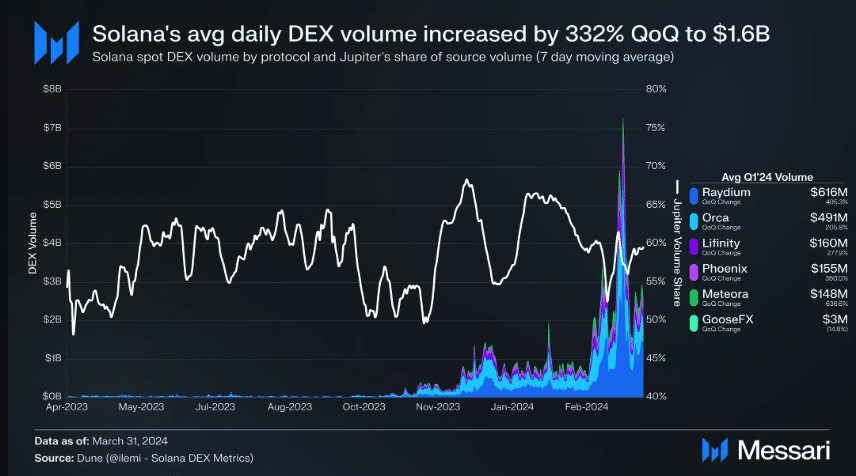

Solana, a prominent blockchain, experienced an impressive 319% surge in its first quarter (Q1) of 2024, setting multiple new records, according to a report by Messari. This surge primarily stemmed from a significant increase in decentralized exchange (DEX) trading volume.

Meme Coin Trading Drives DEX Volume Surge, Generating Significant Revenue for the Solana Blockchain

The surge in DEX volume was predominantly fueled by memecoin trading, highlighting the active participation of market players in buying and selling tokens on decentralized platforms. Notably, Raydium and Orca dominated the liquidity share, but it was the trading of memecoins that drove the substantial increase in volume.

Trading activity involving memecoins played a pivotal role in generating a remarkable $2.1 million in fees for Solana. As the second quarter (Q2) unfolds, a further uptick in memecoin trading could potentially boost the blockchain's revenue.

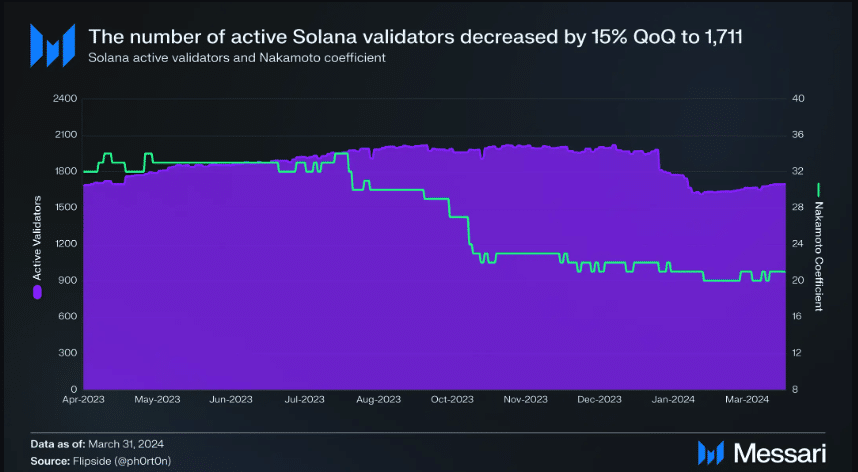

Solana Blockchain Under Pressure: Dual Challenges of Declining DEX Volume and Reduced Number of Validators

Despite the upbeat performance, Solana faced some challenges, including a decline in DEX volume and a reduction in the number of active validators. This decline in validators, down by 15% on a Quarter-on-quarter (QoQ) basis, raises concerns as it exposes the network to vulnerabilities.

A decrease in validator count not only jeopardizes the network's security but also raises the possibility of potential outages or attacks if left unaddressed in Q2. Nonetheless, an increase in validator numbers during this quarter could enhance the network's censorship resistance.

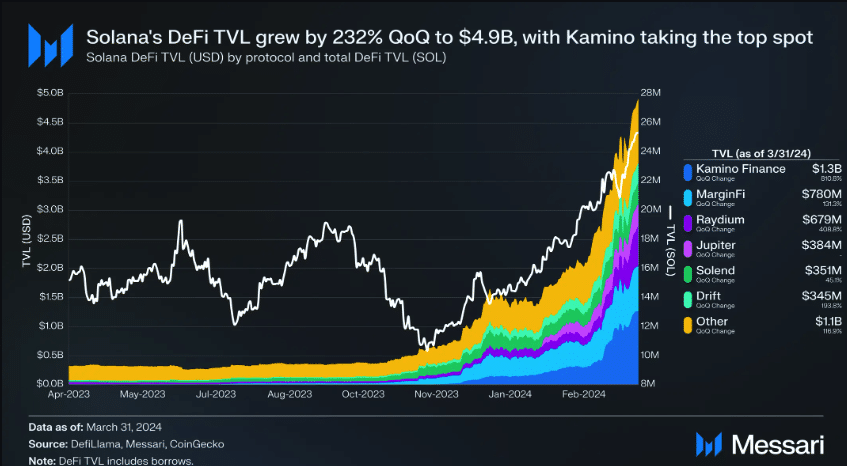

Solana's Total Value Locked (TVL) Soars Over 232%, Kamino Token Airdrop Drives Liquidity Growth, Q2 Outlook Positive

Solana's Total Value Locked (TVL) soared to $4.96 billion, marking a substantial 232% increase from Q4 2023. TVL serves as a gauge of protocol health, reflecting confidence and asset growth.

Factors contributing to Solana's TVL surge include announcements by lending protocol Kamino regarding token airdrops to select users. Such announcements foster optimism and stimulate liquidity for protocols. The anticipation of similar moves by other protocols like MarginFi in Q2 could further bolster Solana's TVL and potentially drive its altcoin price to new highs.

While Solana's Q1 performance showcased remarkable growth, challenges such as declining validator numbers pose risks. Nevertheless, optimistic developments in potential yield could mitigate these challenges and fuel further growth for Solana in Q2.

Anais

Anais