Where is technological narrative going?

Bitcoin is Time, ETH is Money, so What is Crypto?

JinseFinance

JinseFinance

Author: Miles Jennings, General Counsel of a16z crypto; Translator: AIMan@黄金财经

The House of Representatives recently advanced an important new "market structure" bill with an overwhelming majority (294 votes in favor and 134 votes against, with 78 Democrats supporting it).

The bill, called the Digital Asset Market Clarity Act ("CLARITY Act") (HR 3633), will establish a clear regulatory framework for the digital asset market. The bill is currently before the Senate, which is developing its own version of market structure legislation and will refer to the CLARITY Act.

If the bill is passed, it will establish clear rules for blockchain systems - ending years of uncertainty that has stifled innovation, harmed consumer interests, and favored profiteers who adhere to opaque principles rather than entrepreneurs who pursue transparency. Just as the Securities Act of 1933 established investor protections and fueled capital formation in the United States for a century, the CLARITY Act has the potential to be a far-reaching piece of legislation.

When our legal framework fosters innovation while protecting consumers, America leads the way and the world benefits. The CLARITY Act is that opportunity. This legislation builds on last year’s bipartisan FIT21 bill, but the CLARITY Act improves upon it in several key ways, which we’ll outline below: what innovators need to know, and why this bill is critical to aligning innovation, consumer protection, and U.S. national security.

With the just-signed GENIUS Act (more on its contents below), the need for a broader market structure bill has become even more pressing.

Despite the fact that the cryptocurrency industry has existed for more than a decade, the United States has yet to establish a comprehensive regulatory framework. Yet cryptocurrency is no longer just a trend among tech insiders; it’s infrastructure: blockchain systems now underlie payment systems (including through stablecoins), cloud infrastructure, digital marketplaces, and more.

But these protocols and applications are built without clear rules. The result? Legitimate entrepreneurs face an onslaught of regulation, while unscrupulous entrepreneurs take advantage of legal ambiguity. Passage of the CLARITY Act would turn that around.

By providing a transparent path for projects to comply, and ensuring regulators have better tools to police real risks, the CLARITY Act (along with the stablecoin bill, dubbed the “GENIUS Act”) would bring the already massive cryptocurrency industry out of the shadows and into a regulated economy.This new legislation creates a framework for responsible innovation, just like the foundational laws that helped open markets thrive and protect consumers in the 20th century.

In addition to providing a clear path to compliance, the bill provides clearer rules—giving entrepreneurs the legal certainty they need to confidently innovate and operate at home.

In addition to providing a clear path to compliance, the bill also provides clearer rules—giving entrepreneurs the legal certainty they need to confidently innovate and operate at home.

This will ultimately reduce the pressure on legitimate entrepreneurs to start businesses overseas (or circumvent regulation using inefficient and opaque structures).

This legal clarity will open the door to the next generation of decentralized infrastructure, financial instruments, and user-owned applications—all of which will be built in the United States.Ensuring that blockchain systems are developed in the United States will also protect the global digital and financial infrastructure from becoming dependent on blockchain systems created and controlled by, for example, China, while also ensuring that U.S. regulatory standards apply to the core financial infrastructure that is increasingly being used by people outside of cryptocurrency.

The CLARITY Act creates a regulatory framework for digital assets (called “digital commodities”) that give users ownership rights in blockchain systems.

The Act’s control-based maturity framework allows blockchain projects to launch digital commodities and enter the public market without undue regulatory burden or uncertainty.

The Act ensures that centralized players in the cryptocurrency space, such as exchanges, brokers, and dealers, are strictly regulated. These intermediaries include:

required to register with the CFTC; and

subject to compliance standards similar to those governing traditional financial institutions.

These requirements increase transparency in core market infrastructure, help prevent fraud and abuse, and enhance consumer trust. They also close current regulatory gaps that have allowed companies like FTX to operate unfettered in U.S. markets.

The CLARITY Act also establishes direct consumer protection measures, including:

Mandatory public disclosure obligations for digital product issuers - ensuring that retail investors have access to basic, important information;

Restrictions on insider trading - limiting the ability of early stakeholders to exploit information asymmetry to the detriment of user interests.

These measures also provide entrepreneurs with a clearer roadmap for building decentralized blockchain systems, helping to promote innovation.

The CLARITY Act would provide a clear, structured pathway for the transition of digital assets from the SEC to the Commodity Futures Trading Commission (CFTC) for regulation.

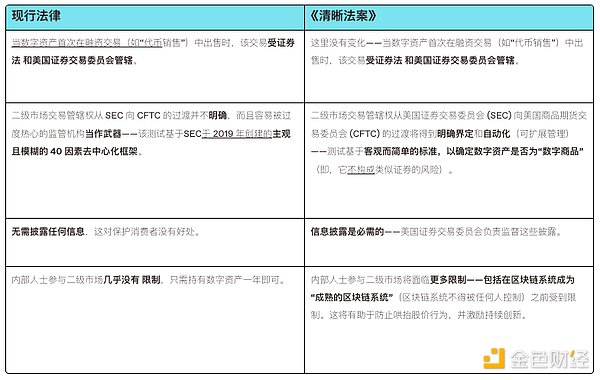

Let’s compare how current law and the CLARITY Act (if passed) would address the unique attributes of blockchain systems:

The above pathway is based on a carefully calibrated “controls-based” risk framework; more on that below.

In contrast to the traditional efforts-based decentralization test created by the U.S. SEC in 2019, which has an unclear definition of decentralization that regulators can use against good actors, CLARITY’s maturity framework employs clear, objective, and easily measurable criteria.

These criteria focus on who has control over the underlying blockchain system and its associated digital goods. This is more consistent with other regulatory regimes (e.g., money transmission) and removes negative incentives that encourage builders to stop building to avoid being seen as centralized. More importantly, this approach will help legitimate builders thrive — and continue to build (rather than being forced to abandon projects) — while making it more difficult for bad actors to exploit legal ambiguity, including by engaging in performative “decentralization drama” (rather than true decentralization).

Specifically, the bill’s framework incentivizes decentralization and protects consumers by:

imposing more oversight and stricter regulatory burdens during the formative stages of a blockchain system—when there is centralized control, the risks associated with the native digital assets of that blockchain system are most similar to the risks of securities;

reducing regulatory requirements as the project matures—when there is no centralized control, the risks are reduced and most similar to the risks of commodities.

Like previous legislative efforts to regulate the shift from centralization to decentralization (see comparison with FIT21 below), regulatory obligations applicable to projects in the “maturity” range include:

mandatory disclosure – which will increase transparency; and

sell restrictions on insiders – which can protect early consumers from insiders (such as participating entrepreneurs and investors) who may have asymmetric information that other consumers are unaware of.

But unlike FIT21, CLARITY sets out seven objective, measurable criteria for determining when a particular blockchain system is no longer controlled by an individual or a jointly managed group (such as a foundation), and thus its native digital assets no longer pose securities-like risks. Because this approach is centered on eliminating control, it can protect consumer investors while fully realizing the potential of blockchain technology. Moreover, because CLARITY uses measurable (rather than amorphous) criteria, it provides a framework that is easier for regulators to apply and builders to follow.

In short, this new framework is a significant improvement over the traditional regulatory framework because securities laws were not designed for assets (such as blockchain systems) whose risk profile can change from being similar to securities to being similar to commodities.

This new framework has also received widespread support from the industry.

The CLARITY Act provides important safeguards for decentralized finance (DeFi). Specifically, the bill:

Exempts DeFi protocols and applications from regulatory requirements for digital commodity trading intermediaries (such as exchanges and brokers);

Sets standards for DeFi - to qualify, DeFi systems must not act as intermediaries - ensuring that specific DeFi systems do not reintroduce risks that regulation is intended to mitigate.

In addition, the bill will provide DeFi projects with the legal clarity they need to:

launch and sell their own native tokens - processes that were previously risky and unclear;

leverage decentralized governance - avoid the risk of being classified as centralized

provide self-custody - many people did this before, but now with this bill, individuals will have "self-custody".

CLARITY levels the playing field for DeFi projects. It also paves the way for integrating the benefits of decentralized finance into the broader financial system, thereby unlocking its true potential more broadly and benefiting consumers.

However, the CLARITY Act is not perfect. Because the bill focuses only on digital commodities, it does not cover other regulated digital assets, such as tokenized securities and derivatives. While the CLARITY Act exempts DeFi systems from federal intermediary rules, it does not replace state-level regulation — meaning the industry remains vulnerable to inconsistent or overly regulatory state policies. These gaps should be addressed by the Senate, future legislation, or through coordinated regulatory guidance (such as rulemaking by the SEC and CFTC).

Yes; the CLARITY Act improves the status quo because…

…the industry currently lacks regulation. While some may argue that no regulation is better than any regulation, the current lack of regulatory clarity creates opportunities for bad actors and profiteers to exploit consumers by taking advantage of this uncertainty. (Not to mention that it allows regulators to abuse their power without restraint.) FTX is a prime example of these problems, harming not only the industry as a whole but also thousands of consumers. If we don’t act now, we’ll open the door for more bad actors like FTX’s former CEO.

…the industry lacks transparency. Consumers are often at risk of scams and fraud due to the lack of mandatory disclosure and listing standards. This lack of transparency fosters a "casino" culture (rather than a more innovative casino), which has led to the emergence of purely speculative products like memecoin.

…Lack of protection for the industry. Blockchain projects (especially DeFi projects) remain vulnerable to the over-regulation common under the previous administration due to the lack of clear constraints on the regulatory authority of various federal agencies.

…Lack of standards for the industry. Without standards for decentralization/control, consumers face unknown risks when using blockchain systems. For example, they may believe that their assets (including stablecoins) are safe - but they may not be if these blockchain systems are controlled by a single entity (someone could just shut it down). As all industries mature, setting standards is becoming more common.

How does the CLARITY Act compare to previous legislative efforts, such as the Financial Innovation and Technology Act for the 21st Century (also known as FIT21)? The CLARITY Act actually draws lessons from FIT21 and improves on it:

1. It improves transparency by plugging loopholes in FIT21 and preventing some legacy projects from evading disclosure. CLARITY provides a framework for fulfilling disclosure obligations for legacy projects that are still in operation.

2. It provides stronger consumer protection by making it more difficult for insiders to exploit information asymmetry. For example, CLARITY strictly restricts project insiders from selling assets before the project matures (that is, while they still control the project).

3. Its maturity framework provides a more principled, control-based decentralization test, which greatly improves the vague approach of FIT21. The framework is also more precise because CLARITY proposes seven objectively measurable criteria to judge whether a blockchain system is mature.

4. It improves regulatory supervision and provides regulators with greater flexibility, which will help ensure that the regulatory framework evolves and scales as the industry matures.

The GENIUS Act represents a critical step toward modernizing our financial system. The House of Representatives made history by passing this important legislation in an overwhelming 308-122 vote, with 102 Democrats supporting it. However, stablecoin legislation significantly increases the need for broader market structure legislation like the CLARITY Act.

Why? Because GENIUS will accelerate the adoption of stablecoins, thereby driving more financial activity onto blockchains, thereby increasing reliance on blockchains for a wider range of payments and commerce. This is already happening as stablecoins are increasingly accepted and adopted by ubiquitous payment processors, traditional financial institutions, established payment networks, and others.

But current stablecoin legislation does not regulate the blockchains on which stablecoin assets circulate—it does not require that these rails be secure, decentralized, or transparently governed. This gap exposes consumers and the economy as a whole to new systemic risks.

With the GENIUS Act now signed into law, the need for CLARITY has become even more urgent.

The CLARITY Act provides the necessary standards and oversight to ensure that the infrastructure supporting stablecoins (the underlying blockchain, protocols, and other tools) meets standards of security, transparency, and control. Its objective, measurable requirements for mature blockchain systems also better help entrepreneurs clarify how to meet these standards.

Without the complementary protections of the GENIUS Act and the CLARITY Act, the adoption of stablecoins could accelerate the use of unregulated, opaque, and even adversarial infrastructure. Passage of the CLARITY Act will ensure that stablecoins operate on secure networks, further protect consumers, reduce financial risks, and consolidate the dollar's strong position and leadership in the next generation of the financial system.

With the CLARITY Act passing the U.S. House of Representatives, the bill will now be sent to the Senate. The Senate Banking and Agriculture Committees could choose whether to take up the bill, amend it through their respective amendment processes, and then send it to the full Senate for a vote.

However, it is more likely that a bipartisan group of senators will introduce a separate Senate version of the cryptocurrency market structure bill, which may be similar to the CLARITY Act in many ways. The Senate Banking and Agriculture Committees would then consider the bill through their respective processes and, if approved, send it to the Senate for a vote.

If both chambers of Congress pass their own bills, the House and Senate would need to reconcile any differences — either through an informal negotiating process or a more formal negotiating committee — and each chamber would then vote on a final compromise version.

When might this happen? Key House and Senate leaders have set a goal of sending the market structure bill to the president for his signature by the end of September.

The CLARITY Act, which passed the House with 71 Democratic votes and 216 Republican votes, continues the bipartisan momentum established by FIT21, which passed the House with 71 Democratic votes. The bill improves on FIT21 across the board—strengthening consumer protections, clarifying standards for decentralization, and more closely aligning with existing regulatory models.

Passage of the CLARITY Act will ensure that the United States remains a global leader in blockchain infrastructure, benefiting developers and consumers alike.

The CLARITY Act is a serious, thoughtful, and bipartisan attempt to create an effective regulatory system for cryptocurrency in the United States that strikes a balance between innovation and regulation. It provides Congress with an opportunity to protect consumer rights while supporting the infrastructure of the digital economy, creating jobs and opportunity, the next major milestone in computing innovation—as important as personal computers, cloud computing, and mobile computing before them.

We are at a critical juncture.

Bitcoin is Time, ETH is Money, so What is Crypto?

JinseFinance

JinseFinanceAfter this massive and controversial airdrop, how will the future of Blast itself and the Layer2 ecosystem develop?

JinseFinance

JinseFinanceIt is now 2024 and the focus is on the consequences of fiscal/monetary policies that have been in place for decades but are being accelerated in a world that is very different from four years ago.

JinseFinance

JinseFinanceLooking back on this journey, for a bottom-up DAO, narrative is not so much the result of "telling others who we are" as it is the process of exploring "who we are".

JinseFinance

JinseFinanceWe'll see how to use them, their definitions and how to use event topic hashes and signatures to filter logs, as well as some advice on when you should use these.

JinseFinance

JinseFinanceU.S. Court imposes heavy penalties on Binance and CEO Zhao for regulatory violations, mandating strict compliance measures.

Kikyo

KikyoThe same day, the Securities and Exchange Commission charged the company with violating securities laws

Others

OthersALSO: Here's why it's important Bitcoin hits $30,000

Coindesk

CoindeskUpcoming narratives in December like Theta's mainnet 4.0 launch, APE staking, Sushi new tokenomics draft; the list goes on.

Twitter

TwitterEvery action you take as a trader is documented in a trading journal, covering risk management, trading strategy assessment, psychology, and more.

Cointelegraph

Cointelegraph