Source: Grayscale; Compiled by: Baishui, Golden Finance

Summary

Crypto valuations retreated in February 2025, in sync with rising macro risks and falling tech stock prices. A hacking attack on a major cryptocurrency exchange and a decline in Meme coin trading activity may have also impacted the market.

Meanwhile, the regulatory environment for the U.S. crypto industry continues to improve: the U.S. Securities and Exchange Commission (SEC) terminated or suspended multiple enforcement actions initiated by the former leadership, while a group of bipartisan senators proposed new stablecoin legislation. In addition, breaking news over the weekend showed that President Trump also emphasized a proposed crypto strategic reserve plan.

Changes in the macroeconomic outlook may continue to bring volatility to the crypto market in the short term. However, given that industry fundamentals are improving, the decline in token valuations may create an attractive entry opportunity for long-term investors.

February 2025 was a contrasting month for the cryptocurrency market, with valuations falling but fundamental news mostly positive. Despite short-term setbacks, improving fundamentals should provide a solid foundation for technological development and user adoption.

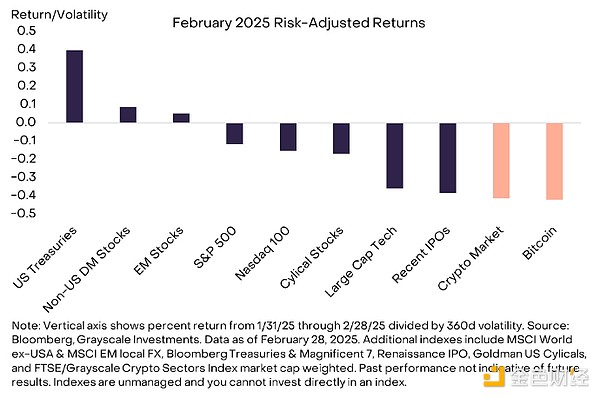

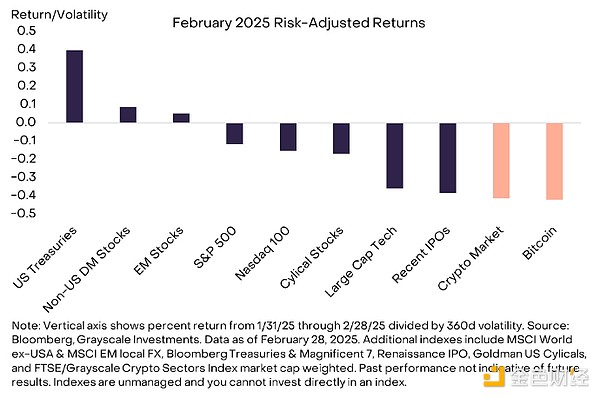

Our market-cap-weighted crypto sector price index fell 22% in February 2025. On a risk-adjusted basis (i.e., taking into account the volatility of each asset), the crypto market’s performance for the month was comparable to the declines in cyclical and technology-oriented equity market sectors (Exhibit 1). Bitcoin performed slightly better than the overall crypto market, falling 18%, although its risk-adjusted return was lower than the overall crypto market (reflecting Bitcoin’s generally lower volatility). Non-U.S. equity markets outperformed as concerns about the outlook for U.S. economic growth led to lower U.S. Treasury yields and strong bond price returns. Figure 1: Cryptocurrency valuations fall as tech stocks fall

Weatherly

Weatherly