Introduction

For a long time, Vietnam's legal characterization of cryptocurrencies has been unclear, and tax policies have also fallen into a "gray area", and market participants have always been shrouded in uncertainty. However, this situation ushered in a major change on June 14, 2025, when the Vietnamese National Assembly passed the "Digital Technology Industry Law", which for the first time included crypto assets into the national legal framework and implemented clear classification supervision, officially granting them legal status, and becoming a milestone in the country's crypto asset supervision process.

The new law divides digital assets into two categories: "virtual assets" and "crypto assets", excluding financial instruments such as securities and digital legal currencies, and gives the government the authority to formulate implementation rules, while focusing on strengthening cybersecurity, anti-money laundering and anti-terrorist financing requirements. The law is scheduled to take effect on January 1, 2026. The core goal is to improve the relevant legal system, connect with international regulatory standards, and help Vietnam get out of the FATF gray list as soon as possible.

This article will try to analyze the role of this legislative breakthrough in reconstructing Vietnam's digital economy and analyze the latest developments and future trends of its tax system. By combing the policy evolution of the Vietnamese government from cautious observation to active construction of a regulatory framework in the past few years, and combining the practices of other representative countries in Southeast Asia and the world in the field of cryptocurrency taxation and regulation, this article will conduct a comparative analysis. In addition, it will also look forward to Vietnam's strategy in balancing risk prevention and innovative development, predict specific policies that may be introduced in the next few years, and the potential impact of these policies on Vietnam as an emerging digital economy.

1 Vietnam clarifies the legal status of crypto assets

Before the promulgation of the Digital Technology Industry Law, Vietnam's legal characterization of cryptocurrencies has been in a vague and evolving state. In the early days, the Vietnamese government's attitude towards cryptocurrencies was mainly reflected in its strict restrictions on its use as a means of payment and risk warnings. For example, the State Bank of Vietnam (SBV) issued a Notice No. 5747/NHNN-PC in July 2017, which clearly stated that cryptocurrencies such as Bitcoin and Litecoin are not recognized as legal tender or means of payment in Vietnam, and explicitly prohibited their issuance, supply and use, and violators may face administrative or criminal sanctions. Subsequently, in April 2018, the Prime Minister issued Directive No. 10/CT-TTg, requiring relevant departments such as the National Bureau of Statistics, the Ministry of Finance and the Ministry of Public Security to strengthen the management of cryptocurrency-related activities to strengthen the control of related transactions and prevent potential damage. Although the Ministry of Finance announced in its Notice No. 4356/BTC-TCT in April 2016 that cryptocurrency transactions were not prohibited and defined them as "property" and liquid "commodities", the lack of clear legislative support has left this directive in an ambiguous position in actual implementation, making compliance and law enforcement related to crypto transactions relatively complicated. Furthermore, according to Article 105.1 of Vietnam’s 2015 Civil Code, assets are defined as various items, currencies, monetary instruments, and property rights, but digital assets such as cryptocurrencies clearly do not fall into any of the above categories, and therefore are not considered physical assets themselves under current Vietnamese law. This lack of classification creates a significant legal gap that directly affects how these assets are handled and regulated within the legal framework. However, this ambiguity took a fundamental turn on June 14, 2025. The Vietnamese National Assembly passed the landmark Law on Digital Technology Industry, which will come into effect on January 1, 2026. This law clearly defines “digital assets” for the first time in the Vietnamese legal system, and further subdivides them into “crypto assets” (secured by encryption and blockchain technology) and “virtual assets” (mainly used for trading and investment, but excluding securities, stablecoins, and central bank digital currencies). This legislative breakthrough ends years of uncertainty in Vietnam over the legal status of crypto assets, formally recognizing crypto assets as legal property under civil law, thus providing a solid legal basis for individuals and organizations to legally establish and exercise property rights.

This strategic shift from "non-recognition" to "legalization" is not accidental, as the Vietnamese government has recognized the huge potential of the crypto economy. Despite regulatory obstacles, Vietnam has one of the highest cryptocurrency holding rates in the world, ranking fifth in the world, with about 20.95% of the population holding crypto assets and annual inflows exceeding US$100 billion. At the same time, Vietnam is also facing the need to cope with international anti-money laundering (AML) and counter-terrorist financing (CTF) pressures, and has been included in the gray list of the Financial Action Task Force (FATF), requiring it to strengthen virtual asset management. Therefore, legalization is a necessary prerequisite for attracting investment, promoting the development of the digital economy, and effectively regulating this emerging industry. This shows that the Vietnamese government has shifted from pure risk prevention to actively embracing the opportunities brought by the digital economy, and is trying to guide and regulate this emerging industry by establishing a sound legal framework, rather than simply suppressing it.

2 The shift in Vietnam's cryptocurrency regulatory system

The change in the Vietnamese government's attitude towards cryptocurrency reflects that its regulatory system has undergone significant changes. In the past, Vietnam's cryptocurrency regulatory system was imperfect and passive, and it mostly adopted a one-size-fits-all regulatory approach; with the rise of the global cryptocurrency wave and changes in Vietnam's top leadership, its current cryptocurrency regulatory system is rapidly improving. It has not only formed a preliminary division of labor regulatory framework, but is also vigorously promoting the discussion and implementation of a number of regulatory pilot projects, striving to effectively respond to challenges such as anti-money laundering (AML) and counter-terrorism financing (CFT) while embracing new technologies.

2.1 Evolution of the regulatory system framework

Vietnam's crypto regulatory system framework has undergone a significant evolution from nothing to something, from passive response to active guidance.

From 2016 to 2022, Vietnam's crypto regulatory system has gone through a phase of development from scratch, from one-size-fits-all to exploratory research.

In April 2016, the Ministry of Finance announced in a public letter that cryptocurrency trading would not be banned, but its characterization was vague. Then in July 2017, the State Bank of Vietnam (SBV) explicitly banned cryptocurrencies such as Bitcoin as a means of payment and emphasized their illegality. In April 2018, the Prime Minister issued a directive to strengthen the management of cryptocurrency-related activities, and the SBV also instructed financial institutions to strengthen measures related to crypto transactions, which reflected the government's early cautious and risk prevention stance.

In May 2020, the Prime Minister instructed the SBV to launch a pilot project to explore the use of blockchain in cryptocurrency and asked it to study and evaluate the pros and cons of cryptocurrency. In March 2022, the Vietnam Blockchain Association (VBA) was established as Vietnam's first crypto-asset-focused legal entity, with the mission of creating and nurturing a framework for the development of cryptocurrencies. In the same year, Vietnam passed anti-money laundering (AML) legislation, which came into effect in 2023, requiring institutions providing payment services to implement know-your-customer (KYC) measures, an important step in its international compliance. In October 2022, the Prime Minister once again called for the regulation of cryptocurrencies, demonstrating the government's urgent need to standardize the field.

After 2023, especially after the high-level changes in Vietnam in 2024, Vietnam's regulatory attitude towards cryptocurrencies gradually softened.

In February 2024, the Prime Minister, through Decision No. 194/QD-TTg, instructed the Ministry of Finance to draft a legal framework for virtual assets, clarifying the government's determination at the legislative level. In October of the same year, the Prime Minister signed Decision No. 1236/QD-TTg, promulgating the "National Strategy for the Development and Application of Blockchain Technology in Vietnam in 2025", and looking forward to 2030, aiming to make Vietnam a regional blockchain innovation leader. The strategy clearly identifies blockchain as a core pillar of digital transformation and emphasizes the "Made in Vietnam" blockchain platform, which shows that the government has regarded blockchain and digital assets as important drivers for the development of the country's digital economy. In June 2025, the "Digital Technology Industry Law" was passed, which established a tolerant and prudent regulatory framework from multiple aspects, such as clarifying the classification of digital assets (crypto assets, virtual assets), enforcing anti-money laundering (AML) and counter-terrorist financing (CTF) measures, introducing a licensing system and incentives for emerging technologies such as artificial intelligence, semiconductors and advanced computing, to promote the development of a wider digital economy. The maturity of the regulatory framework from "passive response" to "active guidance" is a key feature of Vietnam's policy evolution in the field of digital assets. In the early days, Vietnam's regulation of cryptocurrencies was mainly "prohibition as a means of payment" and "risk warning", which was a passive and preventive attitude. In the past two years, from the Prime Minister's instructions to study and establish a blockchain association to the promulgation of the "Digital Technology Industry Law" and the National Blockchain Strategy, the focus of supervision has clearly shifted to actively building a framework to incorporate crypto assets into the national digital economy development strategy. This marks that Vietnam has entered a more mature and pragmatic stage in digital asset regulation. Its goal is no longer just to control risks, but to unleash innovation potential, attract domestic and foreign investment, and enhance its position in the global digital economy by establishing a clear and predictable legal environment.

2.2 Overview of Vietnam’s existing regulatory framework and division of labor

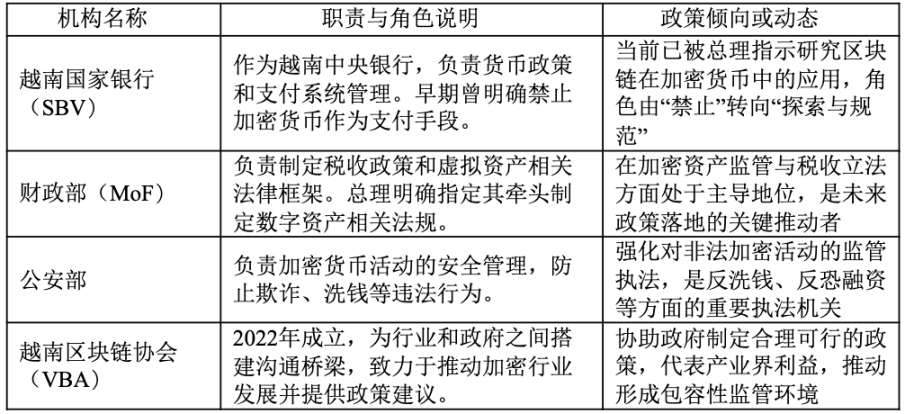

Vietnam’s current crypto regulatory framework is mainly divided among various ministries, forming a “loose regulation” pattern. Several key institutions, including the State Bank of Vietnam (SBV), the Ministry of Finance (MoF), the Ministry of Public Security and the Vietnam Blockchain Association (VBA), work together to build and improve the regulatory framework. The specific division of labor is shown in the table below.

2.3 Regulatory Sandbox Pilot and Risk Compliance Construction under the New Normal

In order to explore the innovative application of digital assets under the premise of controllable risks, the Vietnamese government has actively introduced regulatory sandbox mechanisms and pilot projects.

The Vietnamese government is discussing the establishment of regional and international financial centers, and one of the key aspects is the introduction of a controlled testing policy (sandbox) for financial technology (Fintech), especially for business models involving crypto assets and cryptocurrencies. This sandbox mechanism allows new financial technologies and business models to be tested on a small scale in a controlled environment, thereby evaluating their potential risks and benefits before full promotion. For example, Da Nang has been approved to try out special mechanisms, including a pilot project using stablecoins (USDT) for international tourist payments, which is seen as an important attempt to explore the application of digital payments in the tourism industry. These pilot projects are intended to accumulate practical experience and provide data and basis for a more comprehensive regulatory framework in the future. In addition, Vietnam is also actively exploring the research and development of the central bank digital currency (CBDC) - Digital Som. The Prime Minister of Vietnam has repeatedly called on the SBV to study the pros and cons of digital currencies and launch a pilot cryptocurrency project based on blockchain. Although the issuance of Digital Som is still in the evaluation stage, its potential legal status and complementary role to the traditional financial system are an important part of the development of Vietnam's digital economy. Of course, while promoting innovation in the regulatory framework, Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) compliance remain the core concerns of the Vietnamese authorities, especially after it was included in the gray list by the Financial Action Task Force (FATF).

Vietnam is currently still on the Financial Action Task Force (FATF) "enhanced review list" (grey list), mainly due to its deficiencies in crypto-related anti-money laundering practices. Being included in the grey list means that the country has strategic deficiencies in combating money laundering and terrorist financing, which may affect its international financial reputation and ability to attract foreign investment. In order to be removed from the grey list, Vietnam must formulate virtual asset management policies and strengthen relevant law enforcement.

The passage of the Digital Technology Industry Law is an important measure for Vietnam to cope with the pressure from the FATF. The law explicitly requires all digital asset activities to strictly implement anti-money laundering (AML) and counter-terrorist financing (CTF) measures to enhance security and transparency. This means that future crypto exchanges and related service providers must comply with global standards such as KYC and AML, and may be required to maintain compensation funds to protect users from cyber attacks, thereby reducing the risk of financial crimes.

3 Vietnam's cryptocurrency tax policy and its latest developments

The evolution of Vietnam's cryptocurrency tax policy is almost synchronized with Vietnam's regulatory policy on cryptocurrencies. In the early days, it was not realistic to tax cryptocurrencies due to the vague and contradictory characterization of cryptocurrencies by the Vietnamese authorities, and the extensive and one-size-fits-all regulatory policies. However, the rapid expansion of cryptocurrency transactions has forced the government to face up to its legal status, forcing the Vietnamese authorities to study cryptocurrencies. In particular, in 2024, the government has shown greater urgency in formulating a clear legal framework.

3.1 Currently, cryptocurrency transactions in Vietnam are still in a tax gray area

For a long time, cryptocurrency transactions in Vietnam have been in a tax gray area due to the lack of clear legal definitions and regulatory frameworks. As mentioned above, the Vietnamese Ministry of Finance's 2016 official letter 4356/BTC-TCT, while not prohibiting cryptocurrency trading and defining it as "property" and "commodity", did not involve specific tax regulations. The State Bank of Vietnam (SBV) also made it clear in its 2017 official letter 5747/NHNN-PC that it does not recognize cryptocurrencies such as Bitcoin as a means of payment, further exacerbating legal uncertainty and making it difficult for tax authorities to effectively tax cryptocurrency activities. In addition, Vietnam's 2015 Civil Code does not include digital assets in its definition of property, which also poses a huge obstacle to the taxation of cryptocurrencies.

Compared with Vietnam's clear stock trading tax system, activities in the crypto field have been exempt from tax obligations for a long time. This situation has made Vietnam a de facto "tax haven" in the crypto field, attracting a large number of crypto investors, but it has also led to a huge gap in the government's tax revenue.

3.2 New regulations outline a legal framework for cryptocurrency taxation

The Digital Technology Industry Law will officially take effect on January 1, 2026. This is a key step in Vietnam's cryptocurrency tax policy. Although it is not a direct cryptocurrency tax law, it lays a legal foundation for future taxation. Because although securities, stablecoins and central bank digital currencies (CBDCs) are excluded, this new bill clearly defines "crypto assets" and "virtual assets" at the legal level for the first time. This milestone definition changes the previously ambiguous legal status of cryptocurrencies in Vietnam, making it likely to be regarded as legal property.

Against this backdrop, the Ministry of Finance is finalizing a draft resolution on a pilot program for the issuance and trading of cryptocurrencies. The pilot will evaluate the possibility of applying value-added tax (VAT), corporate income tax (CIT) and personal income tax (PIT) to crypto asset transactions. The pilot program will be conducted on a small scale and closely monitored by state regulatory agencies to study how to determine income from crypto assets in order to establish transparent regulations, avoid budget losses and protect investor rights. There are currently various discussions on the proposed tax rates. One suggestion is that a 0.1% transaction tax on crypto transactions could be levied, similar to stock trading, which is considered to generate considerable income without excessively suppressing market vitality. If cryptocurrencies are classified as investment assets, trading profits may be subject to capital gains tax like stocks or real estate. For businesses engaged in cryptocurrency trading, the standard 20% corporate income tax may be required. In addition, there are suggestions to impose a 5-10% personal income tax on non-fungible token profits, a 1-5% withdrawal fee on foreign investors' profits, and consider providing a 10% corporate income tax incentive (for the first five years) to pilot exchanges, as well as exempting digital asset transactions from value-added tax to promote liquidity.

4 Outlook on Vietnam's Cryptocurrency Policy

The Vietnamese authorities' attitude towards crypto assets has undergone a significant change from early vigilance and restriction to the current active exploration and regulation. This change reflects a pragmatic balance between controlling financial risks (such as money laundering and fraud) and seizing opportunities for the development of the digital economy. The authorities may have realized that simply banning or ignoring crypto assets will lead to an outflow of talent and capital and miss the opportunity to gain a foothold in the global digital economy. In fact, the Vietnamese authorities have included blockchain technology, digital assets and cryptocurrencies in the list of national strategic technologies, alongside cloud computing and artificial intelligence. This shows from the side that Vietnam has regarded digital assets as a key element in promoting the country's digital transformation and economic growth.

Based on the current development trend and the government's clear signals, it is reasonable to believe that the direction of Vietnam's future crypto asset policy will continue to show the characteristics of "inclusive prudence". Specifically, the following predictions can be made about the direction of Vietnam's future crypto asset policy:

First, more regulatory details will be issued and implemented. With the entry into force of the Digital Technology Industry Law, more supporting regulations and guidelines will be issued to clarify the licensing requirements, operating standards, consumer protection measures, etc. of crypto asset service providers. Regulatory sandboxes will continue to play a role in providing a controlled testing environment for new business models and technologies to accumulate experience and improve the long-term regulatory framework to ensure that innovation is carried out under controllable risks.

Second, the tax framework will be gradually improved and implemented. It is expected that after the entry into force of the Digital Technology Industry Law, the Ministry of Finance will accelerate the introduction of specific tax details to clarify the taxation methods, tax rates and collection and management processes for various types of crypto activities. The successful experience of the e-commerce platform tax system is likely to be introduced into crypto trading platforms to improve tax efficiency and compliance. Vietnam may also formulate differentiated tax policies for different types of crypto activities and consider the combination of capital gains tax and turnover tax to achieve fairness and effectiveness of taxation.

Third, digital assets and traditional financial systems will gradually merge. The Vietnamese government will continue to promote the combination of digital assets and traditional financial systems, such as exploring the development of crypto banks, national crypto exchanges and stablecoins to build a more modern financial infrastructure.

In short, Vietnam may become a model of "compliant innovation" in the Southeast Asian crypto economy, competing with Thailand and Malaysia for the Southeast Asian crypto market. Vietnam has a large crypto user base and a relatively clear digital economic development strategy. The recently passed "Digital Technology Industry Law" and the ongoing tax pilot and sandbox mechanism all indicate that it is transforming from a "gray area" to a "clear regulation". This transformation will make it stand out in Southeast Asia and become a market that can embrace innovation and ensure compliance. Vietnam's experience may provide a viable model for other emerging markets and developing countries, that is, how to gradually establish a sound crypto asset supervision and taxation system without stifling innovation, thereby transforming the potential of the crypto market into a driving force for national economic growth.

Weiliang

Weiliang

Weiliang

Weiliang Anais

Anais Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Catherine

Catherine Weatherly

Weatherly Alex

Alex