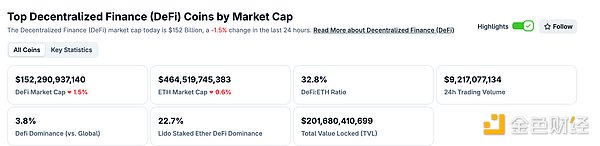

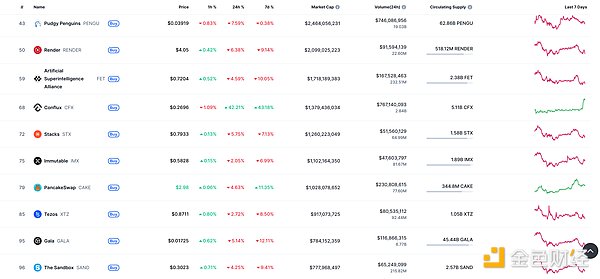

DeFi data

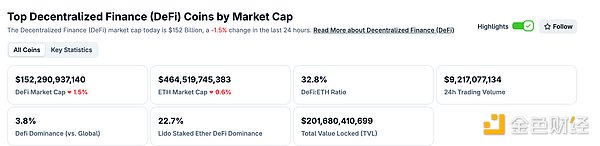

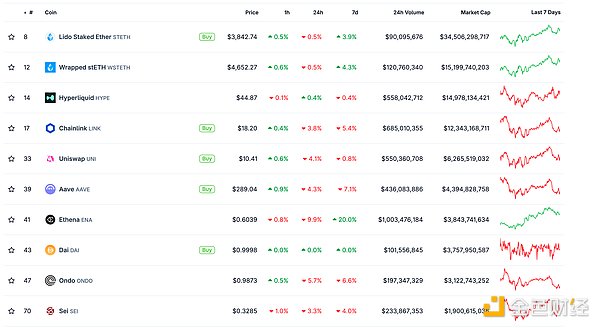

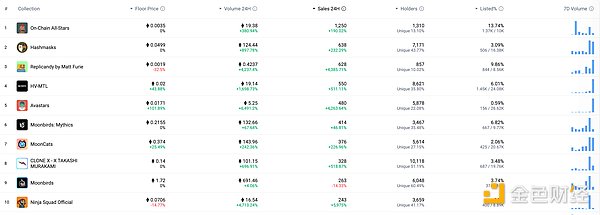

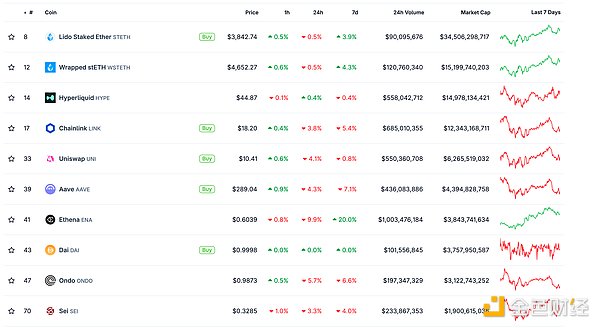

1. Total market value of DeFi tokens: $152.29 billion

DeFi total market value data source: coingecko

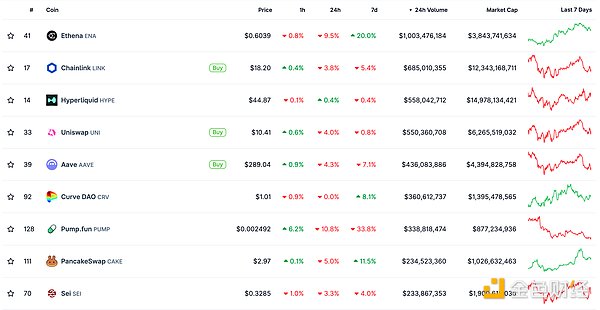

2. The trading volume of decentralized exchanges in the past 24 hours was US$9.217 billion

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

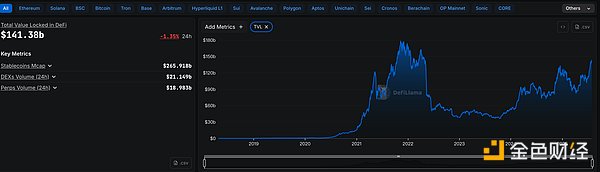

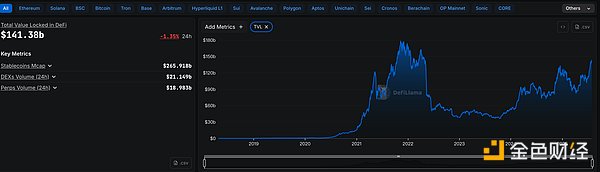

3. Assets locked in DeFi: US$141.38 billion

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

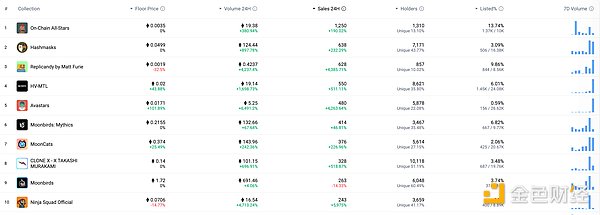

NFT data

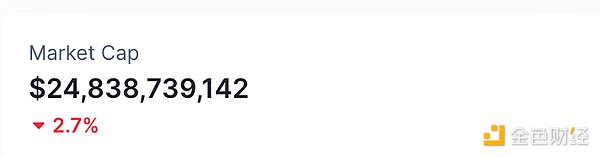

1. Total NFT market value: US$24.838 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

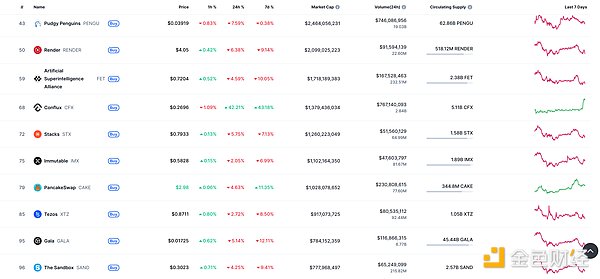

2.24 hour NFT transaction volume: 4.829 billionUSD

3. Top NFTs in 24 hours

Top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

Bloomberg: Bitmain plans to establish its first factory in the United States

NFT hot spots

1. CryptoPunks NFT transaction volume hits a new high since March 2024

Golden Finance reported that according to The Block, NFT market monitoring data showed that the CryptoPunks series exceeded US$24.6 million in trading volume last week, setting a single-week record since March 2024, a surge of 416% from the previous week. Increased market activity was accompanied by a comprehensive increase in price indicators: the base price climbed from 40 ETH to 47.5 ETH, and the average selling price rose from $140,000 to $182,000.

This market recovery is directly linked to the milestone acquisition of Nasdaq-listed GameSquare. The parent company of FaZe Clan recently issued $5.15 million worth of preferred stock, acquiring the rare "Ape Punk" piece #5577 at a valuation three times the market base price. DeFi Hot Topics 1. Degen Protocol Considers Token Burning Plan Golden Finance reports that the Degen Protocol is discussing a token burn proposal. The foundation currently holds 32.5% of the total supply and is considering reducing the token supply through a gradual monthly burn. The proposal aims to optimize the token economics while retaining a necessary portion for continued development. The foundation stated that this move will reduce the possibility of large-scale airdrops in the future and reduce inflation expectations. Community members generally support the proposal. The specific destruction schedule and quantity are yet to be determined.

2. Linea announced a protocol upgrade plan: the Ethereum burning mechanism will be implemented

Golden Finance reported that Linea announced that it will become the first second-layer network to implement the Ethereum burning mechanism at the protocol level. According to the latest plan, the platform will burn 20% of the net transaction fees, which will be collected in the form of Ethereum. At the same time, Linea released a token distribution plan, allocating 85% of the tokens for ecological construction, including 75% for development funds and 10% for early user incentives.

3. Linea posts hint at upcoming TGE

Golden Finance reports that Linea posted an image on X today with the caption "SOMETHING BIG IS COMING," possibly hinting at an upcoming TGE.

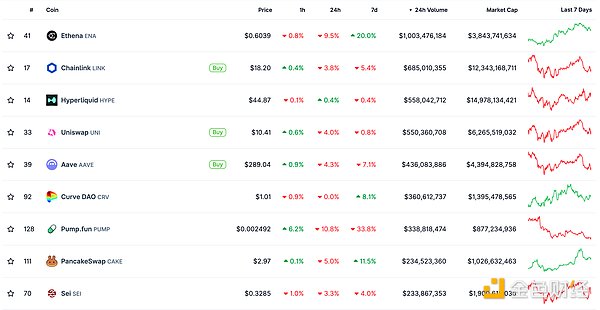

4. ENA will unlock tokens worth approximately $127 million in a week

Golden Finance reports that data shows that Ethena (ENA) will unlock approximately 212.89 million tokens, worth approximately $127 million, at 7:00 am Beijing time on August 5th. 5. Cboe Submits Applications for Canary's Collateralized INJ Fund and Invesco's Spot Solana ETF. Golden Finance reports that Cboe BZX Exchange submitted two crypto ETF applications to the SEC on Monday: a collateralized INJ fund initiated by Canary and a spot Solana ETF jointly developed by Invesco and Galaxy. Both applications are the first step in the SEC's approval process.

The Canary Fund tracks Injective's native asset, INJ, and incorporates a staking mechanism. Currently, the SEC, under the Trump administration's leadership, has relaxed its review process and is simultaneously evaluating multiple fund proposals, including DOGE, SOL, and XRP. Previously, the SEC's Division of Corporate Finance suggested that some staking activities do not constitute securities issuance, sending a positive signal for collateralized ETFs.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

YouQuan

YouQuan