Author: Matt Hougan, Chief Investment Officer of Bitwise; Translated by AIMan@金色财经

Do you remember the nine-dot puzzle?

It's a classic visual puzzle, often seen at summer camp. The puzzle goes like this: How do you connect nine dots with four lines, without a pencil?

This is a test that (literally) challenges you to think outside the box. If you're stuck in a box, you won't be able to connect the dots.

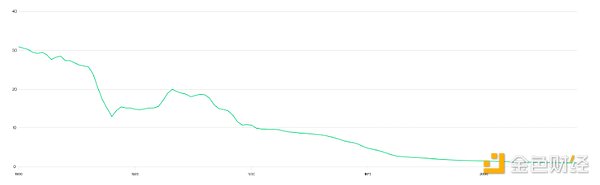

However, drawing outside the lines is easy. Ever since I read Bloomberg columnist Allison Schrager's recent column on cryptocurrencies, I've been pondering the nine-point puzzle. Schrager is an excellent writer, but she's long been a skeptic of cryptocurrencies. For years, she's predicted their demise in her columns, comparing them to tulips and other classic bubbles. Recently, she conceded that cryptocurrencies are here to stay, but now she has a new critique: We don't need them. In her latest crypto column, "Is There Bitcoin in Your 401(k)? I Wouldn't Risk It," Schrage dismisses Bitcoin's future, noting that "government-issued money is pretty great." She expressed a similar sentiment in an earlier column: "The United States already has a means of payment—it's called the dollar—and it works pretty well." These columns make me sad. "Pretty great" and "pretty well"? Schrage is caught in a dilemma. She can't think of a better way. There is a better way. The reality is: our financial system isn't actually that great. Today, the average interest rate on a checking account is 0.07%. So-called "savings accounts" yield 0.38%. Checks are cashed in five days. Stocks settle T+1 (not weekends, as our ad campaign pointed out last year). Visa pays merchants in just 1-3 business days while maintaining an 80% gross profit margin. Our government backstops a handful of banks with implicit guarantees and regularly bails them out with taxpayer money. Meanwhile, the value of the US dollar has fallen by approximately 80% in my lifetime.

Purchasing Power of the US Dollar, 1900-2020

Source: Statista

"Pretty awesome"?

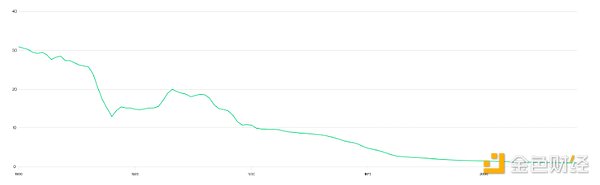

One of the biggest reasons I work in crypto is because I know we can do better. We could live in a world where payments are instant, fees are near zero, and the government doesn't drain your money through inflation. We could live in a world where you earn real returns on your assets—returns that accrue second by second, day by day, rather than periodically according to the whims of your service provider. We could live in a 24/7, global world where we travel without paying currency exchange fees or interbank transfer fees. I find it incredible how easily we accept the status quo. Imagine if your email went down at 4 p.m. on Friday and wasn't back up until 9:30 a.m. on Monday. That's essentially what happens with our brokerage accounts. It might be happier, but it's not the way to run an economy. When I meet TradFi advocates, I want to show them how fast (almost instant) and cheap ($0.002) it is to transfer money through Base. I want them to lend an asset on Aave and see the interest accrue every second. I want them to transfer money between accounts at 7 PM on a Saturday night because, hey, it's your money. And of course, I want to show them a Bitcoin chart that looks like the inverse of the USD purchasing power chart I showed above. Source: Bitwise Asset Management. Data ranges from July 17, 2010, to July 28, 2025. I know what critics like Allison will say: Where are the real-world uses? If cryptocurrency is so great, why haven't I already used it to buy things? The answer is that, like many new technologies, it's not perfect yet. It will require a lot of work from technologists, investors, regulators, and lawmakers before it reaches its full potential. Therefore, as with most new technologies, initial adoption will occur at the margins, where existing systems are particularly problematic. But if you think outside the box, you'll see that a better/faster/cheaper/more global financial world is beginning to emerge. You see it in companies like Yellowcard, which helps businesses in sub-Saharan Africa use stablecoins for cross-border transactions, bypassing the highly inefficient banking industry. You see it in Stripe's $1.1 billion acquisition of Bridge, a stablecoin service provider that helps companies like Starlink invoice customers around the world. You see it every weekend, as the stock market closes and macro traders turn to cryptocurrencies. You see it in people like Ray Dalio, who reluctantly buys Bitcoin out of concern for the dollar's future. New technology always does this. The first cell phones were the size of suitcases and were met with skepticism by many, but they became incredibly useful to a small group of politicians and CEOs. The first digital cameras had poor resolution and were "utterly unusable," but they enabled NASA to send images from space and journalists to write stories without processing film. Over time, the technology got better. Today, we can't imagine a world without digital cameras.

I expect the same to happen with cryptocurrency. Under the right circumstances, this technology is already capable of moving money and financial products better, faster, and cheaper than traditional systems. As regulations evolve and user experience improves, I think we'll see all financial products migrate to cryptocurrency.

This will be a huge boost for the world. It will also remind us that we don't have to be satisfied with the status quo. Things can get better.

I remain convinced that crypto can help us achieve this goal.

Miyuki

Miyuki