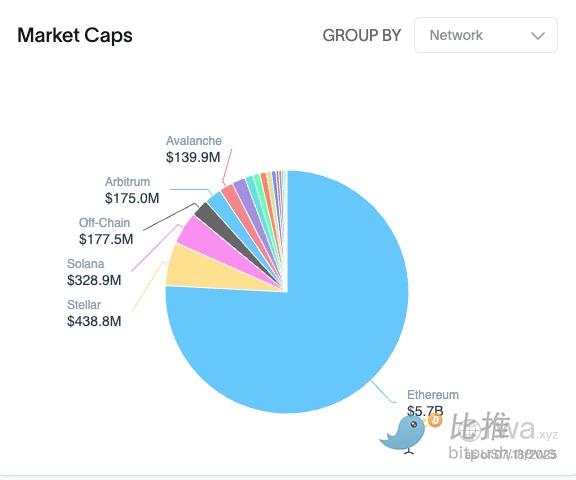

The main battlefield of stablecoins is Ethereum, with a share of 49.61%, mainly used for DeFi, payment, and clearing.

Although Tron has a lot of USDT, it is basically an over-the-counter transfer within Asian CEX and rarely enters the real economic level.

And on Ethereum:

There is USDC settlement of Visa/Stripe/PayPal;

There is MakerDAO's mortgage-interest-bearing DAI;

There is the RWA mortgage system that PayPal and BlackRock are promoting.

Ethereum is the "land of the dollar on the chain", and USDT/USDC is just its surface. Deeper, it is the birth of an on-chain dollar economy.

III. “Dollar Engine”: Re-evaluation of ETH’s role

3.1 Every dollar circulation on the chain will consume ETH

The core sources of Ethereum’s income are:

And stablecoins are just:

High frequency use (transfer, settlement, DeFi)

Easy to integrate (API-based)

Low threshold to attract C-end and institutional users

Stablecoin = Ethereum's killer "fuel consumer".

As of the first half of 2025, the transaction volume of stablecoins on Ethereum accounted for 61%; the ETH burning generated by stablecoin-related contracts accounted for 48.2% of the total; the peak of ETH destruction in a single day exceeded 3,500 ETH, equivalent to approximately US$12 million.

The more stablecoins are legally used, the scarcer ETH becomes.

3.2 ETH = Digital liquidation gold? Valuation model upgrade

Traditional ETH valuation comes from "on-chain usage × market sentiment". However, after the legalization of stablecoins, the ETH valuation model should be upgraded to:

ETH public chain value = on-chain economic activities (stablecoin × RWA × payment) × Gas destruction × staking security × on-chain TVL multiple

The more economic activities → the faster ETH burns → the stronger the deflation

The larger the TVL → the higher the ETH mortgage/pledge demand → the tighter the circulation

The more users → the more stable the income → ETH is more like a financial benchmark asset

From "hype asset" to "liquidation layer token", the value of ETH will move towards a long-term stable + deflation model.

Fourth, RWA synergy: On-chain dollars drive real assets on the chain

4.1 What is RWA?

RWA (Real-World Assets), that is, "real assets on the chain":

Treasury bonds, corporate bonds

Accounts receivable, property rights

Stock fund shares

Even real estate shares

If these assets can be bought and sold by "on-chain dollars", a trinity of stablecoins + smart contracts + clearing networks is required.

Ethereum is the base of this triangle.

4.2 The experiment has begun: BlackRock and Franklin are both on the chain

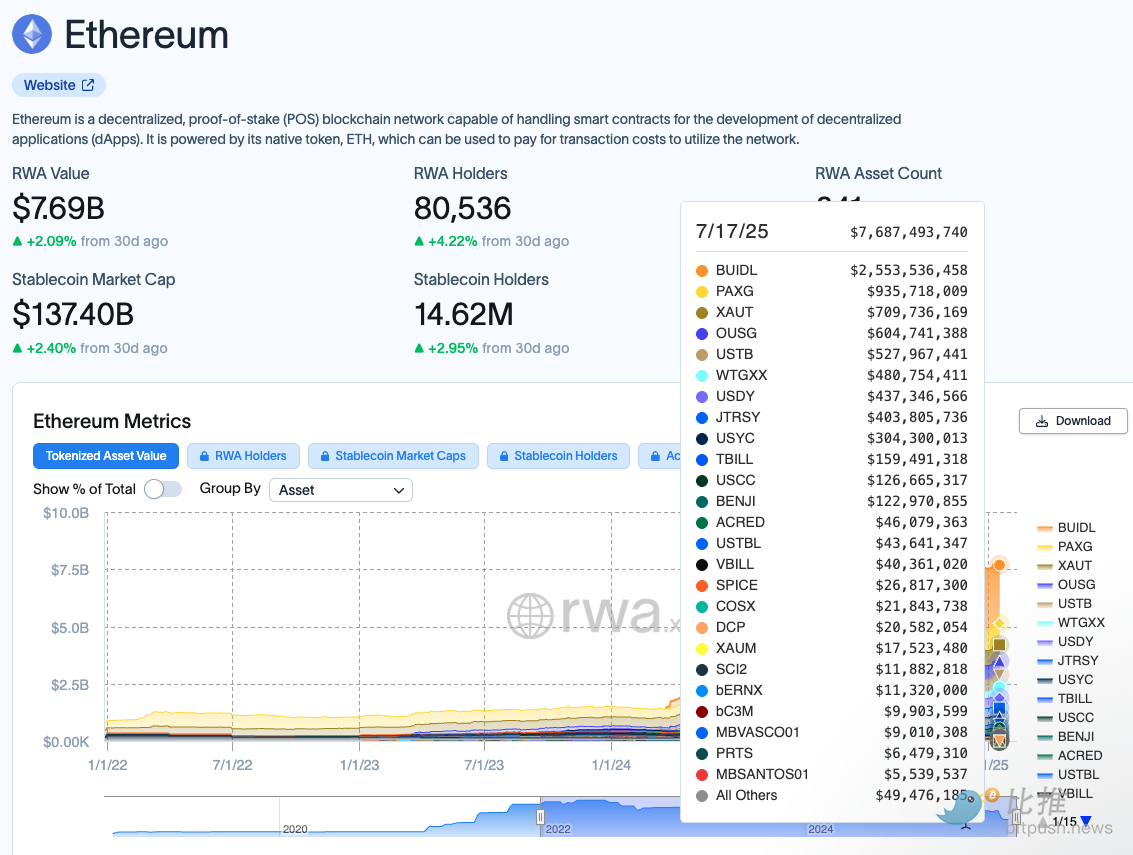

BlackRock's BUIDL fund holds short-term US Treasury bonds and allows redemption with USDC;

Franklin Templeton issues FOBXX fund, supports Ethereum settlement;

The on-chain T-Bill custody scale exceeds US$7.5 billion, and more than 70% is based on Ethereum or its L2.

What does this mean?

US dollar → on-chain stablecoin → purchase US Treasury RWA → get income → continue to flow back to the chain.

Ethereum has become a "digital version of the Federal Reserve system": on-chain coinage + on-chain Treasury market + on-chain clearing house.

As a fuel currency, ETH will directly participate in these financial processes:

ETH is becoming a "credit coal mine" for the financial system.

V. Future Trends: Institutions, Countries, and Regulations Converge

5.1 Institutions are buying, countries are watching, and regulators are giving the green light

BlackRock and Fidelity are deploying RWA and stablecoin funds;

Visa and Stripe are building stablecoin settlement networks;

Circle is applying for a national trust license;

Hong Kong dollar stablecoin and Korean won stablecoin have begun pilot projects;

The European Central Bank and the Bank of Japan are studying the "regulatory compliance stablecoin framework";

5.2 Potential Risks: Five Major Challenges Ethereum May Face

Risk Points | Possible Impact |

L2 diverts ETH revenue | More transactions may go to L2 such as Arbitrum and Base, diluting ETH main chain revenue |

Policy Reversal | Once financial giants lose control, stablecoins will be tightened again |

Tron and Solana may squeeze ETH in local scenarios (such as payment, games) |

Black swan events | On-chain dollar hacker attacks or large-scale depegging will undermine the foundation of trust |

ETH concentrated staking | The trend of staking centralization (Lido accounts for too high a proportion) may affect network neutrality |

Therefore, although Ethereum is leading in the "on-chain dollar battle", its victory is by no means certain.

VI. Conclusion: It is not that Crypto wants the dollar, but that the dollar comes to Crypto

The GENIUS Act is a signal: "The dollar on the chain is part of the US strategy."

Ethereum is the "execution layer" of this strategy. And ETH is the "internal fuel" of this engine.

We are entering a new financial era:

It is not BTC against legal currency, but ETH becomes a legal currency network;

It is not that the chain fights against the chain, but that the chain absorbs the chain;

It is not that Crypto challenges the dollar, but that the dollar invades Crypto and transforms into a digital body.

ETH is not the next BTC, it is the next Swift + clearing house + Fed benchmark.

Catherine

Catherine