Google Cloud Launches Blockchain RPC Service to Streamline DApp Development

Google Cloud’s new Blockchain RPC service simplifies Ethereum-based DApp development, offering scalable solutions to address the growing needs of Web3 developers.

Sanya

Sanya

As mentioned at the beginning, the necessity of public chain compliance stems from two aspects: first, regulatory requirements, and second, user demand. So let's ask a few more questions: Why do regulators require public chain compliance? Whose interests are harmed by non-compliant public chains? Why do users want to use compliant public chains? What value can using compliant public chains bring?

Regulators in every jurisdiction around the world have several top priorities: preventing financial crime (such as money laundering, fraud, and terrorist financing), maintaining financial market stability, and protecting consumers. These involve the most fundamental issues of trust and security in the financial market. For the United States, they are also related to its national security and global hegemony. After being laundered on-chain, illegal funds can flow covertly into legitimate sectors. Cryptocurrency-related scams and frequent hacking attacks often cause investors' wealth to evaporate, sparking market panic. Large crypto companies or platforms, if robbed due to on-chain vulnerabilities or fined for violating relevant laws, not only suffer massive financial losses but also directly impact the liquidity of the financial system. In May 2022, a massive sell-off of the UST stablecoin on Terra (a public chain specializing in algorithmic stablecoins) led to a depegging of the token. The price of the governance token LUNA plummeted, wiping out $40 billion in market capitalization and impacting millions of users. Subsequently, the renowned crypto hedge fund Three Arrows Capital, due to its large holdings of LUNA and a significant decline in assets, ultimately declared bankruptcy. This, in turn, affected several trading platforms, triggering a systemic crisis within the industry. It's conceivable that if such an incident were to occur again in the future, the damage would not be on a scale exceeding tens of billions of dollars, and could even rival the 2008 financial crisis.

With the increasingly deep connection between the crypto world and the traditional financial system, regulators must consider and avoid the possible negative impacts. Especially as the crypto market continues to expand and integrate into the mainstream financial market, if losses result from improper regulation in the future, the consequences can be catastrophic.

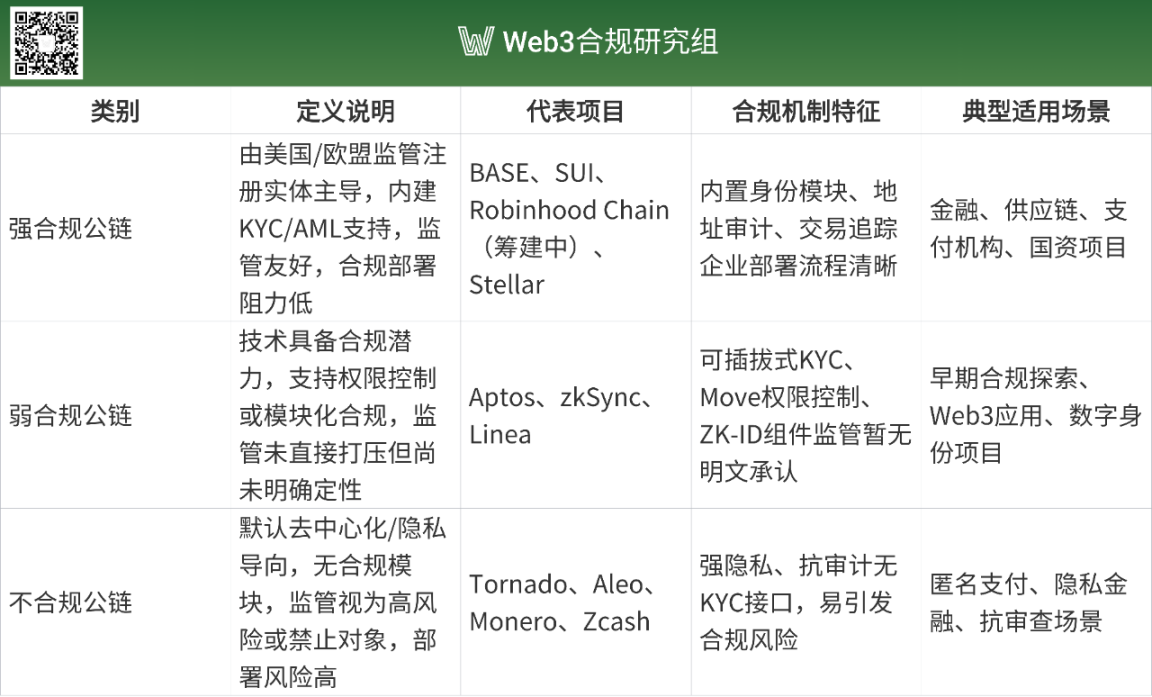

Users of the crypto market can be divided into ordinary retail investors and institutional users. Here we mainly discuss the needs of institutional users. Institutional users generally refer to users who do not participate in the crypto market as individuals, and usually include financial institutions, corporate users, government and state-owned capital background institutions and Web3 native institutions. As the infrastructure of the entire crypto industry, the only viable path for institutional users to deploy on-chain businesses is the public blockchain. BlackRock launched BUIDL, the first tokenized fund on Ethereum; VISA integrated USDC settlement services for merchant payments on Solana and Ethereum; Google provides RPC nodes for Solana, Ethereum, and others; USDC and USDT are issued on multiple public chains. The first question every web3 startup team must consider is which public blockchain ecosystem to join. Just as banks wouldn't choose to deploy on the dark web, institutions won't deploy their businesses on a chain in a "legal gray area." The prerequisites for all of this are compliance, credibility, and controllability. Otherwise, they will never be able to "truly go on-chain," as regulators can easily shatter a team's years of hard work with a single lawsuit. Beyond inevitable commercial and regulatory considerations, for institutional users, compliant public chains are the "ticket" to a new wave of growth. If a chain can meet institutional compliance requirements, it can embrace new businesses like RWAs, central bank digital currencies, and enterprise financial applications, entering the trillion-dollar asset market. This will also directly attract massive amounts of capital from traditional capital sources like venture capital, limited partners, and banks, expanding the collective pie. At the same time, as regulation becomes increasingly refined, modules like "selective privacy," "on-chain identity," and "on-chain credit" will become new infrastructure layers, providing a more solid foundation for the development of platforms like Depin, SocialFi, and GameFi. These areas, which have seen limited growth in the past, may soon break out of the mainstream, just like stablecoins, achieving true mass adoption. (III) What Qualifies as a Truly Compliant Public Chain? The public chain sector has long lacked clear, unified regulatory standards. Regulators often judge projects based on the Securities Act and the OmniVision Test, often subject to subjective factors. During the Biden administration, Ethereum, EOS, and TON have all come under strict regulation, and even Coinbase, a benchmark for compliance, has received multiple SEC subpoenas. With the passage of three major US crypto bills and the SEC's positive voice, compliance in the crypto industry is no longer a vague, trial-and-error approach. This also applies to public chains. While US crypto regulation currently lacks a unified standard specifically for public chain compliance, multiple laws and bills are gradually forming a clearer regulatory framework. However, for public chains to ensure legal and compliant behavior within their ecosystems, they must be able to meet these requirements. The highly compliant public chains mentioned in this article are those that have proactively met regulatory requirements technically, "meeting regulatory needs and undergoing serious transformation." Regulatory requirements primarily stem from the Bank Secrecy Act (BSA), the DAAMLA digital asset anti-money laundering law, the GENIUS Act and the CLARITY Act, cross-enforcement by the CFTC and SEC, and FinCEN guidance. Meeting these requirements requires integrating them into the architecture at a technical level, such as identity verification (KYC/KYB), transaction auditability, and compliance controls within smart contracts. At the same time, it's also necessary to allow on-chain applications to be tested and reviewed in a specific environment, and to grant authorized regulators access to necessary on-chain data. While the examiner didn't specify the criteria, the answer is almost clear. II. The Current Status and Path to Implementation of Strongly Compliant Public Chains Currently, representative projects that closely meet our definition of "strongly compliant public chains" include Base, Sui, and the soon-to-be-launched Robinhood Chain. Next, we'll examine the progress these three have made in achieving compliance and how they've done so. (I) Base: As a leading compliance platform in the US market, Coinbase launched the Base chain, aiming to build a "regulatory-friendly" on-chain ecosystem, providing a compliant, secure, and controllable Web3 environment for institutions and mainstream users. This complements its exchange business and forms the core of its expansion into a diverse and compliant business model. Going forward, its Web3 businesses in three core scenarios—finance, identity, and asset issuance—will all be implemented through the Base chain. For this reason, Base was designed with compliance at its core from the outset. 1. Technical Architecture: First, the technical architecture. With compliance at its core, regulatory requirements must be considered, which in turn requires flexibility in the public chain's architecture. Base's solution is to leverage existing technologies. Base is built on Optimism's OP Stack, a modular, pluggable blockchain development framework that provides a variety of modules and components for every public chain built on the OP Stack. Think of Base as a highway roadbed that can be flexibly equipped with cameras, speed limiters, and ID systems. For example, if you need to meet certain compliance requirements, you can customize compliance modules and integrate them into the execution layer. Coinbase, on the other hand, acts as a "toll booth + identity checker," serving as a critical bridge between off-chain compliance services and the on-chain world. Before accessing the Base Chain, users must first complete Know Your Customer (KYC) and Anti-Money Laundering (AML) verification on the Coinbase platform. This compliance data is not directly exposed on-chain, but is transmitted to the chain through a controlled interface. The user's wallet address (Ethereum address) is then labeled, confirming that the user has passed verification. All on-chain activity becomes traceable, and Base's on-chain address loses its anonymity. This synergy between off-chain identity and on-chain activity essentially creates a "legal highway system." Base itself is the infrastructure for running various Web3 applications—you can run DeFi protocols, deploy NFT marketplaces, launch blockchain games, and more. Coinbase ensures that every "vehicle" (user or funds) entering this highway has undergone legal identity verification, eliminating compliance risks such as money laundering and fraud. By reusing a proven modular framework, Base lowers the technical barrier to implementing compliance features while also leaving room for future adjustments to address more complex regulatory requirements. 2. Functional Design While addressing the major KYC/AML issue, other regulatory requirements remain. Coinbase's approach is to develop corresponding compliance features. Smart contracts are still smart contracts, but Base has designed a compliance channel that supports the issuance of RWAs and security tokens. Its smart contracts support the full process of asset creation, holding, transfer, and redemption. In the future, it will also meet the requirements for responding to instructions such as fund freezes and destruction as outlined in regulations such as the GENIUS Act. JPMorgan Chase's pilot issuance of JPMD, an on-chain deposit token, was implemented on Base, validating its institutional-grade compliance capabilities. An audit is still an audit, but Base will be audited for a longer period of time and plans to provide regulators with standardized APIs or dedicated nodes for real-time access to on-chain data. These interfaces will work with regulatory technology (RegTech) tools such as Chainalysis to achieve real-time risk control, abnormal transaction identification, and address tracking. BASE also introduces blacklist and whitelist functions. The blacklist can automatically block sanctioned addresses, while the whitelist mechanism ensures that sensitive assets only circulate between addresses that have passed compliance review. Privacy-enhancing technologies (such as privacy pools + zero-knowledge proofs) may also be introduced in the future to achieve compliance while protecting user privacy.

3. Acquisition Supplement

In addition, Coinbase has continuously acquired a number of key teams and projects in recent years to strengthen BASE's on-chain compliance capabilities and data infrastructure:

Liquifi: supports the issuance of compliant assets and completes the compliance issuance path of on-chain securities and stablecoins;

Spindl: strengthens user behavior tracking and advertising attribution capabilities;

Deribit equity investment: controls key data in the derivatives market and strengthens risk monitoring.

25 Years of Mergers and Acquisitions among Fintech Companies

This series of integrations covers the entire stack, from enterprise services to the protocol layer to data interfaces, providing BASE with a standardized and replicable template for building a compliant Layer 2 architecture.

In short, BASE embeds compliance into its system design, rather than relying on external governance as an afterthought. From architectural selection to feature development to acquisitions and supplementation, the entire chain sequentially meets the most basic compliance requirements.This design approach makes BASE one of the public chains closest to mainstream compliance requirements in the future Web3 world. (II) Sui: Sui, a public chain project launched in May 2023, has rapidly established itself in the blockchain space with its unique technical architecture and user-friendly design. Compared to many other public chain projects, Sui has demonstrated remarkable robustness in the nearly two years since its launch, particularly in terms of regulatory compliance and cybersecurity. To date, Sui has not been prosecuted or charged, a performance that not only highlights the development team's rigorous approach to technology and compliance but also earns it trust and reputation in the competitive blockchain market. Furthermore, Sui's recent performance further demonstrates its market potential. With the rapid development of the Sui chain ecosystem and the continued growth of its community, Sui's market capitalization has soared to over $13 billion, ranking it among the top 13th largest cryptocurrency by market capitalization globally. This market capitalization not only reflects the market's high recognition of Sui's technological innovation and application prospects, but also signifies its significant position in the competitive public blockchain sector. So, how has Sui managed to maintain compliance while growing rapidly and maintaining a firm foothold in the fierce public blockchain competition? 1. Language Advantage While both meet compliance requirements and offer flexibility, unlike Base, which relies on an existing technical architecture, Sui's flexibility advantage is inherent. Sui uses the Move programming language, which emphasizes high transaction speed and low latency, prioritizing fast and secure transaction execution. This makes it particularly well-suited for real-time applications like gaming and finance. Compared to the more widely adopted EVM language, Move offers advantages that are more advanced and better suited to current blockchain development. The modular design of the Move language allows developers to organize code into reusable modules, sharing resources and functionality, facilitating upgrades and combinations, and providing a superior developer experience. Recently, Ethereum (ETH) founder Vitalik Buterin proposed replacing the Ethereum Virtual Machine with RISC-V. RISC-V and the Move language share many similarities, most notably modularity and scalability. Both RISC-V and Move emphasize modularity and scalability in their designs, supporting user-defined instruction extensions, making them adaptable to a variety of application scenarios and facilitating their expanded use across diverse blockchain applications. This further underscores the technical superiority of the MOVE language. This lays a solid foundation for Sui's compliance path. 2. Empowering Developers/Collaboration/Third-Party Integration Sui Blockchain has taken several measures to ensure regulatory compliance. First, compliance tools are built into "modules" for developers to access on demand. As a decentralized blockchain, Sui does not directly enforce AML or KYC, but it provides the necessary tools and infrastructure for projects built on the platform to meet regulatory standards. Various tools help developers self-regulate and ensure compliance, such as addressing geographic restrictions. For example, Sui partnered with Netki to launch DeFi Sentinel, a compliance oracle that provides developers with automated compliance tools, including real-time KYC/AML (Know Your Customer/Anti-Money Laundering), wallet screening, and financial transaction monitoring. These tools can help dApps verify user location, ensuring that only users in compliant regions can access services. For example, the Doubleup gambling project is only open to users in compliant gambling regions. Of course, to address the potential for illicit projects or individuals to slip through the cracks, Sui's terms of service explicitly stipulate legal compliance obligations: funds can be frozen and access restricted upon legal request, providing a legal interface for compliance reviews. If, for example, $1.46 billion was stolen from Bybit on the Sui chain, the stolen funds could be frozen according to the terms of service. Secondly, seeking support from partners is crucial. Sui's decentralized nature makes it difficult to directly implement AML/KYC like traditional financial institutions, but by providing transparent transaction records and partner tools, it supports projects in meeting regulatory requirements. For example, Sui Blockchain, through a partnership with Ant Digital, leverages its ZAN platform to provide KYC and AML tools to support the compliant tokenization of real-world assets (RWAs). ZAN serves as Sui's RPC node operator, integrating into Sui's infrastructure. This means ZAN's tools can seamlessly communicate with Sui's blockchain network, enhancing its scalability and security. Finally, there's the matter of bringing in third parties. Sui Chain is enhancing compliance through its community-driven Sui Guardian program, collaborating with third parties such as Chainalysis. Sui Guardian tracks scams and phishing websites, while Chainalysis' analytical tools monitor and analyze on-chain transactions, identifying addresses or patterns associated with known illegal activity. By analyzing transaction patterns, Chainalysis can identify potential victims of phishing attacks and help exchanges and users take preventative measures. This helps Sui comply with global AML and KYC regulations, such as the EU's Fifth Anti-Money Laundering Directive (5AMLD) and the US Bank Secrecy Act (BSA). These three points can also be seen in community incentives. Sui's token distribution model has three uses for supporting the development of the Sui ecosystem community: the Community Access Program (5.82%); Stake Subsidies (9.49%); and Community Reserves (10.65%). Tokens allocated to supporting the development of the Sui ecosystem community account for 26%, representing 54.37% of the announced release plan (47.82% by 2030) and more than half of all circulating tokens. The Community Access Program is used for project incentives and support on-chain projects. The Community Reserve, with a 10.65% allocation, focuses more on the long-term development of the Sui ecosystem, such as funding DApp development using the Move language, supporting community governance, and reserving funds for future expansion to guide the development of a compliant ecosystem. In this way, Sui not only meets compliance requirements but also achieves risk isolation. In the blockchain ecosystem, public chains typically serve as the foundational layer, providing services. Users interact with various DApps through smart contracts developed by the project owners. The primary stakeholders are the project owners and users. Currently, most legal disputes and judicial precedents involve the project owners and their participants. Public chains are rarely named as defendants unless a major vulnerability directly causes user losses. For example, Sui recently announced a partnership with xMoney and xPortal to launch a digital Mastercard in Europe that supports the SUI token. Sui itself, as a technology platform, is primarily responsible for building the infrastructure and asset ecosystem. The payment side is handled by licensed institution xMoney, and the application-side user experience is managed by xPortal. 3. Data Compliance Sui is one of the very few public chains with explicit GDPR (EU General Data Protection Regulation) compliance capabilities. Through three native technical tools, a compliance system has been established for highly regulated markets such as the EU:

Through this mechanism, Sui users can use Web2 login to access Web3 applications without exposing their private keys or leaking their identities—both experience and compliance are upgraded simultaneously.

We can see that Sui's approach also internalizes compliance as part of its architecture and product design, but compared to Base, Sui's solution strikes a balance between compliance and decentralization. By integrating compliance into its top-level architecture from the outset, it not only meets global regulatory requirements but also builds a vibrant and robust ecosystem through community incentives, key project development, and offline events. Its user compliance, partner support, and project-level initiatives, such as collaborating with third parties to provide KYC/AML tools and employing innovative technologies to support GDPR compliance, demonstrate its foresight and execution in addressing regulatory challenges. The layout of a public chain should be holistic, adapting to future development trends from the underlying logic. As a public chain project, development planning cannot be based on a single project perspective; it should consider diverse application scenarios and development trends, and plan ahead. Governing a blockchain is like governing a country. Only with comprehensive infrastructure, leading the development of high-investment projects, and properly distributed incentives can a chain attract more developers and users and gradually develop a rich on-chain ecosystem. (3) Robinhood Chain Robinhood, the internet brokerage firm, pioneered the retail trading market and subsequently actively entered the crypto market, listing multiple currencies and developing its own wallet app. At the end of June, it announced the offering of tokenized US stocks, achieving a period of unparalleled success. However, Robinhood has also faced difficult circumstances: in 2020, it was fined $70 million for "payment for order flow" issues—not only making it one of the largest single fines for a brokerage in US history, but also strengthening its awareness of deeply embedding compliance frameworks in its product design. Therefore, Robinhood is essentially a compliance-first fintech company, whose business model is built on "compliance innovation." 1. From Arbitrum to Robinhood Chain: Robinhood's tokenized stocks, launched at the end of June, were issued on the second-layer public blockchain Arbitrum, which offers lower gas fees and higher throughput than the Ethereum mainnet. However, Arbitrum itself does not meet our definition of a highly compliant public chain, so this choice was more of a strategic stopgap. Consequently, its tokenized US stocks are only available to European users, not its home base in the United States. As Web3 enters its industrial integration phase, Robinhood's next step is to launch its own compliant public chain, Robinhood Chain. As a platform for asset issuance, on-chain settlement, and data custody, it aims to fully integrate traditional financial assets (such as stocks and ETFs) onto the chain, enabling 24/7 trading, decentralized circulation, and deep integration with DeFi infrastructure. This will be a crucial transition for Robinhood, transforming from a "Web2.5 compliant exchange" to a "Web3 compliant financial infrastructure." For such a significant strategic step, compliant operations in the US market are a top priority. Consequently, compared to Arbitrum, a key focus of Robinhood Chain's development is its "compliance module."

2. Three steps to compliance

It must be pointed out that Robinhood has not yet disclosed the technical roadmap of its public chain. However, through its officially released "Tokenization Memo" (hereinafter referred to as Memo) and the compliance letter submitted to the SEC, we speculate that Robinhood Chain is most likely to adopt the following compliance technologies in the future:

The first is "on-chain + off-chain identity binding". Like Base, Robinhood opted for "off-chain KYC + on-chain authorized address binding," a practice explicitly outlined in its compliance letter to the SEC. This makes all actions taken by on-chain addresses linked to the Robinhood exchange traceable, and addresses not linked to off-chain accounts will be prohibited from transferring tokens. The next step is the smart contract. This step is also similar to Base. In addition to KYC, the memo also mentions mandatory trading management measures, regulations in different jurisdictions, and more. These rules mentioned in the memo can actually be translated into smart contract logic. Technically, this is a series of if/else statements that can be added to the transfer or mint function to take effect. This means that the contract itself will have enhanced on-chain enforcement capabilities for regional restrictions, blacklists, and position limits, without relying on manual review. Finally, there is compliance API support. In a letter submitted to the US SEC, Robinhood stated that its tokenized stocks, bonds, and other assets will be held by licensed brokers (such as Robinhood itself or a regulated third party) to ensure asset security and prevent theft or misuse. These brokers will be responsible for safeguarding users' private keys, recording transaction ledgers, and undergoing regular audits. Although these assets are on-chain, they must still be traded through traditional channels (such as over-the-counter (OTC) exchanges or automated trading systems (ATSs). Furthermore, these on-chain transactions should be integrated with traditional financial systems (such as direct-to-consumer (DTC) clearinghouses) to ensure consistency between on-chain and off-chain data. To support this, Robinhood Chain will include a set of standardized "regulatory interfaces," similar to API-like technical modules. Through these interfaces, regulators can review transaction records, freeze risky addresses, and retrieve individual user transaction histories to ensure compliance with on-chain regulations. 3. Possible Futures: Robinhood CEO Vlad Tenev once explicitly mentioned in a livestream that Coinbase is a rival he greatly respects. In the grand arena of web3, Coinbase took the lead by launching the Base public chain, providing a valuable model for Robinhood to follow when launching its own public chain. The future Robinhood Chain will follow the same compliance path as Base, learning from each other and developing independently. Robinhood and Base share nearly identical compliance paths: a flexible underlying architecture, self-built compliance modules, and an open API for regulators. This is a common approach seen in public chains pursuing compliance in the US market. Base, Robinhood Chain, and Sui—public chains designed with legal compliance in mind from the outset—are suitable for adoption within the traditional financial system. While other public chains, such as ZKsync and Stellar, also prioritize compliance, face controversy regarding regulatory acceptance, placing them in a middle ground of "weak compliance." Furthermore, a number of public chains face acrimonious relations with regulators and are completely unacceptable to mainstream institutions. (1) Weakly Compliant Public Chains Plasma is a Layer 2 public chain based on Ethereum. Its core feature is its native asset, USDT. Its association with stablecoins like Tether (USDT) has led to widespread questioning of its compliance. Tether has been frequently questioned in recent years for compliance issues, such as insufficient transparency of its reserves and inadequate anti-money laundering (AML) measures. Although the Plasma team has actively adjusted its strategy and attempted to comply with regulations through technical measures (such as improving data availability and introducing audit mechanisms), it has yet to receive formal approval from mainstream regulators. ZKsync, a ZK-rollup scaling solution for Ethereum, has recently attracted attention from traditional financial institutions. Deutsche Bank is developing Project Dama 2 based on ZKsync, aiming to establish a compliant financial chain linked to the Singapore MAS and provide regulators with audit access. While ZKsync is willing to compromise and proactively integrate with compliance projects, its foundation remains an open, freely accessible protocol without built-in mandatory KYC or transaction restrictions. Consequently, it remains under regulatory scrutiny by the US SEC and Treasury Department and has yet to receive official regulatory approval. Aztec is an Ethereum Layer 2 platform centered around private transactions and smart contracts, combining anonymity with programmability. Its system is based on zero-knowledge proof (ZKP) technology and offers a proprietary Noir language for private smart contract execution. While it is promoting privacy and compliance research within academia and the tech community, it has yet to be clearly defined or recognized by mainstream regulators. While Aztec seeks a balance between compliance and privacy, its core positioning remains privacy-first. Its compliance relies on the subsequent adoption of an "optional compliance module" by the ecosystem, while the protocol itself lacks mandatory KYC/AML interfaces. (2) Non-Compliant Public Chains: If a weakly compliant public chain is one that falls short in compliance but at least demonstrates a move toward compliance, then a non-compliant public chain is one that completely disregards regulatory requirements. In January 2025, the US SEC formally filed a lawsuit against Nova Labs, alleging that its issuance of three tokens—Helium Network Token (HNT), Helium Mobile Token (MOBILE), and Helium IoT Token (IoT)—was suspected of illegally selling unregistered securities. The SEC also accused Nova Labs of misleading investors by falsely advertising partnerships with major companies like Nestlé and Salesforce, without actually having the corresponding authorizations or contracts. Helium, a typical example of a Decentralized Infrastructure Network (DePIN), centers around IoT hotspot devices, completely bypassing KYC checks and lacking any on-chain compliance modules. Its token circulation is highly public, and its operations are anonymous, making it difficult for regulators to hold it accountable. The lawsuit is still in the early stages, and the project has completely denied the SEC's allegations. Currently, it lacks any compliance support mechanisms, making it a prime example of a "completely non-compliant" public chain. Another prime example of complete non-compliance is Terra. The SEC has been suing its parent company, Terraform Labs, since 2023, alleging that it used algorithmic stabilization mechanisms to induce investors into participating in unregistered securities sales through the issuance of the UST stablecoin and LUNA. Ultimately, however, the SEC's motive for sueing Terraform was the company's collapse and the lack of basic KYC/AML mechanisms throughout the project, along with the lack of compliance modules such as fund freezes, address restrictions, on-chain audits, and regulatory interfaces. The project deviated from the regulatory framework from the outset of its issuance and is considered a typical violation of securities law regulations.

In the past few years, many projects have been obsessed with "building their own public chains." However, reality has proven that unless you achieve the ultimate in performance, security, and ecosystem, the marginal benefits of building your own chain are far less than the compatibility and compliance benefits of directly integrating with a mainstream chain. The real questions then become three: Will different types of assets or data be moved to blockchains on a large scale? How will the market landscape for compliant public blockchains evolve? What new technologies will emerge in the future as on-chain systems continue to evolve and the regulatory environment shifts? The answer to the first question is undeniable. BlackRock not only tokenized Treasury bond ETF shares on the Ethereum network but also launched the first private equity fund to be issued, settled, and managed entirely on-chain. Wall Street institutions like Goldman Sachs and Citigroup are also exploring the path to bringing RWAs to blockchains. Notably, even transaction data is gradually being "chained"—companies like BlackRock and Fidelity use public blockchains like Ethereum to record some fund operations. Across the ocean, the Hong Kong Securities and Futures Commission (SFC) has officially licensed 41 virtual asset platforms, with Guotai Junan becoming the first Chinese brokerage to do so. This series of moves clearly signals the arrival of the convergence of compliant finance and on-chain assets. At this point, choosing a public chain becomes inevitable. What institutions truly need isn't to "reinvent a chain," but rather to find an architecture that strikes a balance between sovereign compliance, on-chain autonomy, cross-chain interoperability, and secure self-custody. Future public chain architectures will trend toward embedded "modular compliance capabilities." New paradigms, exemplified by Base and Robinhood Chain, have already demonstrated a trend toward synergizing compliance with an open ecosystem through off-chain identity authentication and on-chain behavior tracking, combined with standardized regulatory APIs. This design model will be reused by more chains targeting the institutional market. Another technical direction is "selective compliance," where developers or applications can freely call compliance modules, connect to KYC service providers, and set asset management rules. This is embodied in chains like Sui and ZKsync. We anticipate that regulatory compliance will develop on two parallel tracks: First, increasingly stringent compliance requirements for financial assets will cover the entire process, including KYC, AML, and access to regulatory data. Second, there will remain room for inclusiveness in decentralized architectures and innovative exploration, particularly in areas such as smart contract logic, DAO governance, and ZK privacy-focused computing. As compliant public chains mature, a wave of "natively compliant" projects will emerge at the application level. These projects will not only consider regulatory requirements during issuance and operation but may also directly provide "RegTech-as-a-Service" capabilities. Capabilities such as KYC, AML, risk control engines, identity custody, and contract auditing will form standardized interfaces and become public services within the on-chain ecosystem, further lowering the barrier to entry for traditional financial institutions. For example, in terms of security, multi-sig architecture has become the standard answer. Take NexVault, for example. Its enterprise-grade multi-sig wallet solution already supports 12 mainchains, focusing on asset self-custody, security audits, permissions management, and inheritance logic for businesses, family offices, foundations, and DAOs. It has already implemented regulatory compliance paths in Hong Kong and Singapore. V. Final Thoughts As the crypto industry gradually enters the era of compliance, public chain construction is no longer solely focused on performance and cost; instead, it is beginning to incorporate compliance as a top-level design consideration. From Coinbase to Robinhood, from Base to Sui, we can see a trend: future mainstream chains must serve real-world assets and users, and must also meet the requirements of regulators. The term "compliance" will no longer represent oppression and constraints, but rather a new productivity tool. As long as we systematically understand regulatory logic, technical architecture, and user needs, we can create a blockchain infrastructure that is both open and compliant. The future Web3 world will go beyond anonymous transactions and DeFi arbitrage. It will also be an ecosystem where diverse scenarios such as RWA issuance, identity credit, on-chain governance, and industrial finance coexist. The role of public chains will also be upgraded from "technical laboratories" to "new digital platforms."

Google Cloud’s new Blockchain RPC service simplifies Ethereum-based DApp development, offering scalable solutions to address the growing needs of Web3 developers.

Sanya

SanyaIn my opinion, the most suitable approach for retail investors is to participate in these speculative games with a calm and casual attitude.

JinseFinance

JinseFinanceA new type of cryptocurrency scam has emerged recently. This scam generally uses offline physical transactions as the main scenario, uses USDT as a payment method, and uses the Remote Procedure Call (RPC) of the Ethereum node to conduct fraudulent activities.

JinseFinance

JinseFinanceGolden Finance launches "Golden Web3.0 Daily" to provide you with the latest and fastest game, DeFi, DAO, NFT and Metaverse industry news.

JinseFinance

JinseFinanceThe modular track has just begun, and RPC nodes are also a hard requirement. When the two are combined, I believe this project will be very promising.

JinseFinance

JinseFinanceExplore the strategic transition of Argent from zkSync Era to Starknet, delving into the timeline of changes, the impact on users, and the unwavering commitment to security. Learn proactive steps to navigate this transformative phase and ensure a smooth asset transfer with our comprehensive guide

Weiliang

Weiliang JinseFinance

JinseFinanceThe blockchain network has continued to perform optimally despite the setback.

Beincrypto

BeincryptoCheck out the guide to be potentially eligible for zkSync's airdrop.

Tristan

TristanAnkr also said that it will incentivize independent Optimism node operators to add their nodes to the load balancer in return for ANKR tokens.

Cointelegraph

Cointelegraph