Author: Andrew LIU

Introduction: DeFi lending platform is a historical necessity

Thousands of years ago in ancient Greece, people (including Aristotle) believed that charging interest on loans was dirty and against the will of God. But just a few hundred years later, people broke this restriction and accepted the existence of loan interest.

The lending relationship first occurred between individuals and was naturally decentralized. With the emergence of governments and banks, centralized lending emerged accordingly. The advantage of centralized lending is that a third party other than the borrower and lender can handle defaults based on fair and just rules, but this is not the reason for its long-term existence. The basis for the long-term existence of centralized lending is precisely because of people's "inability" in the original decentralized lending relationship:

The borrower has a greater probability of not being able to strictly abide by the contract, such as willingly transferring the collateral to the lender;

The weak lender has a greater probability of not being able to take effective actions to protect their own interests;

Even if one party takes action, both parties cannot ensure that the action is fair and just;

DeFi lending technology has subverted the above foundations, making it a high probability event for the lending relationship to return to decentralization.

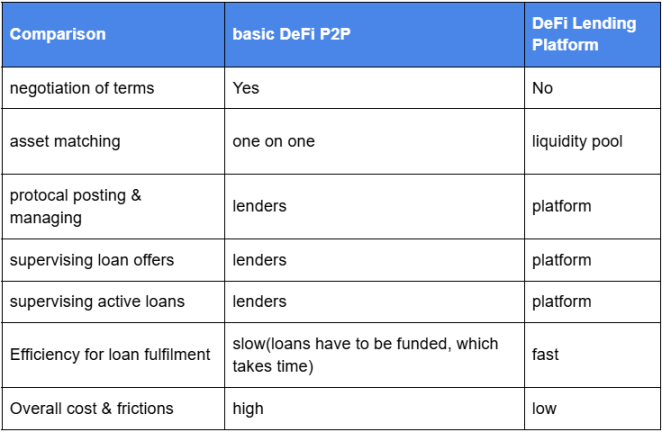

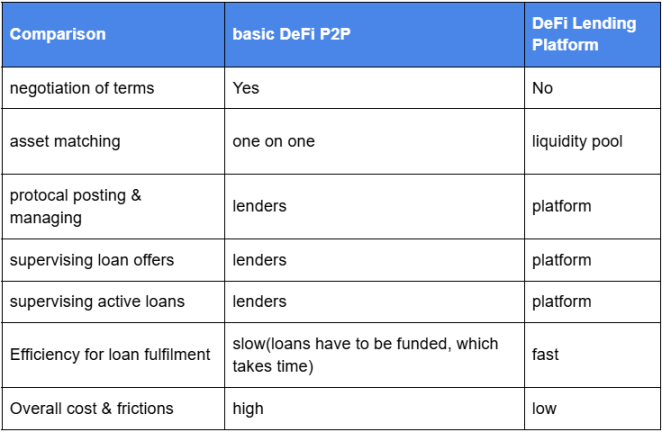

From the underlying logic, DeFi lending can be divided into two forms. The first is the original pure decentralized lending method (this report will temporarily refer to it as basic DeFi P2P), and the second is the decentralized lending platform (DeFi Lending Platform). Through the comparison in the table below, we can find that DeFi Lending Platform has more potential for long-term development.

The business model of DeFi lending platform is essentially the same as that of traditional centralized banks, with income mainly coming from interest and service fees; but because it is based on blockchain and smart contracts, the operating cost is significantly lower than that of traditional centralized banks. Therefore, the emergence of DeFi lending platform is historically inevitable.

This report selects two of the most influential DeFi platforms and presents the industry's development status, competition landscape, future direction and opportunities through comparative analysis.

Overview of DeFi lending market: one dominant player

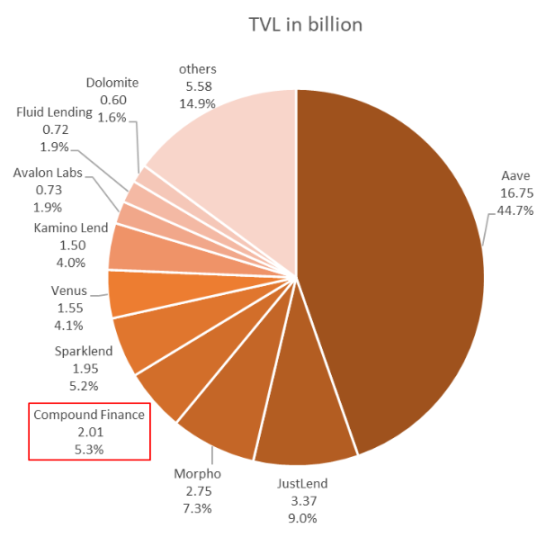

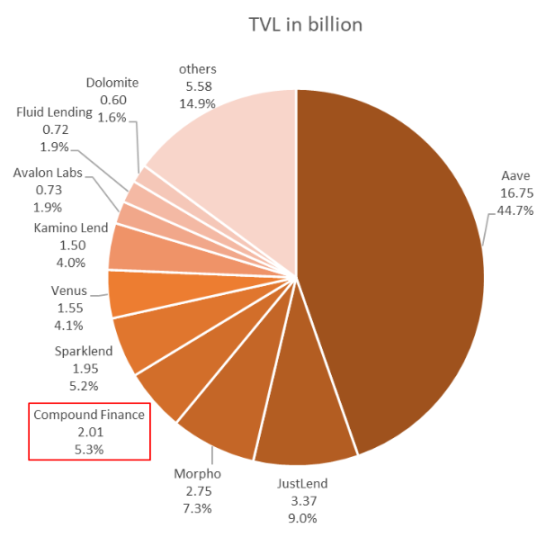

According to DeFiLlama data, as of April 7, 2025, the market TVL of the Lending track is 37.5b, of which Compound and Aave are 2.0b and 16.8b respectively, accounting for 5.3% and 44.7% of the Lending track respectively. Other top participants are shown in the table below:

In addition to TVL, Fees and Revenue are two key indicators, among which:

Fees: reflects the user's cost of using the protocol and the degree of activity. The higher the Fees, the greater the demand for lending.

Revenue: reflects the profitability of the protocol itself, which is usually a part of Fees.

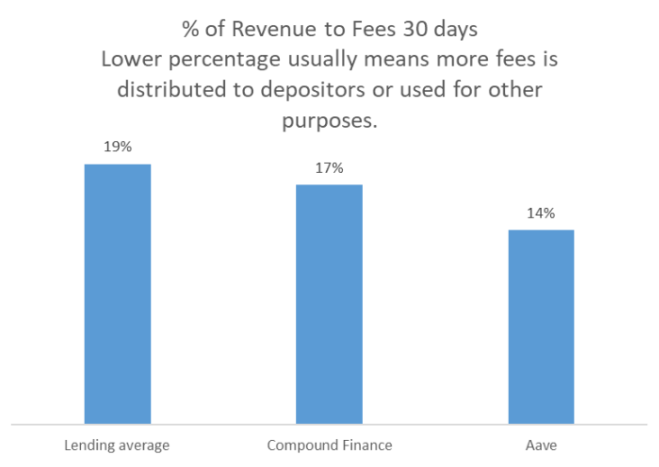

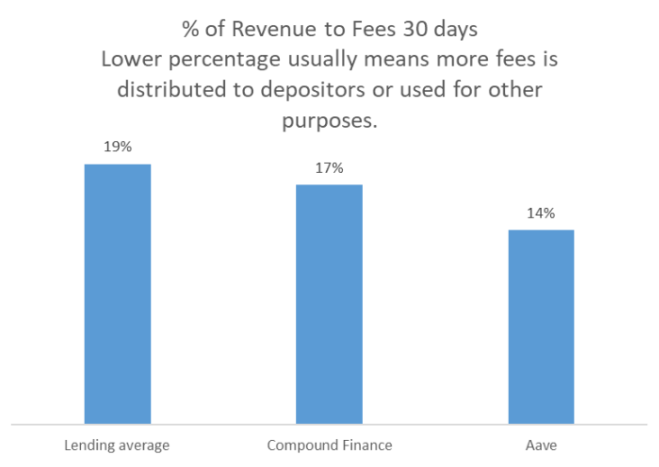

According to DeFiLlama data, the 30-day revenue of the Lending track accounts for 19% of the fees, which means that more than 80% of the fees collected by the DeFi platform are distributed to depositors or used for other purposes.

In comparison, the proportions of Compound and Aave are lower, at 17% and 14% respectively, reflecting that large platforms do pay more attention to ecological incentives rather than short-term profits.

Compound Analysis: Design flaws lead to death spiral

Overall, Compound is not doing well. As an old project that released a white paper as early as 2019, as of April 2025, important indicators such as revenue and TVL have been surpassed by other competitors.

Revenue:

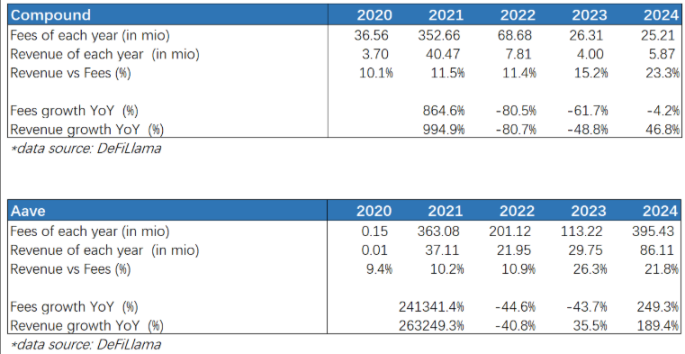

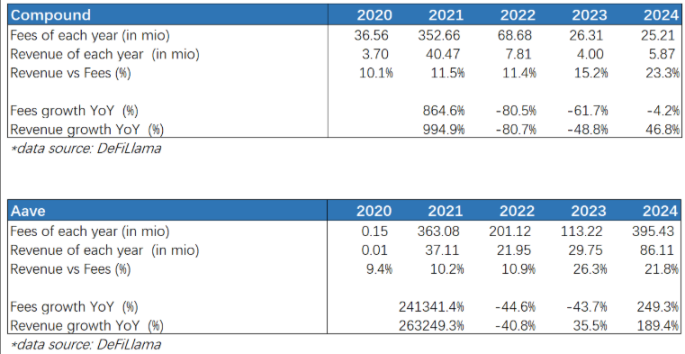

From 2022 to 2024, Compound's Fees fell sharply for three consecutive years, and Revenue only rebounded in 24 years, indicating that the project party increased the proportion of revenue extracted from Fees. It shows that Compound's development has encountered difficulties and has to pay more attention to short-term profits. Aave is in a much better situation. Aave's Fees have exceeded Compound since 2022. Under the same downward trend of the Lending track, it still achieved a 2.5-fold increase in Fees and a 1.9-fold increase in Revenue in 2024.

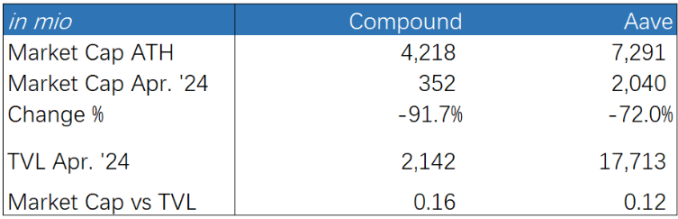

Market value:

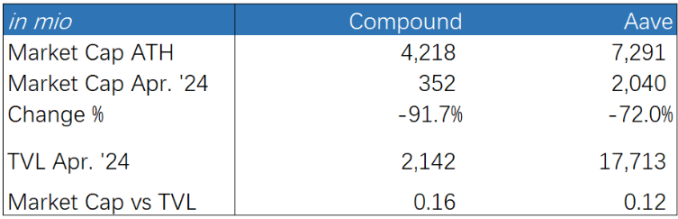

In April 2025, the latest market value of COMP tokens is about 350 million, a decrease of more than 90% from the peak market value in 2021, equivalent to 16% of its TVL (about 2 billion). Aave's latest market value is about 2 billion, a 72% drop from its peak market value in 21 years, equivalent to 12% of its TVL (about 17.8 billion). The other two projects with larger TVL than Compound (JustLend and Morpho) are only 8%. This also reflects that COMP's valuation is high.

Tokenomics:

Next, this report analyzes Compound's Tokenomics from the following 4 dimensions and compares it with Aave to find out why Compound is not as developed as Aave, and hopes to provide a reference for the design of new project economic models.

1) Supply and Distribution of Tokens

COMP has a total supply of 10 million tokens, with an initial distribution rule of 49.95% to project shareholders and teams, and 50.05% to users. The decentralization tendency is not obvious. Aave has a total supply of 16 million tokens, with 80% given to the community, and a more obvious decentralization tendency.

2) Incentive Mechanism

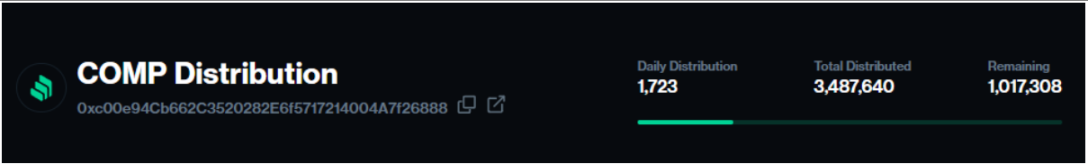

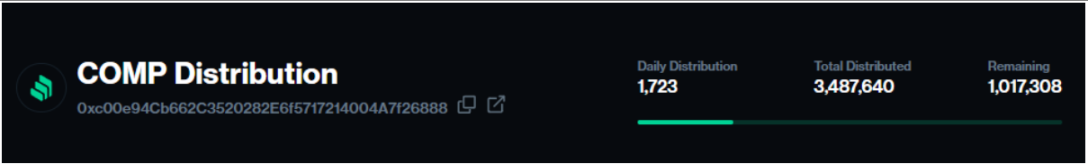

According to the official website of Compound, the project plans to distribute COMP every 4 years. The latest situation on April 11, 25 is that 1,723 COMP will be distributed every day, which is 40% faster than the initial distribution (1,234 COMP per day). This shows that the Compound project hopes to attract more users by increasing incentives when it is lagging behind. However, this did not achieve the expected effect, because simply increasing the number of tokens issued will not increase the user's sense of value, but may make users feel that the value of tokens has decreased, that is, things given for free will be considered worthless. The truly effective mechanism is to combine the issuance of tokens with the goal of platform development, that is, to give users a reason when issuing them so that they have a sense of gain.For example, Aave gives tokens as staking rewards to liquidity providers. This mechanism is more conducive to attracting users to provide liquidity for the platform in the long term.

April 16, 2025, screenshot of the website https://compound.finance/governance/comp

3) Value Capture (Value Accrual)

The Compound project did not fully and comprehensively consider the application scenarios of Tokens from the beginning, which is reflected in:

When designing the economic model, it focuses on incentivizing users to mine liquidity, rather than incentivizing COMP holders. On the surface, this idea seems to be fine, because after all, distributing income to depositors first can maintain a high TVL, thereby increasing its attractiveness to users, but the actual situation shows that the effect is counterproductive. The reason is that if users cannot taste the sweetness of holding COMP, they will always feel that something is missing in their hearts. This "want both" mentality is the mainstream of today's era, and the project party can only comply with it; at the same time, this design of the project party also started a death spiral: the low income of holding COMP affects the reputation of the project, resulting in a decrease in new users, and then a decrease in the growth rate of TVL; COMP holders mainly participate in governance and have almost no qualifications to share project income. From the perspective of human nature, for ordinary retail investors, the so-called governance rights are a relatively virtual concept, and their appeal is far less than the visible and tangible sharing of benefits; it can be said that the project party has made the mistake of avoiding the real and pursuing the virtual at this point.

COMP does not have a clear repurchase or destruction mechanism, that is, the project has not designed a safety net for the token price, and there is almost no emergency mechanism when the price drops sharply.

At the same time, as mentioned above, COMP has been accelerated. This may dilute its value.

Aave is obviously richer in the design of token application scenarios. AAVE holders can share project revenue, including loan interest and flash loan fees, by staking to the Safety Module. Aave also does not have a clear repurchase or destruction mechanism, but Aave has proposed to discuss using project revenue to repurchase AAVE and destroy it, indicating that Aave is more likely to launch a repurchase or destruction mechanism, and the token price has an extra layer of protection.

4) Governance and Power Distribution

According to the latest data from Estherscan on April 11, the top 10 addresses of the Compound project hold 39.1%, and the top 23 addresses hold more than 50%. What does this mean?

Since ancient times, the decentralized governance results of pure voting are usually not as good as the governance results of conscientious elites, which is why there is no absolute democracy in the world today. The advantage of the former is absolute democratic decentralization, and the disadvantage is that it is heavily dependent on the quality and ability of the proposer and the quality of the proposal, and is easily influenced by low-quality populism, resulting in decision-making that ignores the long-term interests of the project, that is, it may vote to its own death in the future. The latter is more like Plato's ideal country. Its advantage is that multiple elites check and balance each other to ensure the bottom line of decision-making. The disadvantage is that it cannot achieve the ideal of decentralization, and multiple elites may conspire to harm the interests of the majority. From this perspective, the relatively concentrated governance of Compound cannot be considered a disadvantage, at least it cannot be regarded as the reason for the recent development stagnation.

At the same time, by linking the governance design of Compound with the aforementioned value capture design, we can more clearly see the thinking of the Compound project: since the actual decision-making is made by several of us large holders (there is a threshold: only those holding more than 100,000 COMP can participate in the decision-making), and we can definitely share the income through equity, then we can care less about whether we and other users can share the income through tokens. This actually reflects that the considerations of the Compound project may not be comprehensive enough, and also reflects that its shareholders have not made good suggestions for its project design.

Conclusion

In the DeFi era, technological progress has made it possible for humans to return to decentralized lending. Although the existing DeFi platforms are not perfect, the industry ecosystem needs to be improved, and various risk events emerge in an endless stream, we should still maintain confidence and attention in DeFi projects.

The DeFi Lending track appears to be on the decline overall, but in fact it is just a normal industry fluctuation. When the overall macroeconomic downturn occurs, lending activities will inevitably decrease, and decentralized lending behavior will inevitably decrease as well.

During the industry's low period, the phenomenon of the Lending track being the only one is particularly obvious. Compound has fallen behind Aave and several up-and-coming companies. Considering the defects in its economic model design, it will be difficult for it to make a comeback.

Compared to Aave, the price of COMP tokens is slightly overvalued, and the price may fall in the future.

The design of the project economic model must fully consider human nature in order to create a win-win and sustainable ecosystem. This is consistent with the customer psychology research in traditional industries. If DeFi lending platforms want to achieve great development, they need to drive the continued participation of users and partners from more aspects.

Brian

Brian