DeFi data

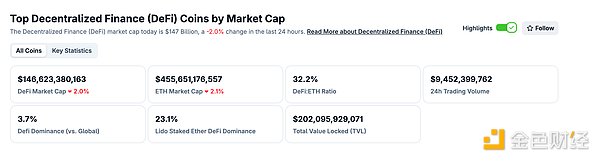

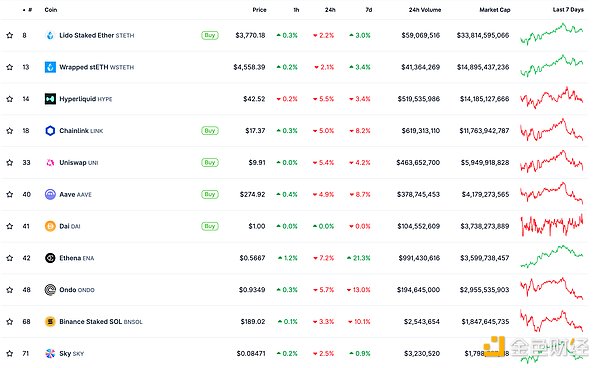

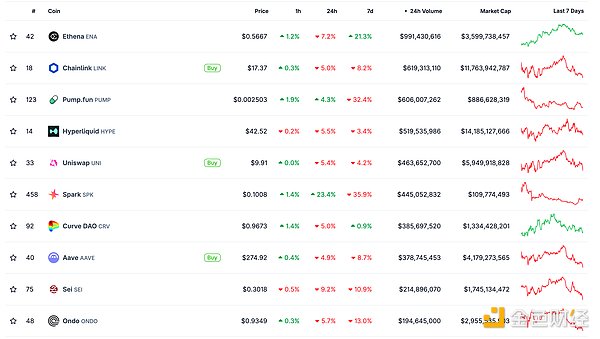

1. Total market value of DeFi tokens: US$146.623 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$9.452 billion

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

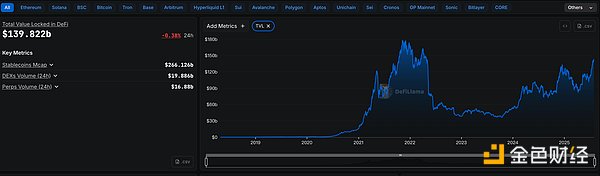

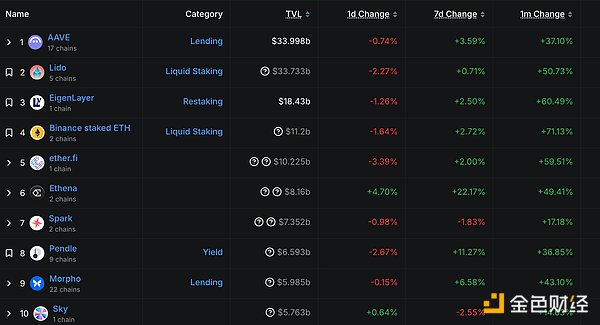

3. Assets locked in DeFi: US$139.822 billion

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

NFT data

1. Total NFT market value: US$23.163 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2.24 hour NFT transaction volume: 3.877 billionUSD

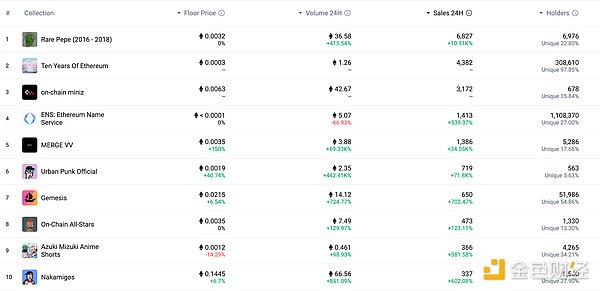

3. Top NFTs in 24 hours

Top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

Telegram founder is again under French judicial investigation, the platform is accused of having illegal content

NFT Hotspots

1. Data: Overall NFT transaction volume fell 35.7% in the past 24 hours to US$16.03 million

Golden Finance reported that according to CoinGecko data, the overall transaction volume of the NFT market fell 35.7% in the past 24 hours to US$16.03 million. The top three NFTs in terms of transaction volume are all Ethereum ecosystem projects, namely CryptoPunks, Fat Penguin and Moonbirds.

2. OpenSea team member: Airdrop standards will take user portraits into consideration

Golden Finance reported that OpenSea team member Adam Hollander said in Discord in response to questions about token airdrop standards that the team is evaluating historical usage data and transaction volume of users in different years. Although it is currently unable to promise or disclose specific details, user portraits will be considered, for example: users who appeared during the bull market and never came back; new users who just came for mining; early users (OGs) who have been here since the earliest days and have never left, and who have survived the bear market and are still here today. DeFi Hot Topics 1. Falcon Finance Receives $10 Million Strategic Investment from WLFI Golden Finance reports that stablecoin protocol Falcon Finance has received $10 million in strategic investment from WLFI. USD1 is now one of the collateral types supported by the Falcon platform, and the two parties will collaborate on the development of an on-chain USD standard. 2. TON Ecosystem DEX Project STON.fi Completes $9.5 Million Series A Funding Golden Finance reports that, according to Decrypt, the development team of the TON Ecosystem DEX project STON.fi announced the completion of a $9.5 million Series A funding round, led by Ribbit Capital and CoinFund.

3. Base Ecosystem Derivatives Exchange Avantis Establishes Foundation, Suspected of Imminent TGE

According to Golden Finance, Base Ecosystem Derivatives Exchange Avantis reposted a long article from the Avantis Foundation on the X platform, reiterating that the foundation's main tasks are to ensure protocol development and security, community governance and transparency, and ecosystem growth and innovation, and it is suspected that a coin issuance is imminent.

4. Ethereum founder Vitalik will appear tonight on the 10th anniversary live broadcast to review the history of Ethereum

Golden Finance reported that the Ethereum Foundation announced that in the 10th anniversary live broadcast to be held at 22:30 Beijing time tonight, Ethereum founder Vitalik Buterin and Consen Sys founder Joseph Lubin will lead the audience to review the history of Ethereum, and the foundation's co-executive directors Hsiao-Wei Wang and Tomasz Stańczak will express their outlook for the next ten years. 5. Linea Announces Token Economics: Total Supply Approximately 72 Billion, 9% Airdropped for Early Users On July 30th, Linea officially announced the LINEA token economics: the total supply is 72,009,990,000 (approximately 72 billion) tokens, equivalent to 1,000 times the initial circulating supply of ETH. The distribution method echoes Ethereum's genesis distribution: 85% of the supply is dedicated to the ecosystem, and the remaining 15% is allocated to the Consensys Treasury. Early users will receive tokens from an allocation equivalent to 9% of the token supply, which will be airdropped and fully unlocked during the Time General Evolution (TGE). Airdrop eligibility will be evaluated based on a series of metrics, including LXP and on-chain indicators. Full details and individual eligibility information will be announced prior to the TGE via the official eligibility checker. In addition to the user airdrop, 1% of the LINEA token supply will be reserved for strategic builders within the Linea ecosystem and fully unlocked at the TGE, including the core application and community. 75% of the LINEA token supply will be allocated to an ecosystem fund, managed by the Linea Alliance, whose members include ENS Labs, Eigen Labs, SharpLink, Status, and Consensys. Approximately 25% of the fund will be allocated to support ecosystem launch over the first 12-18 months, with the remaining 50% to be gradually released over 10 years. This fund will fund protocol R&D, shared infrastructure, open-source tooling, and strategic partnerships with aligned developers. 15% of the total token supply will be allocated to the Consensys Treasury. These tokens will be locked for five years and will not be transferable until the full vesting period expires. ETH is used as the network's gas token. After deducting L1 costs, 20% of the gas fees will be destroyed, thereby reducing ETH's supply and increasing its monetary premium. The remaining 80% of the gas fees are used to destroy LINEA. Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. We encourage everyone to establish correct investment concepts and be aware of risks.

Alex

Alex

Alex

Alex Kikyo

Kikyo Weatherly

Weatherly Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Catherine

Catherine Anais

Anais Alex

Alex