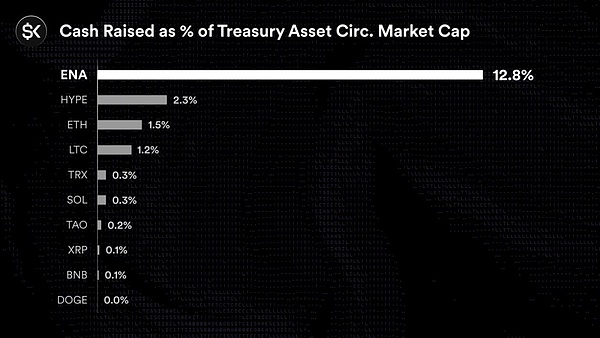

We are pleased to announce that ArkStream Capital invested an additional $10 million in Ethena in August 2025, adding to our long-term investment in Ethena following our initial $5 million investment in December 2024. This increase reflects our strong recognition of Ethena's structural breakthroughs in both its product and capital markets. What makes us determined to double down is not only the explosive growth in data, but also Ethena's institutional innovation at the capital market level. Over the past two years, Ethena has not only demonstrated USDe's product PMF, but is also bundling a purely crypto-native decentralized protocol with a configurable capital vehicle for US stocks into the flywheel of the "coin-stock dual-track," completing a critical transition we call Capital-Market Fit (CMF). This isn't about short-term arbitrage, but rather connecting protocol cash flows, governance, and external, compliant capital into a reusable capital structure. Equity (StablecoinX): Following the business merger with TLGY SPAC, the PIPE has increased from $360 million to a cumulative $895 million (with the latest round adding $530 million). The company plans to list on the Nasdaq under the symbol "USDE." Upon closing, StablecoinX will hold over 3 billion ENA on its balance sheet. Funds raised in this round will be used to purchase locked ENA from an Ethena Foundation subsidiary. Simultaneously, the foundation subsidiary will commission a third-party market maker to execute approximately $310 million in spot buybacks on the open market over the next 6–8 weeks. The buybacks will be at a rate of $5 million per day if ENA falls below $0.70, and $10 million per day if ENA falls below $0.70 or experiences a single-day decline of more than 5%. This total is expected to account for 13% of the circulating supply, compared to approximately 7.3% already acquired in the first PIPE round. The Ethena Foundation reserves the right to veto any sell-off of StablecoinX. This locks equity financing and the demand side of on-chain governance assets together, forming an institutionalized channel of "compliant capital → governance token demand".

Token side (ENA): USDE scale has reached US$12 billion, ranking third in stablecoins, the protocol's historical revenue has exceeded US$500 million, and Aave's risk exposure to USDe-related assets has reached approximately US$4.7 billion; discussions on the sENA fee switch are accelerating: the Ethena Risk Committee has set clear activation indicators (USDE circulation, cumulative protocol revenue, CEX With USDe's listing on Binance, the final key condition has been met, and the protocol now has a mechanism in place to allocate a portion of its revenue to sENA. This means the token's cash flow capture valve is entering a substantial opening phase, and ENA's value will shift from relying solely on growth expectations to being directly anchored to the protocol's cash flow. External Signals (DAT Reserves): Mega Matrix (NYSE: MPU) has announced that it will designate ENA as its primary strategic reserve for DAT, effectively using the listed company's balance sheet to "buy long-term" positions on the protocol. At the same time, Mega Matrix submitted a $2 billion shelf registration to the SEC, reserving space for flexible financing in tranches over the next few years. This not only locks in ENA in asset allocation, but also sets a ceiling for "continuously increasing holdings" or related capital operations at the financing tool level, providing external institutional support for the long-term demand side of ENA.

Unlike the arbitrage model of "direct shell purchase + PIPE + ATM", this three-point design forms a closed loop:

Equity financing → ENA demand/buyback → USDe expansion → protocol cash flow growth (support valuation and refinancing) → DAT/institutional allocation → external structural buying → back to the two levels of currency and stock, ultimately benefiting both token holders and shareholders. This is the first time that a DeFi protocol has entered the U.S. stock market through structured financial instruments. Ethena is transforming "protocol growth" into "institutional demand," making ENA's value capture more capital-resilient across cycles, which is also one of the core reasons why we continue to place heavy bets on it.

USDe: DeFi's new benchmark interest rate

USDe uses a crypto-native delta-neutral mechanism to drive returns, and is gradually regarded by the market as the new benchmark interest rate for DeFi funds and the anchor of "risk-free assets":

Supply volume:As of the end of August, it exceeded US$12.5 billion, becoming the third largest stablecoin;

Top lending exposure:Aave's risk exposure to Ethena-related assets reached 47 $1 billion, demonstrating its tier-one liquidity position in the mainstream DeFi credit market. Cross-chain Scale: Cumulative trading volume exceeds $5.7 billion; Return Range: Through a delta-neutral strategy, it provides an annualized return of approximately 9–11%, considered the "risk-free rate" of DeFi. Protocol Revenue: Cumulative revenue exceeds $500 million, with a peak of $13.4 million in a single week in August 2026. When USDe becomes more widely used as a collateral and settlement asset, the positive feedback loop of scale, liquidity, and returns will further strengthen ENA's governance and distribution value (including potential value returns from mechanisms like fee-switches). The "backup" after stablecoins: From the yield dollar to the two-wing expansion of the settlement and capital layers. Stablecoins are not the destination, but the foundation for cash flow and distribution. Ethena's "back-up" strategy is reflected in the coordinated expansion of distribution and settlement: Distribution Layer: Bringing "yield dollars" to institutions and billions of users iUSDe (Institutional Edition): Through a transfer-restricted contract format, the yield nature of sUSDe is packaged and integrated into the TradFi distribution network in a compliant manner, reducing operational and compliance friction for institutions. tsUSDe (Telegram/TON): Through in-depth cooperation with TON, sUSDe is natively embedded in the Telegram wallet ecosystem, targeting billions of users and making US dollar earnings an instantly distributable internet-native asset.

Why it's important:The "light compliance + platform-level entry" on the distribution side can enhance the positive feedback of "USDe scale → lending exposure → protocol revenue"; the $4.7 billion related risk position on Aave is already verifying this main line.

Settlement layer: Converge turns USDe into a native gas/settlement asset

Converge Chain:Co-built with Securitize, the Arbitrum + Celestia modular combination supports USDe/USDtb as gas and settlement assets, and uses ENA staking to enhance security, compatible with both permissioned and permissionless applications. Why it matters: When the "yield dollar" becomes the underlying settlement fuel, USDe's network effect rises from a financial primitive to a transaction routing/accounting unit; this gives Ethena the opportunity to undertake high-value-added businesses beyond stablecoins, such as RWA issuance, institutional settlement, and market-making collateralization. Our assessment: This combination of "institutional compliance portal + super-distribution front-end + dedicated settlement chain" significantly improves USDe's accessibility and usability, and provides ENA with sustained cash flow spillover across scenarios and customer segments. Risks and Moats: Transparent Mechanism + Diversified Structure Our increased holdings in Ethena are also based on our review of its risk governance and transparency: Transactional Risk: USDE fundamentally relies on a "long spot/short perpetual" basis/funding framework. Extreme market conditions can compress returns or even lead to temporary inversions. Ethena mitigates these risks through multiple exchanges, diversified counterparties, and dynamic hedging parameters.

Systemic spillover:As USDe becomes a leading collateral asset, the risk governance of major lending protocols (raising risk weights and governance parameters) is also being synchronized.

ArkStream's investment logic

From the short term to the long term, Ethena's investment logic is very clear:

Short term (tactical level):USDe has grown into DeFi's largest yield-generating capital reservoir. Its $12.5 billion in circulation and $4.7 billion in exposure on Aave have established USDe as a "primary collateral asset" in the DeFi lending market. Furthermore, USDe's 9–11% annualized yield has been viewed by the market as a near-risk-free rate, making it a core anchor for liquidity aggregation. The logic behind this phase is: The continued growth of USDe's scale and returns will make it a funding hub for the entire ecosystem, providing a stable source of cash flow for the protocol. Medium-term (structural): Ethena's capital structure has been integrated with traditional markets. Through the SPAC → PIPE → De-SPAC process, USDe/ENA was tied into the US stock market compliance framework. StablecoinX established an institutionalized channel for governance token demand through its cumulative $895 million PIPE and 3 billion ENA on its balance sheet. Meanwhile, Mega Matrix's DAT reserves and $2 billion shelf registration further institutionalized external capital purchases. The logic behind this phase is to link equity financing with token demand through structured financial instruments, thereby aligning ENA's valuation with traditional capital markets. Long-term (paradigm level): The most critical turning point came with the official launch of the sENA fee switch. The three activation metrics set by the Risk Committee (USDe circulation, cumulative revenue, and CEX coverage) have now all been met, particularly with USDe's listing on Binance, which fulfilled the final coverage requirement. This means Ethena is now in a position to allocate a portion of its protocol revenue directly to sENA. From this point forward, ENA will shift from a "growth narrative-driven" to a "cash flow-driven" model, becoming the first stablecoin governance token to directly capture the protocol's actual cash flow. Combined with the long-term external buying power generated by the DAT reserve, ENA's value will be supported by a dual-engine drive of "endogenous cash flow distribution + external structured allocation." We believe that within this framework, ENA has the potential to evolve into a "quasi-gold reserve" asset for stablecoin governance, achieving a cross-cycle positive cycle between the protocol's cash flow and the capital market. Conclusion: In ArkStream's view, Ethena is more than just a stablecoin protocol, but rather a connection layer between crypto-native returns and traditional capital markets. When the product has the right base rate and the capital structure provides institutional access to US equities, ENA's value capture is scalable across multiple cycles. Our decision to invest at this time is a decisive step in supporting Ethena's transition from a PMF to a CMF.

Alex

Alex

Alex

Alex Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Alex

Alex Alex

Alex Catherine

Catherine Kikyo

Kikyo Catherine

Catherine