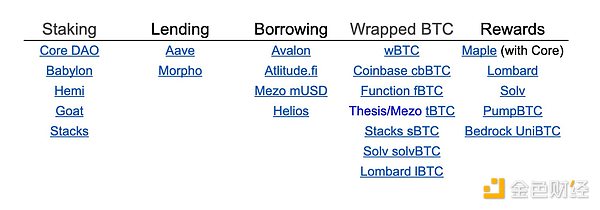

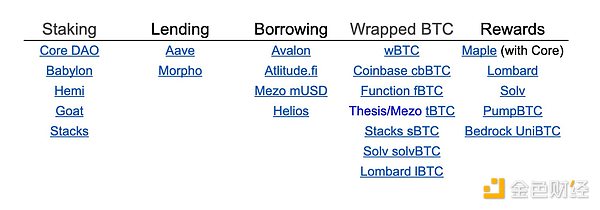

By Lou Kerner and Andy Singleton, Source: Quantum Economics, Translated by Shaw Jinse Finance. In April 2020, the total value locked (TVL) on Ethereum was approximately $750 million. In May 2020, the launch of Compound's governance token, COMP, kicked off what became known as the "Summer of DeFi." By the end of 2020, Ethereum's TVL was approximately $15 billion. Today, Ethereum's TVL is approximately $96 billion. By comparison, Bitcoin's gains appear to be just getting started. We know there is latent demand for decentralized finance (DeFi) on Bitcoin to earn yield and use as collateral to borrow USD, as there is over $35 billion of wrapped Bitcoin in use in DeFi on various blockchains other than Bitcoin: We believe that BTCfi will eventually scale due to a variety of factors, including improving infrastructure (such as Taproot, BitVM, and BRC-20), a more favorable US regulatory environment, and greater (institutional-driven) liquidity. Sources of Bitcoin Yields Based on the chart below, we have identified four sources of Bitcoin yields and provide more context for each below the chart: Staking Staking provides Bitcoin-denominated returns that are earned on blockchains and staking networks that use Bitcoin as collateral for validation. Staked Bitcoin is often advertised as having high security and can be locked directly on the Bitcoin chain. This is a new idea, but it's not very appealing, in part because the current yield is only around 1%. However, if combined with token rewards for long-term holding or holding non-Bitcoin protocol tokens, the yield could be much higher. There's a thriving market for "liquidity re-collateralization tokens," which wrap Bitcoin or other liquidity staking tokens in the previous category and add a yield, with the rewards (theoretically) being used for other purposes. Some of these tokens may not be backed by collateral, so users of these tokens should verify that they can actually be redeemed for the underlying asset. These tokens could ultimately be used in DeFi lending and trading strategies, potentially adding additional yield. The core yield on USD is provided by borrowers who need USD. BTCfi has a market for lending Bitcoin in the same way. However, unlike USD, the price of Bitcoin can surge, making it prohibitively expensive to repay the loan. As a result, despite the abundance of Bitcoin available in lending pools, demand for lending is low. This is why the native lending rate is typically no more than 1%. There is demand for borrowing Bitcoin for short selling or market making (essentially shorting short positions). There is also demand for arbitrage between different types of wrapped Bitcoin and the liquidity supply token (LST) known as BTC. Furthermore, some pools offer yields that are boosted by protocol rewards, up to 8%. Trading Bitcoin is one of the most active and liquid markets in the world. Participants in these markets can earn liquidity (LP) and arbitrage fees by trading Bitcoin. They can provide LP positions in pools that trade different types of Bitcoin, hedge in pools that trade Bitcoin against other assets, or engage in cross-chain market making. They can use Bitcoin as margin for perpetual swaps and options trading strategies. Yield-focused derivatives strategies often sell options to meet leverage requirements. A proven Bitcoin trading strategy involves short-term arbitrage between centralized exchanges (CEXs) offering Bitcoin. Some DeFi vaults offer tokenized positions to hedge funds, which also employ this strategy. As more trading volume enters the DeFi space and DeFi becomes more efficient, the trading category for BTCfi is growing. US Dollar Strategies: Bitcoin can be used as collateral to borrow US dollars at a low-risk rate. These dollars can then be invested in higher-yielding US dollar strategies. Borrowers can typically borrow up to 60% of the locked Bitcoin value. Therefore, if a borrower pays 5% interest and earns a 10% return, they earn a 5% interest spread on 60% of the Bitcoin value, resulting in a total return of 3% on the locked Bitcoin. USD borrowing terms are a crucial variable in any USD strategy. The BTCfi market offers variable rates, fixed rates, or CDP rates (which remain constant until liquidation) based on usage. Borrowers seek out markets that are competitive in terms of cost and scale, then optimize for loan-to-value (LTV) and interest rate stability. Two of the most popular investment strategies today are DeFi high-yield and basis spread strategies. DeFi high-yield strategies work well with smaller investment amounts. This applies to providers like Pendle and Morpho, as well as reward boosting strategies on various lending platforms. Yields can reach over 15%, equivalent to Bitcoin yields of over 6% (with a 60% loan-to-value ratio and a 5% borrowing cost). Basis spread strategies involve establishing delta-neutral positions on perpetual swap exchanges, namely going long on cryptocurrencies and shorting perpetual swaps. This earns "funding rates," providing leverage to long perpetual swap buyers. This strategy is scalable and profits from perpetual swap traders who want to go long on cryptocurrencies and are willing to pay a positive funding rate. Funding rates fluctuate significantly, but have recently averaged above 11%. You can engage in basis trading by purchasing staked Ethena and receive a share of the basis proceeds. Alternatively, you can choose to trade basis through a professional provider like Hermetica or establish your own position through an exchange or Hyperliquid.

Identifying BTCfi’s Key Participants

The following list is our initial overview of the different participants in BTCfi:

We look forward to including other relevant parties as they emerge or we learn about them.

What’s Next

As BTCfi matures, it will increasingly resemble the fixed income market, providing market-neutral and scalable solutions. BTCfi will become more structured, risk-managed, institutionalized, and more like CeFi.

The winners will be those who can provide fair and transparent Bitcoin-denominated returns, have real infrastructure, and stable returns, and this is just the beginning.

Catherine

Catherine