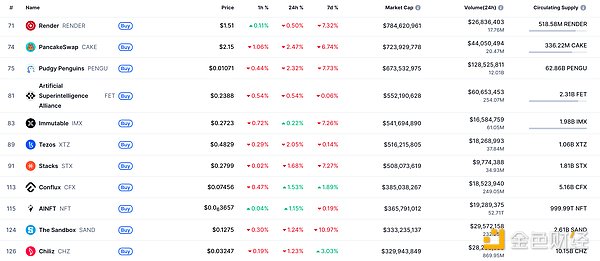

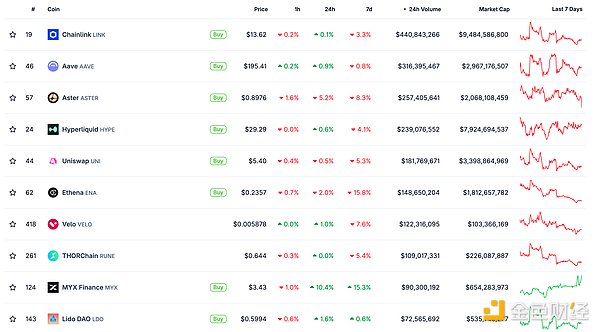

DeFi data

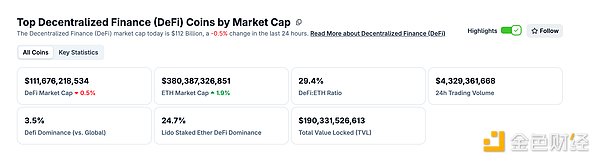

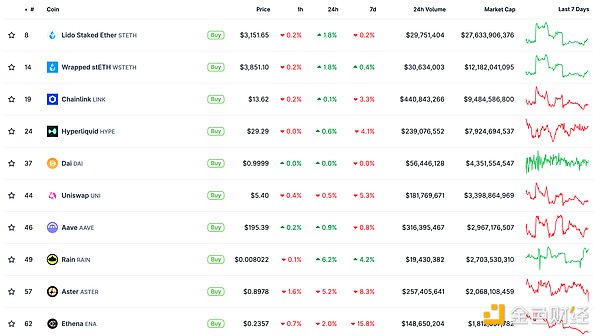

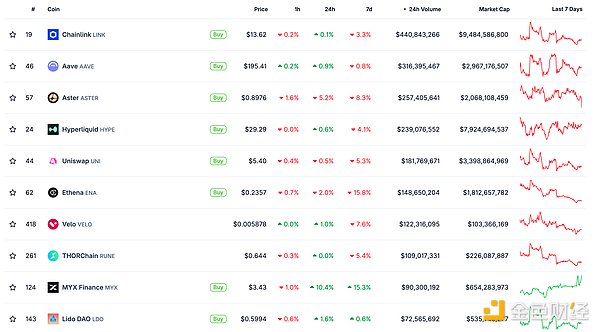

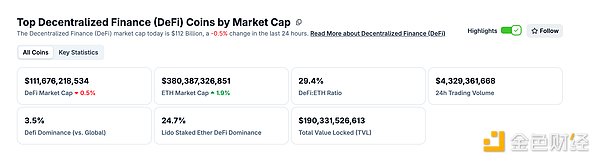

1. Total market value of DeFi tokens: 111.676 billion US dollars

DeFi Total Market Cap Data Source: coingecko

2. Trading volume of decentralized exchanges in the past 24 hours: $43.29

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

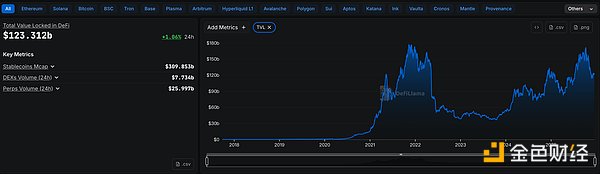

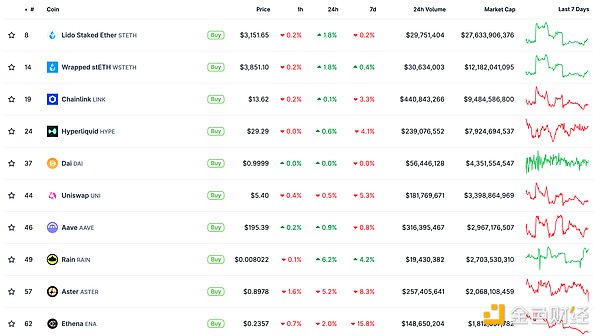

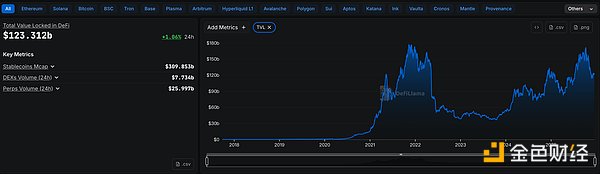

3. Assets locked in DeFi: $123.312 billionbillion

![]() Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

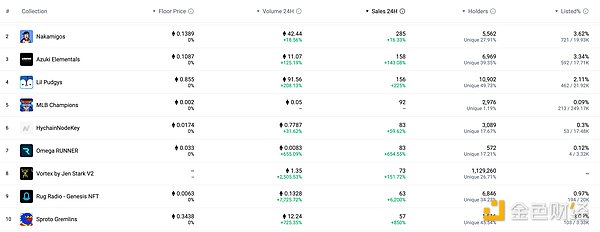

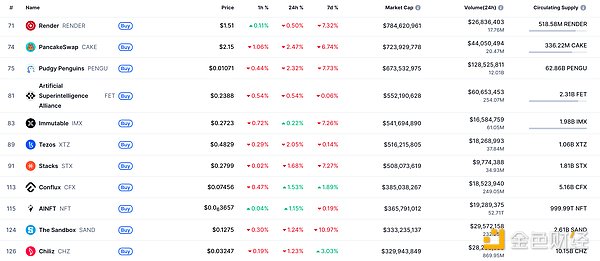

NFT Data

1. Total Market Cap of NFTs: $10.51 Billion

alt="xRGYrLzmOh4UpKAo5j5eKcBc4CpNpROs8o1yy9VD.png">

NFT Total Market Capitalization, Top Ten Projects by Market Capitalization Data Source: Coinmarketcap

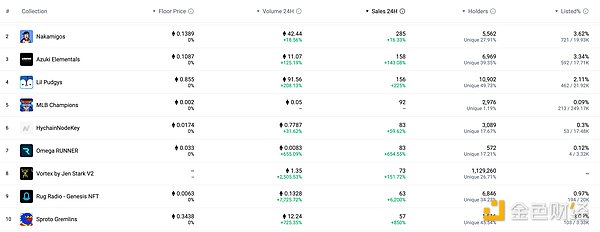

2.24-Hour NFT Transaction Volume: $937 MillionUSD

![]()

Top 10 NFTs by Sales Growth in the Last 24 Hours. Data Source: NFTGO

Headlines

The UK Treasury is drafting new regulations to regulate the cryptocurrency market

The UK Treasury is drafting rules requiring cryptocurrency companies to comply with a series of standards, and the Financial Conduct Authority (FCA) will be responsible for regulation. Cryptocurrencies will be regulated in a manner similar to other financial products under legislation that will come into effect in 2027.

UK government officials have been pushing for reforms to the crypto market.

DeFi Hot Topics

1. Base co-founder suspected of driving traffic to RUG token, drawing strong criticism from the community

2. Kaiko: Binance's Market Dominance May Constitute Systemic Risk

According to a report by Jinse Finance, DLnews reports that Kaiko's latest report shows that excessive concentration of liquidity in the crypto market on a few platforms such as Binance poses significant structural, operational, and legal risks. The report warns that although Binance is the world's largest exchange (US$15.3 billion in spot trading volume and US$27 billion in open interest in derivatives), the platform is not formally regulated, has been convicted in the US for inadequate anti-money laundering efforts, and does not hold an EU MiCA license.

The October crypto market crash led to the liquidation of US$19 billion in futures positions, and Binance experienced price deviations and account access issues. Kaiko researchers point out that if Binance experiences operational, legal, or technical shocks, it could trigger severe market-wide volatility.

3. Aave Governance Forum Sparks Heated Debate Over CoW Swap Fees

Jinse Finance reports that Aave DAO, responsible for managing the Aave protocol, and Aave Labs, the core development company of the Aave series of products, have disagreed on the distribution of fees generated from the recently announced integration with the decentralized exchange aggregator CoW Swap. The controversy continues to escalate. The issue was raised by EzR3aL, an anonymous member of Aave DAO. He pointed out that the fees generated from exchanging crypto assets through CoW Swap did not go into the Aave DAO's treasury, but instead flowed into a designated on-chain address.

In fact, these fees ultimately flowed to a private address controlled by Aave Labs. EzR3aL raised several questions, including why the DAO was not consulted before the fee flow adjustment, and argued that the ownership of these fees should belong to the DAO.

4. Robinhood Tokenizes Stock on Arbitrum

According to Jinse Finance, Token Terminal published an article on the X platform stating that Robinhood has tokenized its stock on Arbitrum, with the total market capitalization of the tokenized shares recently exceeding $13 million.

Johann Kerbrat stated, "Ethereum provides us with native security, while Arbitrum gives us the engineering flexibility we need." Aster Announces Phase 3 Airdrop Now Open for Claim On December 15th, according to official news, decentralized exchange Aster's Phase 3 airdrop is now officially open for claiming. The claiming period is from 12:00 UTC on December 15, 2025 to 12:00 UTC on January 15, 2026, lasting one month. Users need to go to the official Aster platform and connect their wallets to claim the airdrop.

Disclaimer: Jinse Finance, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish sound investment principles and be sure to enhance your risk awareness.

Miyuki

Miyuki