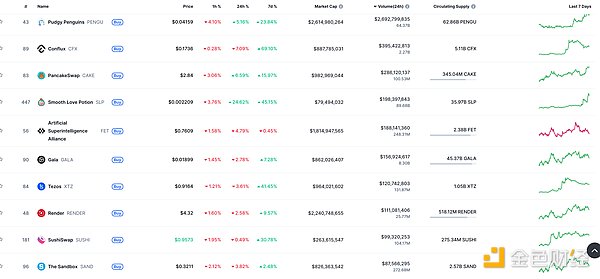

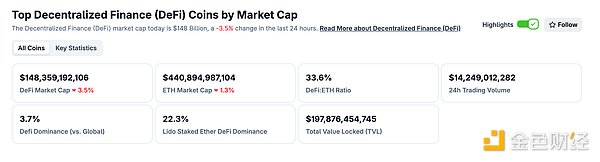

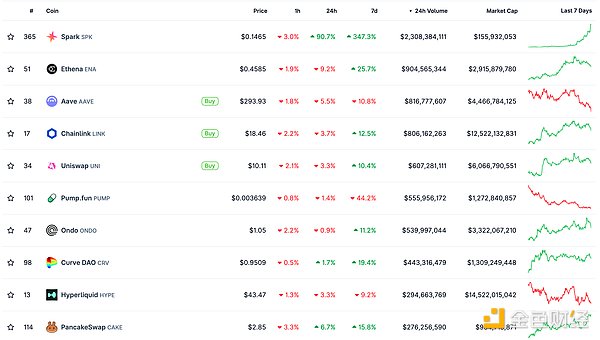

DeFi data

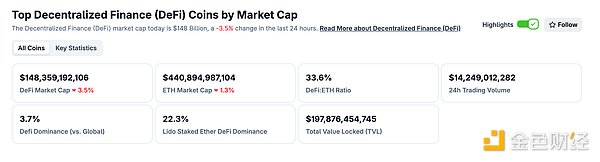

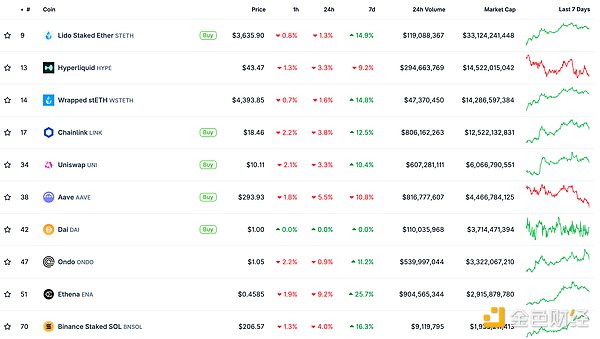

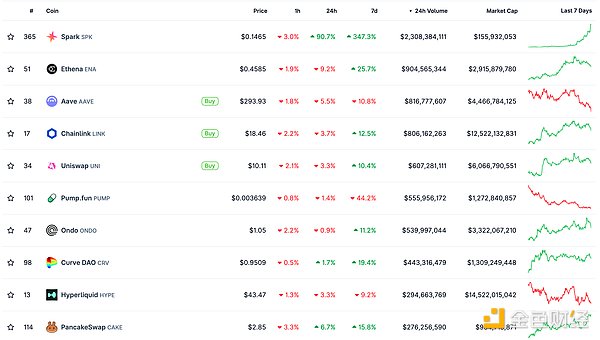

1. Total market value of DeFi tokens: 148.359 billion US dollars

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 14.249 billion US dollars

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

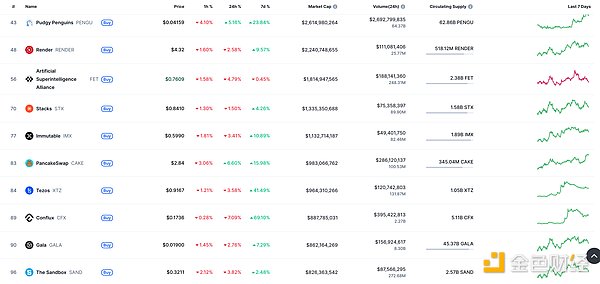

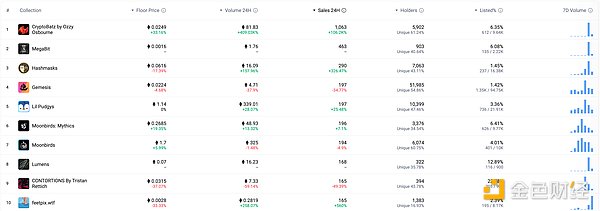

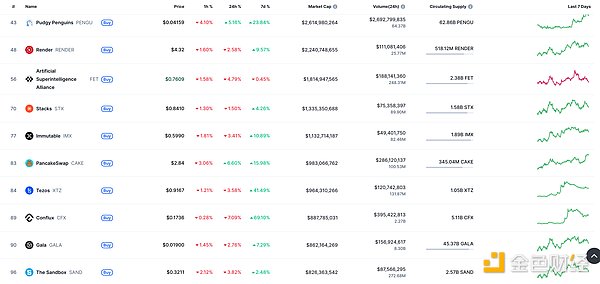

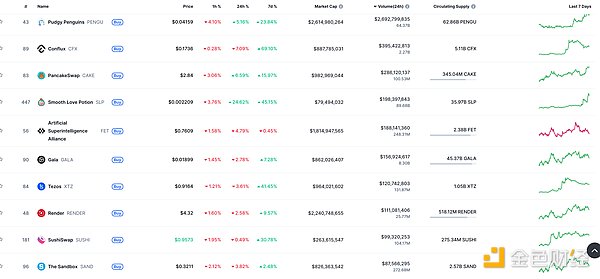

NFT data

1. Total market value of NFT: US$24.832 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 6.284 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

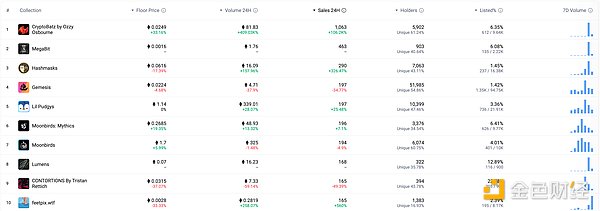

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

SpaceX warns investors: Musk may return to US politics

Golden Finance reported that the media quoted SpaceX documents and people familiar with the matter as saying that Musk, who previously served as a senior adviser to Trump, may return to US politics. The documents show that Musk may hold a similar position to his previous one and will devote a lot of time and energy. The company included language listing such "risk factors" in documents sent to investors to discuss the acquisition offer. Some of the people said it was believed to be the first time such language has appeared in these acquisition offers.

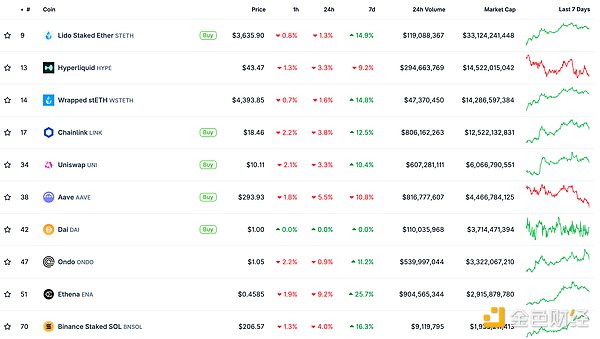

MEME Hotspot

120 million PUMP tokens are suspected to be transferred from Binance hot wallets back to project-related addresses

Golden Finance reported that according to monitoring by chain analyst Ai Yi, 2 billion PUMP tokens are suspected to be transferred from Binance hot wallets back to project-related addresses. It is reported that this part of the tokens was transferred to the address 9SnqX...seSGz after being recharged into Binance a week ago, and was transferred back from the address in batches half an hour ago. The analyst said that tomorrow is the expected date for the airdrop.

2. Data: PUMP broke the issue price, and only 12.7% of pre-sale buyers still hold tokens

Golden Finance reported that according to the monitoring of chain analyst Spot On Chain (@spotonchain), the price of PUMP has fallen below the private placement price of $0.004, and the market performance is poor. Data shows that among the 10,145 pre-sale buyers, only 12.7% still hold tokens, 31.6% have sold them on decentralized exchanges, and 53% have transferred tokens to new wallets or centralized exchanges.

It is worth noting that large investment institutions such as "PUMP Top Fund 1" and "PUMP Top Fund 2" have made profits of 19% and 43% respectively and successfully cashed out. At the same time, other whale users such as "8UHpWB", "9Ucygi" and "2WHL4X" are facing losses of about 7.7%. Machi Big Brother's 5x leveraged long position faces a floating loss of $4.06 million. The Pumpfun fee account used SOL to repurchase approximately $19.81 million worth of PUMP tokens in the past week, but the repurchase rate has slowed down significantly.

DeFi Hotspots

1. Analysis: The huge amount of ETH waiting to be unpledged may be related to the sudden drop in the supply of Ethereum on Aave

Golden Finance reported that according to the analysis of Ai Yi, an analyst on the chain, the batch unpledge of 620,000 ETH may be related to the large-scale withdrawal of ETH deposits on the Aave platform, which led to a surge in borrowing interest rates. In a short period of time, a large number of Aave ETH deposits were withdrawn, causing borrowing interest rates to soar. Revolving loan players went from enjoying the spread to losses, and were forced to redeem stETH to deleverage, leading to the current situation.

Aave ETH borrowing APR once soared to 10%, and the current exit waiting period of Lido stETH has been extended to 21 days (normally within a week). The on-chain stETH exchange for ETH is still at a discount of nearly 0.4%.

Regarding the implementation of revolving loans, Aave's collateral rate for ETH is 93%, which means that arbitrageurs can even use up to 14 times leverage to obtain interest rate spreads. Under normal circumstances, the annualized rate of return on the principal can reach ~7%.

2. The supply of stablecoins on the Ethereum network has exceeded $140 billion

Golden Finance reported that according to on-chain data, the supply of stablecoins on the Ethereum network has exceeded $140 billion, a record high. The supply has almost doubled from the level in January 2024.

3. Analysis: Ethereum's current round of rise is mainly driven by structural capital inflows

Golden Finance reported that according to Bitwise analysis, since May 15, ETFs and corporate treasuries have purchased a total of about 2.83 million ETH, far exceeding the new output in the same period, with a supply-demand ratio of 32:1. CIO Matt Hougan pointed out that this round of rise is mainly driven by structural capital inflows, not emotional factors. He expects ETH net purchases to reach $2 billion in the next year, continuing to push up prices.

4. Ethereum L2 network Taiko has been integrated with Dune

Golden Finance reported that according to official news, Ethereum L2 network Taiko has been integrated with Dune, and Taiko's on-chain data can now be viewed in real time on Dune.

Through this integration, Taiko network data will be presented to developers and the community in a more transparent, open and convenient way.

5. Ethereum staking flows accelerated, with exit and entry funds rising to highs of approximately $2 billion and $1.3 billion, respectively

Golden Finance reported that due to the rise of more than 160% in Ethereum since April, ETH stakers have seen a large-scale cashing-out wave, with the number of validators exiting the queue climbing to 519,000 ETH, worth approximately $1.92 billion, and the queue time exceeding 9 days, the highest level since January 2024.

At the same time, the high enthusiasm of institutional staking has driven the number of ETH entry queues to climb to 357,000, worth approximately $1.3 billion, and the queue time exceeding 6 days, the longest since April 2024. Since companies such as Sharplink Gaming switched to the ETH vault strategy in May, the demand for staking has increased significantly.

Analysis shows that exits are mainly driven by early pledgers taking profits, while entries are boosted by favorable regulations after the SEC clarified on May 29 that "pledges do not violate securities laws." As of now, the number of active validators on Ethereum has exceeded 1.09 million, an increase of more than 54,000 since the end of May.

Andy Cronk, co-founder of Figment, said that institutional pledge entrustment volume increased by more than 100%, and the queue time of validators increased by more than 360%, which is consistent with the rise in ETH prices.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Jasper

Jasper