Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Points Overview:

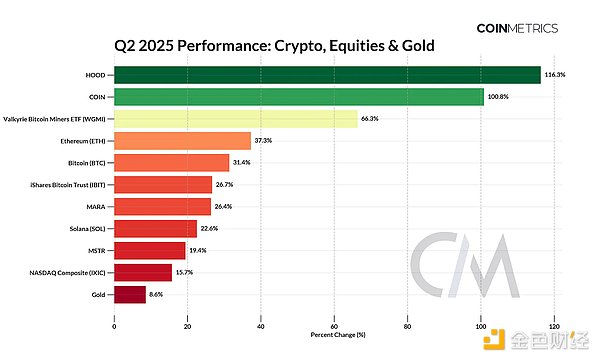

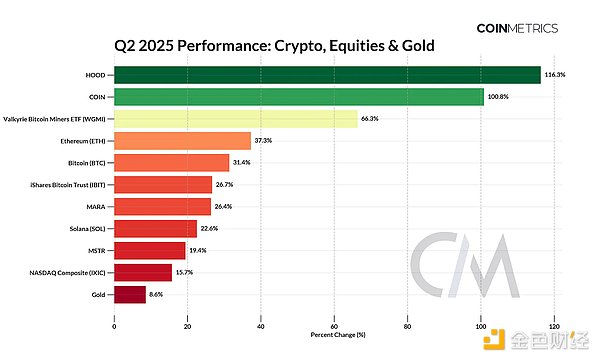

The total market value of cryptocurrencies rebounded to $3.3 trillion in the second quarter. Investor focus turned to stocks related to crypto infrastructure, with Robinhood (+116%) and Coinbase (+100%) leading the gains. ETH (+37%), BTC (+31%) and SOL (+22%) all recorded strong gains, and the market shifted to a "risk-on" mode.

Stablecoins have taken another step towards mainstream legitimacy, with Circle's IPO and the advancement of the US GENIUS Act showing growing investor interest and recognition of their role in the global market.

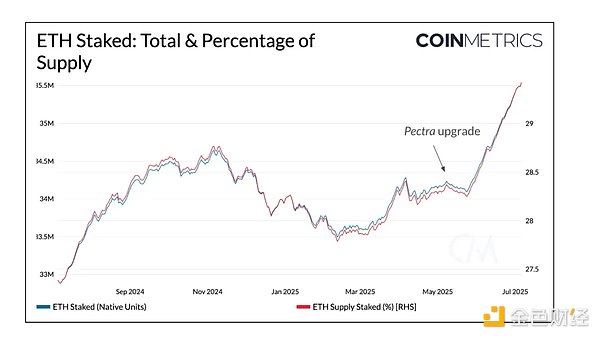

Ethereum’s Pectra upgrade improves staking and scaling, with 35.5M ETH (~22.4% of total supply) now staked. Blob space remains underutilized, driving blob fees to near zero while improving rollup economics and supporting Layer-2 growth.

Exchanges and institutions continue to expand on-chain. Robinhood announced plans to launch a rollup for tokenized RWAs (real-world assets), joining Coinbase and Kraken in adopting rollup infrastructure. Meanwhile, private networks such as Canton are gaining traction and adoption in regulated financial scenarios.

This article will review the key developments shaping digital asset markets and on-chain activity in the second quarter of 2025, based on data.

Markets rebound after turbulent Q1

Q2 2025 is a period of extreme opposition, with complex macro pressures from trade policy and geopolitical tensions. At the same time, momentum continues to build for regulatory favorability and on-chain infrastructure adoption.

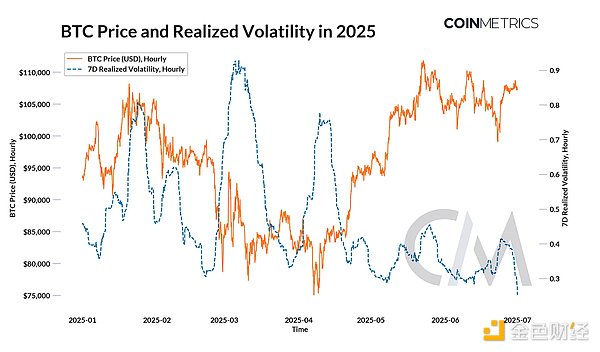

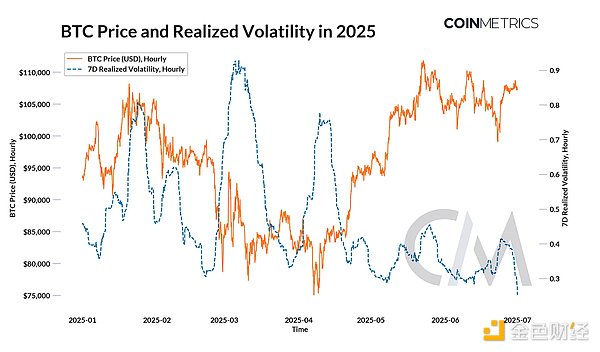

The second quarter started turbulently: President Trump’s announcement of tariff plans on April 2 caused market unease, but it ended with a strong recovery, with Bitcoin hitting a new all-time high and a quarterly gain of 31.4%. Bitcoin dominance rose to 65%, putting pressure on most altcoins. Spot trading volume on centralized exchanges (CEXs) fell back to an average of about $45 billion per week, but activity in futures markets remained high.

The decline in BTC volatility and market uncertainty laid the foundation for the rebound in the second quarter. Market risk appetite increased, and Robinhood (+116%), Coinbase (+100%) and Bitcoin mining stocks became the main beneficiaries. ETH and BTC both recorded strong double-digit gains, while gold, the best performer in the first quarter, lagged behind crypto assets.

It is particularly noteworthy that listed crypto companies have become a new focus of investors this quarter. From the increasing allocation of corporate treasury treasury to Circle's IPO, they all reflect the interest in equity assets related to crypto infrastructure. Their excellent performance suggests a broader trend: the deep integration of traditional capital markets with on-chain infrastructure, especially through the tokenization of stablecoins and real-world assets (RWA).

"Summer of Stablecoins" and the GENIUS Act

Stablecoins have become the absolute protagonists of this quarter. USDT continues to dominate the market, Circle's listing caused a sensation, and the advancement of stablecoin legislation in the United States has brought unprecedented attention to this track. The U.S. Senate has advanced the GENIUS Act (Guiding and Establishing the National Innovation for United States Stablecoins Act), bringing the industry one step closer to long-sought regulatory clarity.

Currently, the adjusted stablecoin chain has a monthly transaction volume of more than $2 trillion. Stablecoins have long become the backbone of on-chain value exchange and storage, and are a key channel for emerging markets to obtain US dollars.

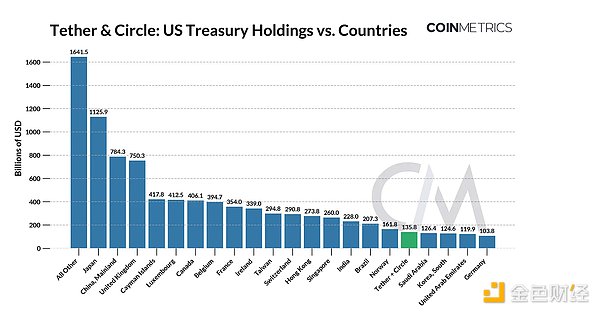

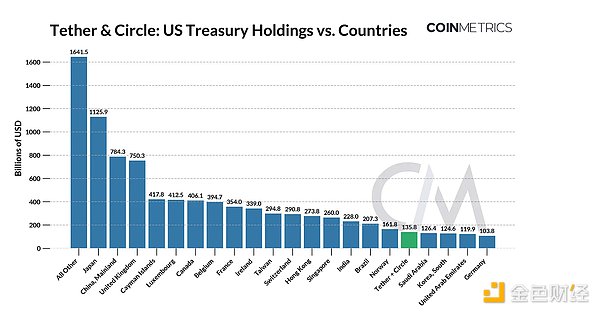

If passed, the GENIUS Act will hopefully formally establish the US dollar stablecoin as an "upgraded" payment track for the payment and capital markets, expanding the market size and scope of its serviceability. The bill establishes a regulatory framework for "payment stablecoins," requiring issuers to hold short-term US Treasury bonds and cash as reserves, provide monthly reserve reports, and comply with anti-money laundering (AML) regulations. Tether and Circle currently hold more than $135 billion in US Treasury bonds, making them the 17th largest foreign creditors of the United States. This regulatory clarity is expected to deepen global demand for the US dollar and US Treasury markets.

The bill also defines who can issue stablecoins in the U.S., limiting it to banks and licensed non-bank entities. This opens the door for large, regulated market participants, from banks and fintechs to big tech companies. Market interest is already accelerating, for example:

JPMorgan pilots its tokenized bank deposits (JPMD) on Base Layer-2

Stripe deepens its stablecoin technology stack

Walmart and Amazon are rumored to be exploring issuing their own stablecoins

Visa and Mastercard have integrated stablecoins into their massive merchant payment networks.

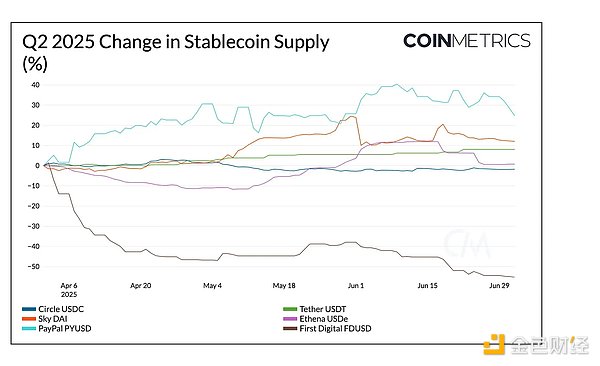

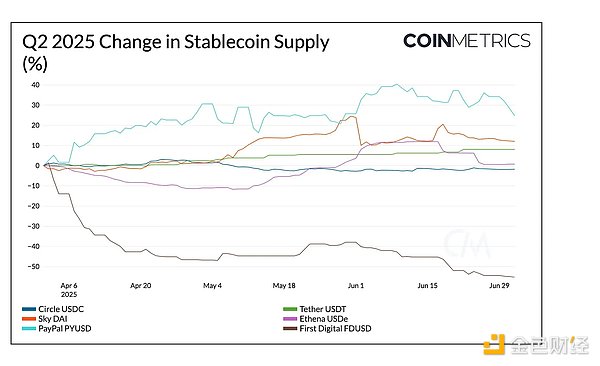

Against this backdrop, the total supply of stablecoins rose to $245 billion in the second quarter of 2025. PYUSD, issued by Paxos, grew the fastest, breaking the $1 billion mark on Ethereum and Solana and meeting upcoming stablecoin regulatory requirements. Hong Kong-based FDUSD saw a 54% drop in supply. USDT grew 8%, driven primarily by Tron on-chain issuance, while USDC saw a small decline in supply.

Ethereum Pectra Upgrade Improves Scalability and Staking Efficiency

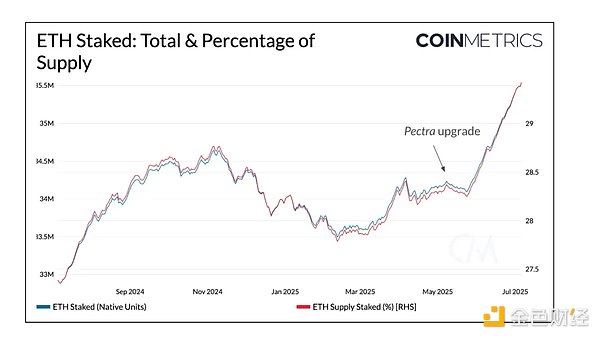

Ethereum's Pectra hard fork went live on May 7, bringing key improvements to staking efficiency and Layer-2 scalability. One of the most important Ethereum Improvement Proposals (EIPs) is EIP-7251, which increases the maximum effective balance of validators from 32 ETH to 2048 ETH. This allows participants to merge or supplement validators, thereby realizing compound interest and reducing network communication load.

After the upgrade, staking demand has accelerated, and 35.5 million ETH (about 29.4% of the current total supply) has been staked. While the number of active validators initially dropped due to the merge, it has since recovered to 1.089 million, with an average effective balance of 32.6 ETH, and about 15,400 merge requests submitted to date.

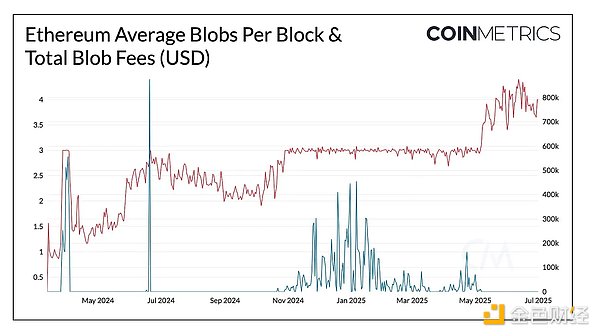

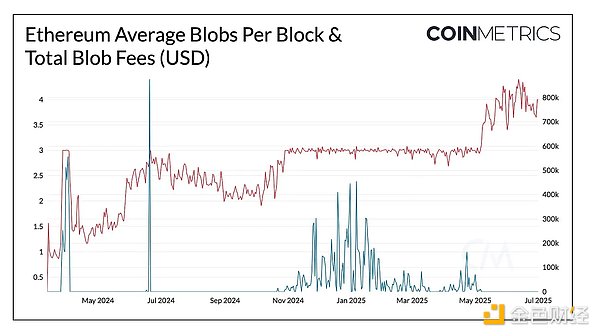

Another focus of this upgrade is to support Layer-2's scalability. This is achieved through EIP-7691, which doubles Ethereum's blob capacity. Blobs provide a way for L2 rollups to package and submit transaction data to the Ethereum mainnet. The upgrade increased the target number of blobs from 3 to 6 and the upper limit from 6 to 9, effectively increasing transaction processing capacity.

This directly resulted in lower data availability costs (blob fees) and increased transaction activity on Ethereum L2.

After Pectra went live, the number of blobs submitted by rollups per day increased from ~21,300 to ~28,000 (equivalent to about 4 blobs per block). However, as blob space is still underutilized, the total fees the Ethereum network earns from blobs per day is about $0.000008.

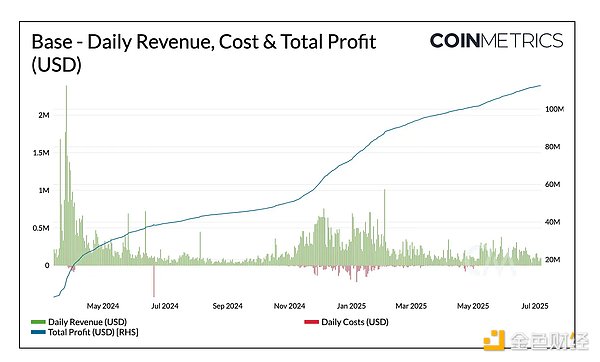

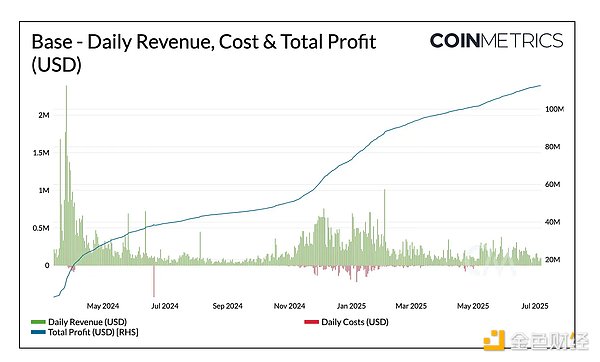

While this means minimal fee revenue for Ethereum itself, it is good for the profitability of rollups such as Base, Arbitrum, and Optimism. Lower blob fees reduce the cost of rollup data publishing, increase sequencer profit margins, and incentivize more companies to build on L2. In effect, Ethereum is prioritizing growth over short-term fee revenue, and continuing to expand the capabilities of the mainnet by supporting the development of Layer-2.

Exchanges and institutions accelerate on-chain deployment

This quarter, CEXs and institutions accelerated their on-chain deployment, thanks to the maturity of infrastructure and their ability to bring users and capital to the chain on a large scale. Today, enterprises have more architectural choices, from general-purpose Layer-1 and Layer-2 to emerging privacy-focused networks such as Canton.

Centralized exchanges expand on-chain infrastructure

This shift is reflected in the combination of expansion and integration. Bybit announced plans to launch Byreal, a decentralized trading extension of its main exchange; Coinbase is deepening its integration with native DEXs on Base, such as Aerodrome. At the infrastructure level, Coinbase, Kraken, and now Robinhood have all adopted the rollup model, which provides more control and customization while relying on the security of the Ethereum mainnet. For example, Base has retained about $112 million to date (user transaction fee revenue after deducting blob costs), which also shows the potential for Robinhood to monetize and expand its revenue sources on the chain in the future by operating its own rollup sorter.

At the EthCC conference, Robinhood announced a series of on-chain plans, including "stock tokens" for EU users. These tokenized stocks were initially deployed on Arbitrum and will be migrated to "Robinhood Chain" in the future, an Ethereum Layer-2 built on Arbitrum Orbit. The current product portfolio includes: Robinhood tokenized contracts that track stock prices, “wrapped products” issued by regulated SPVs such as Kraken, Bybit, and Solana and Backed Finance, and natively issued equity tokens such as Superstate’s Opening Bell.

Different models have different implications in terms of ownership, transferability, and usage. Although it is a big step forward in the on-chainization of capital markets, equity tokenization is still in its early stages.

Institutional Finance Takes Shape on the Canton Network

As public chain infrastructure grows, permissioned networks with privacy features like Canton are also emerging to meet the needs of institutional finance. Built on the DAML smart contract language, Canton is a private ledger synchronization network designed for regulated financial scenarios. Its native utility token, Canton Coin, supports the Global Synchronizer network, which ensures network security by rewarding validators and rewards application developers based on usage. Canton Coin currently has 27.8 billion in circulation, a market value of approximately $1.39 billion, and a unit price of approximately $0.050.

Canton provides an on-chain infrastructure route parallel to the public chain, designed for inter-institutional workflows, such as collateral management and settlement, which have strict requirements for privacy, compliance, and integration with existing systems.

Conclusion

The second quarter of 2025 was an encouraging quarter, benefiting from market recovery, regulatory progress, and the increasing integration of traditional finance with on-chain infrastructure. Stablecoins and asset tokenization are the two core narratives of this quarter, and the GENIUS Act has a profound impact on the demand for the US dollar, the market competition landscape, and the modernization of the global financial payment system. Equity assets and underlying networks related to these trends have benefited from them.

The Pectra upgrade has laid an important foundation for the long-term scalability of Ethereum, and exchanges and institutions have also accelerated their on-chain layout on public and permissioned chain networks.

Looking to the second half of the year, global liquidity, regulatory clarity, and the accelerated pace of on-chain adoption will continue to shape the evolution of the market.

Anais

Anais