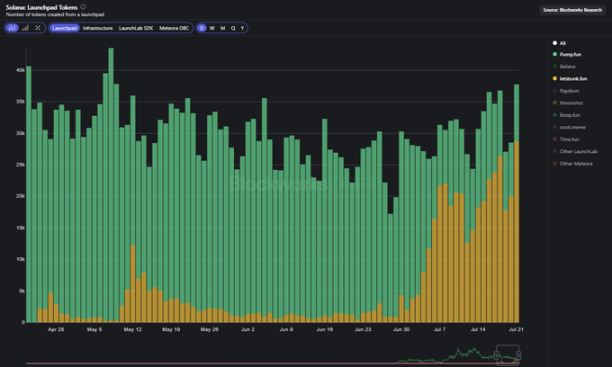

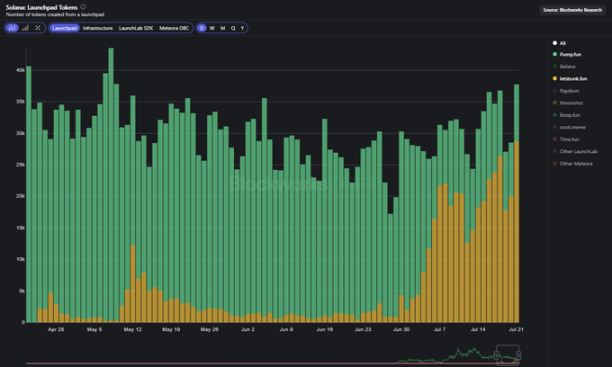

Author: Blockworks Research & Compiler: TechFlow @bonk_fun and @pumpdotfun are vying for dominance on Launchpad. Bonk’s rise over the past month has put it firmly at the top of Solana Launchpad revenue. What else can we discover by analyzing Bonk’s growth? Let’s dive in. Before Bonkfun, Pumpfun was steadily issuing 30,000 to 40,000 tokens per day. Since Bonk took over, the total amount of token issuance on each platform has remained relatively stable. However, Bonk now issues more than 25,000 tokens per day, while Pump issues less than 10,000 tokens per day.

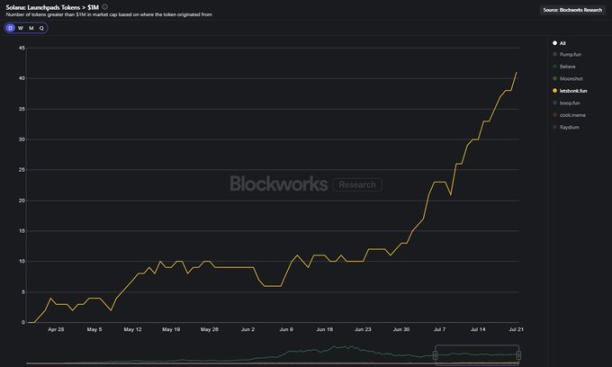

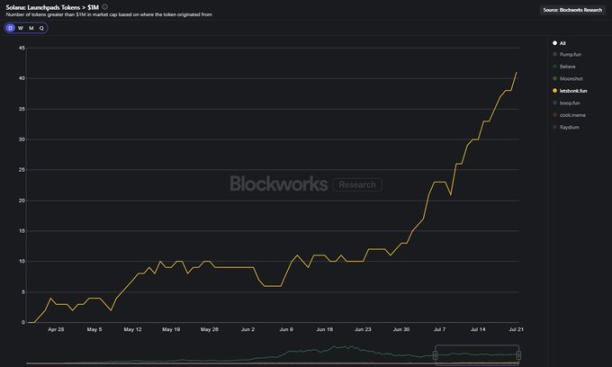

As the number of tokens grows, so does the market value of Bonk's tokens. As the platform's market share continues to expand, the number of tokens with a market value of more than $1 million is also on the rise.

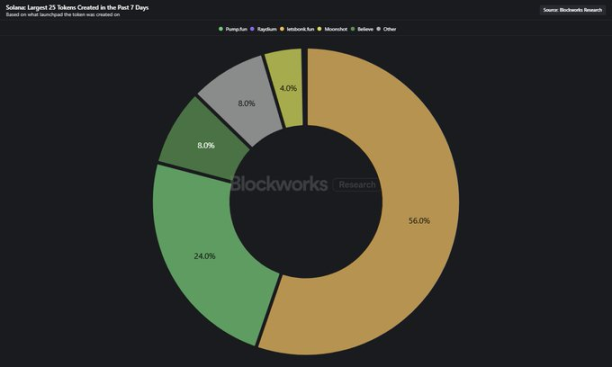

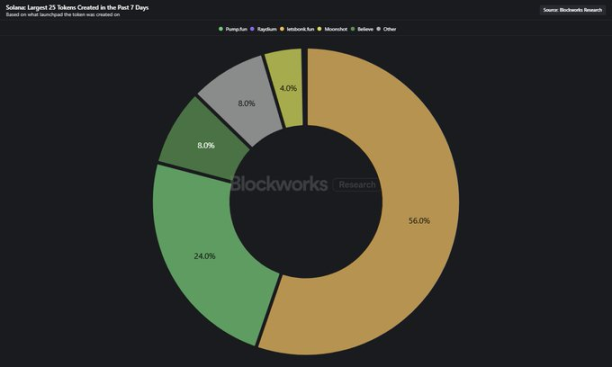

We also found that most of the tokens with the highest market capitalization issued in the past 7 days are from Bonkfun. The growth in issuance, trading volume, and market capitalization may be accelerating a flywheel effect, with traders preferring Bonk-based tokens due to their superior performance.

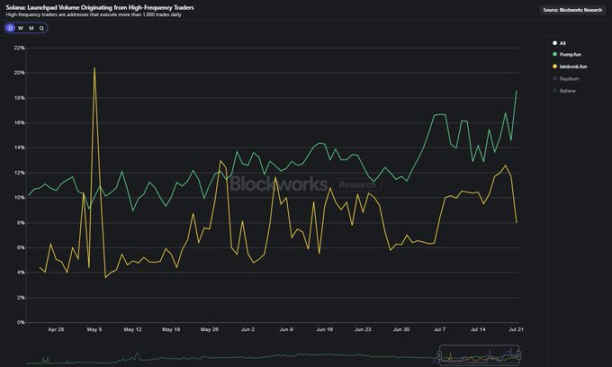

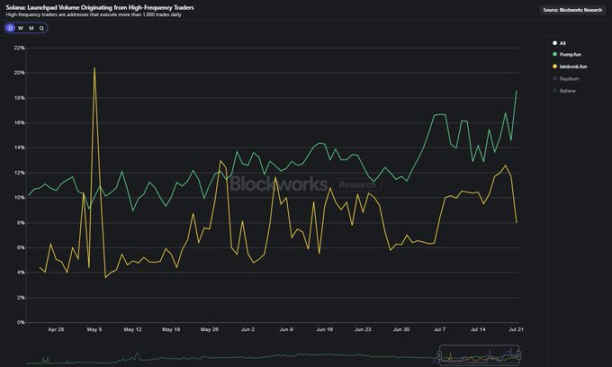

Interestingly, the proportion of high-frequency traders on the Pumpfun platform is higher than that of Bonk. This could indicate a growing presence of prosumer traders or bots, which is interesting given Bonk’s overall growth in both tokens and volume.

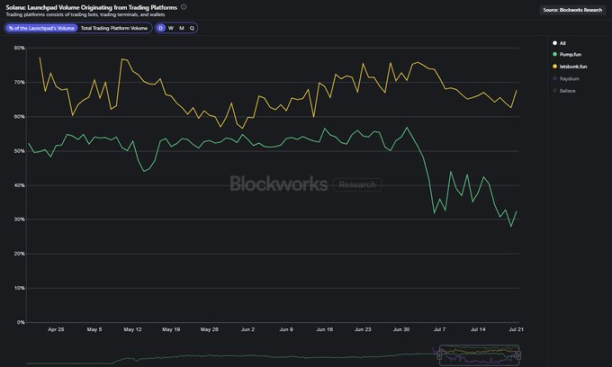

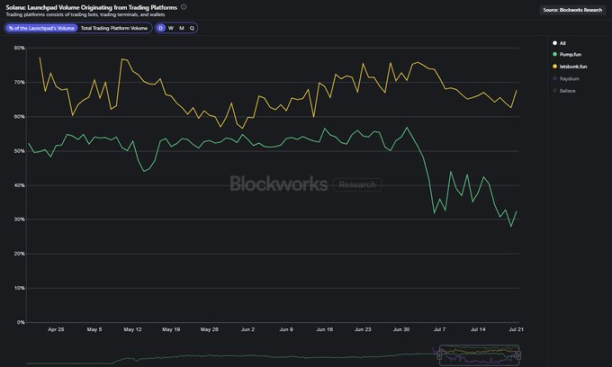

We also found that more than two-thirds of Bonkfun’s volume comes from third-party trading apps. Meanwhile, Pump’s share has dropped from more than half to around 30% today.

A few months ago, Pump had a firm grip on the market. But in recent weeks, with Raydium and Bonk taking the token issuance market by storm, Pump’s position is facing challenges. With Pump’s recent fundraising and token issuance, we can’t help but wonder how the team will respond.

Weatherly

Weatherly