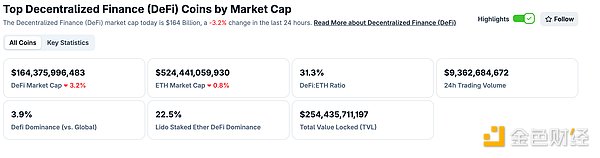

DeFi data

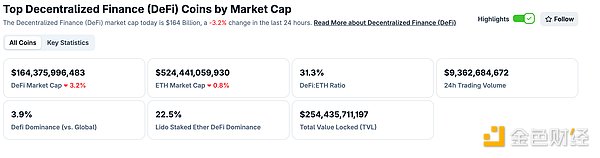

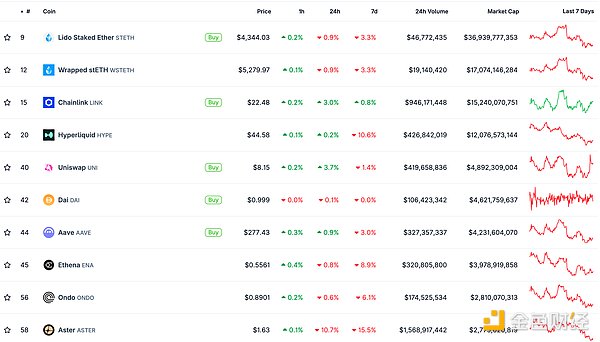

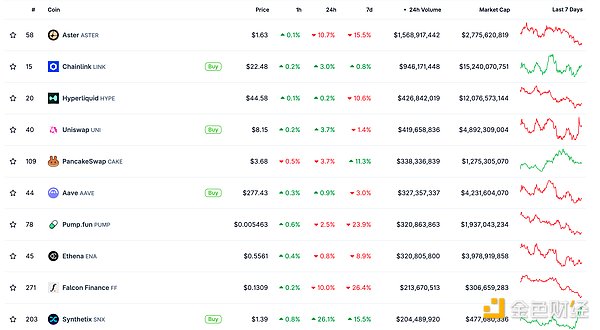

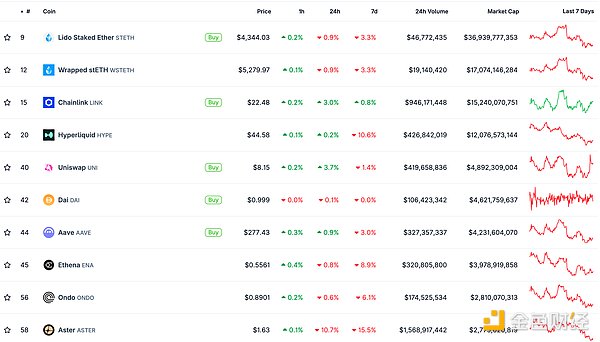

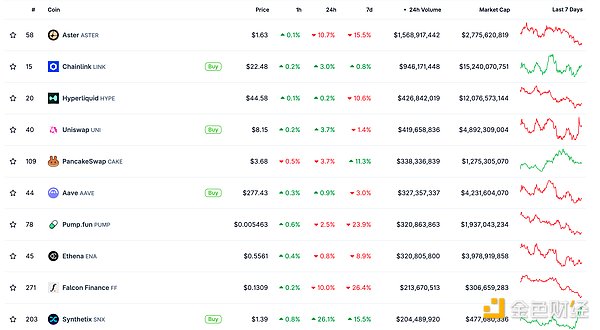

1. Total market value of DeFi tokens: 164.375 billion US dollars

2. The trading volume of decentralized exchanges in the past 24 hours is US$93.62

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

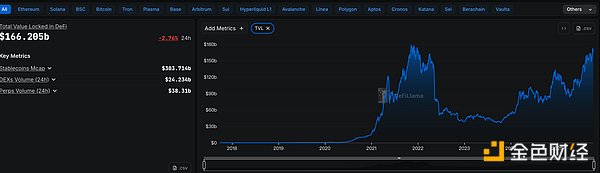

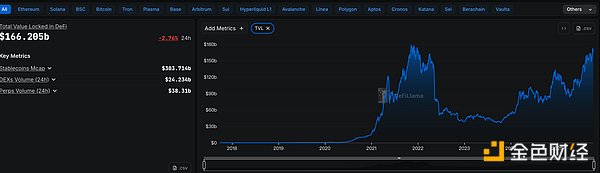

3. Assets locked in DeFi: 166.205 billion US dollars

img src="https://img.jinse.cn/7405072_watermarknone.png" title="7405072" alt="5WUFKZQvJ96AHohTP90EfV2rRmRlAfWDsUf6cJUE.png">

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

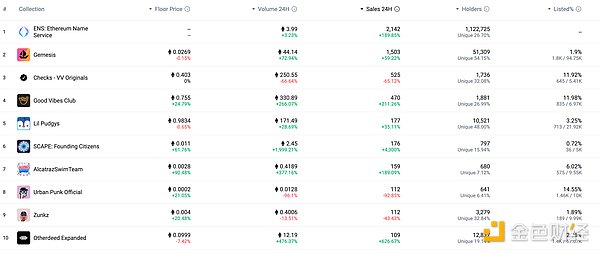

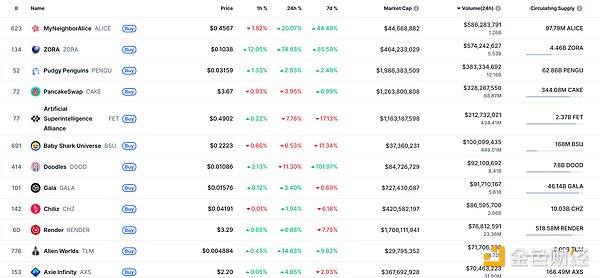

NFT Data

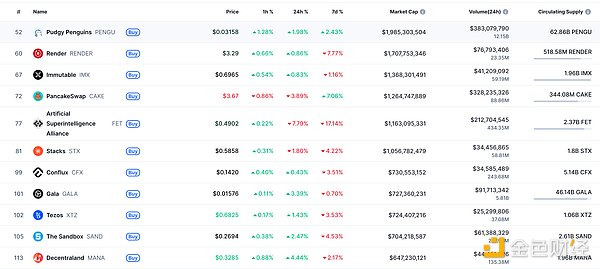

1. Total NFT Market Value: US$21.621 Billion

NFT total market value, top ten projects by market value Data source: Coinmarketcap

2. 24-hour NFT trading volume: 3.846 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

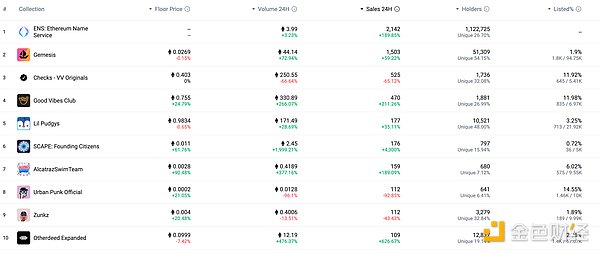

3. Top NFTs in 24 hours

Top ten NFTs with the highest sales volume in 24 hours Data source: NFTGO

Headlines

HashKey seeks IPO in Hong Kong

Market news: Virtual asset exchange HashKey seeks IPO in Hong Kong, raising no more than US$500 million.

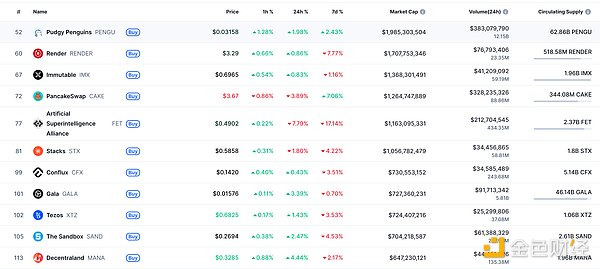

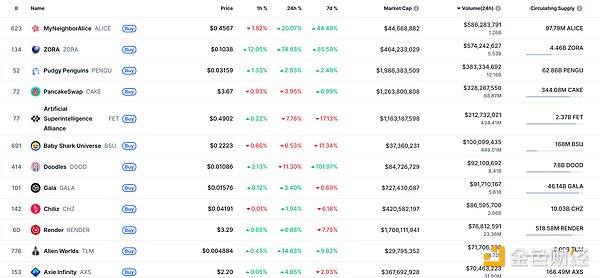

MEME Hotspots

1.Four.meme: The platform has returned to normal, and the problems that previously caused the downtime have been fully resolved

Golden Finance reported that Four.meme officials stated that the platform has returned to normal online, and all data access issues caused by the earlier traffic surge have been fully resolved. The team has completed emergency repairs and optimizations to ensure smoother performance in the future. 2. A Certain Address Traded Six BSC Meme Coins in 24 Hours, Losing $255,000. According to Jinse Finance, on-chain analyst Yu Jin monitored a certain address (0x7f8...b3dc) and traded six meme coins over the past 24 hours, resulting in a total loss of $255,000 and a 0% win rate.

The address initially traded tokens such as T4, Binance Pattern, BNBBuilder, BNBHolder, and Meme Rush, resulting in a loss of $97,000. Subsequently, the address spent $472,000 to purchase 18.5 million Xiuxian coins, becoming the largest holder of the coin. The address subsequently sold most of the Xiuxian coins at a loss of $160,000. 3. Vitalik sold multiple Meme coins and transferred the funds through a privacy protocol. According to Golden Finance, on-chain analyst Onchain Lens (@OnchainLens), Vitalik sold 40.25 billion $SPURDO, 10.31 billion $MARVIN, and 6 trillion $DOJO tokens, earning a total of 20.24 ETH (approximately $96,000). He then transferred 70 ETH (approximately $304,000) to a new wallet address associated with @mfoundation and transferred the funds through the privacy protocol @RAILGUN_Project. DeFi Hot Topics 1. Negotiations on US Cryptocurrency Market Legislation Stalled Due to Leaked Democratic DeFi Proposal According to Crypto In America, negotiations between Senate Republicans and Democrats on a legislative bill for the cryptocurrency market structure have reached an impasse after Democrats submitted a new DeFi regulatory proposal to their Republican counterparts, sparking strong opposition from the industry. On Wednesday evening, Democratic staff sent a document titled "Preventing Illegal Financing and Regulatory Arbitrage through Decentralized Financial Platforms" to Republican staff on the Senate Banking Committee, which outlined several suggestions for regulating DeFi. The document was quickly leaked to the industry, and within hours, members of the cryptocurrency community were frantically calling each other and Republican Party offices, asking if what they had read was true.

The document outlined broad rules for regulating DeFi, classifying anyone who designs, deploys, operates, or profits from a front-end interface (website) as an intermediary. The industry called it overly broad, out of sync with the very concept of DeFi, and potentially stifling the decentralized ecosystem in the United States, forcing software developers to move overseas and diverting users to centralized platforms.

Critics, including Jake Chervinsky of Variant Fund, said the proposal gave government regulators unchecked power, raised issues under the First and Fourth Amendments, and could trigger an endless wave of litigation. Furthermore, the proposal stood in stark contrast to the Republican draft released last month, which included provisions protecting self-custody and software developers and won widespread support from the DeFi community.

With both sides blaming each other, it remains unclear who will compromise first: Democrats agreeing to a markdown date or Republicans returning to the negotiating table. The longer the impasse drags on, the more likely it is that the bill will be delayed until 2026, when Congress will inevitably turn its attention to the midterm elections, putting cryptocurrency policy on the back burner. Furthermore, the bill is still halfway through. 2. Hyperliquid Launches "Based Streams" According to Golden Finance, Hyperliquid has launched "Based Streams," a live streaming platform powered by a decentralized exchange (DEX). Using the Hypercore protocol, Based Streams allows creators to livestream videos, interact with viewers, and showcase on-chain transaction activity. Viewers can also donate tokens to streamers and earn "Based Gold" by watching live streams.

3. Coinbase CEO announced that the new self-custodial wallet Base App will be launched later this year

Golden Finance reported that according to Coinbase CEO Brian Armstrong, Coinbase plans to launch a new self-custodial wallet Base App later this year, which will be open to all users. He also announced that users can join the waiting list and said that relevant links will be provided in subsequent posts.

4. The "Institutional Privacy Working Group" under the Ethereum Foundation released initial public reference materials

Golden Finance reported that the Ethereum Foundation recently announced the establishment of a new privacy cluster, of which the wallet privacy stack Kohaku and the Institutional Privacy Task Force (IPTF) are one of the important initiatives of the privacy cluster. On October 9th, the Ethereum Foundation officially released Kohaku. Today, Oskar, head of the Institutional Privacy Working Group, open-sourced the Institutional Privacy Working Group's public reference materials. These materials include (validated) use cases from institutions, specific patterns/specifications, and vendor approaches, as well as detailed information on business sectors and jurisdictions. The Ethereum Foundation's Institutional Privacy Working Group aims to help institutions and businesses onboard Ethereum, focusing on ensuring their privacy needs are met in an efficient, secure, usable, and accessible manner. [Unrelated text follows:] Crypto Fund C1 Fund Announces Purchase of Ripple Stake Golden Finance reports that crypto fund C1 Fund has acquired a stake in Ripple, a provider of enterprise blockchain solutions. The specific purchase amount and equity percentage have not yet been disclosed. C1 Fund reportedly previously announced a $60 million IPO, intending to increase its investment in digital asset technology.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and is not intended as actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

Weatherly

Weatherly