Deng Tong, Golden Finance

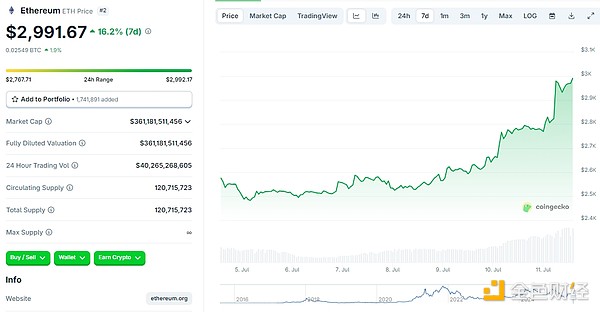

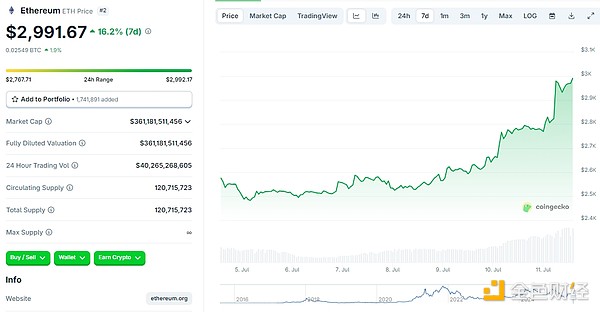

This morning, ETH briefly reached the $3,000 mark, the first time since early February this year. In recent days, ETH has reversed its previous decline, rising from around $2,500 to $3,000. As of press time, the seven-day increase is 16.2%.

According to 8marketcap data, Ethereum's market value has risen to $361.68 billion, surpassing SAP and ranking 35th in the global asset market value. Although ETH's rise has a linkage effect with BTC, what other factors are affecting ETH's market? What do industry insiders say? Is Ethereum leading the altcoin season?

1. What factors are driving the rise of ETH?

1. More and more companies use Ethereum as a treasury asset. This will undoubtedly strengthen Ethereum's position as "digital gold" in asset allocation. It also proves that companies are optimistic about the development prospects and future market trends of Ethereum. On June 26, Bit Digital, a US-listed company, announced a strategic transformation, planning to gradually stop its Bitcoin mining business and gradually convert its BTC holdings into ETH, focusing on Ethereum staking and asset allocation, and becoming a "pure Ethereum staking and treasury company".

From June 28 to July 4, SharpLink Gaming spent approximately US$19.2 million to increase its holdings by 7,689 ETH. On July 10, Sharplink Gaming increased its holdings by 5,072 Ethereum (ETH), worth approximately $13.51 million. On July 11, Sharplink Gaming increased its holdings by another 12,648 ETH, worth $35.31 million. The company currently holds more than 222,000 ETH, with an average purchase price of $2,617.

On June 30, BitMine announced the pricing and signing of a private placement agreement to purchase and sell 55,555,556 common shares (or common stock equivalents in lieu thereof) at a price of $4.50 per share, with an estimated total proceeds of approximately $250 million, after deducting placement agent fees and other issuance expenses (funded with a combination of cash and cryptocurrency), to implement the Ethereum financial strategy.

On July 8, GameSquare Holdings, Inc. announced that its board of directors had approved the establishment of an Ethereum treasury in phases, with a total amount of up to $100 million. It will sell 8,421,054 common shares (or common stock equivalents) at $0.95 per share, and the total proceeds before deducting underwriting discounts and commissions and issuance expenses are expected to be approximately $8 million, as the first batch of Ethereum treasury establishment expenses. On July 10, GameSquare took another action: announcing that it had spent $5 million to buy 1,818.84 ETH to support its Ethereum treasury.

On July 8, Blockchain technology company BTCS Inc. plans to raise $100 million to acquire Ethereum in 2025. The move is part of the company's long-term vision to build a leading public company focused on Ethereum infrastructure while continuing to be one of the largest ETH holders among public companies. Depending on market conditions, the company plans to raise funds to acquire Ethereum in a rolling manner and is committed to maximizing capital efficiency. BTCS CEO Charles Allen said: "We believe that Ethereum has huge growth potential and is at the core of the future digital financial infrastructure. Now that Ethereum's price is at the level of 2021, it is a good time for us to deepen our investment. ”

On July 10, Thumzup Media Corporation has expanded its crypto funding strategy beyond Bitcoin to cover several major digital assets, including ETH), SOL, etc.

Anthony Sassano, founder of The Daily Gwei, pointed out that the number of ETH purchased by companies holding Ethereum as their treasury assets has exceeded the number of newly issued ETH. In the past 30 days, about 77,000 new ETH have been issued (net issuance after deducting destruction is about 57,000). In the same period of time, Ethereum treasury companies purchased more than 200,000 ETH.

2. Giant whales buy

On July 5, a giant whale purchased 1,616.53 ETH when the market fell rapidly, with a total value of about US$4.038 million and an average purchase price of US$2,492.04.

On July 9, according to OnchainLens monitoring, a whale address sold 69.07 WBTC (about 7.49 million US dollars) to buy 2,881 ETH, with an average purchase price of 2,600 US dollars.

On July 10, according to the chain analysis platform Lookonchain monitoring, within one day, 7 institutions or whale accounts purchased a total of 127,971 ETH, worth about 358 million US dollars.

On July 10, according to @ai_9684xtpa monitoring, two addresses increased their holdings by more than 12,000 ETH, with a total value of about 33 million US dollars. Among them: The address starting with 0x8C0 spent $25 million to buy 9187.52 ETH in the past 7 hours, with an average price of $2721; pfm.eth built a position in ETH again after two months, buying 2900.5 ETH at an average price of $2766, worth about $8.02 million.

The actions of whales can be used as a reference for market confidence. The frequent and large purchases by whales indicate that the market's confidence in the price trend of ETH is recovering, which will be beneficial to the market outlook.

3. Ethereum official strategy

On July 10, the Ethereum Foundation announced the reorganization of its Ecosystem Development (EcoDev) strategy, focusing on four key areas. The plan includes the establishment of four new teams to focus on ecosystem acceleration, covering corporate relations, developer growth, application research and founder support. The Foundation will also strengthen its ecosystem expansion efforts, continue to provide funding support, and work to address global adoption barriers. The adjustment aims to achieve two major goals: expand the Ethereum user base and enhance the resilience of its technical and social infrastructure. The foundation emphasized that it will work with a wide range of partners in the ecosystem to promote the growth and development of Ethereum.

As early as July 4, the Ethereum Community Foundation posted on the X platform that it would release full funding details, the first batch of work initiatives, core team and contribution value information in the coming weeks, and disclose how to apply or make contributions. The Ethereum Community Foundation stated that the organization is not a think tank, but a "battle fund" to push ETH to $10,000. ETH is an on-chain infrastructure, a public product, and is not subject to censorship.

Ethereum co-founder Vitalik Buterin and Ethereum researcher Toni Wahrstätter also co-authored the proposal EIP-7983, which proposes to set the gas limit for a single Ethereum transaction to 16.77 million.

The proposal aims to reduce the risk of denial of service (DoS) attacks, optimize the performance of the zero-knowledge virtual machine (zkVM), and balance the overall gas usage efficiency.

4. US crypto policy shift

On July 5, Grayscale posted on the X platform: "We believe Ethereum may benefit from the US policy shift towards cryptocurrency-friendly. New legislation like the Genius Act may clarify stablecoin rules, promote investment, and accelerate the popularity of smart contracts. With strong development activities and expansion plans, Ethereum is ready to benefit from it."

Recently, the US "GENIUS Act" and "CLARITY Act" have attracted attention one after another. The US crypto policy shift has provided a more favorable development environment for various projects in the Ethereum ecosystem, which will attract more developers to participate in the construction of the Ethereum ecosystem, promote the innovation and development of applications such as DeFi and NFT, and further consolidate Ethereum's position in the blockchain field. In addition, as a demonstration area for crypto regulation, the US policy orientation will also affect the global cryptocurrency regulatory landscape. If the US regulatory policy is favorable to the ETH price, the clarity of global regulatory policies in the future will further promote the rise of ETH prices. US regulatory policies are bringing medium- and long-term policy benefits to Ethereum in terms of compliance paths and institutional participation.

5. Ethereum ETF continues to see net inflows

Recently, Ethereum ETF has been in a state of net inflows, especially in the last two days: On July 10, the US spot Ethereum ETF had a net inflow of $383.1 million, which was the second highest net inflow in the fund's history; on July 9, it had a net inflow of $211.3 million; on July 8, it had a net inflow of $29.5 million; on July 7, it had a net inflow of $62.1 million...

Bitwise Chief Investment Officer Matt Hougan believes that the inflow of funds into Ethereum exchange-traded funds will accelerate significantly in the second half of the year, as more and more stablecoins and stocks will begin to be traded on the Ethereum chain, which is a phenomenon that is easy to understand for traditional investors. In June this year, the inflow of funds into Ethereum ETFs has reached 1.17 billion US dollars. If this trend continues, the inflow of funds into Ethereum ETFs in the second half of the year is expected to reach 10 billion US dollars. The continued net inflow of Ethereum ETFs means that more funds are flowing into the market to buy assets related to ETH, which directly increases the demand for ETH. The supply of Ethereum is relatively stable over a certain period of time. According to the principle of supply and demand, the increase in demand will inevitably drive up the price of ETH.

6. Stablecoin Ecosystem Driven

On the Ethereum network, the issuance of stablecoins has always remained active, and it is the cash engine on the chain, driving the continuous demand for ETH block space and ensuring the liquidity of the Ethereum chain ecosystem.On June 26, the adoption rate of stablecoins based on Ethereum hit a record high, with more than 750,000 independent users per week. USDT and USDC together account for most of the approximately $134 billion stablecoin market on the network.

On March 25, the stablecoin USD1 launched by the Trump family project World Liberty Financial was issued based on Ethereum and Binance Smart Chain.

On June 10, Société Générale-Forge, a crypto subsidiary of Société Générale-Forge, announced the launch of a stablecoin pegged to the US dollar, USDCV, based on the Ethereum and Solana blockchains.

On May 22, Circle issued an additional 100 million USDC on the Ethereum network.

On June 18, Tether minted 1 billion USDT on the Ethereum network.

On July 4, Tether issued an additional 1 billion USDT on the Ethereum network.

In addition, stablecoins play an important role in trading and lending. Not only are they important assets in the DeFi field, they can also drive Ethereum trading volume and asset liquidity. According to Token Terminal data, the active loan amount of lending protocols on Ethereum reached US$22.6 billion, a record high. Among them, important players in this market include: Aave, Spark, Morpho, Maple, Fluid, Compound, Euler, etc.

II. Views of industry institutions and people

10x Research pointed out on July 9: Currently, the price of Ethereum (ETH-USDT) is above the 7-day moving average and the 30-day moving average, which means that the price of ETH is in a bullish trend. In the past week, the price of ETH has risen by about 3.6%. This trend may be driven by the inflow of about US$148.5 million into the Ethereum ETF, especially the BlackRock Ethereum ETF began to increase its holdings of ETH. The current asset size of the ETF has reached about US$4.6 billion. In addition, BitMine raised $250 million to support its ETH asset strategy, and SharpLink Gaming increased its holdings by 9,468 ETH, which strengthened institutional demand.

Matrixport pointed out: Combined with the historical seasonal strength in July, Ethereum's current price structure is not only driven by market inertia, but also reflects the resonance of fundamental support and market expectations. For long positions, $2,500 should still be regarded as a key technical support level.

Bankless co-founder David Hoffman said that Ethereum's continued investment in credible neutrality and minimization of MEV (miner extractable value) may bring additional advantages to its adoption in the traditional financial (TradFi) field. He pointed out that blockchains like Robinhood that use a single sorter do not have the problem of illegal MEV, but Ethereum's investment in fair MEV infrastructure is equivalent to the "compliance" efforts in traditional finance. This investment may become an important driving factor for traditional financial institutions to choose Ethereum instead of other blockchains, further enhancing Ethereum's competitiveness in compliance and technical credibility.

Former Ethereum core developer Eric Conner said that Ethereum has been hovering between $2,400 and $2,600 for several weeks, with reduced trading volume and highs and lows quietly appearing. Long-term consolidation usually leads to violent fluctuations. Therefore, if ETH firmly breaks through $2,600, the trend may be rapid and violent.

Nick Tomaino, founder of 1confirmation, disclosed data that Ethereum has occupied more than 80% of the real world asset (RWA) market share and 50% of the stablecoin market share. Trusting RWA and trusting stablecoins is equivalent to trusting ETH.

3. Is Ethereum going to lead the altcoin season?

The data analysis platform Swissblock pointed out that the current trend of Ethereum against Bitcoin is much more bullish than in the second quarter, which may herald the beginning of the altcoin season. Analysis points out that Ethereum's inflow momentum is increasing, and its ecosystem narrative is also strengthening, which is in stark contrast to Bitcoin's weakening momentum and consolidation. If ETH remains strong, it may mark the true beginning of the altcoin season. This shift coincides with the decline in BTC's dominance, which is a historical marker for altcoin surges.

Ethereum's gains have been further fueled by the apparent demand from institutional investors for Ethereum's recent strength. Chicago Mercantile Exchange (CME) Ethereum futures open interest has climbed to $3.27 billion, the highest level since February 2. The surge indicates an increase in institutional investors' positions, reflecting the growing interest of professional investors in ETH as price momentum strengthens.

Fourth, Summary

ETH’s rise above the $3,000 mark today was influenced by multiple factors, including an increase in Ethereum treasury companies, whale purchases, official strategic shifts, a shift in US encryption policies, net inflows from Ethereum ETFs, and the drive of the stablecoin ecosystem. Industry insiders are generally optimistic about the prospects of ETH, and some data analysis platforms believe that altcoins are about to take off.

In the short term, the push from the capital side is directly beneficial to the price trend of ETH, but in the long run, technology development, ecological construction, and the favor of traditional finance are the magic weapons that make ETH more valuable for long-term investment.

Brian

Brian