Author: Arnav Pagidyala, Source: Bankless, Translated by: Shaw Jinse Finance

On-chain lending has become a pillar of decentralized finance (DeFi). However, despite its rapid development, its underlying architecture has remained virtually unchanged since Compound v2. Over 99% of DeFi still operates in some form of over-collateralized, floating-rate model pioneered a few years ago.

For the world to truly operate on-chain, lending must mature far beyond its current form.

What began as a simple stablecoin lending mechanism is now evolving into a complete financial system. This article aims to highlight the latest breakthroughs in protocol design, credit architecture, and regulation that are driving on-chain lending to become the foundational layer of a programmable global economy.

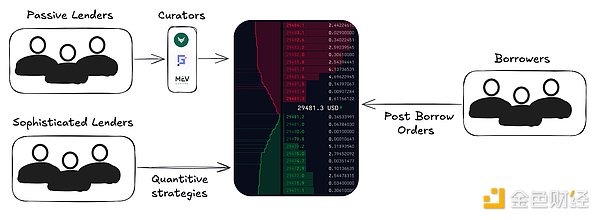

1. DeFi as a New Financial Operating System Over the past cycle, DeFi has quietly evolved from a series of isolated applications into a **composable global financial operating system**. In 2018, protocols such as Aave, Compound, and Uniswap operated as independent applications, each with its own liquidity, governance mechanisms, and user base. By 2025, they had evolved into a "financial kernel": a programmable environment where liquidity, risk, and execution are abstracted into modular layers that other developers can combine, extend, or build into new financial systems. In traditional software, an operating system provides three functions: shared memory, standardized interfaces, and permissionless scalability. The same model is now appearing in the DeFi space. These new "operating system protocols" manage the shared state of funds, rather than the shared state of files. Liquidity acts as the memory layer, the interest rate curve and Automated Market Makers (AMMs) act as system calls, while oracles, treasuries, and governance mechanisms constitute the layer for coordinated execution. Several mainstream protocols already embody this design philosophy: Aave v4 is evolving into a hub-and-spoke liquidity operating system. At its core is a controlled kernel called the "Liquidity Hub," surrounded by modular markets for RWAs, GHOs, and permissioned pools. Liquidity only needs to be provided once and can be deployed to all branches under controlled risk parameters, achieving unified capital efficiency rather than fragmented liquidity pools. This marks a significant step forward for Aave v4 from the isolated market architecture of Aave v3 to a fully shared liquidity layer. Morpho v1 and Euler v2 take a completely different approach: they employ a minimalist credit core, sharing only logic and not liquidity. Each vault is an independent micromarket, but all inherit the same underlying architecture—a unified accounting and clearing engine. Morpho v2 extends this by replacing static vaults with an intent-based Request for Quotation (RFQ) matching layer, allowing fixed-rate and floating-rate loans to coexist in a unified credit market. Fluid represents the most vertically integrated version, a unified liquidity operating system where lending, trading, and collateral all originate from a shared pool of funds. It is the first system to treat every dollar of idle capital, collateral, and borrowed funds as an interconnected resource. These architectures collectively mark the next stage in the development of DeFi. The era of isolated money markets is giving way to more interoperable financial systems that function more like operating environments than applications. Liquidity, risk, and governance are becoming shared infrastructure, not product features. Whether through modular hubs, minimalist kernels, or vertically integrated engines, the ultimate goal is the same: to build an open, programmable, and globally composable financial system. 2. Order Book-Based Lending Most DeFi lending still relies on the pool model, where all liquidity providers share risk and reward. This model offers simplicity and shared liquidity, but at the cost of insufficient precision. Furthermore, interest rates are not determined through negotiation but generated by algorithms or decentralized autonomous systems (DAOs), a stark contrast to the refined interest rates offered by traditional finance (TradFi). The next breakthrough in lending microstructure is the order book-based lending model, where lenders and borrowers post specific quotes, similar to a centrally limited order book (CLOB) in traditional finance. This structure allows for granular control over terms: fixed or floating interest rates, maturity dates, collateral requirements, and even custom risk parameters. Hybrid models are also emerging, combining pooling liquidity for increased depth with order book mechanisms for price discovery. Just as AMMs evolved into models with centralized liquidity, lending markets may also tend towards this more expressive design. However, the key difference is that lending markets are built for passive lenders, so the experience is largely the same for ordinary borrowers, but borrowers will have more choices.

Order books can be used for both floating-rate and fixed-rate loans, but their basic mechanism is similar: lenders publish quotes, borrowers accept quotes, and the matching results generate credit positions on-chain. Most of the funding in these systems comes from passive lenders, typically deployed through custodians or vault managers who aggregate liquidity and manage parameters on behalf of passive lenders. Avon is pioneering a hybrid architecture that combines a centrally controlled order book with custom strategies (independent markets), allowing compatible orders to be atomically cleared while still meeting the needs of passive lenders.

3. The Era of Convenience

As mentioned above, the underlying lending protocol will be completely abstracted by a series of consumer-facing products. Examples include revolving lending, automated risk management, yield abstraction, and consumer agency.

Revolving strategies are being abstracted into seamless, one-click operation products. Platforms like Contango and Loopscale have already automated the process, while lending marketplaces like Jupiter, Euler, and Silo are beginning to integrate these mechanisms directly into their front-end interfaces.

Yield Abstraction: For end users, lending will be simplified to a single "net return" figure. The underlying strategies will gradually fade from view, just as banks hide the operation of overnight repurchase agreements behind current account interest rates.

Yield Abstraction With direct integration between exchanges like Coinbase and protocols like Morpho, yield will become a basic user experience feature, rather than a complex financial operation. Consumer Agents: Smart agents will dynamically manage collateral ratios, refinance, and liquidation protection on behalf of users. These systems will rebalance positions across protocols in real time, optimize borrowing costs, and hedge volatility in real time, transforming active portfolio management into a back-office process. 4. Ratings, Benchmarking, and Compliance DeFi can only reach trillions of dollars if using it doesn't jeopardize the CFO's job. Any financial market needs standards, and the lending market is no exception. Credit ratings, transparent benchmarks, and compliance frameworks constitute the trust infrastructure that connects code-based markets with real-world capital. Ratings: Just as Moody's or S&P assess corporate and sovereign credit, independent risk rating agencies will emerge to evaluate DeFi vaults, protocols, and on-chain credit portfolios. These ratings will quantify smart contract risk, collateral quality, counterparty risk exposure, and historical performance, allowing institutional risk frameworks to be clearly mapped to the underlying DeFi technology. While I believe S&P and Moody's will likely remain dominant in this space, emerging agencies like Web3SOC and Credora are also appearing. Benchmarking: Standardized indices, such as "DeFi LIBOR" or "on-chain SOFR," will enable borrowers, lenders, and vaults to price risk and compare yields across different protocols. This will lay the foundation for native on-chain building of derivatives, yield curves, and structured credit markets.

Compliance: With the addition of institutions, embedded KYC/AML will become a basic requirement. Protocols will increasingly divide liquidity into permissionless and compliant tiers, enabling regulated entities to access DeFi tracks while maintaining open access for all other users. For example, Morpho v2 vaults support customizable access controls designed to meet institutional compliance requirements.

These elements together constitute the institutional interface for on-chain lending.

5. Beyond Overcollateralization

The current market is dominated by crypto asset overcollateralization and floating-rate lending, which, while practical, is essentially a narrow niche market. The future development of on-chain lending will go far beyond this model, unlocking the complete credit system that underpins traditional finance.

Fixed-Rate Loans: Predictable payments, clear maturity dates, and structured instruments are prerequisites for institutional adoption. Protocols like Morpho v2 are pioneering intent-based fixed-rate markets, while emerging designs like Term and Tenor are exploring auction-driven and order book mechanisms to price term risk directly on-chain. In effect, Morpho v2 may serve both ends of the market: a highly liquid, order book-based market on one end, and a highly customizable over-the-counter (OTC) market on the other, with custodians allocating liquidity vaults and lending divisions managing more targeted credit risk exposures. Low-Collateralized Loans: Protocols like 3Jane and Wildcat are pioneering frameworks for trust-minimized, low-collateralized lending, combining the guarantees enforced by smart contracts with real-world underwriting and trusteeship reputation. Alternative Credit Markets: Lending is also expanding into the long tail and non-traditional collateral areas, such as tokenized RWAs, alternative FX pairs, stablecoin arbitrage trading, and even credit lines guaranteed by credit. These markets introduce new dimensions of risk, including diversification, cross-border liquidity, and reflection of the complexities of global finance. The explosive growth of Midas is a prime example, highlighting the dynamics of two-way demand: traditional finance seeks to enhance on-chain liquidity through cyclical mechanisms, while crypto-native investors seek high-yield exposure to uncorrelated traditional financial instruments. These cutting-edge areas collectively signify DeFi's evolution from a collateral-constrained niche into a comprehensive, programmable credit system capable of collateralizing a wide range of financial products, from consumer loans to sovereign debt, with all transactions settled directly on-chain. Finally, when discussing the future of DeFi lending, I must mention the rise of custodians like Gauntlet, Re7, Steakhouse, and MEV Capital. These institutions actively manage liquidity, optimize returns, and adjust protocol parameters. They are evolving into on-chain versions of Millennium or Citadel, deploying quantitative strategies, risk models, and dynamic liquidity management across multiple protocols. In the past few years, custodians have earned modest performance fees and often subsidize users with incentives to attract deposits. But this is not a quick fix. They understand that custody itself will be one of the most scalable and profitable businesses of the next decade. Attracting deposits is merely a means of user acquisition; the ultimate goal is data distribution. As these companies grow in size and reputation, it's easy to imagine them becoming on-chain asset management firms managing over $10 billion in assets and holding a significant position across all major protocols. The competition for deposits will only intensify. There are many hedge funds, but only one Millennium, and every project manager in the DeFi space is vying to become its on-chain successor. Conclusion DeFi lending is no longer a collateral-based leverage experiment; it is evolving into the architecture of a programmable financial system. From order book-based credit markets and one-click revolving products to institutional-grade ratings and low-collateral frameworks, each layer of architecture is being rebuilt for scale, precision, and accessibility. Once lending truly becomes programmable, finance will no longer be confined to institutions but will exist within the network.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine